Market Overview

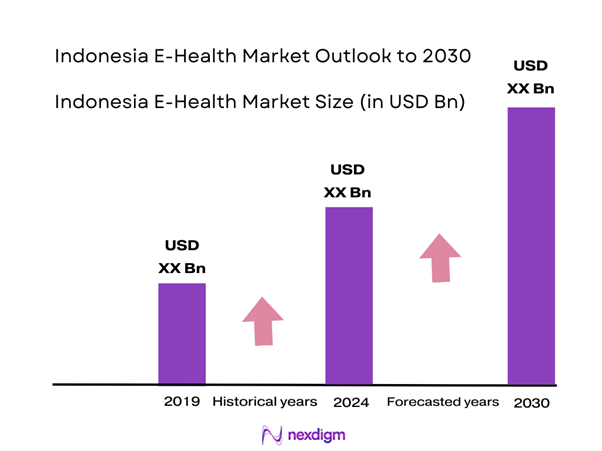

The Indonesia E-Health Market is valued at USD 3.5 billion with an approximated compound annual growth rate of 8.38% from 2024-2030, driven by factors such as increasing healthcare costs, a growing aging population, and rising accessibility to digital technologies. The COVID-19 pandemic has further accelerated the adoption of telehealth services, with consumers becoming more aware of the benefits of remote healthcare solutions. Along with the push from the government to digitize healthcare systems, this market is set to experience substantial growth in the coming years.

Cities like Jakarta and Surabaya dominate the E-Health market due to their dense populations and extensive healthcare infrastructures. Jakarta, as the capital, benefits from a concentration of health service providers, technology firms, and government initiatives aiming to improve healthcare accessibility. Additionally, urban areas are leading in internet penetration and smartphone usage, facilitating greater adoption of E-Health solutions compared to rural regions.

The implementation of data protection laws, particularly the Personal Data Protection Law in Indonesia, significantly impacts the E-Health market. Enforced in 2022, this law requires healthcare providers to strengthen their data security measures and adhere to patient confidentiality standards. As of 2023, approximately 60% of health organizations implemented new compliance measures due to these regulations, affecting how they handle patient information.

Market Segmentation

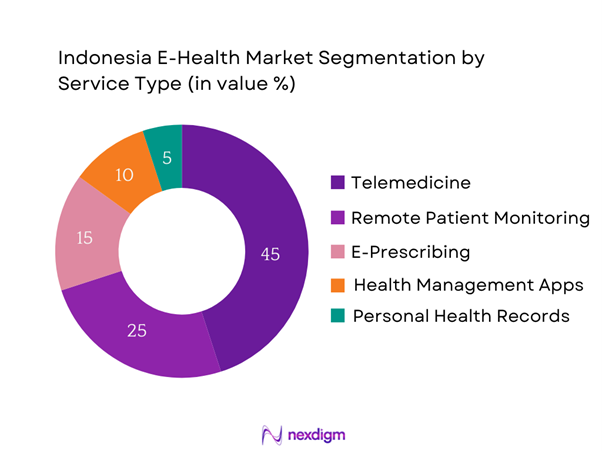

By Service Type

The Indonesia E-Health market is segmented by service type into telemedicine, remote patient monitoring, e-prescribing, health management apps, and personal health records. Telemedicine holds a dominant market share within this segmentation, primarily due to its effectiveness in providing immediate healthcare access to individuals in remote areas. The growing acceptance of virtual consultations and the convenience of on-demand healthcare significantly contribute to the expansion of telemedicine services.

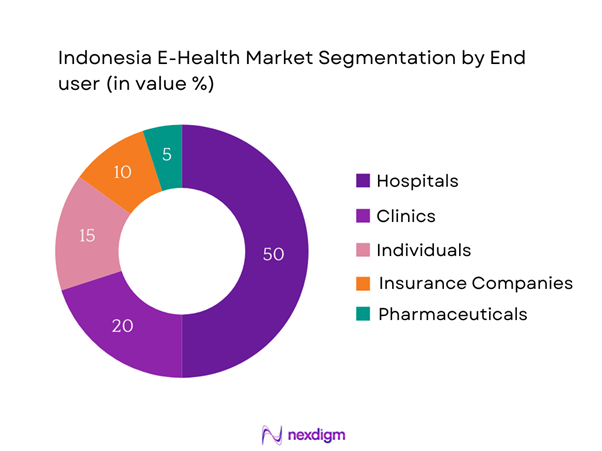

By End User

The E-Health market is also segmented by end user into hospitals, clinics, individuals, insurance companies, and pharmaceuticals. Hospitals dominate this segmentation due to their need for streamlined operations and improved patient care. With increasing patient loads, hospitals leverage E-Health solutions to enhance efficiency, reduce waiting times, and improve patient outcomes. This shift is being reflected in significant investments in E-Health technologies within the hospital sector.

Competitive Landscape

The Indonesia E-Health market is dominated by several key players, including both local startups and established international firms. A competitive landscape exists where innovation and technology adoption are critical drivers of success. Major players such as Halodoc and Alodokter have established strong market positions through tailored services and partnerships with healthcare providers. The ability of these firms to navigate regulatory guidelines while adopting advanced technologies is vital for maintaining competitive advantage in this rapidly evolving sector.

| Company | Establishment Year | Headquarters | Market Segment | Key Technologies | Key Partnerships | Customer Base |

| Halodoc | 2016 | Jakarta, Indonesia | – | – | – | – |

| Alodokter | 2014 | Jakarta, Indonesia | – | – | – | – |

| KlikDokter | 2015 | Jakarta, Indonesia | – | – | – | – |

| Doctor Anywhere | 2017 | Singapore | – | – | – | – |

| SehatQ | 2018 | Jakarta, Indonesia | – | – | – | – |

Indonesia E-Health Market Analysis

Growth Drivers

The Rise of Health Awareness

Indonesia has seen a notable increase in health awareness among its population, driven by factors such as educational campaigns and social media influence. Reports indicate that around 60% of Indonesians are actively seeking healthier lifestyles and preventive care, which is a shift from traditional healthcare practices. This proactive attitude is influenced by public health programs aimed at reducing non-communicable diseases, highlighting the urgent need for E-Health solutions that cater to preventive care.

Push for Remote Patient Monitoring Due to COVID-19

The COVID-19 pandemic has significantly accelerated the demand for remote patient monitoring solutions in Indonesia. In 2022, it was reported that around 45 million people utilized telehealth services due to lockdown measures, which facilitated access to healthcare amidst the pandemic. With high rates of COVID-19 cases, the reliance on virtual consultations increased, showing widespread acceptance of these services. This paradigm shift has led hospitals and clinics to invest more in technology to support remote patient management effectively.

Market Challenges

Regulatory Compliance

Indonesia faces significant regulatory challenges in the E-Health sector, particularly concerning data privacy and health standards. The government has issued various regulations, like the Personal Data Protection Law, implemented in 2022, which mandates strict compliance for all healthcare providers. In this context, over 60% of healthcare organizations reported difficulty in adhering to these new regulations, leading to increased operational costs and delayed technology integration in the health sector. Failing to comply can result in hefty fines and loss of credibility among patients.

Digital Literacy and Accessibility Issues

Despite progress in digital adoption, approximately 40% of Indonesians have limited digital literacy, impeding the effective use of E-Health services. Reports reveal that rural areas face infrastructural challenges, with only about 25% of rural populations possessing reliable internet connectivity compared to 75% in urban settings. This disparity underlines a significant challenge for healthcare providers to ensure that E-Health solutions are accessible and user-friendly for all demographics, particularly in remote regions where traditional healthcare access is already constrained.

Opportunities

Expanding Telehealth Services

The increasing internet accessibility, currently reported at 72% in Indonesia, provides a fertile ground for expanding telehealth services. With the anticipated rise in 5G technology and digital health innovations, healthcare providers are recognizing the long-term benefits of telehealth. Currently, there are around 200 digital health startups in the country, signifying rapid growth potential in this segment. The ongoing rise in health awareness also encourages the proliferation of telehealth solutions that can effectively cater to the needs of the population, further solidifying their market positions.

Government Initiatives on Digital Health

The Indonesian government is actively promoting digital health initiatives to bridge the gap in healthcare accessibility and efficiency. The “Sehat Negeriku” program, launched in 2021, aims to integrate digital health platforms into existing healthcare systems, focusing on providing equitable healthcare access across the nation. Furthermore, the Health Ministry allocated USD 500 million in 2023 to support technological advancements in healthcare, indicating a strong commitment to enhancing digital health capabilities. Such government support is expected to catalyze further growth in the E-Health market in the coming years.

Future Outlook

Over the next few years, the E-Health market in Indonesia is expected to exhibit robust growth, fueled by continuous improvements in technology, increasing investments in digital healthcare, and changing attitudes towards traditional health services. The growing demand for affordable and accessible healthcare, combined with the need for efficient patient management systems, sets the stage for a significant transformation in how healthcare services are delivered in the country.

Major Players

- Halodoc

- Alodokter

- KlikDokter

- Doctor Anywhere

- SehatQ

- GoMed

- Aido Health

- Medigo

- E-Sewa Health

- Ralali Health

- Teleradiology Solutions

- Medico

- Fathia Health

- Farmaku

- Moka

Key Target Audience

- Hospitals and healthcare providers

- Health insurance companies (BPJS Kesehatan)

- Government and regulatory bodies (Ministry of Health)

- Pharmaceutical companies

- Investment firms and venture capitalists

- Technology firms focusing on healthcare solutions

- Telehealth service providers

- Non-profit organizations focusing on health awareness

Research Methodology

Step 1: Identification of Key Variables

The research initiates by mapping out the ecosystem encompassing all major stakeholders in the Indonesia E-Health market. This extensive desk research is backed by proprietary databases to accumulate comprehensive industry-level information. The primary aim of this step is to identify and define critical variables that influence market dynamics, including service types, user demographics, and technology adoption rates.

Step 2: Market Analysis and Construction

This phase involves collating and analyzing historical data pertaining to the Indonesia E-Health market. It includes assessing market penetration, the ratio of service providers to users, and revenue generation metrics. Additionally, a thorough evaluation of service quality metrics will be conducted to ensure the reliance and accuracy of revenue estimates, thereby providing a clearer picture of market trends.

Step 3: Hypothesis Validation and Expert Consultation

Relevant market hypotheses will be developed and then validated through computer-assisted telephone interviews (CATI) with industry experts from various companies. These discussions will yield invaluable operational and financial insights directly from industry practitioners and ensure the refinement and confirmation of market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple E-Health service providers to acquire detailed insights into product segments, user preferences, and overall market dynamics. This direct interaction will serve to verify and enhance the statistics derived from both top-down and bottom-up research approaches, ensuring a comprehensive, accurate, and validated analysis of the Indonesia E-Health market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Smartphone Penetration

The Rise of Health Awareness

Push for Remote Patient Monitoring Due to COVID-19 - Market Challenges

Regulatory Compliance

Digital Literacy and Accessibility Issues - Opportunities

Expanding Telehealth Services

Government Initiatives on Digital Health - Trends

Integration of AI in E-Health Solutions

Shift toward User-Centric Designs - Government Regulation

Data Protection Laws

Licensing and Accreditation - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Users, 2010-2024

- By Average Spend Per User, 2019-2024

- By Service Type (In Value %)

Telemedicine

Remote Patient Monitoring

E-Prescribing

Health Management Apps

Personal Health Records - By End User (In Value %)

Hospitals

Clinics

Individuals

Insurance Companies

Pharmaceuticals - By Distribution Channel (In Value %)

Direct Sales

Online Platforms

Mobile Applications - By Region (In Value %)

Java

Sumatra

Bali and Nusa Tenggara

Kalimantan

Sulawesi - By Technology Used (In Value %)

Artificial Intelligence

Blockchain

Internet of Things (IoT)

- Market Share of Major Players on the Basis of Value/Users, 2024

Market Share of Major Players by Type of E-Health Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Technological Advancement, Market Reach, Customer Base, Revenue, Operational Efficiency, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Halodoc

Alodokter

KlikDokter

Doctor Anywhere

SehatQ

GoMed

Aido Health

Cek Bahan Baku

Medigo

GrabHealth

Teleradiology Solutions

E-Sewa Health

Ralali Health

Rumah Sakit Bersalin Online

Mozaic Health

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Users, 2025-2030

- By Average Spend Per User, 2025-2030