OECD releases Transfer Pricing Guidelines 2022 edition

The integration of national economies and markets has increased substantially in recent years, putting a strain on the international tax rules designed more than a century ago. In a global economy where Multinational Enterprises (MNEs) play a prominent role, governments need to ensure that the taxable profits of MNEs are not artificially shifted out of their jurisdiction and that the tax base reported by MNEs in their country reflects the economic activity undertaken therein. For taxpayers, it is essential to limit the risks of economic double taxation. The Organization for Economic Co-operation and Development (OECD) established in 1961, is an international organization of 38 countries committed to democracy and the market economy. The OECD Transfer Pricing Guidelines (OECD TP Guidelines) provide guidance on the application of the ‘Arm’s Length Principle (ALP),’ which is largely considered across various countries in determining the ALPs for the intercompany transactions between Associated Enterprises (AEs).

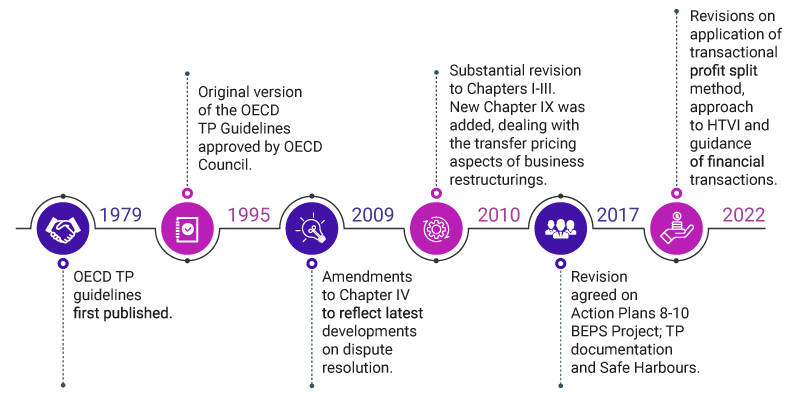

First published in 1979, the OECD TP Guidelines have been supplemented with a series of updates as illustrated below –

1995: The TP Guidelines for MNEs and Tax Administrations were originally approved by the OECD Council. They were completed with additional guidance on cross-border services, intangibles, costs contribution arrangements and advance pricing arrangements in 1996-1999.

2009: In the 2009 edition, some amendments were made to Chapter IV, primarily to reflect the latest developments in dispute resolution.

2010: Chapters I-III were substantially revised with the addition of new guidance on the selection of the most appropriate TP method to the circumstances of the case, on how to apply transactional profit methods (the Transactional Net Margin Method (TNMM) and the Profit Split Method (PSM)) and on how to perform a comparability analysis. Furthermore, a new Chapter IX was added, dealing with the TP aspects of business restructurings.

2017: Incorporates the substantial revisions in Chapters I, II, V-VIII to reflect the clarifications and revisions agreed upon in the 2015 BEPS1 Reports on Actions 8-10 Aligning Transfer Pricing Outcomes with Value Creation and on Action 13 TP Documentation and Country-by-Country Reporting. It also includes the revised guidance on safe harbours approved in 2013, which recognizes that properly designed safe harbours can help to relieve some compliance burdens and provide taxpayers with greater certainty.

The January 2022 edition, released on 20 January 2022, includes revisions in the guidance based on the following OECD reports–

- the Revised Guidance on the Application of the Transactional Profit Split Method – published in June 2018;

- the Guidance for Tax Administrations on the application of the approach to Hard-to-Value Intangibles – published in June 2018, and

- the new TP Guidance on Financial Transactions was published in February 2020.

The above updates have been discussed in the ensuing paragraphs.

Revised Guidance on the Application of the Transactional Profit Split Method published in June 2018

The OECD TP Guidelines have included guidance on the Transactional Profit Split Method since their first publication in 1995. The revised guidance released in June 2018 significantly expands the guidance on when a profit split method may be the most appropriate method. The revised text also expands the guidance on how the profit split method should be applied, including determining the relevant profits to be split and appropriate profit splitting factors. It describes the presence of one or more of the following indicators as being relevant:

- Each party makes unique and valuable contributions.

- The business operations are highly integrated such that the contributions of the parties cannot be reliably evaluated in isolation from each other.

- The parties share the assumption of economically significant risks, or separately assume closely related risks.

The guidance clarifies that while a lack of comparables is, by itself, insufficient to warrant the use of the profit split method. However, it will be difficult to adopt the profit split method in a converse situation, where reliable, comparable companies are indeed available. In the revised guidance, OECD has included sixteen examples to illustrate the principles discussed in the text and demonstrate how the method could be applied in practice. These examples demonstrate the principles for the application of the profit split method for entities engaged in the pharmaceutical sector, electronic appliances, IT solutions, asset management services, retail fashion industry, to name a few. These are provided in Annex II to Chapter II of the Guidelines.

To view detailed guidance click here.

Guidance for Tax Administrations on the Application of the Approach to Hard-to-Value Intangibles published in June 2018

Action 8 of the Action Plan on Base Erosion and Profit Shifting (BEPS) mandated the development of TP rules or special measures for transfers of Hard-to-value Intangibles (HTVI) aimed at preventing base erosion and profit shifting by moving intangibles among group members. The outcome of that work is found in the 2015 Final Report for Actions 8-10, "Aligning Transfer Pricing Outcomes with Value Creation," which has now been formally incorporated in the OECD TP guidelines as Section D.4 of Chapter VI. The BEPS Action Plan also mandated the development of guidance for tax administrations on the application of the HTVI approach. In light of the above, the guidance aims to reach a common understanding and practice among tax administrations on how to apply adjustments resulting from the application of the HTVI approach. In particular, the new guidance:

- Presents the principles that should underlie the application of the HTVI approach by tax administrations;

- Provides a number of examples clarifying the application of the HTVI approach in different scenarios; and

- Addresses the interaction between the HTVI approach and the access to the mutual agreement procedure under the applicable tax treaty.

The guidance for tax administration on the application of the HTVI approach has been incorporated into the OECD TP Guidelines as Annex II to Chapter VI. To view detailed guidance, click here.

TP Guidance on Financial Transactions published in February 2020

This was the first time that the OECD has released any specific guidance on the TP aspects of financial transactions, including a number of examples to illustrate the principles discussed. The new guidance –

- Elaborates on how the accurate delineation analysis applies to the capital structure of an MNE within an MNE group. It also clarifies that the guidance does not prevent countries from implementing approaches to address capital structure and interest deductibility under the domestic legislation.

- Outlines the economically relevant characteristics for analyzing the terms and conditions of financial transactions.

- Addresses specific issues such as treasury functions, intra-group loans, cash pooling, hedging, guarantees and captive insurance, etc.

- Determines a risk-free rate of return and a risk-adjusted rate of return.

The guidance has been incorporated in Chapter X of the OECD TP Guidelines. To view detailed guidance click here.

Our Comments

To summarize, the latest edition consolidates the changes/ updates/guidance published by OECD since OECD TP guidelines 2017.

Indian TP law does not explicitly recognize the direct applicability of the OECD TP Guidelines. However, India has framed its own rules and guidance on TP while drawing reference from the OECD TP Guidelines as well as the UN TP Manual. Though not a member of the OECD, India participates as an Observer in the OECD’s Committee on Fiscal Affairs. It would be imperative for MNEs to revisit their current TP positions with respect to financial transactions and intangibles in light of the amendments in the revised guidelines.

The OECD TP Guidelines will continue to be supplemented with additional guidance addressing other aspects of TP and will be periodically reviewed and revised on an ongoing basis. To view the OECD TP Guidelines 2022 edition online, click here.

1. Base Erosion and Profit Shifting