Market Overview

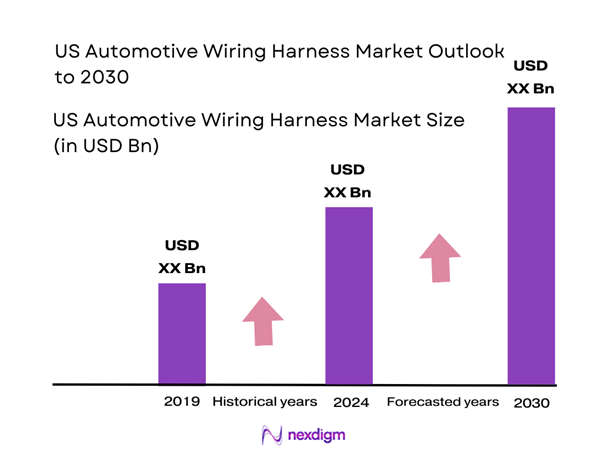

The US automotive wiring harness market is valued at USD 12.8 billion in 2024 with an approximated compound annual growth rate (CAGR) of 2.1% from 2024-2030, backed by a strong consumer base and increasing demand for vehicle connectivity and electronic features. The growth is driven by the rise in electric and hybrid vehicle production, which requires sophisticated wiring solutions. Furthermore, the data from industry sources indicates a projected market size of USD 15.2 billion, highlighting a robust expansion in a rapidly evolving automotive landscape characterized by technological advancements and stringent regulatory requirements.

Dominant cities and regions in the automotive wiring harness market include Michigan, California, and Texas. Michigan, particularly, is a hub for automotive manufacturing, housing major automotive giants and a well-established supply chain network. California leads in electric vehicle innovation due to its progressive policies on sustainability, while Texas’s growing automotive sector is attributed to its advantageous business environment and skilled labor force, making it an attractive location for both established and new automotive companies.

Government regulations concerning safety and emission standards in the automotive sector have been tightening, significantly impacting the automotive wiring harness market. For instance, the National Highway Traffic Safety Administration (NHTSA) reported that regulations are shifting towards not only improved safety features but also emissions controls.

Market Segmentation

By Vehicle Type

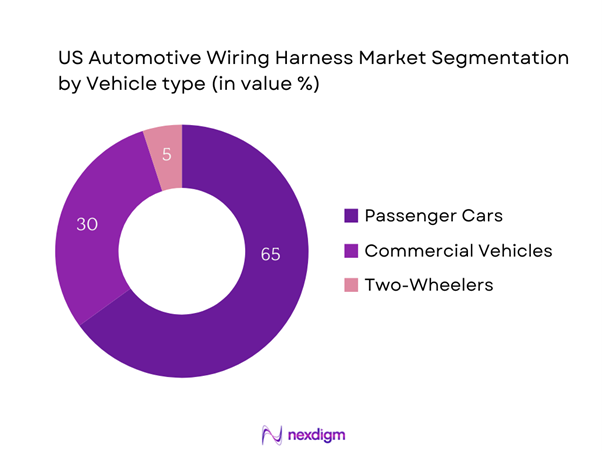

The US automotive wiring harness market is segmented by vehicle type into passenger cars, commercial vehicles, and two-wheelers. Passenger cars hold a dominant market share, driven by high production volume and consumer preference for advanced connectivity features. This segment benefits from technological advancements, such as the integration of sophisticated infotainment systems and safety features requiring extensive wiring solutions. Additionally, the growing trend of electric vehicles propels the need for complex wiring harness systems, reinforcing the passenger car segment’s stronghold in the market.

By Application

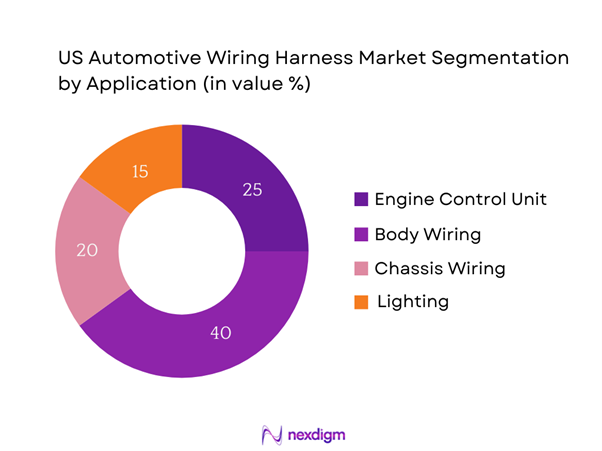

The market is further segmented by application, including engine control units, body wiring, chassis wiring, and lighting. Among these, body wiring has emerged as the leading application segment. This is largely due to its critical role in vehicle comfort and safety systems, which encompass power windows, lighting, and control systems. As consumers prioritize comfort and technological features, the demand for body wiring solutions is expected to increase, thus reinforcing its market dominance and fostering innovative wiring solutions tailored for modern vehicles.

Competitive Landscape

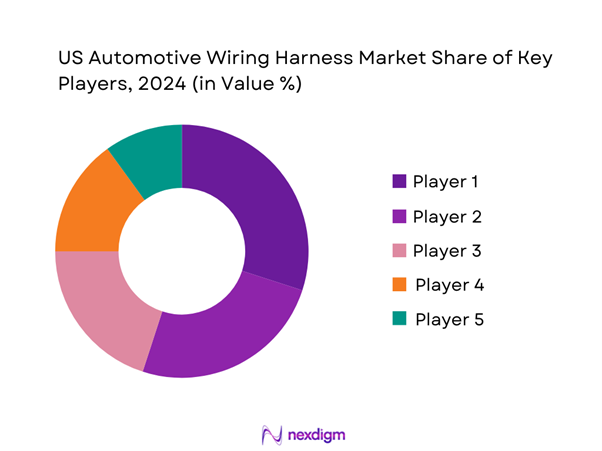

The US automotive wiring harness market is characterized by competition among several major players, including local and international companies. The market landscape consists of prominent organizations like Delphi Technologies, Yazaki Corporation, and Aptiv, which have established strong product portfolios and distribution channels. The consolidation of key players highlights their significant influence in shaping industry standards and driving technological advancements.

| Companies | Establishment Year | Headquarters | Revenue (USD) | Number of Employees | Product Range | Market Specific Innovations |

| Delphi Technologies | 1994 | Troy, Michigan | – | – | – | – |

| Yazaki Corporation | 1929 | Tokyo, Japan | – | – | – | – |

| Aptiv PLC | 2017 | Dublin, Ireland | – | – | – | – |

| Lear Corporation | 1917 | Southfield, Michigan | – | – | – | – |

| Leoni AG | 1917 | Nuremberg, Germany | – | – | – | – |

US Automotive Wiring Harness Market Analysis

Growth Drivers

Rising Electric Vehicle Adoption

The adoption of electric vehicles (EVs) in the United States is witnessing exponential growth, significantly influencing the automotive wiring harness market. This trend is fueled by government incentives and increasing consumer awareness of environmental issues, projected to continue as the Biden Administration aims for 50% of all new vehicles sold to be zero-emission by 2030, targeting 25 million EVs on the road by then. This rise in EVs directly correlates with a greater need for advanced wiring solutions.

Increasing Infrastructure Investments

Significant investments in infrastructure are propelling the US automotive wiring harness market. The Infrastructure Investment and Jobs Act, signed into law, allocates around $1.2 trillion for infrastructure improvements over the next decade, with substantial portions aimed at enhancing transportation systems. This funding is expected to modernize transit systems and road networks, thereby increasing vehicle efficiency. As infrastructure improves, there is an increase in electric charging station installations, which inherently drives demand for wiring solutions that support EV operations.

Market Challenges

Fluctuations in Raw Material Costs

There are significant challenges pertaining to fluctuations in the costs of raw materials used in automotive wiring harness manufacturing. As copper is a key material in wiring harness production, these fluctuations can directly affect manufacturing costs and profitability margins for companies. Additionally, ongoing geopolitical tensions and reductions in mining activity in top producing countries contribute to these price instabilities.

Stringent Regulatory Compliance

The automotive industry faces stringent regulatory compliance requirements related to safety and environmental aspects. In 2022, the EPA issued new greenhouse gas emission standards for light-duty vehicles, pushing manufacturers to adapt rapidly. Vehicles must now comply with an average of 163g CO2/km, or face penalties which can further escalate compliance costs. These evolving regulations often require manufacturers to redesign their wiring harness systems for improved energy efficiency and reduced emissions, resulting in higher development costs.

Opportunities

Development of Smart Wiring Solutions

The current market presents significant opportunities for the development of smart wiring solutions. As connected vehicle technology integrates more sensors and devices, the demand for intelligent wiring harness systems increases. These developments highlight the potential for wiring manufacturers to innovate and provide solutions tailored to the rising demand for connectivity and automation in vehicles.

Growing Demand for Lightweight Materials

There is a current trend towards using lightweight materials in automotive manufacturing, particularly in wiring harnesses. By incorporating materials like aluminum and advanced composites, manufacturers can reduce vehicle weight, leading to improved fuel efficiency and performance This trend presents an opportunity for wiring harness producers to innovate in material solutions, enhancing overall automotive performance while maintaining safety standards.

Future Outlook

Over the next five years, the US automotive wiring harness market is anticipated to witness significant growth, driven by the increasing demand for electric vehicles and advanced automobile technologies. The emphasis on sustainability and regulatory compliance will propel the need for innovative wiring solutions that simplify installation and improve vehicle performance. Furthermore, government initiatives aimed at enhancing automotive safety and emissions reduction are expected to catalyze further developments in wiring harness technologies.

Major Players

- Delphi Technologies

- Yazaki Corporation

- Aptiv PLC

- Lear Corporation

- Leoni AG

- Sumitomo Electric Industries

- Furukawa Electric Co., Ltd.

- Kongsberg Automotive

- Rosenberger Hochfrequenztechnik

- Nexans S.A.

- Hitachi, Ltd.

- SAMVARDHANA MOTHERSON GROUP

- Molex

- TE Connectivity

- Continental AG

Key Target Audience

- Automotive Manufacturers

- Tier-1 Suppliers

- Automotive Design Engineers

- Original Equipment Manufacturers (OEMs)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Transportation, Environmental Protection Agency)

- Automotive Aftermarket Players

- Research and Development Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the US automotive wiring harness market. This step is underpinned by comprehensive desk research, utilizing a combination of secondary and proprietary databases to gather detailed industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as technological advancements and consumer trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the automotive wiring harness market. This includes assessing market penetration rates, the ratio of manufacturers to service providers, and the resultant revenue generation. Additionally, a thorough evaluation of supply chain dynamics and material sourcing will be conducted to provide context for revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing diverse sections of the automotive wiring harness industry. These consultations will offer valuable operational insights to refine and corroborate the market data, ensuring that interpretations align with current market realities.

Step 4: Research Synthesis and Final Output

The final phase consists of direct engagement with automotive wiring manufacturers to gather rich insights into product segments, sales performance, and emerging consumer preferences. This interaction aims to verify and complement the statistics derived from the bottom-up analytical approach, ensuring a comprehensive, accurate, and validated analysis of the US automotive wiring harness market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Genesis and Overview

- Historical Timeline of Major Players

- Business Cycle and Economic Impact

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Electric Vehicle Adoption

Technological Advancements in Vehicle Design

Increasing Infrastructure Investments - Market Challenges

Fluctuations in Raw Material Costs

Stringent Regulatory Compliance - Opportunities

Development of Smart Wiring Solutions

Growing Demand for Lightweight Materials - Trends

Shift Towards Sustainable Practices

Innovations in Wiring Design and Manufacturing - Government Regulation

Safety and Emission Standards

Automotive Quality Assurance Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles

Two-wheelers - By Material Type (In Value %)

Copper

Aluminum

Fiber Optics - By Application (In Value %)

Engine Control Unit

Body Wiring

Chassis Wiring

Lighting - By Region (In Value %)

North America

South America

Europe

Asia-Pacific - By Technology (In Value %)

Embedded Wiring Harnesses

Modular Wiring Harnesses

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Automotive Wiring Harness Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Wiring Harness, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants, Capacity, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Delphi Technologies

Yazaki Corporation

Samvardhana Motherson Group

Aptiv PLC

Leoni AG

Molex

TE Connectivity

Sumitomo Electric Industries

Lear Corporation

Hitachi, Ltd.

Furukawa Electric Co., Ltd.

Kongsberg Automotive

Rosenberger Hochfrequenztechnik

Nexans S.A.

Continental AG

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocation Patterns

- Regulatory and Compliance Expectations

- Needs, Desires, and Pain Points

- Decision-Making Processes of Key Stakeholders

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030