Market Overview

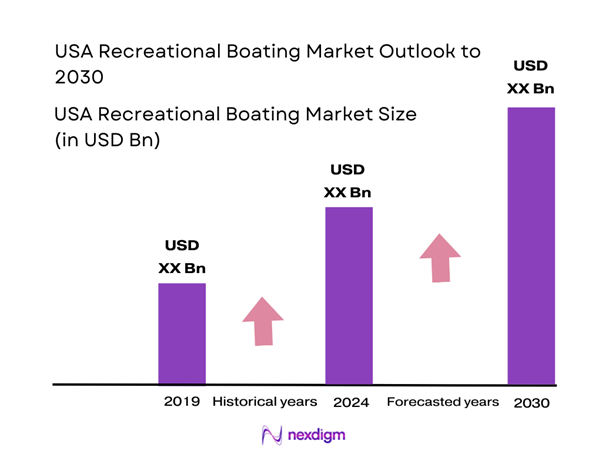

The USA Recreational Boating Market is valued at approximately USD 28.71 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 5.10% from 2025-2030, reflecting a strong growth trajectory fueled by rising disposable incomes and consumer interest in outdoor recreation. This significant market size can be attributed to increasing participation in boating activities among all demographics as people seek leisure and adventure.

The market is predominantly influenced by major coastal states such as Florida, California, and Texas, which boast extensive waterways and favorable climates for year-round boating activities. Florida, in particular, stands out due to its robust tourism industry, attracting millions of visitors annually who engage in boating. California’s diverse marine environments and Texas’s growing population of outdoor enthusiasts further solidify their leadership in the recreational boating sector.

The millennial generation, representing more than 70 million individuals in the U.S., is increasingly becoming a significant driver in the U.S. recreational boating market. Their growing interest in experiential leisure activities, as well as increasing spending power, enhances market opportunities. By the end of 2025, millennials are projected to contribute around USD 1.4 trillion to the recreational economy, with a substantial part directed toward boating and related experiences. This demographic shift reflects changing attitudes towards outdoor adventures and family-oriented recreational opportunities.

Market Segmentation

By Boat Type

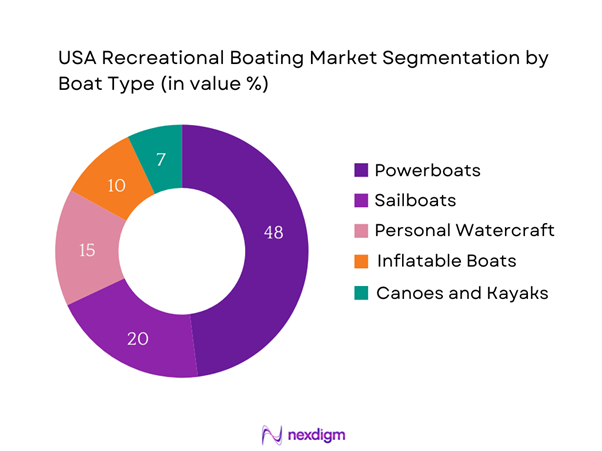

The USA Recreational Boating Market is segmented by boat type into powerboats, sailboats, personal watercraft, inflatable boats, and canoes and kayaks. Among these segments, powerboats hold a dominant market share due to their versatility and popularity among leisure and recreational users. Powerboats are particularly favored for water sports and fishing, appealing to a wide range of consumers. Their variety of styles, sizes, and manufacturer options enhance consumer choice, leading to a high adoption rate. Additionally, innovations in fuel efficiency and technology are making powerboats more accessible, further entrenching their market dominance.

By Usage

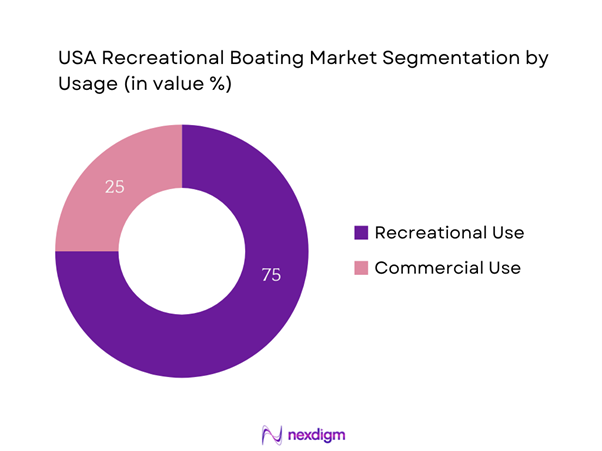

The market is also segmented by usage into recreational use and commercial use. Recreational use dominates this sector, stemming from the rising popularity of boating as an outdoor leisure activity. The recreational segment appeals to families, young adults, and hobbyists who view boating as an enjoyable escape from daily routines. This has been underscored by increasing interest in lifestyle choices that promote health and wellness through outdoor activities. Moreover, the versatility of boats designed for recreational use, which cater to both relaxation and adventure seekers, further solidifies their appeal and market share.

Competitive Landscape

The USA Recreational Boating Market is dominated by several major players, showcasing a competitive landscape that reflects both local and global influences. Key manufacturers include Brunswick Corporation, Yamaha Motor Corporation, and Kawasaki Heavy Industries. These companies leverage their extensive experience and innovation in manufacturing to enhance their market positions. Their brand recognition, combined with a focus on quality and consumer preferences, sets a high bar in the competitive environment.

| Company Name | Establishment Year | Headquarters | Market Focus | Annual Revenue | Key Product Offerings |

| Brunswick Corporation | 1845 | Mettawa, Illinois | – | – | – |

| Yamaha Motor Corporation | 1953 | Iwata, Japan | – | – | – |

| Kawasaki Heavy Industries | 1896 | Kobe, Japan | – | – | – |

| MasterCraft Boat Company | 1968 | Vonore, Tennessee | – | – | – |

| Sea Ray Boats | 1959 | Knoxville, Tennessee | – | – | – |

USA Recreational Boating Market Analysis

Growth Drivers

Increasing Disposable Income

Rising disposable income levels in the United States significantly drive the recreational boating market. As of 2024, the average household income stands at approximately USD 76,700, according to the U.S. Census Bureau. Increased income allows consumers to spend more on leisure activities, such as boating, leading to higher purchases of boats and related equipment. Additionally, the robust job market, with an unemployment rate projected at 3.5%, encourages consumer confidence and spending, further supporting growth in this sector.

Growth in Adventure Tourism

Adventure tourism is gaining traction across the U.S., with enthusiasts seeking outdoor recreational experiences. The adventure travel market is valued at USD 775 billion as of 2022, with a significant portion allocated to water-based activities. The increase in demand for unique experiences, especially among younger populations looking for adrenaline-pumping activities, correlates with the growth of the boating sector. In 2023, over 70 million Americans participated in water-related recreational activities, reinforcing the connection between adventure tourism and recreational boating.

Market Challenges

Regulatory Compliance

The recreational boating sector faces stringent regulatory compliance issues concerning safety and environmental standards. The U.S. Coast Guard established regulations to ensure safety equipment is on board, impacting manufacturers in terms of design and production costs. Non-compliance can result in penalties, with violations leading to fines that can reach up to USD 10,000 per incident. Additionally, restrictions on emissions from marine engines due to environmental regulations also pose challenges, affecting small manufacturers who may struggle to meet these standards.

Economic Uncertainty

The overall economic uncertainty can pose significant challenges to the recreational boating market. With current inflation rates hovering around 4.5% as of early 2024, consumer confidence may waver, leading to reduced spending on discretionary items, including recreational boats. This economic climate can inhibit growth as consumers prioritize essential over luxury purchases. Furthermore, potential fluctuations in interest rates, which are projected to stay around 4%, could affect the financing availability for boat purchases, further impacting market dynamics.

Opportunities

Technological Advancements in Boating

The recreational boating market is ripe with opportunities stemming from technological advancements. Smart systems, such as GPS and automation in navigation, are increasingly becoming standard features on boats. Moreover, industry stakeholders are investing heavily in research and development to innovate and enhance the boating experience, which positions the market favorably for future growth as consumers seek more integrated and user-friendly boating solutions.

Rising Interest in Eco-Friendly Options

There is a notable rise in demand for eco-friendly boating options as environmentally conscious consumers become more prevalent in the market. In 2023, approximately 25% of consumers expressed interest in purchasing electric or hybrid boats. The growing awareness of environmental issues, combined with legislation promoting sustainability, is leading manufacturers to innovate in this area. The current trend of integrating electric propulsion systems and sustainable materials in boat design creates opportunities for market players to tap into a brand new consumer segment, which is expected to become a significant portion of the boating market in the coming years.

Future Outlook

The USA Recreational Boating Market is expected to witness continued growth, bolstered by advancements in boating technology, increasing environmental awareness, and the growing popularity of water-based recreational activities. As eco-friendly options expand in the marketplace, coupled with government initiatives promoting recreational marine activities, the market is positioned for sustainable growth. Additionally, the expected increase in disposable income and leisure time among consumers should contribute to an uptick in boat purchases and usage over the coming years.

Major Players

- Brunswick Corporation

- Yamaha Motor Corporation

- Kawasaki Heavy Industries

- MasterCraft Boat Company

- Sea Ray Boats

- Polaris Industries

- Malibu Boats

- Chaparral Boats

- Beneteau Group

- Bass Pro

- Tracker Marine Group

- Grady-White Boats

- Four Winns

- Cobalt Boats

- Hurricane Boats

Key Target Audience

- Boat Manufacturers

- Marine Equipment Retailers

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (U.S. Coast Guard, National Marine Manufacturers Association)

- Recreational Boating Associations

- Fleet Operators

- Water Sports Equipment Suppliers

- Environmental and Wildlife Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Recreational Boating Market. This step utilizes a combination of secondary and proprietary databases to gather comprehensive industry-level information, including consumer behavior, market trends, and technological advancements. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the USA Recreational Boating Market is compiled and analyzed. The analysis includes assessing the penetration rates of boat types and usage categories, the ratio of marketplaces to service providers, and the resultant revenue generation. This phase ensures a detailed understanding of market performance based on actual sales and growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies, associations, and stakeholders in the recreational boating sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase consists of extensive engagement with multiple manufacturers and dealers to acquire detailed insights into product segments, sales performances, consumer preferences, and emerging market trends. This interaction serves to verify and complement the statistics derived from the previous analyses, ensuring a comprehensive, accurate, and validated assessment of the USA Recreational Boating Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Disposable Income

Growth in Adventure Tourism

Expanding Millennial Demographics - Market Challenges

Regulatory Compliance

Economic Uncertainty - Opportunities

Technological Advancements in Boating

Rising Interest in Eco-Friendly Options - Trends

Shift Towards Electric and Hybrid Boats

Increased Focus on Safety Features - Government Regulation

Environmental Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Boat Type (In Value %)

Powerboats

Sailboats

Personal Watercraft

Inflatable Boats

Canoes and Kayaks - By Usage (In Value %)

Recreational Use

Commercial Use - By Distribution Channel (In Value %)

OEM Dealers

Online Retail

Boat Shows

Direct Sales - By Region (In Value %)

Northeast

Midwest

South

West - By Customer Demographics (In Value %)

Age Group

Income Level

Geographic Distribution

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Recreational Boating Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Boat Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Brunswick Corporation

Marine Products Corporation

Yamaha Motor Corporation

Polaris Industries

MasterCraft Boat Company

Sea Ray Boats

Chaparral Boats

Tracker Marine Group

Bayliner

Beneteau Group

Cobalt Boats

Grady

White Boats

Four Winns

Hurricane Boats

Lowe Boats

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030