Market Overview

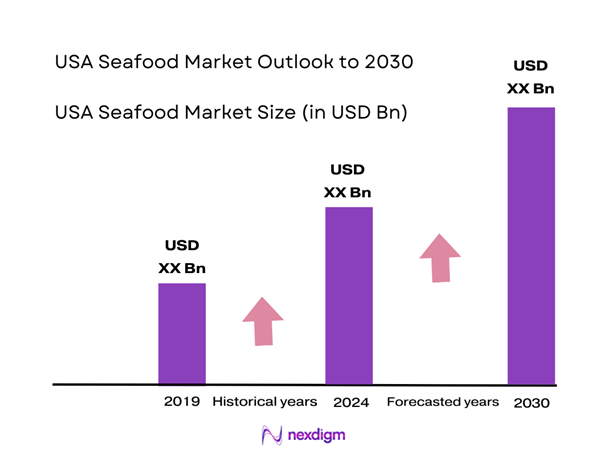

The USA Seafood Market is valued at USD 24.7 Billion in 2024 with an approximated compound annual growth rate (CAGR) of 1.29 % from 2024-2030, driven by factors such as increased health consciousness and the adoption of a protein-rich diet among consumers. The seafood sector benefits from a growing preference for fresh and sustainable food sources, which is increasingly emphasized in culinary trends and dietary choices. As people become more aware of the health benefits linked to seafood consumption, the demand continues to rise, shaping a robust market landscape.

Major cities like New York, Los Angeles, and Seattle dominate the USA Seafood Market due to their extensive coastal access and substantial consumer bases. These cities offer a variety of seafood outlets and restaurants, making seafood a popular dining choice. Additionally, states with significant fishing industries, such as Alaska and Florida, contribute to the dominance of seafood availability and consumption in these urban centers. The combination of coastal proximity and high population density promotes seafood as a staple in these regions.

Government regulations surrounding sustainability certifications are becoming increasingly crucial in the seafood industry. In 2023, over 40% of seafood imports were certified by recognized sustainability programs, which include the Marine Stewardship Council and the Aquaculture Stewardship Council. These certifications provide assurance to consumers and retailers regarding responsible sourcing practices.

Market Segmentation

By Product Type

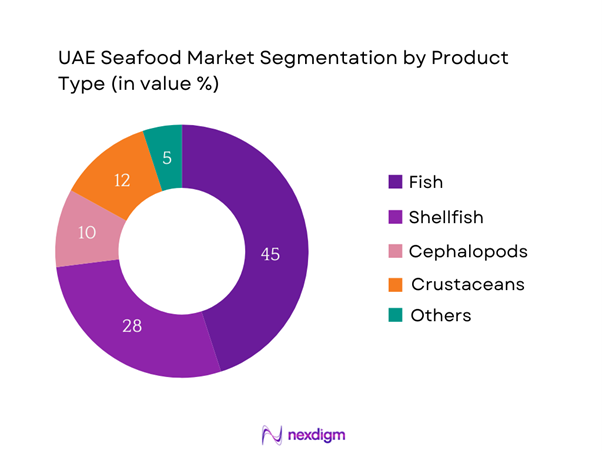

The USA Seafood Market is segmented by product type into fish, shellfish, cephalopods, crustaceans, and others. Fish holds a prominent position within this segmentation, driven by its established presence in the American diet. The popularity of species such as salmon, tuna, and tilapia has led to an increased market share. Fish’s versatility in cooking, along with its health benefits, including high protein and omega-3 fatty acids, ensures its dominance in both retail and food service sectors. Furthermore, the growing trend of consumers seeking natural and sustainably sourced fish solidifies its standing as the leading product type in the market.

By Application

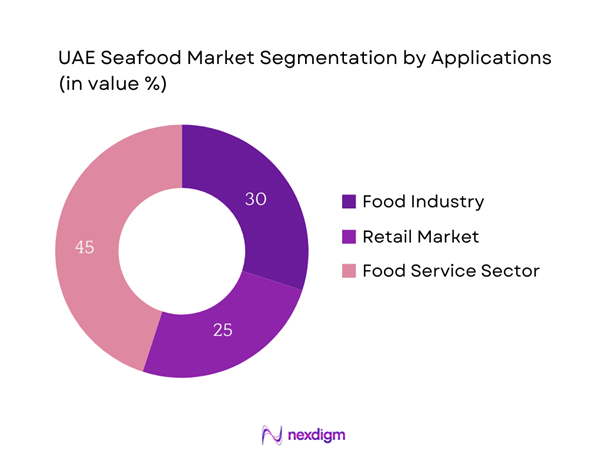

The USA Seafood Market is segmented by application into the food industry, retail market, and food service sector. The food service sector, which includes restaurants and catering services, dominates this segment due to the growing trend of dining out and the increasing culinary experimentation in menus. With consumers becoming more adventurous in their food choices, establishments are incorporating diverse seafood options, thus driving demand. Additionally, the rising popularity of seafood dishes in restaurants has contributed to higher sales and a significant market share within this segment.

Competitive Landscape

The USA Seafood Market is characterized by competition among a limited number of key players, including well-established companies that manufacture and distribute a wide range of seafood products. The market features both local and international firms, indicating a robust competitive environment that influences pricing strategies, product innovation, and marketing efforts. The major players leverage their strong distribution networks and established brand identities to capture consumer interest effectively.

| Company Name | Established Year | Headquarters | Annual Revenue (USD) | Key Brands | Product Range |

| Maritime Seafood | 1988 | Boston, MA | – | – | – |

| High Liner Foods | 1899 | Lunenburg, NS | – | – | – |

| Bumble Bee Seafoods | 1899 | San Diego, CA | – | – | – |

| Trident Seafoods | 1973 | Seattle, WA | – | – | – |

| SeaPak | 1948 | Brunswick, GA | – | – | – |

USA Seafood Market Analysis

Growth Drivers

Rising Health Consciousness

As consumers increasingly shift toward healthier dietary choices, seafood consumption continues to rise. The World Health Organization emphasizes that seafood is a rich source of omega-3 fatty acids, which promote cardiovascular health. In 2023, approximately 42% of American adults reported including more seafood in their diets due to its health benefits. Additionally, the USDA’s Dietary Guidelines recommend that individuals consume at least two servings of seafood per week. This growing health consciousness among consumers is significantly driving the demand for seafood as an integral part of a balanced diet.

Innovations in Seafood Processing

Technological advancements in seafood processing have driven market growth by enhancing product freshness, safety, and shelf life. The National Institute of Food and Agriculture (NIFA) reports that 30% of seafood processing facilities now utilize advanced freezing and vacuum packaging technologies, which improve product quality and waste reduction. Moreover, updated processing techniques have led to higher adoption rates among consumers, with the U.S. frozen seafood market experiencing a significant increase in sales over the past two years. Innovations facilitate the introduction of new products, making seafood more accessible and appealing to a broader consumer base.

Market Challenges

Regulatory and Compliance Issues

Regulatory frameworks play a vital role in the seafood sector, especially concerning food safety and environmental practices. The U.S. Food and Drug Administration (FDA) oversees seafood safety, with strict guidelines influencing the processing and distribution stages. Compliance costs can reach as much as $2 million annually for some seafood companies to meet these stringent regulations. Additionally, evolving regulations regarding sustainability practices create additional pressure on businesses, compelling them to adapt to compliance requirements that may impact profit margins. Such regulatory challenges hinder growth, particularly for small businesses in the sector.

Fluctuations in Supply Chain

The seafood market faces significant challenges due to fluctuations in supply chain dynamics, influenced by factors such as climate change and geopolitical factors. According to the Global Fishing Watch, fish stock levels have declined by nearly 40% since 1970, impacting availability and prices. Additionally, disruptions caused by global events, such as the COVID-19 pandemic, have increased logistical costs, intensifying supply chain vulnerabilities. Price volatility represents a considerable challenge for seafood businesses, as reported supply issues lead to increased consumer prices, causing reduced demand during economic downturns.

Opportunities

Growing Trend Toward Organic Seafood

The demand for organic seafood is rapidly increasing as consumers become more health-conscious and environmentally aware. In 2023, organic seafood sales reached USD 1 billion, reflecting a 25% growth since 2022. Consumers are increasingly willing to pay a premium for certified organic products, with the Organic Trade Association noting that 80% of consumers prioritize organic labels when purchasing seafood. The growing appetite for organic options creates a robust opportunity for seafood companies to diversify their product offerings and attract environmentally conscious consumers, reinforcing the trend toward healthier, sustainable options.

Expansion into Emerging Markets

Emerging markets present significant growth prospects for the seafood industry, driven by rising incomes and urbanization. Data from the World Bank suggests that GDP growth rates in Asia and Africa are projected to exceed 5%, which correlates with increased disposable income levels. As consumers in these regions develop palates for seafood, American seafood producers can tap into new markets through exports. The U.S. Department of Commerce anticipates that seafood exports to these regions may increase by up to $600 million over the coming years, positioning U.S. producers favorably for expansion opportunities.

Future Outlook

Over the next several years, the USA Seafood Market is anticipated to experience substantial growth attributed to evolving consumer preferences towards healthier eating habits, increased accessibility to seafood, and rising demand for sustainable sourcing practices. The impact of seafood on nutrition, combined with the expansion of the food service and retail sectors, will drive market expansion, providing opportunities for innovation and product diversification within the industry.

Major Players

- Maritime Seafood

- High Liner Foods

- Bumble Bee Seafoods

- Trident Seafoods

- SeaPak

- Pacific Seafood

- American Seafoods

- Mazzetta Company

- Clearwater Seafoods

- Gorton’s

- Smuckers

- Sizzlefish

- Nordic Seafood

- Stavis Seafood

- Oceana Seafood

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (U.S. FDA, NOAA)

- Retail Chains and Food Service Providers

- Seafood Distributors and Wholesalers

- Sustainable Seafood Organizations

- Exporters and Importers of Seafood

- Researchers and Industry Analysts

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing a comprehensive ecosystem map that encompasses all significant stakeholders within the USA Seafood Market. This maps out the direct and indirect influences on the market. Extensive desk research is conducted to tap into secondary databases, industry reports, and proprietary data sources to gather reliable market information. The objective is to identify critical variables that drive market dynamics and trends.

Step 2: Market Analysis and Construction

In this stage, we compile and analyze historical data relevant to the USA Seafood Market. This encompasses examining trends in market penetration, analyzing the ratio of seafood products in the supply chain, and evaluating revenue streams associated with different seafood segments. Additionally, quality statistics derived from market surveys and consumer data will be evaluated to ensure the accuracy of revenue projections and market analyses.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and subsequently validated through consultations with industry experts. These experts come from diverse sectors, including seafood processing, retail, and import/export. The insights gained through structured interviews provide important operational, financial, and strategic perspectives that are essential for corroborating and refining the collected market data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the information gathered from previous phases. Direct engagement with seafood manufacturers and suppliers will yield insights into product segments, sales performance, consumer preferences, and emerging trends. This extensive interaction helps verify statistics obtained through previous analyses, providing a thorough, accurate, and validated overview of the USA Seafood Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Health Consciousness

Increasing Demand for Sustainable Sourcing

Innovations in Seafood Processing - Market Challenges

Regulatory and Compliance Issues

Fluctuations in Supply Chain - Opportunities

Growing Trend Toward Organic Seafood

Expansion into Emerging Markets - Trends

Adoption of Sustainable Practices

Advances in Seafood Preservation Technologies - Government Regulation

FDA Regulations

Sustainability Certifications - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Fish

Shellfish

Cephalopods

Crustaceans

Others - By Application (In Value %)

Food Industry

Retail Market

Food Service Sector - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Convenience Stores

Online Retail - By Region(In Value %)

Northeast

Midwest

South

West - By Packaging Type (In Value %)

Canned

Fresh

Frozen

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Seafood Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, , Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Mowi ASA

NH Foods Ltd

Sysco Corporation

Thai Union Group PCL

The Kraft Heinz Company

Admiralty Island Fisheries Inc.

Beaver Street Fisheries

High Liner Foods Inc.

Inland Seafood Inc.

Trident Seafood Corporation

Pacific Seafood Group

American Seafoods Company

Bumble Bee Foods LLC

Clearwater Seafoods Incorporated

Cooke Aquaculture Inc.

- Market Demand and Utilization

- Consumer Preferences and Behavior

- Dietary Restrictions and Trends

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030