Market Overview

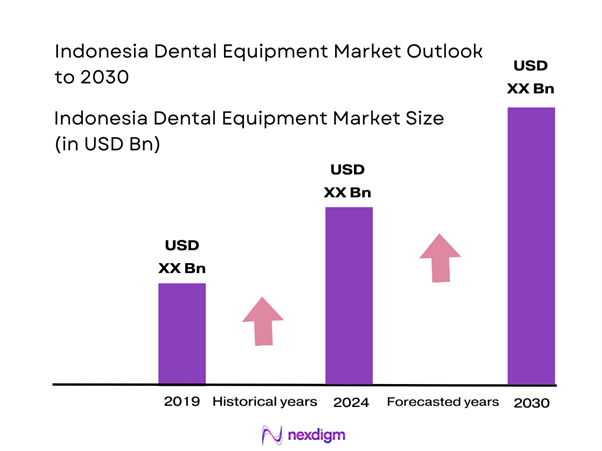

The Indonesia dental equipment market is valued at approximately USD 450 million in 2024 with an approximated compound annual growth rate (CAGR) of 6.5% from 2024-2030, based on a comprehensive five-year historical analysis. The growth is fueled by factors such as the rising dental awareness among the population, an increase in dental care facilities, and governmental initiatives aimed at improving healthcare infrastructure. This increasing focus on oral health has resulted in greater demand for advanced dental technologies and equipment, driving significant growth in the market.

Dominance in the market is observed predominantly in urban centers such as Jakarta, Surabaya, and Bandung. These cities are characterized by a higher concentration of dental clinics and healthcare facilities that require sophisticated equipment. The rapid urbanization, coupled with an increasing number of dental professionals and educational programs, has reinforced the dominance of these cities in shaping the dental equipment landscape. Investments in healthcare infrastructure in these urban regions remain a significant contributor to market growth.

The Indonesian government has implemented several initiatives aimed at improving public health, including dental care. Programs targeting rural health have gained momentum, with the Indonesian government allocating approximately IDR 11 trillion (USD 765 million) for health expenditures related to dental treatment and disease prevention. These investments are crucial for establishing rural dental clinics and mobile units to enhance access to essential dental services in underserved areas.

Market Segmentation

By Product Type

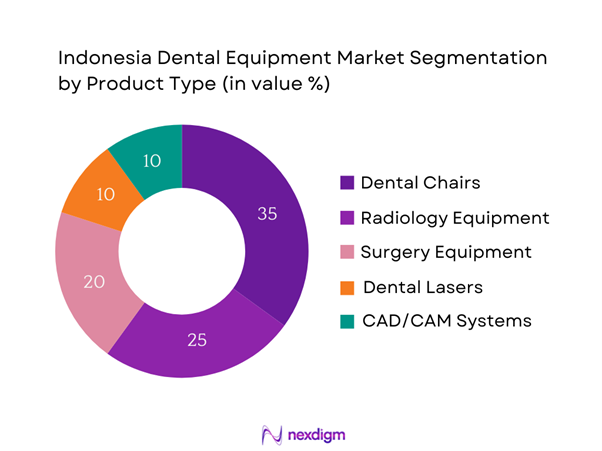

The Indonesia dental equipment market is segmented by product type into dental chairs, radiology equipment, surgery equipment, dental lasers, and CAD/CAM systems. Currently, the dental chair segment dominates the market, primarily due to its essential role in any dental practice. Dental chairs are vital for patient comfort and facilitate a broad array of dental procedures. As more dental professionals upgrade to technologically advanced chairs with additional features like ergonomics and integrated diagnostic tools, this segment continues to maintain a strong presence in the market.

By Application Type

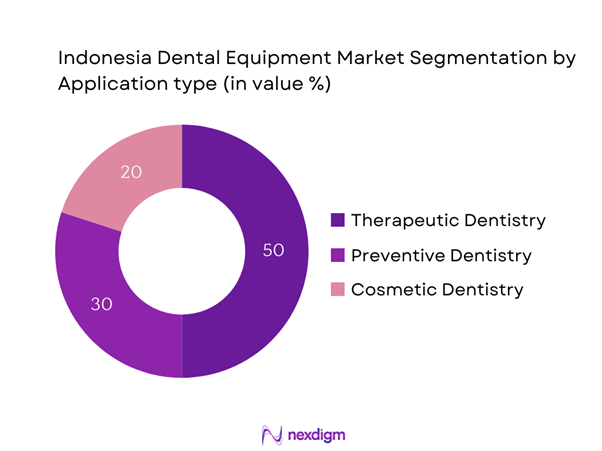

The market is also segmented by application type, which includes therapeutic dentistry, preventive dentistry, and cosmetic dentistry. Within this segmentation, therapeutic dentistry currently holds the most substantial share. This segment is driven by the increasing prevalence of dental diseases and a growing awareness of preventative care among the Indonesian population. As more individuals seek treatment for dental issues, the demand for equipment used in therapeutic procedures, such as surgical tools and diagnostic equipment, escalates, contributing significantly to market growth.

Competitive Landscape

The Indonesia dental equipment market is dominated by several key players, including both local and international manufacturers. Notable companies such as Danaher Corporation, Dentsply Sirona, and Planmeca are at the forefront, combining innovative technology and extensive distribution networks to consolidate their market positions. The homogenization of competitors emphasizes the intense rivalry prevalent in the market, which encourages continuous innovation and advancements in dental equipment and technologies.

| Company | Establishment Year | Headquarters | Revenue (Est.) | Product Offerings | Market Strategies |

| Danaher Corporation | 1969 | Washington, USA | – | – | – |

| Dentsply Sirona | 2016 | York, USA | – | – | – |

| Planmeca | 1971 | Helsinki, Finland | – | – | – |

| GC Corporation | 1921 | Tokyo, Japan | – | – | – |

| Carestream Dental | 2011 | Rochester, USA | – | – | – |

Indonesia Dental Equipment Market Analysis

Growth Drivers

Increasing Dental Awareness

The Indonesian population has shown a notable increase in dental awareness, driven by educational campaigns and a growing understanding of oral health’s importance. The National Health Survey indicated that around 83% of Indonesians are aware of the importance of dental care, which is a significant increase from previous years. Additionally, with the World Bank reporting the country’s life expectancy at approximately 73 years, this creates a larger base of individuals seeking preventive dental care. This heightened awareness translates directly into increased demand for various dental services and, consequently, the equipment needed to facilitate these services.

Rise in Dental Procedures

The demand for dental procedures in Indonesia is on the rise, primarily due to the increasing prevalence of dental diseases and an aging population. According to the Ministry of Health of Indonesia, oral health consultations have risen to over 45 million visits annually. With non-communicable diseases such as diabetes mellitus affecting about 10.7% of the population, the associated dental complications necessitate a greater volume of dental interventions. This surge in procedures directly boosts demand for dental equipment and services across a variety of practices throughout the nation.

Market Challenges

High Import Costs

One of the significant challenges facing the Indonesian dental equipment market is the high cost of imported equipment. Indonesia imports nearly 60% of its medical devices, with duties and tariffs raising costs significantly. The average import tariff for medical devices has been reported at around 5%, while other costs such as transport and insurance can add an additional 15% to the final price. As a result, these high costs often push dental practices to use older, less efficient equipment, which can hinder the overall advancement of dental technology in the country.

Lack of Skilled Professionals

The dental sector in Indonesia faces a notable deficiency in skilled professionals, which poses a significant challenge to market growth. The ratio of dentists to the population is approximately 1:6,000, significantly below the World Health Organization recommendation of 1:2,000. This shortage of qualified dental practitioners limits the number of procedures that can be performed and consequently stifles demand for advanced dental equipment. To bridge this gap, investments in education and training programs are critical, as they would help improve service delivery and broaden the market’s scope.

Opportunities

Technological Advancements

The rapid pace of technological advancements in dental procedures offers significant opportunities for growth within the Indonesian dental equipment market. Technologies such as 3D printing are being increasingly utilized for dental prosthetics, providing innovative solutions that enhance patient care. Recent data indicates that approximately 30% of dental practices in urban areas of Indonesia have started integrating digital solutions in their workflows. As technology becomes more accessible, further investment into modern equipment is anticipated, which will not only improve care but also spur industry growth.

Growth in Aesthetic Procedures

There is a growing trend in Indonesia towards aesthetic dental procedures, particularly among the urban middle class. According to the Indonesian Society of Aesthetic Dentistry, aesthetic procedures have seen a rise of around 20% in demand over the past two years, as more individuals prioritize their appearance. This growth is underscored by the broader socio-economic shifts, including an urbanization rate that reached 56%. As a result, practices focused on cosmetic dentistry are increasingly investing in advanced equipment, further expanding their offerings and enhancing patient outcomes.

Future Outlook

Over the coming years, the Indonesia dental equipment market is anticipated to experience significant growth due to ongoing urbanization, increased dental care awareness, and advancements in dental technology. As healthcare infrastructure continues to expand, complemented by a rising number of dental professionals, the demand for innovative dental solutions is expected to escalate. Additionally, government support for healthcare initiatives is likely to bolster market growth and enhance access to quality dental care across the nation.

Major Players

- Danaher Corporation

- Dentsply Sirona

- Planmeca

- GC Corporation

- Carestream Dental

- Nobel Biocare

- Sirona Dental Systems

- Midmark Corporation

- 3M Oral Care

- A-dec

- VDW GmbH

- DentalEZ Group

- Amann Girrbach AG

- Kuraray Noritake Dental

- Voco GmbH

Key Target Audience

- Dental Clinics

- Hospitals

- Dental Equipment Distributors

- Government and Regulatory Bodies (Ministry of Health – Indonesia, Indonesian Dental Association)

- Investments and Venture Capitalist Firms

- Dental Product Manufacturers

- Insurance Companies

- Research and Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all significant stakeholders within the Indonesia dental equipment market. This step relies on extensive desk research, utilizing a blend of secondary and proprietary databases to collect detailed industry-level information. The primary objective is to identify key variables that influence the dynamics of the market, including technological advancements, competitive landscape, and regulatory considerations.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data concerning the Indonesia dental equipment market. This includes evaluating market penetration rates, the ratio of suppliers to dental practices, and resultant revenue generation metrics. Additionally, an investigation into service quality statistics is conducted to ensure reliability and accuracy in revenue estimates while understanding market trends and demand gaps.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts from a diverse array of companies. These consultations provide valuable operational and market insights directly from industry practitioners, which are instrumental in refining and corroborating the gathered market data, ensuring a more robust analysis.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with several dental equipment manufacturers to gain detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to both verify and complement the statistics derived from the bottom-up approach while ensuring a thorough, accurate, and validated representation of the Indonesia dental equipment market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Context

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Dental Awareness

Rise in Dental Procedures

Government Initiatives - Market Challenges

High Import Costs

Lack of Skilled Professionals - Opportunities

Technological Advancements

Growth in Aesthetic Procedures - Trends

Digital Dentistry

Minimally Invasive Techniques - Government Regulation

Licensing Requirements

Quality Control Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Dental Chairs

Radiology Equipment

Surgery Equipment

Dental Lasers

CAD/CAM Systems - By Application Type (In Value %)

Therapeutic Dentistry

Preventive Dentistry

Cosmetic Dentistry - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Sales - By End User (In Value %)

Dental Clinics

Hospitals

Research Institutions - By Region (In Value %)

Java

Sumatra

Bali

Sulawesi

Kalimantan

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Dental Equipment Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Financial Performance, Product Innovation, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Equipment

- Detailed Profiles of Major Companies

Danaher Corporation

Dentsply Sirona

Carestream Dental

Planmeca

VDW GmbH

Sirona Dental Systems

GC Corporation

Youdent

Dental Wings

Midmark Corporation

Amann Girrbach AG

Kuraray Noritake Dental

Nobel Biocare

DentalEZ Group

3M Oral Care

- Market Demand and Utilization

- Purchasing Behavior and Budget Allocations

- Regulatory Compliance Requirements

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030