Market Overview

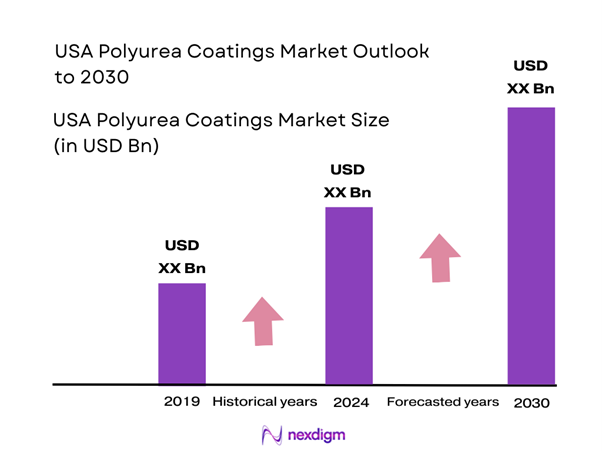

The USA Polyurea Coatings Market is valued at USD 1.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 6.7% from 2024-2030, based on a comprehensive analysis of historical trends and growth patterns. The robust growth of this market is driven by increasing demand for protective coatings in various industries, such as construction, automotive, and oil & gas. The superior properties of polyurea coatings, including fast curing time, flexibility, and chemical resistance, are attracting significant investment from manufacturers looking to enhance product longevity and usability.

The USA market is dominated by cities such as Houston, Los Angeles, and New York, primarily due to their extensive industrial activities and infrastructure projects. Houston, with its strong presence in the oil and gas sector, drives considerable demand for polyurea coatings for protective applications. Similarly, Los Angeles showcases a growing need for coatings in construction and automotive sectors, while New York’s diverse industries contribute to the overall market significance. The convergence of multiple industrial activities in these locations enhances their market dominance.

The regulatory framework governing coatings in the U.S. is stringent and continually evolving to ensure safety and environmental protection. Regulatory bodies such as the Environmental Protection Agency (EPA) enforce compliance standards that mandate lower volatile organic compounds (VOCs) in coatings. As part of their regulatory strategy, the EPA has been actively involved in imposing restrictions on harmful substances.

Market Segmentation

By Product Type

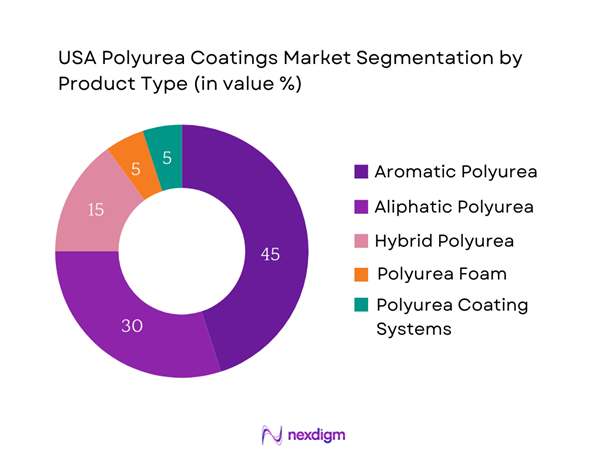

The USA Polyurea Coatings Market is segmented by product type into aromatic polyurea, aliphatic polyurea, hybrid polyurea, polyurea foam, and polyurea coating systems. Among these, aromatic polyurea holds a dominant market share due to its cost-effectiveness and flexibility, making it a preferred choice in various applications such as industrial coatings, secondary containment, and cargo truck linings. Aromatic polyurea is favored for its outstanding tensile strength and excellent resistance to harsh chemicals and UV radiation, resulting in long-lasting protective solutions across different sectors.

By Application

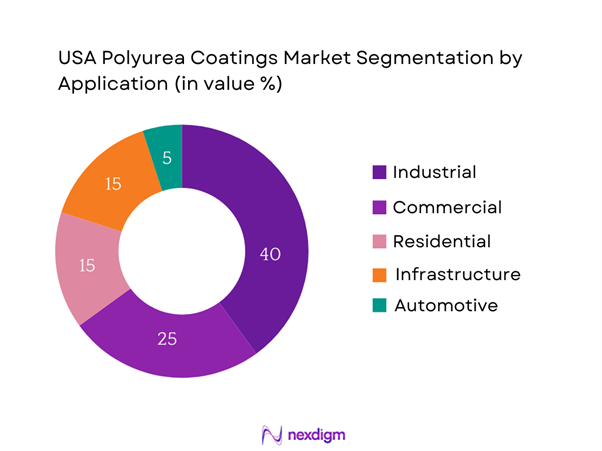

The USA Polyurea Coatings Market is segmented by application into industrial applications, commercial applications, residential applications, infrastructure applications, and automotive applications. The industrial applications segment exhibits a dominant market share, primarily due to the increasing demand for protective coatings used in manufacturing facilities, warehouses, and chemical processing plants. The durability and quick application of polyurea coatings make them ideal for safeguarding industrial assets from wear and tear, accelerating their adoption in various industrial activities.

Competitive Landscape

The USA Polyurea Coatings Market is characterized by the presence of several key players, each contributing to the competitive dynamics of the sector. Major players include global and regional manufacturers renowned for their product innovation and customer service, which enhance their competitive edge in the market.

| Company | Establishment Year | Headquarters | Annual Revenue (USD) | Product Innovation | Market Focus | Distribution Network |

| Rhino Linings Corporation | 1989 | San Diego, CA | – | – | – | – |

| The Sherwin-Williams Company | 1866 | Cleveland, OH | – | – | – | – |

| Gaco Western | 1955 | Waukesha, WI | – | – | – | – |

| BASF SE | 1865 | Ludwigshafen, Germany | – | – | – | – |

| PPG Industries | 1883 | Pittsburgh, PA | – | – | – | – |

USA Polyurea Coatings Market Analysis

Growth Drivers

Increasing Infrastructure Projects

The United States has earmarked approximately USD 1.2 trillion for infrastructure projects as part of its bipartisan infrastructure law. These investments are geared towards modernizing aging roads, bridges, and public transit systems, which are crucial for economic growth. With the demand for durable and protective materials constantly on the rise, polyurea coatings will play a pivotal role in safeguarding infrastructure from environmental degradation, mechanical wear, and weather damage. This government push not only enhances the quality of existing infrastructure but also fuels the demand for advanced protective solutions such as polyurea coatings.

Rising Demand for Protective Coatings

In response to increasing industrial activities, the demand for protective coatings within the United States is set to escalate. As industries prioritize asset protection against wear, tear, and adverse environmental effects, polyurea coatings are favored for their superior durability and quick curing properties, positioning them as ideal solutions. Consequently, companies are more inclined to invest in high-quality coatings to ensure longevity and reliability of their assets.

Market Challenges

High Initial Costs

While polyurea coatings offer many benefits, their high initial costs present a significant barrier for enterprises, particularly small to medium-sized businesses. The price of raw materials for polyurea, such as isocyanates, has fluctuated, compounded by supply chain disruptions caused by geopolitical tensions, notably with Russia and Ukraine. This situation leads to heightened production costs that can deter investment in polyurea solutions, especially when companies are weighing budgetary constraints against the longevity of alternative options.

Competition from Alternative Coatings

The market faces stiff competition from alternative coatings such as epoxy and polyurethane, which are well-established and widely used due to their cost-effectiveness and proven performance. The coatings industry in the U.S. was valued at USD 25 billion in 2022, with these alternatives collectively capturing a substantial market share. As businesses strive to balance performance with costs, many may opt for these alternatives, posing challenges for polyurea coatings to overcome. The necessity for continuous innovation will be paramount for manufacturers to maintain competitive advantages in an increasingly saturated market. Source: American Coatings Association

Opportunities

Innovations in Formulations

Current trends show a significant investment in research and development towards innovating polyurea formulations to enhance their properties, such as slip resistance, abrasion resistance, and flexibility. With the U.S. chemical industry projected to spend over USD 11 billion on R&D initiatives, these advancements may lead to formulations that can better cater to specific industry needs, including automotive and aerospace. As manufacturers create high-performance polyurea coatings with tailored properties, the potential market demand can expand significantly, allowing for greater adoption across various sectors. This trend indicates a robust future for polyurea coatings, benefitting from continual enhancements in product offerings, thereby meeting the evolving needs of consumers. Source: American Chemistry Council

Expanding Applications in Various Industries

Polyurea coatings are finding increasing applications across diverse industries such as construction, automotive, and marine, driven largely by their unique properties. The U.S. construction industry, for example, is projected to reach USD 1.7 trillion by end of 2025, leading to a significant uptick in demand for protective coatings that provide moisture, corrosion, and chemical resistance. Furthermore, the automotive sector anticipates an increase in sales, projected at USD 36 billion over the next few years.

Future Outlook

Over the next five years, the USA Polyurea Coatings Market is expected to demonstrate significant growth driven by increased investment in industrial infrastructure, the adoption of eco-friendly coatings, and technological advancements in coating applications. As industries focus on sustainability and durability, the demand for polyurea coatings is anticipated to rise, leading to innovative product developments and market expansion.

Major Players

- Rhino Linings Corporation

- The Sherwin-Williams Company

- Gaco Western

- BASF SE

- PPG Industries

- Covestro AG

- Versaflex Incorporated

- Alpha Coating Technologies

- Specialty Polymer Coatings

- Carboline Company

- Sika AG

- GAF Materials Corporation

- Polycoat Products

- Tremco Incorporated

- Carboline Company

Key Target Audience

- Industrial Manufacturers

- Construction Firms

- Automotive Manufacturers

- Oil and Gas Companies

- Government and Regulatory Bodies (EPA, OSHA)

- Investments and Venture Capitalist Firms

- Building and Facility Managers

- Coatings Distributors and Suppliers

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive ecosystem map of the USA Polyurea Coatings Market. Extensive desk research is conducted, utilizing a combination of secondary data sources—including industry reports, market databases, and company profiles—to gather in-depth information. The objective is to outline critical variables that influence market dynamics and trends effectively.

Step 2: Market Analysis and Construction

We compile and analyze historical data specific to the USA Polyurea Coatings Market. This phase includes evaluating market penetration, assessing the ratio of producers to end-users, and understanding revenue generation dynamics. An in-depth evaluation of service quality metrics is performed to validate the accuracy of the revenue estimates gathered during this phase.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses that are subsequently validated through in-depth consultations with industry experts. Utilizing methods such as computer-assisted telephone interviews (CATI), diverse representatives from various companies provide operational and financial insights directly. These expert consultations are instrumental in refining and corroborating the market data collected thus far.

Step 4: Research Synthesis and Final Output

The final phase of methodology involves direct engagement with numerous polyurea manufacturers to obtain detailed insights regarding product segments, sales performance, and consumer preferences. This interaction helps to verify and supplement market statistics derived from prior steps, leading to a comprehensive, accurate, and validated analysis of the USA Polyurea Coatings Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Infrastructure Projects

Rising Demand for Protective Coatings

Sustainability and Eco-friendly Solutions - Market Challenges

High Initial Costs

Competition from Alternative Coatings - Opportunities

Innovations in Formulations

Expanding Applications in Various Industries - Trends

Development of Smart Coatings

Growth in Online Sales Channels - Government Regulation

Compliance Standards for Coatings

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Aromatic Polyurea

Aliphatic Polyurea

Hybrid Polyurea

Polyurea Foam

Polyurea Coating Systems - By Application (In Value %)

Industrial Applications

Commercial Applications

Residential Applications

Infrastructure Applications

Automotive Applications - By End-User Industry (In Value %)

Construction

Automotive

Oil & Gas

Marine

Aerospace - By Distribution Channel (In Value %)

Direct Sales

Distributors and Retailers

E-commerce - By Region (In Value %)

Northeast

Midwest

South

West

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Polyurea Coatings Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Type of Polyurea Coatings Offered, Application Sectors, Curing Times, Durability and Performance Metrics, Environmental Compliance Standards, Customization Options Available, Warranty and After-Sales Services, Pricing Strategy, Market Penetration Rate, Technical Support and Training Services, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Companies

Rhino Linings Corporation

The Sherwin-Williams Company

Gaco Western

BASF SE

PPG Industries

Dow Inc.

Versaflex Incorporated

Covestro AG

Alpha Coating Technologies

Specialty Polymer Coatings

Carboline Company

Sika AG

GAF Materials Corporation

Polycoat Products

Tremco Incorporated

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

By Value, 2025-2030

By Volume, 2025-2030

By Average Price, 2025-2030