Market Overview

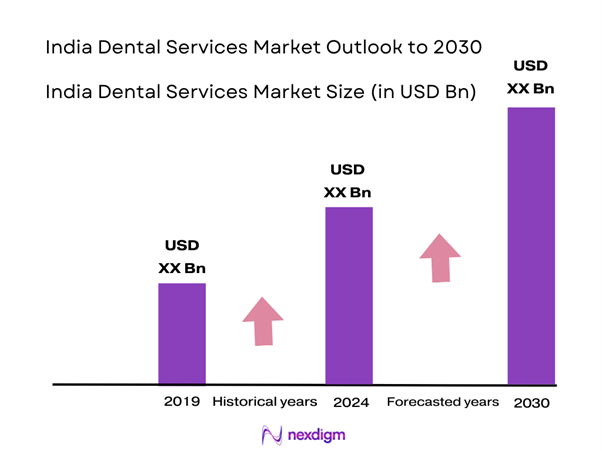

The India Dental Services market is valued at USD 2.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, based on a comprehensive five-year historical analysis. Driven by increasing awareness of oral health among the populace and advancements in dental technology, the market has seen significant growth. Rising disposable incomes and government initiatives aimed at improving healthcare access also contribute to the expanding market size.

The market is predominantly concentrated in urban centers such as Delhi, Mumbai, Bangalore, and Hyderabad. These cities dominate due to higher per capita income, greater availability of advanced healthcare facilities, and an increasing number of dental professionals. Their robust infrastructure and growing middle-class populations are essential drivers for the expansion of dental services, as residents show a willingness to invest in preventive and cosmetic dental care.

The Indian government is taking active measures to promote dental health through various initiatives and policies. The National Oral Health Program aims to create a framework for enhancing dental care services across the country, with an investment of INR 500 crores allocated towards various health campaigns. Policies promoting the establishment of Dental Health Clinics in rural and urban areas are supported by incentives for healthcare professionals to practice in underserved regions.

Market Segmentation

By Service Type

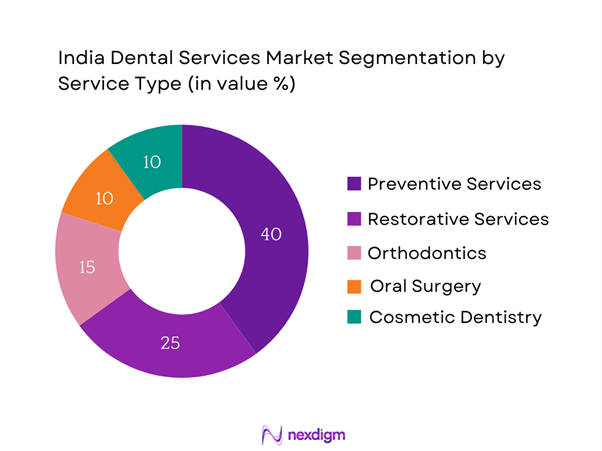

The India Dental Services market is segmented by service type into preventive services, restorative services, orthodontics, oral surgeries, and cosmetic dentistry. The preventive services sub-segment is currently dominating the market share due to the increasing public awareness regarding the importance of maintaining oral health and regular check-ups. This has led to a surge in dental visits for cleanings, check-ups, and early interventions, which are significantly promoted by dental professionals and health campaigns.

By End User

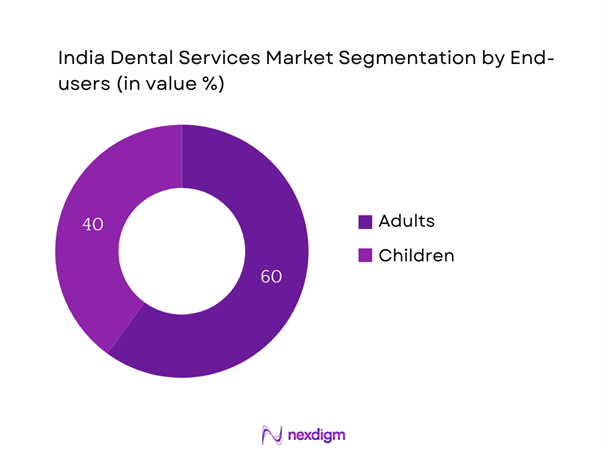

The second segment classification focuses on end users, especially adults and children. Among these, the adult demographic is currently dominating the market share. The rising prevalence of dental issues such as periodontitis and oral cancers among adults drives the demand for procedural treatments. Additionally, adults increasingly seek services related to aesthetics and functionality, including teeth whitening, veneers, and crowns, making this sub-segment a lucrative market phase for dental service providers.

Competitive Landscape

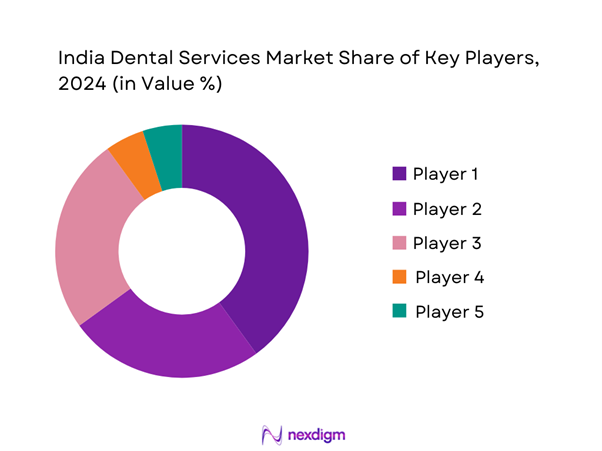

The competitive landscape of the India Dental Services market features several key players. The market is characterized by a mix of established organizations and new entrants offering innovative dental solutions. The India Dental Services market is dominated by a few major players, including Apollo White Dental and Clove Dental, which offer a diverse range of dental solutions. These companies maintain a competitive advantage with extensive networks, advanced technologies, and strong brand presence, illustrating their significant influence in the market. The leading companies include:

| Company Name | Year Established | Headquarters | No. of Clinics | Employee Strength | Key Services Offered |

| Apollo White Dental | 2008 | New Delhi | – | – | – |

| Clove Dental | 2011 | Gurugram | – | – | – |

| Dentzz Dental Care | 2005 | Mumbai | – | – | – |

| MyDentist | 2018 | Bangalore | – | – | – |

| 32 Smiles | 2010 | Chennai | – | – | – |

India Dental Services Market Analysis

Growth Drivers

Increasing Oral Health Awareness

The growing awareness about oral health is significantly boosting the dental services market in India. As per the National Oral Health Program initiated by the Government of India, oral diseases are increasingly recognized as a public health issue. The program aims to reduce the burden of dental disease through increased public awareness and education. The Indian government’s investment of approximately INR 400 crores in various dental health initiatives by end of 2025 highlights the emphasis on improving oral hygiene practices.

Rise in Disposable Income

With India’s per capita income projected to reach USD 2,500 by end of 2025, an increase in disposable income is enabling consumers to allocate more funds toward health care, including dental services. The consumption expenditure on dental care is expected to rise as median household income continues to improve. According to UN data, India is experiencing significant economic growth, contributing to an increase in the middle-class population, which has educational and health needs, specifically relating to oral hygiene.

Market Challenges

Shortage of Dental Professionals

There is a pressing shortage of dental professionals in India, with estimates indicating that the country requires at least 20,000 more dental practitioners to meet the current demand. The ratio of dentists in India is approximately 1:10,000, significantly lower than the WHO recommendation of 1:2,000. This shortage not only affects accessibility to dental services but also contributes to increased waiting times, further dissuading potential patients from seeking care. The lack of adequate training facilities and resources for dentists exacerbates the challenge further.

High Cost of Advanced Dental Procedures

The cost of advanced dental procedures in India can be prohibitively high, creating a barrier to access for many potential patients. For instance, dental implants, which are increasingly in demand, can range from INR 30,000 to INR 1,50,000 per implant, depending on various factors including technology and location. High-quality dental care often requires advanced materials and technology, further increasing costs. The disparity in pricing can preclude lower-income individuals from obtaining necessary dental services, highlighting economic inequalities in healthcare access.

Opportunities

Growth in Cosmetic Dentistry

The demand for cosmetic dentistry in India is surging, fueled by the increasing importance of aesthetics and social media influence. With around 70% of the urban population expressing a preference for aesthetic dental procedures, this sub-segment of the market offers robust growth potential. Procedures such as teeth whitening, veneers, and orthodontics are becoming increasingly popular among millennials and Generation Z who prioritize their appearance. The aesthetic dental market is thus ripe for expansion, especially as clinics begin to offer new technologies and treatments tailored to this demographic’s preferences.

Tele-dentistry Services

The rapid growth of digital healthcare solutions is paving the way for tele-dentistry services, offering new avenues for patient engagement and convenience. With over 800 million internet users in India, the adoption of telehealth solutions, including virtual consultations and follow-up appointments, has become increasingly feasible and attractive. Tele-dentistry can address geographical barriers, particularly in rural areas where access to experienced dental professionals is limited. This innovation enhances the overall patient experience by reducing travel time and improving access, enabling dental practices to cater to a wider audience.

Future Outlook

Over the next five years, the India Dental Services market is expected to show significant growth driven by continuous government support, advancements in dental technology, and increasing consumer demand for both preventive and cosmetic dental solutions. With a rising awareness of oral hygiene and health, coupled with the growing middle-class consumer base, the market is projected to expand further. Innovations in equipment and treatment methodologies will likely enhance patient experience and boost service delivery efficiency.

Major Players

- Apollo White Dental

- Clove Dental

- Dentzz Dental Care

- MyDentist

- 32 Smiles

- Axis Dental

- Narayana Health

- GSK Dental Clinic

- Smile Care

- Talwalkars

- Batra’s Homeopathy

- Agarwal’s Eye Hospital

- Fortis Healthcare

- Manipal Hospitals

- Dental Vann

Key Target Audience

- Dental Clinics and Hospitals

- Dental Equipment Manufacturers

- Cosmetic Dentistry Practices

- Insurance Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare, Dental Council of India)

- Public Health Organizations

- Pharmaceutical Companies involved in Dental Care

Research Methodology

Step 1: Identification of Key Variables

The research process begins with the construction of an ecosystem map that includes all key stakeholders in the India Dental Services market. To achieve this, extensive desk research is conducted, utilizing a combination of secondary sources, including market reports, journal articles, and proprietary databases. The goal during this step is to identify and define critical variables influencing market dynamics, including demographic trends, healthcare policies, and consumer behavior.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical and current data relevant to the India Dental Services market. The research emphasizes a thorough assessment of market penetration rates, service provider density, and revenue generation metrics. Additionally, service quality statistics are evaluated to ensure reliable and accurate revenue estimates. By comparing different metrics, a comprehensive picture of market performance is constructed.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on the initial analysis and are validated through direct consultations with industry experts via computer-assisted telephone interviews (CATIs). These interviews encompass representatives from diverse companies, ranging from dental service providers to dental equipment manufacturers. Insights gained here are invaluable in refining market data and incorporating operational and financial insights directly from practitioners within the field.

Step 4: Research Synthesis and Final Output

In this final phase, direct engagement with a range of established dental service providers is carried out. This interaction aims to gather detailed insights into specific services offered, sales performance metrics, patient preferences, and other pertinent factors. This dialogue will serve to confirm and complement the statistics derived from the bottom-up approach, ensuring a validated and comprehensive analysis of the India Dental Services market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Market Landscape

- Market Development Timeline

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Dental Awareness

Rising Disposable Income

Increasing Penetration of Dental Insurance - Market Challenges

High Treatment Costs

Shortage of Skilled Professionals - Opportunities

Growth of Medical Tourism

Technological Advancements - Trends

Rise in Cosmetic Dentistry

Tele-dentistry Adoption - Regulatory Landscape

Licensing and Accreditation

Quality Control Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Preventive Services

Restorative Services

Orthodontics

Oral Surgery

Cosmetic Dentistry - By End User (In Value %)

Adults

Children - By Region (In Value %)

North India

South India

East India

West India - By Specialty (In Value %)

Periodontics

Prosthodontics

Oral and Maxillofacial Surgery - By Payment Mode (In Value %)

Cash

Insurance

EMIs

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Dental Services Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenue Analysis, Number of Clinics, Distribution Channels, Staff Strength, Patient Satisfaction Scores, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Apollo Dental

Dr. Joy Dental Clinic

Clove Dental

Toothsi

FMS Dental Hospital

Dentzz Dental Care

Queen’s Dental Clinic

Dental Lounge

Smiles on Wheels

Practo Health Services

32 Dental Care

Sri Dental Clinic

Meraki Dental Clinic

BriteSmile Dental Care

The Dental House

- Market Demand and Utilization

- Patient Budget Allocations

- Regulatory and Compliance Requirements

- Patients’ Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Average Price, 2025-2030