Market Overview

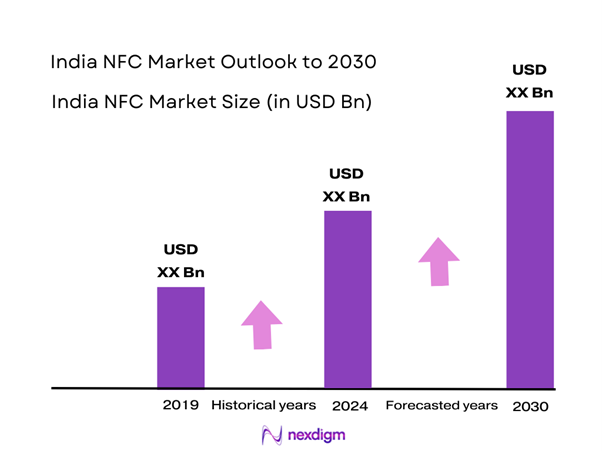

The India NFC market is valued at USD 8.5 billion in 2024 with a Compound Annual Growth Rate of 14.5% from 2024-2030, supported by a significant increase in mobile payments, the rising prevalence of contactless transactions, and a growing number of NFC-enabled devices. Major drivers include the Indian government’s push for digital payments and the increasing use of smartphones equipped with NFC technology. Furthermore, advancements in technology and security have fostered consumer trust, contributing to market growth.

Leading cities such as Delhi, Mumbai, and Bangalore dominate the India NFC market due to their dense urban populations, high smartphone penetration rates, and the establishment of numerous businesses adopting contactless payment solutions. Additionally, government initiatives aimed at promoting digital transactions like the Digital India movement have further supported growth in these urban centers, creating a conducive environment for the growth of NFC technology.

India has witnessed a monumental rise in smart device adoption, with the number of active smartphones expected to reach over 800 million by end of 2025. A report by the Internet and Mobile Association of India (IAMAI) highlights that smart device usage is closely linked to increased consumer spending on digital goods and services, anticipated to reach USD 125 billion by end of 2025. This proliferation in smart devices creates a conducive landscape for various applications, including NFC technology, which offers seamless connectivity and convenience for consumers in accessing different services.

Market Segmentation

By Technology Type

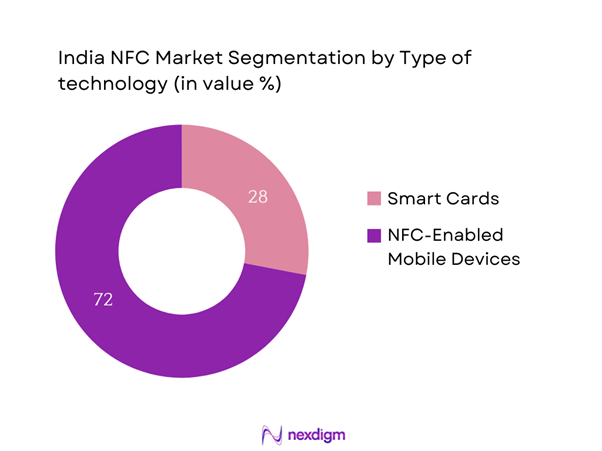

The India NFC market is segmented by technology type into smart cards and NFC-enabled mobile devices. NFC-enabled mobile devices currently hold a dominant market share, as the rapid adoption of smartphones has led to increased usage of contactless payments. Consumers are increasingly preferring mobile wallets for transactions due to convenience, speed, and the ability to integrate loyalty programs seamlessly. Companies like Google Pay and PhonePe have established themselves as key players, enabling consumer access to NFC technology.

By Application

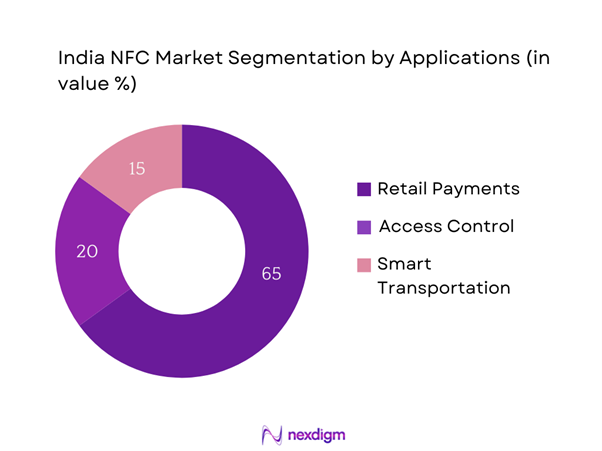

The application segment includes retail payments, access control, and smart transportation. Retail payments dominate, with businesses rapidly adopting contactless payment systems to enhance customer experiences while reducing wait times at checkout. The growing demand for convenient and hygienic payment solutions, especially after the COVID-19 pandemic, has significantly boosted the popularity of NFC in retail environments, allowing customers to complete transactions quickly and safely.

Competitive Landscape

The India NFC market is characterized by strong competition among a few dominant players, including multinational corporations and local firms. Major players such as NXP Semiconductors and Infineon Technologies drive innovation and market growth through ongoing research and development, forging partnerships with various industries, including banking and telecommunications. Their established expertise enables them to maintain a competitive edge, thereby solidifying their presence in the market.

| Company | Establishment Year | Headquarters | Employees | Market Focus | Key Products |

| NXP Semiconductors | 2006 | Eindhoven, Netherlands | – | – | – |

| STMicroelectronics | 1987 | Geneva, Switzerland | – | – | – |

| Infineon Technologies | 1999 | Neubiberg, Germany | – | – | – |

| Sony Corporation | 1946 | Tokyo, Japan | – | – | – |

| Mastercard | 1966 | Purchase, USA | – | – | – |

India NFC Market Analysis

Growth Drivers

Rising Mobile Payments

The growth of mobile payments in India is exceptionally driven by the increased smartphone penetration, which reached 800 million users in 2023, according to the Telecom Regulatory Authority of India (TRAI). By end of 2025, mobile payment transactions are projected to exceed USD 500 billion, showcasing substantial acceptance among consumers. The Unified Payments Interface (UPI), managed by the National Payments Corporation of India, facilitated over 117.6 billion transactions in 2023 alone, representing a vital ecosystem for mobile payment adoption.

Growth of E-commerce

India’s e-commerce market is forecasted to reach USD 188 billion, propelled by an increase in internet connectivity and a growing online shopper base, which stood at 175 million in 2023. The trends showcased a shift towards omnichannel retailing, where service providers integrate both offline and online experiences. Moreover, major retail players reported a 30% increase in transactions through contactless payments, often facilitated by NFC technology, making it an essential component of the shopping experience. The widespread adoption of e-wallets and online transactions underscores this growth trajectory.

Market Challenges

Security Concerns

Security remains a prominent concern within the India NFC market, with the National Cyber Security Coordinator revealing an exponential rise in cyberattacks, exceeding 30,000 incidents reported in 2023. The increasing sophistication of threats—including data breaches and identity theft—poses significant risks to users and financial institutions engaging in NFC transactions. Furthermore, a survey conducted by the Ministry of Electronics indicated that 58% of consumers expressed concerns regarding the safety of their financial data when using contactless payment methods, thereby impeding the adoption of NFC technology in daily transactions.

Limited Consumer Awareness

Consumer awareness regarding NFC technology remains relatively low, with only 40% of mobile users familiar with the concept as of 2023, according to a report by the Reserve Bank of India. Efforts to educate consumers on how to utilize NFC capabilities can be greatly improved, as many perceive contactless payments to be complicated. Consequently, this knowledge gap can serve as a barrier to widespread adoption, particularly in rural areas where digital literacy may lag. Increasing awareness through targeted campaigns is essential for enhancing user confidence in NFC-enabled transactions.

Opportunities

Expansion in Retail Sector

The retail sector in India offers ample opportunities for NFC deployment, having witnessed a growth rate of 10% annually, with the market size positioned to reach USD 1.3 trillion by end of 2025. The emergence of new retail formats, including organized retail chains and e-commerce integration, significantly enhances the scope for NFC applications. In 2023, the introduction of various loyalty programs utilizing NFC technology has played a vital role in improving customer retention, leading to an anticipated growth in contactless payment adoption. Retailers report that around 60% of consumers prefer using contactless payment methods, driven by convenience and faster checkouts. The increasing focus on enhancing the shopping experience presents a substantial opportunity for NFC technology to expand its footprint in Indian retail.

Integrating NFC with IoT

The Internet of Things (IoT) market in India is projected to experience substantial growth, with an estimated worth of USD 15 billion by end of 2025. Integrating NFC technology with IoT devices offers extensive opportunities for innovation across various domains such as smart homes, wearables, and automotive. This integration allows for seamless interactions and data exchange among devices, enhancing user experiences and automating processes. In 2023, nearly 60% of IoT devices sold in India came with NFC capabilities, underscoring the demand for connected smart solutions. Such advancements are expected to create a rapidly expanding market for NFC in IoT applications.

Future Outlook

The India NFC market is expected to experience significant growth over the next five years, fueled by continuous government support promoting digital transactions alongside rapid technological advancements in mobile payment systems. As urbanization continues to rise, the demand for efficient, contactless payment solutions will increase, leading to broader adoption in various sectors beyond retail, such as transportation and healthcare. This growth trajectory reflects the evolving consumer preferences for convenience and security.

Major Players

- NXP Semiconductors

- STMicroelectronics

- Infineon Technologies

- Sony Corporation

- Mastercard

- Visa Inc.

- Qualcomm Technologies

- Broadcom Inc.

- Texas Instruments

- Gemalto NV

- Apple Inc.

- Samsung Electronics

- HID Global Corporation

- CardLogix Corporation

- Zebra Technologies

Key Target Audience

- Retail Payment Service Providers

- Bank and Financial Institutions

- Mobile Wallet Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Reserve Bank of India, Ministry of Electronics and Information Technology)

- Telecommunications

- Healthcare Systems and Providers

- Smart Transportation and Logistics Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India NFC market. This process includes extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, including technological advancements, consumer behavior, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India NFC market. This includes assessing market penetration rates, the ratio of NFC-enabled devices to users, and resultant revenue generation across different applications. Additionally, an evaluation of service quality metrics and operational efficiencies will be undertaken to ensure the reliability and accuracy of projected market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse range of companies within the NFC ecosystem. These consultations will provide invaluable operational insight directly from practitioners active in the market. This qualitative data will aid in refining and corroborating quantitative market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with prominent NFC device manufacturers and service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and technological advancements. This interaction serves to verify and augment the statistics obtained through a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India NFC market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Value Chain and Supply Chain Analysis

- Growth Drivers

Increasing Smartphone Penetration

Growth in Contactless Payment Adoption

Advances in Payment Security - Market Challenges

Security Concerns

Lack of Awareness & Infrastructure - Opportunities

Expansion in Digital Payment Ecosystem

Adoption by Small and Medium Enterprises - Trends

Rise of IoT and Smart Devices

Adoption of Mobile Wallets - Government Regulation

Payment and Settlement Systems Act

Data Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Smart Cards

NFC-Enabled Mobile Devices - By Application (In Value %)

Retail Payments

Access Control

Smart Transportation - By End User (In Value %)

Retail

Healthcare

Transportation - By Region (In Value %)

North India

West India

East India

South India - By Deployment Model (In Value %)

Cloud-Based

On-Premise - By Component (In Value %)

Hardware

Software

Services

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Edible Oil Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Transaction Volume, Average Transaction Value, Integration Capabilities, Customer Service Rating, Security Features and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Paytm Payments Bank

PhonePe

Google Pay

Cisco Systems

Mastercard

Visa

NXP Semiconductors

STMicroelectronics

Gemalto (Thales Group)

Infineon Technologies

Samsung Electronics

Amazon Pay

Mobikwik

Bharat Pe

Razorpay

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Average Price, 2025-2030