An insight into the significance of the Customs (Administration of Rules of Origin under Trade Agreement) Rules, 2020

As part of its commercial, strategic and diplomatic endeavors over the decades, India has entered into various Preferential Trade Agreements (PTAs) and Free Trade Agreements (FTAs) with different countries and trade blocs. The countries/ trade blocs with which India has such trade agreements include ASEAN, Mercosur, Malaysia, South Korea, etc. As part of such PTAs and FTAs, India provides complete or partial exemptions from Customs duty on import of specified commodities from these countries.

Such concessional imports require adherence to certain conditions such as the fulfillment of the ‘Regional Value Content’ (RVC) or the ‘origin criteria.’ The origin criteria intend to ensure that the partial or full Customs duty exemption benefits are provided only for goods originating from countries/trade blocs with which India has entered into PTAs/FTAs.

In recent times, certain Indian manufacturers have raised apprehensions with the government that the Customs duty exemption benefits under these trade agreements are misused by some importers by claiming benefit in respect of goods which do not originate from the specified countries, thereby hampering domestic manufacturing as well as resulting in a disadvantage to non-FTA importers. In certain cases, even the Indian Customs authorities were seeking to deny Customs duty exemption benefits to importers by disputing the regional value content mentioned in the Certificate of Origin. However, such action on the part of the Customs authorities was struck down by the courts in several cases.

Introduction of CAROTAR

A need was felt for Indian Customs officials to have wider powers to deny Customs duty exemption benefits to importers in case of inadequate information. Therefore, Hon’ble Finance Minister, in her Budget speech on 1 February 2020, announced the insertion of Chapter VAA - Administration of Rules of Origin Under Trade Agreement, in the Customs Act, 1962. Thereafter, the Customs (Administration of Rules of Origin under Trade Agreement) Rules, 2020 [CAROTAR] were notified vide Notification No. 81/2020- Customs (N.T.) and made effective from 21 September 2020 for importers making claim of a preferential rate of duty under any trade agreement.

The CAROTAR are in addition to the Rules of Origin, which have been already notified under various PTAs/FTAs, and intend to provide further powers to the Customs officials to inquire into imports where they have a reason to believe that the origin criteria has not been met.

Responsibilities of the importer under CAROTAR

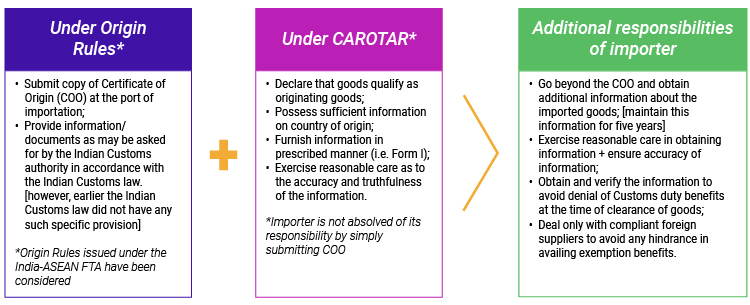

The CAROTAR casts additional responsibilities on the importer vis-a-vis the Origin Rules. A snapshot of these changes has been captured below:

It can be seen that the CAROTAR casts the responsibility on the importer to go beyond the COO and ‘exercise reasonable care’ that the imported goods qualify under the origin criteria under the respective trade agreement. As a result, the Indian Customs officials can ask the Indian importer to provide additional information in relation to the origin of the goods, and such importer cannot shed responsibility by simply submitting the COO.

Powers granted to Indian Customs authorities

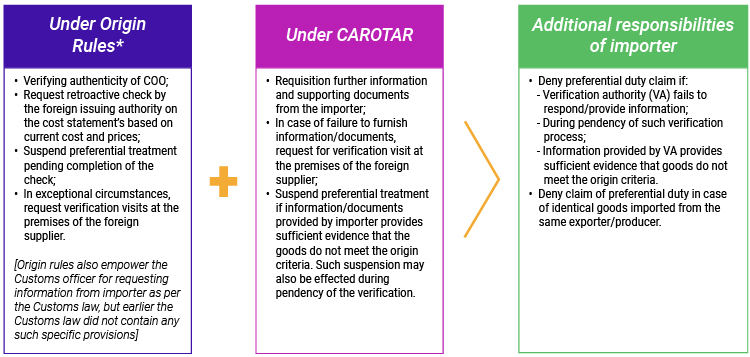

The CAROTAR has granted additional powers to the Indian Customs authorities, which have been captured in the below graphic:

Thus, the CAROTAR grants significant powers to the Customs authorities by allowing them to ask the Indian importer to provide crucial information such as:

- The manufacturing process is undertaken in the country of origin;

- Originating criterion fulfilled by the manufacturing process – e.g., minimum regional value content, change in tariff classification, etc.;

- Following details of originating material/components used

in the production of imported goods:

- Whether manufactured by the producer of final goods?

- Whether procured locally from a third party?

- In the case of third party procurement, whether the producer has confirmation and documentary proof of origin?

- Certain additional details in relation to criteria applied to determine that import goods qualify as originating goods.

Conclusion

The government’s step to regulate the imports claiming preferential benefits will no doubt give a boost to Indian manufacturing by making the cost of the indigenous products competitive with the foreign imports. However, there are certain sectors where the domestic manufacturing capabilities may not be fully developed, and the importers would still rely on foreign suppliers to meet their demands. In such cases, the introduction of CAROTAR can result in various practical challenges, such as:

- Can Indian importers make their foreign suppliers understand the necessity to obtain the additional documentation/information?

- Will the foreign suppliers agree to provide sensitive data of their costing/local procurements etc., to the Indian importer to justify the originating criteria?

- Whether the Customs officers at the port have the expertise to understand the cost structure data of the foreign supplier? [Usually, such valuation aspects in case of related party imports are handled by the Special Valuation Branch]

- The term ‘reasonable care’ is subjective and can trigger avoidable litigation.

Therefore, the successful implementation of CAROTAR will require close monitoring by the Indian Government to ensure that genuine importers under various PTAs/FTAs are not burdened with cumbersome and onerous requirements by the jurisdictional Customs authorities.