Market Overview

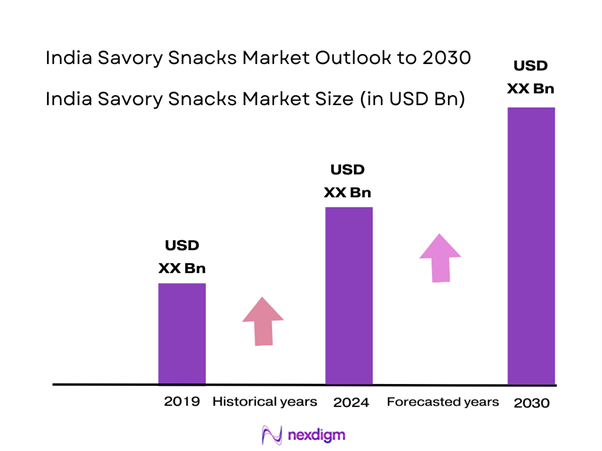

The India savory snacks market is valued at USD 253.21 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 6.03 % from 2025-2030, based on a comprehensive five-year historical analysis. This substantial market size is driven by the growing urban population, increasing disposable income, and a shift toward snacking culture among consumers. Additionally, the rise of organized retail and e-commerce is making savory snacks more accessible to a larger demographic, thus propelling market growth.

Dominant cities like Mumbai, Delhi, and Bengaluru are at the forefront of the savory snacks market due to their large population bases and urbanized lifestyles. These cities boast a diverse consumer palette with a preference for both traditional and contemporary snacks. The burgeoning middle-class population in these urban areas is also contributing to increased demand for innovative snack offerings and high-quality products, further solidifying their dominance in the market.

The upward trend in disposable income in India is a significant driver for the savory snacks market. As of 2023, the per capita income has reached around USD 2,485, and it is expected to increase, bolstering consumers’ purchasing power. A report by the World Bank highlighted that with a projected increase to USD 2,937 by end of 2025, the growing affluence allows consumers to spend more on discretionary items like snacks, especially innovative and premium products.

Market Segmentation

By Product Type

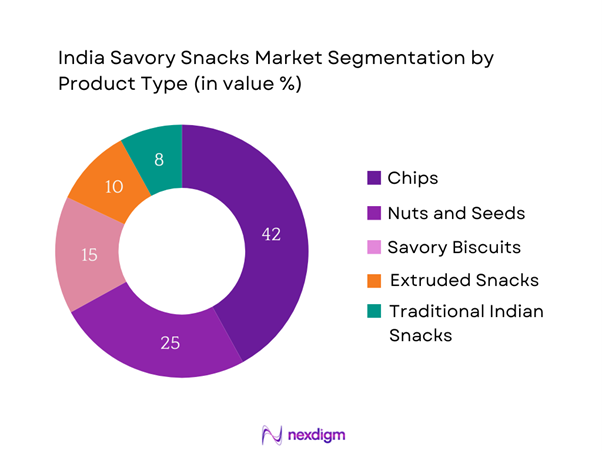

The India savory snacks market is segmented by product type into chips, nuts and seeds, savory biscuits, extruded snacks, and traditional Indian snacks. The chips segment holds the dominant market share under this classification, as they have ingrained themselves as a staple snack in Indian households. Brands like Lay’s and Kurkure have significantly contributed to this dominance by introducing diverse flavors tailored to local tastes, thus ensuring widespread appeal and consumer loyalty. The versatility of chips also suits various consumption occasions, making them a go-to option for snacking.

By Distribution Channel

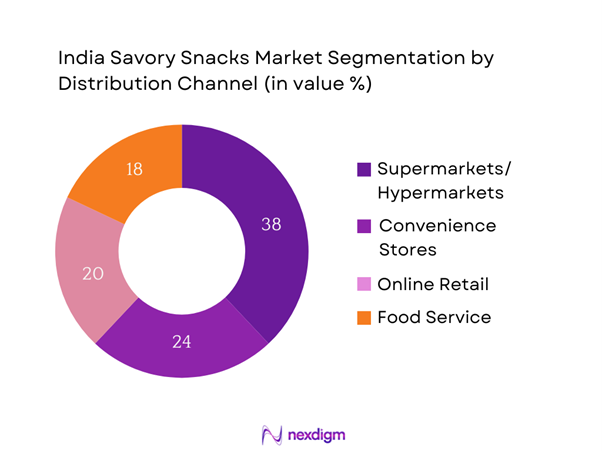

The India savory snacks market is also segmented by distribution channel into hypermarkets/supermarkets, convenience stores, online retail, and food service. The hypermarkets and supermarkets segment currently dominates the market, capturing a significant share due to their ability to offer a wide range of products under one roof. The physical store experience allows for impulse buying and the ability for consumers to browse various brands and products, which enhances their purchasing decisions.

Competitive Landscape

The India savory snacks market is dominated by a few major players, including PepsiCo, ITC Limited, and Haldiram’s. This consolidation highlights the significant influence of these key companies, which benefit from strong brand recognition and extensive distribution networks that span rural and urban marketplaces alike. Their ability to adapt to changing consumer preferences and invest in innovative snack products further fortifies their market positions.

| Company | Establishment Year | Headquarters | Market Position | Product Range | Distribution Network | Brand Recognition |

| PepsiCo | 1965 | Purchase, NY, USA | – | – | – | – |

| ITC Limited | 1910 | Kolkata, India | – | – | – | – |

| Haldiram’s | 1937 | Nagpur, India | – | – | – | – |

| Britannia Industries | 1892 | Bangalore, India | – | – | – | – |

| Parle Agro | 1984 | Mumbai, India | – | – | – | – |

India Savory Snacks Market Analysis

Growth Drivers

Urbanization

Urbanization continues to propel the growth of the India savory snacks market, with approximately 36.36% of India’s population now living in urban areas as of 2023, a number projected to rise significantly. The increasing urban population has led to lifestyle changes that favor fast, convenient, and readily available food options. The National Institution for Transforming India (NITI Aayog) has projected that urban areas will contribute to 70% of the country’s GDP by end of 2025. This rapid urban growth fosters a culture of convenience, leading to a consistent preference for ready-to-eat snacks, thereby driving market demand.

Flavorful and Innovative Offerings

Innovation in snack flavors and product offerings is essential in retaining consumer interest and driving sales. Data shows that the introduction of new and unique flavors has spurred an annual growth in product launches by over 20% during the past years. With Indian consumers increasingly seeking diverse taste experiences, companies have started offering products ranging from traditional flavors to fusion snacks that cater to evolving palates. The Food Safety and Standards Authority of India (FSSAI) supports diversification, promoting new formulations to enhance consumer choice. This innovative approach is likely to continue bolstering market growth.

Market Challenges

Health Concerns

The rising health consciousness among consumers presents a considerable challenge for the savory snacks market. A survey by the Ministry of Health and Family Welfare found that about 58% of urban adults believe that unhealthy eating habits contribute to health issues like obesity and diabetes. As a result, consumers are increasingly scrutinizing the nutritional content of snacks, leading to a shift towards healthier options. The government has launched initiatives promoting healthier eating practices, which compel manufacturers to adapt their offerings to balance taste and health benefits, resulting in additional costs and R&D efforts.

Pricing Pressure

Pricing pressure remains a critical challenge for manufacturers in the savory snacks sector, stemming from volatile raw material prices and increased operational costs. According to the Food and Agricultural Organization (FAO), fluctuations in prices of essential ingredients like grains and oils have risen sharply, impacting profitability. The budget allocation for snacks is becoming more scrutinized among consumers who may opt for economical choices over premium products. Consequently, manufacturers need to devise strategies to manage costs while maintaining quality to remain competitive in a price-sensitive market.

Opportunities

Utilization of E-commerce Platforms

The expansion of e-commerce platforms presents a promising opportunity for the savory snacks market, particularly with the rise of online grocery shopping. As of 2023, e-commerce penetration in the grocery sector reached approximately 9%, with projections indicating that this figure could grow significantly in the coming years. Data from the Ministry of Commerce and Industry shows that online grocery sales in India are expected to cross USD 18 billion by end of 2025, driven by increased smartphone usage and internet penetration.

Increased Focus on Healthier Options

As health trends become a priority for consumers, manufacturers have the opportunity to innovate and offer healthier alternatives to traditional snacks. Data indicates that the demand for low-calorie and high-protein snacks has surged, with current health-focused trends suggesting that around 45% of consumers are actively seeking healthier ingredients. Moreover, the government’s ‘Eat Right India’ initiative encourages the consumption of safe and nutritious food. Brands can capitalize on this movement by reformulating existing products or introducing new ones that meet these health standards, appealing to the growing health-conscious demographic.

Future Outlook

Over the next five years, the India savory snacks market is expected to witness robust growth, driven by continuous urbanization, evolving consumer preferences, and the increasing demand for convenient and on-the-go snack options. The burgeoning health-conscious consumer base is also steering manufacturers towards the introduction of healthier snack alternatives, which could further expand the market. Additionally, the rise of e-commerce is enhancing accessibility to a wider audience, facilitating easier purchasing decisions for consumers.

Major Players

- PepsiCo

- ITC Limited

- Haldiram’s

- Britannia Industries

- Parle Agro

- Bikanervala

- Nibblee

- DFM Foods

- Anmol Industries

- Sunfeast (ITC)

- Balaji Wafers

- MTR Foods

- Camelia Foods

- Nutty Yogi

- Ranjeet Foods

Key Target Audience

- Retail Distributors

- Food and Beverage Manufacturers

- Supermarkets and Hypermarkets

- E-commerce Platforms

- Food Service Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India savory snacks market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as consumer preferences and demographic trends.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertinent to the India savory snacks market. This includes evaluating market penetration rates, assessing the ratio of marketplaces to service providers, and the resultant revenue generation. An in-depth assessment of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates, aiding in a robust market picture.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple savory snacks manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India savory snacks market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Landscape

- Key Milestones of Major Players

- Market Dynamics

- Revenue Model Analysis

- Growth Drivers

Increasing Health Consciousness

Rising Urbanization

Expansion of Retail Outlets - Market Challenges

Health Concerns

Intense Competition - Opportunities

Innovations in Flavors

Penetration into Tier II and III Cities - Trends

Desire for Organic Snacks

Growth of Ethical Consumption - Government Regulation

Food Safety Standards

Packaging Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Chips

Nuts and Seeds

Savory Biscuits

Extruded Snacks

Traditional Indian Snacks - By Distribution Channel (In Value %)

Hypermarkets/Supermarkets

Convenience Stores

Online Retail

Food Service - By Packaging Type (In Value %)

Flexible Packaging

Rigid Packaging - By Region (In Value %)

North India

South India

East India

West India

Central India - By Consumer Demographics (In Value %)

Age Group

Income Levels

Urban vs Rural

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Savory Snacks Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Volume Sales, Inception Year, Number of Product Variants, Customer Satisfaction Index, Average Price, Innovation Rate, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Haldiram Snacks

Britannia Industries

Pepsico India

ITC Limited

Bikano

MTR Foods

Pran Foods

Urban Platter

Parle Agro

DFM Foods

Tasty Bite Eatables

Sunfeast

Del Monte

NutriSnack

Karam Snacks

- Consumption Patterns

- Brand Loyalty and Preferences

- Pricing Sensitivity

- Motivational Factors

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030