Market Overview

The USA Hearing Aids Market is valued at approximately USD 12.96 billion in 2025 with an approximated compound annual growth rate (CAGR) of 7.31% from 2024-2030, underpinned by an increasing aging population, heightened awareness of hearing impairments, and advancements in hearing aid technology. The growing prevalence of hearing loss among adults and children, particularly in the older demographics, has driven demand for hearing aid devices. In recent years, there has also been a significant shift towards digital and smart hearing aids, which enhances sound quality and user experience. As more individuals seek assistance for hearing-related issues, the market is poised for robust growth.

Dominant cities within the USA market include Los Angeles, New York City, and Chicago. These urban centers boast substantial populations with aging demographics, leading to higher demand for hearing aids. Furthermore, the availability of leading audiology clinics and retail chains in these locations creates a conducive environment for consumers to access cutting-edge products and services. The prominence of healthcare facilities and trained professionals in metropolitan areas further enhances the market’s growth potential, making these cities critical hubs for the hearing aids industry.

Market Segmentation

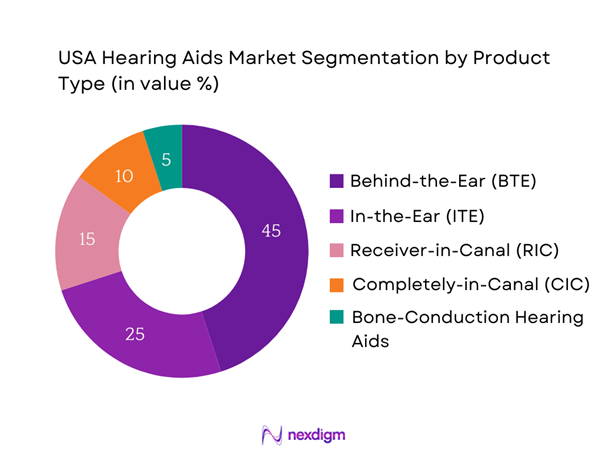

By Product Type

The USA Hearing Aids Market is segmented by product type into Behind-the-Ear (BTE), In-the-Ear (ITE), Receiver-in-Canal (RIC), Completely-in-Canal (CIC), and Bone-Conduction Hearing Aids. Among these, BTE hearing aids dominate the market share due to their versatility and suitability for a wide range of hearing losses. BTE devices are larger than their ITE counterparts, and they house more powerful components, making them ideal for individuals with severe to profound hearing loss. Their broad customizability and ease of operation further bolster their popularity among users. Additionally, they are equipped with enhanced features such as Bluetooth connectivity, providing convenience and improved sound quality.

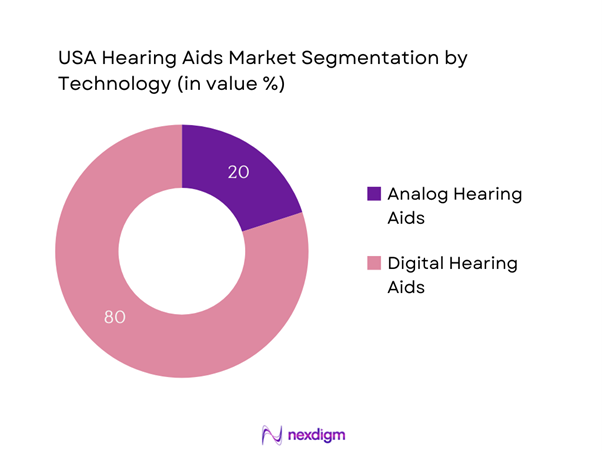

By Technology Type

The USA Hearing Aids Market is further segmented by technology type into Analog Hearing Aids and Digital Hearing Aids. Digital hearing aids are the dominant segment, representing a significant share as they offer superior sound processing capabilities and features that enhance user experience. Unlike analog aids, which merely amplify sound, digital aids convert sound waves into digital signals, allowing for better customization and clarity. Features such as noise cancellation, feedback suppression, and connectivity with mobile devices make digital hearing aids increasingly popular among consumers seeking advanced auditory solutions.

Competitive Landscape

The USA Hearing Aids Market is characterized by a competitive landscape dominated by a few key players. Major companies include Sonova Holding AG, Amplifon S.p.A, GN Store Nord A/S, Demant A/S, and Starkey Hearing Technologies. The consolidation of these firms highlights their significant influence over innovation and product development within the industry. The rivalry fosters advancements in technology, resulting in better solutions for users.

| Company | Establishment Year | Headquarters | Market Reach | Product Offerings | R&D Investment | User Experience Focus |

| Sonova Holding AG | 1947 | Stäfa, Switzerland | – | – | – | – |

| Amplifon S.p.A | 1950 | Milan, Italy | – | – | – | – |

| GN Store Nord A/S | 1869 | Ballerup, Denmark | – | – | – | – |

| Demant A/S | 1904 | Smørum, Denmark | – | – | – | – |

| Starkey Hearing Technologies | 1967 | Eden Prairie, Minnesota | – | – | – | – |

USA Hearing Aids Market Analysis

Growth Drivers

Aging Population

The increasing aging population in the United States is a significant driver of the hearing aids market. As of 2023, individuals aged 65 and older represent approximately 17% of the total U.S. population, with projections indicating this percentage will rise to around 20% by 2030. This demographic shift means more individuals will experience age-related hearing loss, which affects nearly 30% of older adults. The U.S. Census Bureau reported that by 2030, there will be about 73 million seniors, up from 52 million in 2018, highlighting the growing demand for hearing assistance devices.

Increased Awareness of Hearing Loss

There is a rising awareness regarding the importance of hearing health, which strongly contributes to market growth. Approximately 48 million Americans experience some degree of hearing loss, with recent campaigns emphasizing its impact on cognitive decline and overall well-being. The National Institute on Deafness and Other Communication Disorders (NIDCD) indicates that untreated hearing loss is linked to an increased risk of cognitive decline, depression, and social isolation. This awareness is driving individuals to seek solutions and prompting healthcare providers to recommend hearing aids more frequently.

Market Challenges

High Cost of Devices

The cost of hearing aids remains a significant barrier to accessibility for many individuals in the United States. The average price of a pair of hearing aids can range from USD 4,000 to USD 6,000. According to the U.S. Department of Health and Human Services, only about 30% of individuals who could benefit from hearing aids actually obtain them, primarily due to financial constraints. Many healthcare plans do not cover hearing aids, leaving consumers to bear the entire cost themselves, which further impedes widespread usage.

Limited Reimbursement Policies

The reimbursement policies for hearing aids are notably restrictive, posing a significant challenge for consumers seeking assistance. According to a report by the American Speech-Language-Hearing Association (ASHA), only a handful of states have mandated coverage for hearing aids under private insurance, while Medicare generally does not provide coverage for these devices. Consequently, patients are often required to pay out-of-pocket, making it financially burdensome for many, particularly those in retirement or fixed-income situations. This lack of support limits market penetration and growth.

Opportunities

Technological Innovations

Technological advancements within the hearing aid sector present substantial market opportunities. The integration of Bluetooth technology allows users to connect their hearing aids directly to smartphones, improving the user experience through personalized sound settings and streaming capabilities. The World Health Organization (WHO) predicts that by the end of 2025, 1.2 billion people globally will utilize some form of hearing aid technology due to these advancements. Current innovations are crucial for enhancing user satisfaction and broadening the target audience by providing products that meet the needs of tech-savvy customers.

Expanding Telehealth Services

The growth of telehealth services offers strategic opportunities for the hearing aids market. With the ongoing expansion of telemedicine, particularly in response to the COVID-19 pandemic, patients can now receive consultations and adjustments for their hearing devices remotely. According to a recent report by the Centers for Medicare & Medicaid Services (CMS), telehealth usage surged with over 28% of beneficiaries receiving care via telehealth in early 2021. This mode of service delivery can reduce barriers to accessing audiology services, facilitating increased sales of hearing aids through convenient consultations and support.

Future Outlook

Over the next five years, the USA Hearing Aids Market is expected to experience substantial growth driven by technological advancements, increased healthcare funding, and a growing awareness of hearing health issues. The integration of cutting-edge features such as artificial intelligence, mobile app connectivity, and telehealth services is set to further elevate the user experience. Additionally, government initiatives aimed at making hearing aids more accessible and affordable will play a crucial role in expanding market reach. This favorable regulatory environment, combined with an increasing demand for personalized auditory solutions, underscores the optimistic outlook for the industry.

Major Players in the Market

- Sonova Holding AG

- Amplifon S.p.A

- GN Store Nord A/S

- Demant A/S

- Starkey Hearing Technologies

- Cochlear Limited

- WS Audiology

- Eargo, Inc.

- Oticon A/S

- Unitron

- Sivantos GmbH

- Rexton

- Bernafon

- Phonak

- Signia

Key Target Audience

- Audiology Clinics and Professionals

- Retail Pharmacies

- Hearing Aid Manufacturers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (FDA, CDC)

- Healthcare Providers

- Insurance Companies

- Non-Profit Organizations Focused on Hearing Health

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map is constructed, covering all major stakeholders within the USA Hearing Aids Market. This step utilizes extensive desk research, incorporating both secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data concerning the USA Hearing Aids Market. Assessments will focus on market penetration rates and the ratio of hearing aid devices to potential consumers, thereby generating relevant revenue estimates. Additionally, service quality metrics will be evaluated to ensure accuracy in the market data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in the earlier phases will be validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These experts represent a diverse range of companies within the auditory health sector and will provide essential insights that will help refine and corroborate the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase engages multiple hearing aid manufacturers to gain detailed insights regarding product offerings, sales performance, consumer preferences, and other relevant factors. This direct engagement validates and enhances the statistics obtained through a bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the entire USA Hearing Aids Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Aging Population

Increased Awareness of Hearing Loss - Market Challenges

High Cost of Devices

Limited Reimbursement Policies - Opportunities

Technological Innovations

Expanding Telehealth Services - Trends

Smart Hearing Aids Integration

Growing Use of Direct-to-Consumer Models - Government Regulation

FDA Regulations on Hearing Devices

Quality Assurance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Behind-the-Ear (BTE) Hearing Aids

In-the-Ear (ITE) Hearing Aids

Receiver-in-Canal (RIC) Hearing Aids

Completely-in-Canal (CIC) Hearing Aids

Bone-Conduction Hearing Aids - By Technology Type (In Value %)

Analog Hearing Aids

Digital Hearing Aids - By Application (In Value %)

Adult Segment

Pediatric Segment - By Distribution Channel (In Value %)

Audiology Clinics

Retail Pharmacies

Online Retail - By Region (In Value %)

Northeast Region

Midwest Region

South Region

West Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Hearing Aids Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Product Offering Differentiation, Marketing Strategies, Distribution Reach, Customer Service Approach, Technological Capabilities, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Sonova Holding AG

Amplifon S.p.A

GN Store Nord A/S

Demant A/S

Starkey Hearing Technologies

Cochlear Limited

WS Audiology

Eargo, Inc.

Oticon A/S

Unitron

Sivantos GmbH

Rexton

Bernafon

Phonak

Signia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030