Market Overview

The KSA Edible Oil Market is valued at USD 1.36 billion in 2024, reflecting robust growth with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, fueled by rising health consciousness among consumers and an increasing demand for diverse cooking oils. The market is primarily driven by the growing consumption of vegetable oils, as they are considered healthier alternatives to saturated fats. According to data from the Saudi Food and Drug Authority, consumption rates continue to climb, highlighting shifts in dietary preferences and increased urbanization in the region, which drives higher demand for packaged edible oils.

Key cities such as Riyadh, Jeddah, and Dammam dominate the KSA Edible Oil Market due to their large populations and significant food service industries. Riyadh, being the capital, leads in retail and food production, while Jeddah serves as a major trading hub both locally and for imports.

The Saudi government is actively implementing initiatives aimed at enhancing food security, notably under the Vision 2030 framework. Significant investments amounting to USD 27 billion have been directed towards improving agricultural productivity and technology adoption in the food sector, including edible oils. Initiatives such as the Saudi Agriculture and Livestock Investment Company support local farmers and producers, promoting nutritional quality and sustainability in agricultural practices.

Market Segmentation

By Product Type

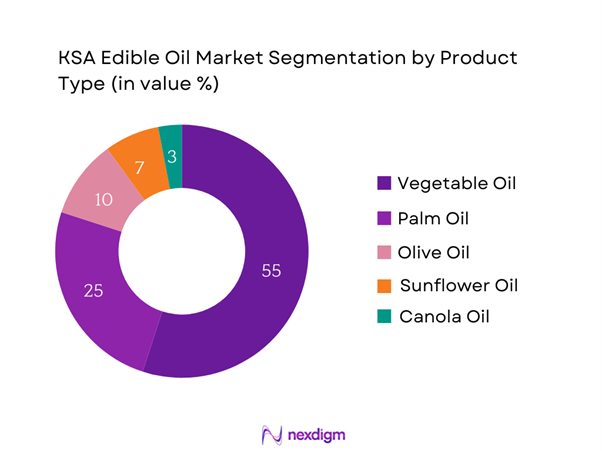

The KSA Edible Oil Market is segmented by product type into vegetable oil, palm oil, olive oil, sunflower oil, and canola oil. Currently, the vegetable oil segment holds a dominant market share due to its broad acceptance and versatility in various culinary applications. Vegetable oils, particularly those derived from soybeans and rapeseed, are sought after for their health benefits, cooking properties, and affordability. The popularity of this segment is further augmented by aggressive marketing strategies from leading brands, which emphasize health attributes and sustainability, making it the preferred choice for consumers.

By Application

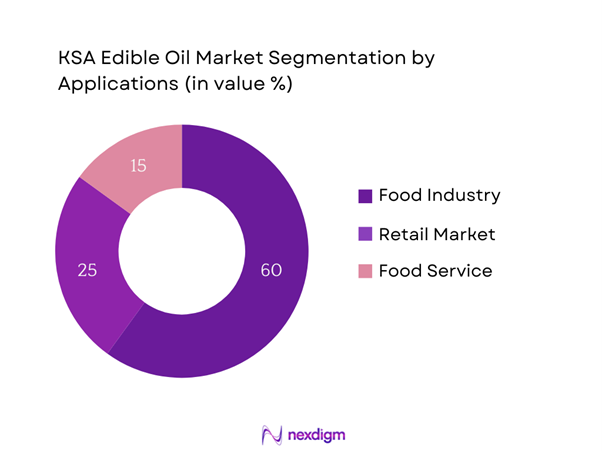

The KSA Edible Oil Market is also categorized by application into food industry, retail market, and food service sector. The food industry segment commands a significant market share, as it encompasses a range of uses from frying to baking and food processing. Major food processing companies rely heavily on edible oils for product formulations, and this dependency underpins the segment’s dominance. Furthermore, the growth of the quick-service restaurant sector, which favors the use of high-quality oils for cooking, continues to drive demand in this application.

Competitive Landscape

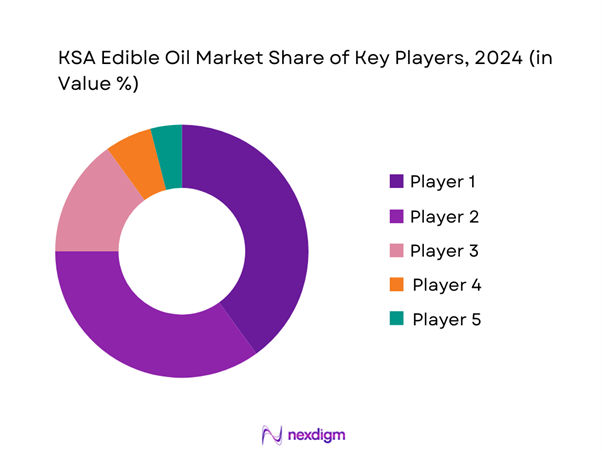

The KSA Edible Oil Market is characterized by the presence of major players, including both local manufacturers and international brands. The market landscape is primarily shaped by strong competition among these companies, with leading brands such as Saudi Arabian Oil Company (Aramco), Savola Group, and Almarai Company playing crucial roles in maintaining quality standards and market influence.

| Company Name | Establishment Year | Headquarters | Product Range | Distribution Strategy | Sustainability Practices |

| Saudi Arabian Oil Company (Aramco) | 1933 | Dhahran | – | – | – |

| Savola Group | 1979 | Jeddah | – | – | – |

| Almarai Company | 1977 | Riyadh | – | – | – |

| United Foods Company | 1994 | Dammam | – | – | – |

| Nadec | 1981 | Riyadh | – | – | – |

KSA Edible Oil Market Analysis

Growth Drivers

Increasing Population

The Kingdom of Saudi Arabia’s population is projected to reach approximately 36 million in 2023, up from around 34 million in 2022. This population growth drives demand for food products, including edible oils, as more households consume cooking oils in various dishes. With an annual population increase of about 1.76 million, the continued expansion will significantly impact the overall demand for edible oils in the market. This growth in population contributes to higher consumption rates, benefiting the edible oil sector as households require more essential cooking ingredients.

Rising Health Awareness

Health consciousness is on the rise among Saudi consumers. The Saudi Health Council has reported a significant increase in awareness around health and nutrition, particularly concerning the negative impact of saturated fats on cardiovascular health. According to the Saudi Ministry of Health, 55% of the population is now actively looking for healthier food options, including oils low in saturated fats and high in polyunsaturated fats. This shift in consumer behavior stimulates demand for healthier edible oil alternatives, encouraging market growth and innovation in product offerings.

Market Challenges

Fluctuating Raw Material Prices

The edible oil market in Saudi Arabia is susceptible to price fluctuations of raw materials, particularly due to reliance on imports for key ingredients. As of 2023, global prices for palm oil surged to USD 886 per metric ton, largely driven by climatic conditions and geopolitical tensions in producing regions. This volatility poses a significant challenge for producers in Saudi Arabia, as fluctuating raw material costs can lead to increased operational costs and ultimately affect retail prices and consumer purchasing decisions negatively.

Health Concerns Related to Edible Oils

Growing health concerns regarding certain types of edible oils impact consumer preferences in Saudi Arabia. Reports from the Saudi Food and Drug Authority indicate that the incidence of lifestyle-related diseases, such as obesity and heart disease, has increased among the population, prompting a reassessment of dietary fats. In 2023, approximately 23.7% of adults in the Kingdom are classified as obese, leading to heightened scrutiny of edible oil products. As a result, consumers are increasingly seeking healthier oils, placing pressure on manufacturers to adapt their offerings and educate the market effectively.

Opportunities

Introduction of Healthier Options

There is a growing market opportunity for healthier options within the edible oil segment in Saudi Arabia. The health-conscious consumer base has driven suppliers to explore innovative products such as extravirgin olive oil and oils enriched with omega-3 fatty acids. The market for healthy cooking oils is currently expanding, indicating a significant potential for growth. For instance, sales of olive oil have seen an impressive rise, with consumption increasing by 15% in the last year alone. This shift can be attributed to the health benefits associated with olive oil, such as reducing the risk of heart disease and improving digestion.

Export Potential

Saudi Arabia is well-positioned to capitalize on the growing global demand for edible oils, particularly in the Middle East and North Africa (MENA) region. The Kingdom’s strategic location enables easy access to international markets. In 2022, Saudi Arabia exported edible oils worth approximately USD 500 million, driven largely by increasing demand for vegetable oils in Gulf Cooperation Council (GCC) countries. Continued improvements in quality standards and packaging can further enhance export potential. The government’s commitment to diversifying the economy and supporting agricultural exports is likely to strengthen this opportunity further.

Future Outlook

Over the next five years, the KSA Edible Oil Market is expected to experience significant growth driven by increasing health awareness among consumers, innovative product offerings, and expanding distribution channels. Government support for local production and a push towards healthier cooking options will further enhance market dynamics, positioning the edible oil sector for robust expansion. As consumer preferences evolve, manufacturers will likely adapt by introducing fortified and organic oils, thereby tapping into a growing niche market.

Major Players

- Saudi Arabian Oil Company (Aramco)

- Savola Group

- Almarai Company

- United Foods Company

- Nadec

- Al Khabeer Group

- Asemco

- Nourish Foods

- Al-Babtain Group

- Al-Rajhi Foods

- Arabian Food Industries Company

- Al-Fadl Company

- Krispy Foods

- Aujan Group

- Al-Watania Agriculture

Key Target Audience

- Food Manufacturers

- Retail Chains

- Restaurants and Cafés

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food and Drug Authority)

- Distributors and Wholesalers

- Agricultural Cooperatives

- Food and Beverage Exporters

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Edible Oil Market. This step is underpinned by extensive desk research, utilizing a combination of secondary data from industry reports, trade publications, and internal databases to gather comprehensive insights. The primary objective is to identify and define the critical variables that influence market dynamics, such as consumer behavior and production trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA Edible Oil Market. This includes assessing market penetration rates among various product types and understanding revenue generation across different segments. An evaluation of consumer preferences and consumption patterns is also conducted to ensure an accurate understanding of the revenue estimates and growth opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representative of key companies within the KSA Edible Oil Market. These consultations provide valuable operational insights that are instrumental in refining decision-making processes and corroborating projected market data.

Step 4: Research Synthesis and Final Output

The final phase involves in-depth engagement with multiple edible oil manufacturers to gather detailed insights into product segments, sales performance, and consumer preferences. This interaction helps verify and complement statistics derived from both the top-down and bottom-up approaches, ensuring a comprehensive, accurate, and validated analysis of the KSA Edible Oil Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Consciousness

Rising Population and Urbanization

Expansion of Food Processing Industry - Market Challenges

Fluctuations in Raw Material Prices

Regulatory and Compliance Requirements - Opportunities

Emerging Demand for Organic Oils

Growing Trend of Health-Oriented Products - Trends

Shift Towards Sustainable Practices

Innovations in Packaging - Government Regulation

Import Tariffs and Duties

Quality Assurance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Vegetable Oil

Palm Oil

Olive Oil

Sunflower Oil

Canola Oil - By Application (In Value %)

Food Industry

Retail Market

Food Service Sector - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Convenience Stores

Online Retail - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Packaging Type (In Value %)

Bottles

Pouches

Cans

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Edible Oil Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Edible Oil, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Al-Jazira Oil & Gas

Saudi Vegetable Oil

SAAHEM

Savola Group

Al-Watania

United Oil Processing and Packaging

Aujan Group

Gulf Oil Industries

Al-Faisal Group

Cargill

Unilever

Ajwa Group

Tawazun

Makkah Refineries

Al-Futtaim

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030