Finance Act 2021: New Procedure of Re-assessment Proceedings

Re-assessment proceedings generally empower the Revenue Authorities to tax the income which has escaped assessment. The proceedings also cover the assessments where income is being assessed for the first time under the provisions of the Income Tax Act, 1961 (Act). The Finance Act 2021 has revamped the provisions of re-assessment proceedings with effect from 1 April 2021. With the amendment by Finance Act 2021, the procedure prescribed under the Apex Court Judgment, in the case of GKN Driveshafts (India) Limited vs ITO [(2003) 259 ITR 19 (SC)], has been codified in law to a larger extent. Read ahead for an overview of the new re-assessment proceedings under the provisions of the Act.

Information - A prerequisite

Under the new provisions, possession of information with the Assessing Officer (AO) is a prerequisite for initiating the assessment/re-assessment proceedings. Information has been defined to mean:

- Information flagged in accordance with risk management strategy

- Audit Objection by Comptroller and Auditor General

Furthermore, under the following cases, AO shall be deemed to have information with him for the three years immediately preceding the year in which search is initiated/books of accounts or other documents are requisitioned, or survey is conducted in the case of the taxpayer/money, bullion or jewelry or any other article or thing or books of accounts, etc. are seized in case of any other taxpayer:

- Search is initiated under Section 132 or books of accounts, other documents or other assets are requisitioned under Section 132A in the case of the assessee, on or after 1 April 2021;

- A survey is conducted under Section 133A on or after 1 April 2021 other than TDS survey or survey in respect of expenses on account of any function/ceremony/event;

- AO is satisfied, with prior approval of PCIT/CIT, that money, bullion, jewelry, or other valuable article or thing, seized under Section 132 or requisitioned under Section 132A in the case of any other person on or after 1 April 2021, belongs to the taxpayer;

- With prior approval of PCIT/CIT, that any books of accounts or documents seized under Section 132 or requisitioned under Section 132A in the case of any other person on or after 1 April 2021 belong to the taxpayer.

In common parlance, the term ‘information’ is very expansive and would include almost any data/ document/asset/ observation available.

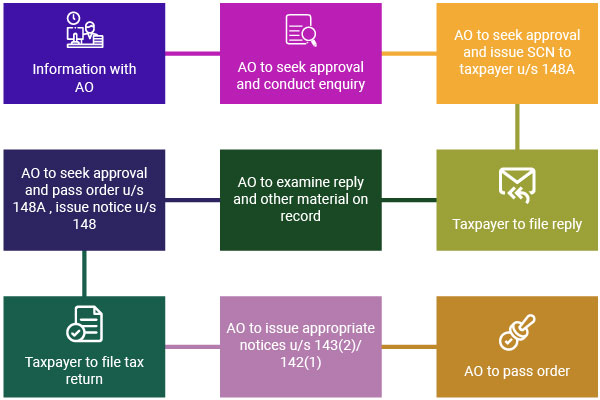

Inquiry before issuance of Notice for Reassessment- Section 148A

Upon having such information, the AO shall:

- conduct the inquiry with respect to the information in his possession, which suggests the escapement of income, with prior approval;

- issue show-cause notice, with prior approval, to the taxpayer as to why a notice initiating the assessment/ reassessment proceedings under Section 148 be not issued, basis the information and inquiry conducted;

- consider the reply furnished by the taxpayer;

- pass the order, with prior approval, deciding as to whether it is a fit case for re-assessment or not.

The above procedure of pre-inquiry will not be applicable in the following cases:

- Search is initiated under Section 132 or books of accounts, other documents or other assets are requisitioned under Section 132A in the case of the assessee, on or after 1 April 2021;

- AO is satisfied, with prior approval of PCIT/CIT, that money, bullion, jewelry or other valuable article or thing, seized under Section 132 or requisitioned under Section 132A in the case of any other person on or after 1 April 2021, belongs to the taxpayer;

- AO is satisfied, with prior approval of PCIT/CIT, that any books of accounts or documents seized under Section 132 or requisitioned under Section 132A in the case of any other person on or after 1 April 2021 belong to the taxpayer.

Assessment/Re-assessment Proceedings

Notification to be submitted

Post the above procedure, the assessment would be initiated and/or completed under Section 147 of the Act. New provisions of Section 147 are sans most of the provisos/ explanations provided under the erstwhile provisions of Section 147 of the Act.

A brief snapshot of the new re-assessment regime is given hereunder:

Notice Thresholds

Notice under Section 148 of the Act for initiation of assessment/re-assessment proceedings under Section 147 of the Act will not be issued after expiry of:

- Three years under all the situations;

- 10 years, if AO has in his possession books of accounts/ other documents which suggest that escaped income as represented by an asset exceed INR 50 million.

No notice under the new regime could be issued for assessment years up to AY 2021-22 – if it could not be issued under a six-year threshold (i.e., escaped Income >= INR 0.1 million) of the erstwhile regime.

Re-assessment Proceedings-Old vs New Regime

A brief contra-distinction between the two regimes is highlighted hereunder:

| Old Regime | New Regime |

|---|---|

| Reason to believe essential | No reason to believe- ‘information’ is must |

| Procedure as per GKN Driveshaft | Procedure codified in Section 148A |

| 4 years, 6 years and 16 Years - notice threshold | 3 years and 10 Years - notice threshold |

| Sanctioning Authority- JCIT, PCCIT/CCIT/PCIT/ CIT | Sanctioning Authority- PCCIT/CCIT/PCIT/CIT |

Our Comments

The new procedure seems to have been introduced to incorporate the principles established via judicial precedents into the law. This should bring down the litigation around the assumption of jurisdiction/grounds for issuing notice under Section 148 of the Act. Litigation could be further brought down if the below-mentioned issues could also be clarified:

- Re-opening of assessment where issue already examined under scrutiny assessment;

- Whether AO may take refuge of the relief provided under the old regime, wherein it was provided that the AO may be entitled to carry out re-assessment, in a case where he may have to conduct due diligence, even if the information was disclosed to him;

- Issues arising around the authenticity of the information available/collected by the AO, especially during search/ survey/seizure operations.