Market Overview

The UAE fire protection market is valued at USD 3.4 billion in 2024, based on a five-year historical analysis with an approximated compound annual growth rate (CAGR) of 9% from 2024-2030. The market is primarily driven by stringent government regulations mandating fire safety measures, increased awareness regarding safety hazards, and significant growth in the construction sector. Additionally, the continuous upgrade and maintenance of existing fire safety systems contribute to the market’s expansion.

The UAE market is dominated by key cities such as Dubai and Abu Dhabi, where rapid urbanization and large-scale construction projects drive the demand for fire protection solutions. Dubai’s status as a global business hub attracts numerous enterprises, solidifying its role as a leader in implementing advanced fire safety systems. The government is also focused on establishing high safety standards to protect its investments in real estate and infrastructure, which further boosts the adoption of fire protection measures across these cities.

The UAE government has been proactive in implementing regulations aimed at enhancing fire safety across the country. The UAE Fire and Life Safety Code, established in 2020, sets stringent requirements for fire safety standards in both residential and commercial buildings. Compliance mandates have led to a notable increase in demand for fire protection solutions.

Market Segmentation

By Product Type

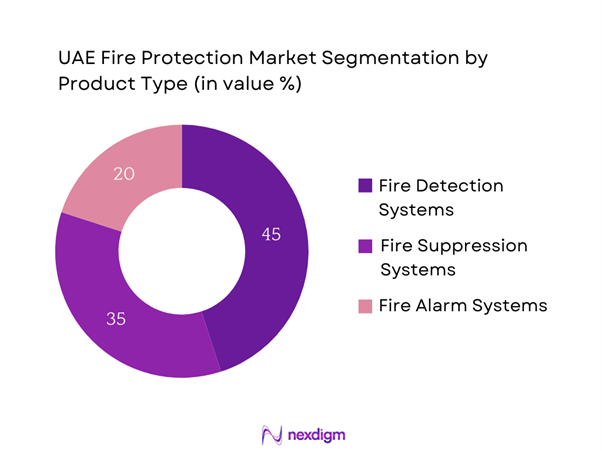

The UAE fire protection market is segmented by product type into fire detection systems, fire suppression systems, and fire alarm systems. Fire detection systems currently dominate the market due to the increasing demand for early-warning solutions that can significantly reduce property damage and save lives during fire incidents. As building codes become more stringent, and as businesses become more aware of the financial implications of fire hazards, the emphasis on advanced fire detection technologies has led to an increased market presence for this segment.

By Service Type

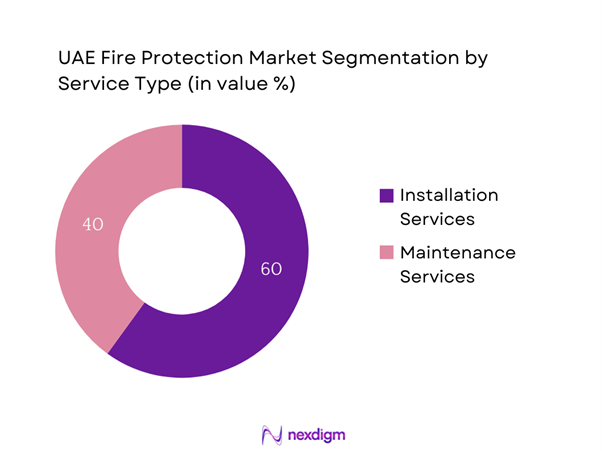

The UAE fire protection market также segmented by service type into installation services and maintenance services. Installation services are currently dominating the market share, as new constructions arise across the UAE and require comprehensive fire protection systems from the ground up. The growing complexity of integrated fire systems, coupled with the need for compliance with regulatory standards, emphasizes the critical nature of professional installation services, thereby driving this sub-segment’s growth.

Competitive Landscape

The UAE fire protection market is characterized by the presence of several major players, including advanced local companies and global brands. The competition is primarily driven by innovation, technological advancements, and reliable customer service. Companies are increasingly focusing on integrated solutions and smart technologies to enhance safety in buildings. The presence of both established global firms and emerging local players ensures a dynamic market environment.

| Company Name | Establishment Year | Headquarters | Market Position | Product Range | Geographic Reach | Client Segments |

| Honeywell International Inc. | 1906 | Morris Plains, NJ, USA | – | – | – | – |

| Tyco International | 1960 | Cork, Ireland | – | – | – | – |

| Siemens AG | 1847 | Munich, Germany | – | – | – | – |

| Johnson Controls International | 1885 | Cork, Ireland | – | – | – | – |

| UTC Climate, Controls & Security | 1994 | Farmington, CT, USA | – | – | – | – |

UAE Fire Protection Market Analysis

Growth Drivers

Increased Safety Awareness

In recent years, rising urbanization and increasing population densities in cities like Dubai and Abu Dhabi have enhanced public safety awareness regarding fire hazards. As urban infrastructure continues to grow, so does the recognition of the need for robust fire safety measures. Reports indicate a significant rise in the number of fire incidents, emphasizing the urgency for effective fire protection systems.

Urban Development Initiatives

The ongoing urban development initiatives across the UAE have significantly bolstered the demand for fire protection solutions. The UAE is investing heavily in mega infrastructural projects, especially in the lead-up to global events like Expo 2020 and Dubai’s Vision 2040, which aims to make the city one of the world’s best urban environments. The construction sector is projected to grow, contributing to a significant rise in the number of high-rise buildings and commercial complexes.

Market Challenges

Technological Limitations

Technological limitations present a significant challenge for the UAE fire protection market. While advancements in fire safety technologies are rapid, some local implementations still rely on outdated systems that lack integration with smart technologies and IoT (Internet of Things) capabilities. As the industry moves towards more integrated fire safety solutions, many facilities struggle to upgrade due to compatibility issues with legacy systems. As of 2022, it was estimated that around 40% of existing fire protection installations across various sectors still operate without the latest technologies, hampering efficiency and overall effectiveness.

Lack of Skilled Professionals

Another challenge facing the UAE fire protection market is the shortage of skilled professionals specializing in fire safety systems. The demand for qualified engineers and technicians has outpaced the supply in recent years, primarily due to the rapid expansion of the construction and safety sectors. As of 2022, approximately 60% of companies reported difficulty in recruiting professionals with the necessary qualifications in fire safety technology. These skills gap not only delays system installations and maintenance but also hinders overall industry growth and compliance with government regulations.

Opportunities

Expanding Construction Sector

The expanding construction sector in the UAE presents a significant opportunity for the fire protection market. Massive ongoing projects and developments, including residential towers, commercial complexes, and infrastructure, have resulted in heightened demand for comprehensive fire safety measures. In 2022, the construction sector was projected to grow by over 4% year-on-year, driven by investments in mega projects and public-private partnerships. This growth offers a fertile ground for fire protection companies to introduce advanced safety solutions tailored to modern building practices, thus fostering further market expansion.

Aging Infrastructure Upgrades

As existing infrastructure ages, the need for updating fire safety systems becomes critical. A notable portion of the UAE’s buildings, particularly older structures in urban areas, lack adequate fire protection measures, representing a key opportunity for upgrading and renovating fire safety systems. By 2022, around 30% of commercial buildings were identified as requiring significant upgrades to meet modern fire safety standards, particularly due to the evolving regulatory landscape. This presents a market opportunity for fire protection firms to engage in retrofit projects, ultimately improving compliance and safety in these older facilities.

Future Outlook

Over the next five years, the UAE fire protection market is expected to show substantial growth driven by ongoing government initiatives promoting safety regulations, advancements in fire safety technology, and the increasing demand for sophisticated fire protection solutions in newly developed infrastructures. As fire safety becomes a priority, both public and private sectors are anticipated to invest heavily in fire protection systems, leading to a robust market outlook.

Major Players

- Honeywell International Inc.

- Tyco International

- Siemens AG

- Johnson Controls International

- UTC Climate, Controls & Security

- Bosch Security Systems

- Halma plc

- Hochiki Corporation

- Minimax Viking

- Securitas AB

- Advanced Protection Systems

- Fire Safety Systems LLC

- National Fire Equipment Ltd.

- LSC Group

- MSA Safety Incorporated

Key Target Audience

- Government and Regulatory Bodies (e.g., UAE Civil Defence)

- Fire Safety Consultancies

- Property Developers and Real Estate Firms

- Construction Companies

- Facility Management Companies

- Insurance Companies

- Investments

- Venture Capitalist Firms

- Industry Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map that identifies all the major stakeholders within the UAE fire protection market. This is achieved through extensive desk research, utilizing a mix of secondary and proprietary databases to gather insightful industry-level information. The primary goal is to spotlight and define the pivotal variables influencing market dynamics, ranging from regulatory requirements to technological innovations.

Step 2: Market Analysis and Construction

In this phase, historical data related to the UAE fire protection market is compiled and scrutinized. This includes assessing market penetration rates, the ratio of different service types, and resultant revenue generation from fire protection solutions. An evaluation of service quality metrics is also conducted to ensure the reliability and accuracy of revenue estimations, providing a clearer picture of business performance and consumer demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses formulated in earlier phases are validated through consultations with industry experts representing diverse companies in the fire protection sector. These consultations leverage computer-assisted telephone interviews (CATIs) and provide substantial operational and financial insights directly from practitioners. This collaborative effort is essential to refine, corroborate, and enhance the dataset obtained through previous research phases.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with prominent fire protection manufacturers and service providers. Detailed insights are gathered on product segments, sales performance, consumer preferences, and evolving market factors. This interplay of direct insights complements the bottom-up approach adopted earlier, leading to a comprehensive, accurate, and validated analysis of the UAE fire protection market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Deptt, Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genisis

- Timeline of Major Players

- Business Cycle

- Value Chain and Supply Chain Analysis

- Growth Drivers

Increased Safety Awareness

Implementation of Government Regulations

Urban Development Initiatives - Market Challenges

High Installation Costs

Technological Limitations

Lack of Skilled Professionals - Opportunities

Technological Innovations

Expanding Construction Sector

Aging Infrastructure Upgrades - Trends

Integration of Smart Technologies

Growing Adoption of Fire Safety Standards

Sustainable Fire Safety Solutions - Government Regulations

UAE Fire and Life Safety Code

Mandatory Fire Safety Audits

Building Codes Compliance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Fire Detection Systems

Fire Suppression Systems

Fire Alarm Systems - By Service Type (In Value %)

Installation Services

Maintenance Services - By Application (In Value %)

Residential

Commercial

Industrial - By End User (In Value %)

Hospitality

Healthcare

Manufacturing - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Other Northern Emirates

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Fire Protection Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Product Range, Customer Satisfaction Index, Technological Innovation, Distribution Network, Regional Presence, Regulatory Compliance Rate and others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Tyco International

Honeywell

Siemens

Johnson Controls

UTC Fire & Security

National Fire Protection Inc.

Gulf Fire & Safety

Emirates Fire Fighting Equipment Factory

Al Badaa Fire and Safety

Naffco

Fire Safety Solutions

AEGIS Fire Protection

Ansul

BRK Brands

Firetrace International

- Market Demand and Utilization Patterns

- Regulatory Compliance Expectations

- Decision-Making Process for Purchases

- By Value, 2025-2030

- By Average Price, 2025-2030