Market Overview

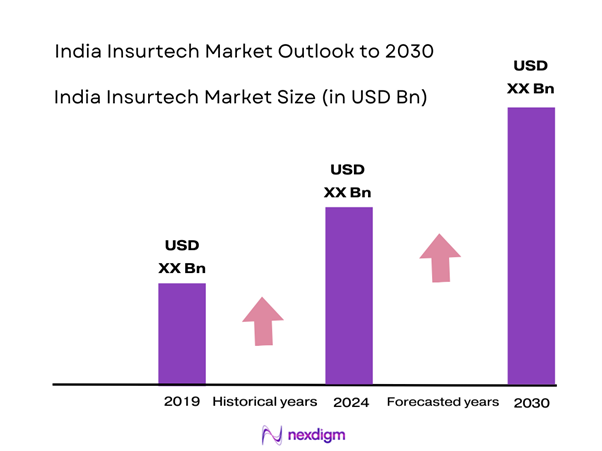

The India insurtech market is valued at USD 10 billion in 2024 with an approximated compound annual growth rate (CAGR) of 55.4% from 2025-2030, based on a five-year historical analysis. This growth is driven primarily by advancements in technology such as AI and big data analytics, which enhance customer experience and streamline processes.

Major cities leading the insurtech trend in India include Bengaluru, Mumbai, and Delhi. Bengaluru, often dubbed the ‘Silicon Valley of India,’ is home to numerous tech startups and attracts significant venture capital investment focused on innovative insurtech solutions. Mumbai, being the financial capital, houses many traditional insurance players and regulatory bodies, providing a fertile environment for insurtech growth. Delhi, with its diverse demographic, presents a vast market potential, further supported by government initiatives to promote digital innovation in the insurance sector.

The Indian government and the Insurance Regulatory and Development Authority of India (IRDAI) are actively promoting the insurtech ecosystem. Recent policy initiatives have simplified licensing procedures for new players, thereby facilitating a more conducive regulatory environment. The IRDAI’s focus on digital innovation and regulatory sandboxes enables startups to test their services in a controlled environment, significantly boosting the insurtech landscape.

Market Segmentation

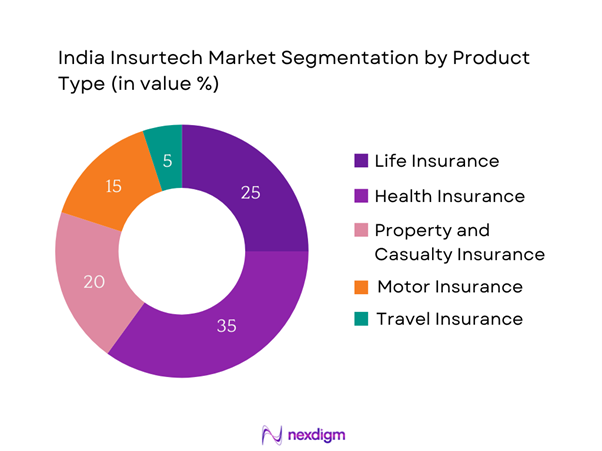

By Product Type

The India insurtech market is segmented by product type into life insurance, health insurance, property and casualty insurance, motor insurance, and travel insurance. Currently, health insurance has a dominant market share owing to the rising healthcare costs and increasing awareness of health risks. More consumers are recognizing the need for comprehensive health coverage, especially in light of recent pandemic experiences. Insurtech firms leverage technology to provide innovative, flexible health insurance products that cater to individual needs and preferences, attracting a broad customer base. Moreover, digital platforms streamline the purchasing process, further boosting the segment’s dominance.

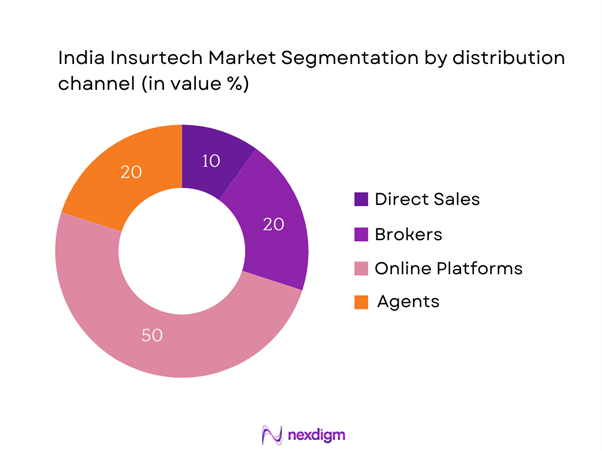

By Distribution Channel

The India insurtech market is also segmented by distribution channel into direct sales, brokers, online platforms, and agents. Online platforms are emerging as the dominating segment due to their convenience and simplicity for consumers. These platforms allow for quick comparisons of policies, facilitating informed decision-making. The shift towards digitalization has led to increased consumer comfort when purchasing insurance online, particularly among younger demographics who favor ease of access. This growing adoption of online transactions is further accelerated by developments in secure payment gateways and user-friendly interfaces, attracting more customers to this channel.

Competitive Landscape

The India insurtech market is characterized by several major players, including a blend of established insurance companies and innovative tech-startups. The market landscape demonstrates a significant concentration among key competitors, including PolicyBazaar, Acko, and Digit Insurance. This competitive environment is reflective of rapid advancements in technology and evolving customer demands, leading to disruptive business models that challenge traditional players.

| Company Name | Establishment Year | Headquarters | Market Share % (2024) | Product Range | Key Partnerships | Technological Edge |

| PolicyBazaar | 2008 | Gurugram | – | – | – | – |

| Acko | 2016 | Bengaluru | – | – | – | – |

| Digit Insurance | 2017 | Bengaluru | – | – | – | – |

| HDFC ERGO | 2002 | Mumbai | – | – | – | – |

| ICICI Lombard | 2001 | Mumbai | – | – | – | – |

India Insurtech Market Analysis

Growth Drivers

Increasing Digital Penetration

India’s internet user base reached approximately 1.2 billion as of 2023. The increasing availability of affordable smartphones and data services contributes significantly to this growth. According to the Telecom Regulatory Authority of India (TRAI), the mobile data consumption grew to an average of 18.5 GB per user per month in 2023, driven by the transition to digital platforms for services, including insurance. This wave of digital adoption is facilitating easier access to insurance products and services, driving the growth of the insurtech sector in India.

Rising Middle-Class Population

The middle-class population in India reached over 550 million in 2024, representing a significant increase in disposable income and overall purchasing power. According to the World Bank, the country’s GDP per capita is anticipated to increase to USD 2,200, providing consumers with the financial flexibility to invest in various insurance products. This expanding middle-class demographic is also inclined towards seeking more comprehensive insurance coverage to secure their financial future, thereby driving the demand for innovative insurtech solutions tailored to their needs.

Market Challenges

Data Privacy Concerns

With the growing reliance on digital platforms in the insurance sector, data privacy has emerged as a significant challenge. In 2023, India’s personal data protection bill was still pending legislative approval, creating uncertainty regarding compliance requirements for insurtech companies. According to a report by the Ministry of Electronics and Information Technology, a staggering 75% of Indian consumers express concerns about the security of their personal information when using online platforms for financial transactions. This lack of trust inhibits potential customers from exploring insurtech solutions fully.

High Customer Acquisition Costs

Customer acquisition costs for digital insurance products in India remain notably high, often exceeding INR 3,500 per policyholder. This challenge is exacerbated by intense competition among insurtech firms seeking to attract customers through extensive marketing efforts and offering attractive incentives. According to industry studies, it is not uncommon for startups to spend up to 40% of their revenue on customer acquisition initiatives. The high costs can limit visibility for newer players entering the market and result in lower profitability, making it a critical area for improvement.

Opportunities

Emergence of On-Demand Insurance

The on-demand insurance model is gaining traction among Indian consumers, driven by their desire for flexibility and personalized coverage options. According to a study by the Insurance Institute of India, there has been a 60% increase in inquiries regarding on-demand insurance products between 2022 and 2023, suggesting a clear trend towards flexible coverage that adapts to individual lifestyle needs. The rapid adoption of digital platforms allows insurtech firms to deliver customized insurance offerings, further exemplifying the potential for growth in this segment as consumers demand products that fit their specific requirements.

Increasing Focus on User Experience

As competition intensifies among insurtech firms, improving user experience stands out as a significant opportunity for differentiation. Data indicates that 85% of Indian consumers consider user experience to be a crucial factor when choosing an insurance provider. Incorporating user-friendly interfaces, streamlined claims processes, and personalized services will enhance customer retention and brand loyalty. In 2023, firms investing in customer experience improvements are likely to see a competitive advantage, positioning themselves favorably in the evolving insurtech landscape.

Future Outlook

Over the next five years, the India insurtech market is expected to witness substantial growth driven by continuous advancements in technology, expanding internet connectivity, and increasing consumer awareness. The growth will be further supported by regulatory framework adjustments that aim to facilitate the integration of digital innovations into the traditional insurance sector. Moreover, the rising adoption of telemedicine and online health consultations among consumers is poised to accelerate growth in the health insurance segment, paving the way for more tech-driven insurance solutions.

Major Players

- PolicyBazaar

- Acko

- Digit Insurance

- HDFC ERGO

- ICICI Lombard

- Reliance General Insurance

- Bajaj Allianz

- Max Bupa Health Insurance

- Aditya Birla Health Insurance

- Kotak Mahindra General Insurance

- LIC (Life Insurance Corporation of India)

- New India Assurance

- Future Generali India Insurance

- SBI Life Insurance

- Oriental Insurance

Key Target Audience

- Insurance Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (IRDAI)

- Financial Institutions

- Technology Providers

- Healthcare Providers

- Consumer Advocacy Groups

- Corporate Entities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the India insurtech market. This step involves extensive desk research, utilizing a combination of secondary and proprietary databases to gather relevant industry-level information. The primary objective is to identify and define critical variables influencing market dynamics and stakeholder interactions.

Step 2: Market Analysis and Construction

During this phase, historical data will be compiled and analyzed regarding the India insurtech market. This includes evaluating market penetration rates, the ratio of service providers to marketplaces, and their resultant revenue generation. Additionally, an in-depth analysis of service quality statistics will be conducted to ensure the data’s reliability and accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts from a diverse range of companies. These consultations will provide valuable insights into operational and financial aspects of the market, essential for refining and corroborating the data gathered.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple insurtech manufacturers to acquire comprehensive insights into product segments, sales performance, and consumer preferences. This engagement serves to verify and complement the statistics derived from the bottom-up approach, ensuring an exhaustive and validated analysis of the India insurtech market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Digital Penetration

Rising Middle-Class Population

Regulatory Support for Insurtech - Market Challenges

Data Privacy Concerns

High Customer Acquisition Costs - Opportunities

Emergence of On-Demand Insurance

Increasing Focus on User Experience - Trends

Growth of Behavioral Analytics in Underwriting

Increase in Embedded Insurance Models - Government Regulations

Insurance Regulatory and Development Authority of India (IRDAI) Guidelines

Data Security Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Policy Premium, 2019-2024

- By Product Type (In Value %)

Life Insurance

Health Insurance

Property and Casualty Insurance

Motor Insurance

Travel Insurance - By Distribution Channel (In Value %)

Direct Sales

Brokers

Online Platforms

Agents - By Customer Type (In Value %)

Individual Customers

Small and Medium Enterprises (SMEs)

Corporates - By Geography (In Value %)

Northern India

Southern India

Eastern India

Western India - By Technology Adoption (In Value %)

Traditional Insurers

Digital Insurers

Insurtech Startups

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Insurtech Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Technology Utilization, Distribution Channels, Customer Engagement Strategies, Market Penetration Strategies, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Insurtech Offerings

- Detailed Profiles of Major Companies

PolicyBazaar

Acko General Insurance

Digit Insurance

Coverfox

Turtlemint

Go Digit General Insurance

Toffee Insurance

Easypolicy

Bajaj Allianz Life Insurance

HDFC Life

ICICI Prudential Life Insurance

SBI Life Insurance

New India Assurance

Star Health Insurance

Reliance General Insurance

- Market Demand and Utilization

- Purchasing Trends and Preferences

- Regulatory Implications on Consumers

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Average Policy Premium, 2025-2030