Market Overview

The KSA Circuit Breakers Market is valued at USD 468 million in 2024 with an approximated compound annual growth rate (CAGR) of 6.9% from 2024-2030, supported by a robust infrastructure and growing industrial sectors. Factors driving this market include increased urbanization, advancements in electrical safety standards, and substantial investments in renewable energy projects. The demand for reliable electrical distribution systems further contributes to the growth of circuit breakers, making them essential components for residential, commercial, and industrial applications.

Dominant cities influencing the KSA Circuit Breakers Market include Riyadh, Jeddah, and Dammam. Riyadh, being the capital, leads in infrastructure development projects, driving demand for electrical safety equipment, including circuit breakers. Jeddah and Dammam also contribute significantly due to their strategic positioning as economic hubs, with ongoing industrial expansions and commercial upgrades fueling market growth.

The Kingdom of Saudi Arabia is undergoing extensive infrastructure development as part of its Vision 2030 initiative, which prioritizes urban growth and enhanced connectivity. The government allocated USD 32 billion specifically for infrastructure projects in 2022, leading to significant investment in electrical installations and distribution systems. This massive investment is expected to enhance the demand for circuit breakers to ensure electrical safety and reliability in new developments, including smart cities and urban expansions.

Market Segmentation

By Product Type

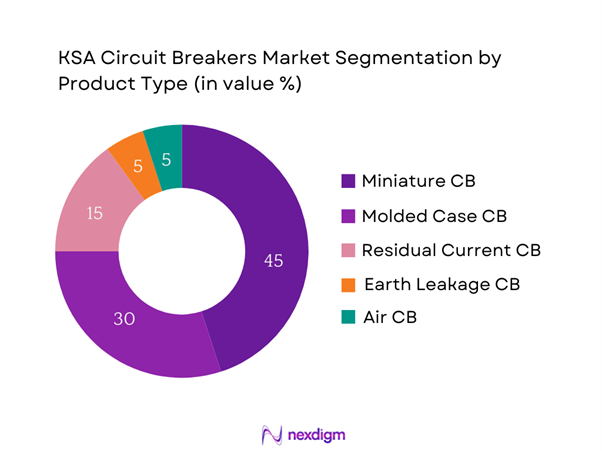

The KSA Circuit Breakers Market is segmented by product type into Miniature Circuit Breakers (MCB), Molded Case Circuit Breakers (MCCB), Residual Current Circuit Breakers (RCCB), Earth Leakage Circuit Breakers (ELCB), and Air Circuit Breakers (ACB). Among these, the Miniature Circuit Breakers (MCB) hold the dominant market share due to their widespread use in residential and commercial applications. Their ability to automatically switch off electrical circuits in case of overload or short-circuit conditions makes them invaluable for ensuring safety in electrical installations. The increasing number of new constructions combined with the retrofitting of older buildings to meet current safety standards further bolster the demand for MCBs in the Kingdom.

By Application

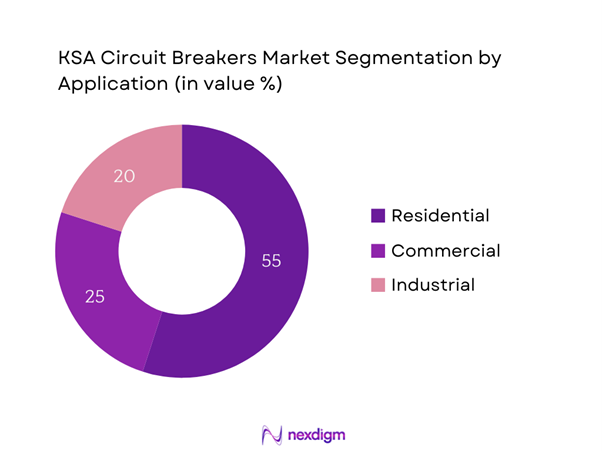

The KSA Circuit Breakers Market is also segmented by application, which includes Residential, Commercial, and Industrial uses. The residential segment dominates the market as it caters to the increasing number of households and substantial urban residential developments throughout the country. As electrical safety regulations become more stringent, the installation of circuit breakers in homes has become a standard requirement to protect against electrical faults. The rising awareness of electrical safety and growing population in urban regions contribute significantly to this segment’s growth.

Competitive Landscape

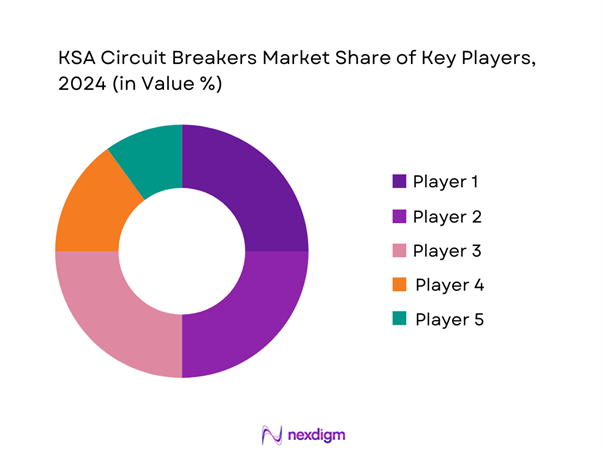

The KSA Circuit Breakers Market is dominated by key players such as Schneider Electric, Siemens, ABB, Eaton, and GE. These companies possess strong brand recognition, comprehensive product portfolios, and an extensive distribution network that allows them to cater to diverse customer needs. The competitive landscape is characterized by innovation, where these leaders invest significantly in research and development to introduce advanced circuit breakers, enhancing safety features and integration with smart technologies.

| Company | Est. Year | Headquarters | Revenue | Market Share | Product Range | Innovation Focus |

| Schneider Electric | 1836 | France | – | – | – | – |

| Siemens | 1847 | Germany | – | – | – | – |

| ABB | 1988 | Switzerland | – | – | – | – |

| Eaton | 1911 | Ireland | – | – | – | – |

| GE | 1892 | USA | – | – | – | – |

KSA Circuit Breakers Market Analysis

Growth Drivers

Rising Urbanization

Saudi Arabia’s urban population has been growing steadily, with UN projections indicating that around 85% of the population will reside in urban areas by end of 2025. This increase leads to higher requirements for housing, commercial developments, and public infrastructure, subsequently elevating the demand for electrical safety equipment, including circuit breakers. The urbanization process is marked by the construction of high-rise buildings, shopping malls, and other amenities, all of which require reliable electrical systems. As the urban landscape expands, the reliance on modern circuit protection solutions will be imperative to ensure safety and efficiency in energy distribution

Adoption of Renewable Energy

The adoption of renewable energy in Saudi Arabia is gaining momentum as the government aims to diversify its energy portfolio. The National Renewable Energy Program aims to generate 58.7 GW of renewable energy by 2030, which is crucial for reducing dependency on fossil fuels. Given that solar and wind energy systems require state-of-the-art protection equipment, the demand for advanced circuit breakers is expected to surge to handle the complexities associated with these energy sources. This focus on incorporating renewable energy systems not only facilitates energy transition but also creates opportunities for circuit breaker manufacturers, enhancing safety in renewable installations.

Market Challenges

Fluctuations in Raw Material Costs

The KSA Circuit Breakers Market is facing challenges due to the volatility of raw material prices, particularly copper and aluminum, which are essential elements in circuit breaker manufacturing. Fluctuations in global metal prices have caused significant impacts, with copper prices reaching USD 4.65 per pound in early 2024. Such price instability leads to increased production costs and can pressure profit margins for manufacturers. These fluctuations are often driven by global economic dynamics and shifting supply chains, creating ongoing challenges for companies looking to maintain competitive pricing.

Regulatory Compliance

Stringent regulatory frameworks governing electrical safety and environmental standards present challenges in the KSA market. The Saudi Standards, Metrology and Quality Organization (SASO) enforces strict compliance with safety regulations, requiring all electrical products to meet specific operational standards. As of 2024, the penalty for non-compliance has risen significantly, incentivizing manufacturers to invest in advanced safety technologies, leading to increased operational costs. Adhering to these regulations while remaining competitive in price can be a difficult balancing act for companies within the circuit breakers market.

Opportunities

Increasing Demand for Smart Circuit Breakers

The push towards smart technology integration within electrical systems presents a valuable opportunity for the circuit breakers market. Currently, approximately 34% of households in Saudi Arabia are embracing smart technologies, reflecting growing consumer interest in automation and energy management solutions. This trend is accompanied by government incentives to promote smart building technologies, providing a platform for manufacturers to introduce innovative smart circuit breakers that offer automated monitoring and fault detection. As demand for energy-efficient solutions escalates, companies that can deliver smart circuit protection systems will be poised for substantial growth in the coming years.

Growth of the Renewable Energy Market

The ongoing growth of the renewable energy market in Saudi Arabia offers considerable opportunities for circuit breaker suppliers. With targets of generating 50% of electricity from renewable sources by 2030, the country is positioning itself as a leader in sustainable energy production. The current installed capacity of solar energy in Saudi Arabia has reached 2.9 GW, significantly contributing to the national grid. This burgeoning sector requires advanced circuit protection solutions to handle energy fluctuations and ensure system reliability, representing a key market opportunity for suppliers focusing on renewable energy applications.

Future Outlook

The KSA Circuit Breakers Market is anticipated to witness substantial growth driven by continuous infrastructure development, increasing urbanization, and the adoption of renewable energy sources. Over the next five years, factors such as rising safety regulations and advancements in electronic components are expected to fuel market expansion. Furthermore, with the government’s focus on enhancing the electrical grid and promoting smart technology integrations, the demand for circuit breakers will likely intensify, positioning the market for significant expansion. The push towards sustainability and energy efficiency will also encourage investments in modern circuit protection solutions, ensuring that the KSA Circuit Breakers Market remains competitive and innovative in the face of changing energy demands.

Major Players in the Market

- Schneider Electric

- Siemens

- ABB

- Eaton

- GE

- Mitsubishi Electric

- Legrand

- Honeywell

- Rockwell Automation

- LSIS

- Hager Group

- Southwire Company

- Alfanar

- TE Connectivity

- Hitachi

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Electricity Company, Saudi Arabian Standards Organization)

- Major Electrical Contractors

- Renewable Energy Companies

- Property Developers

- Electrical Equipment Distributors

- Manufacturing Companies

- Trade Associations and Industry Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem surrounding the KSA Circuit Breakers Market by identifying all major stakeholders. This is an extensive process that includes utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary goal is to pinpoint and define critical variables that influence market dynamics and trends.

Step 2: Market Analysis and Construction

In this step, we will collect and analyze historical data relevant to the KSA Circuit Breakers Market. This includes assessing market penetration rates, the ratio between various circuit protection products, and their resultant revenue contributions. An evaluation of the service quality metrics will also be undertaken to ensure the reliability of revenue estimates and market assessments.

Step 3: Hypothesis Validation and Expert Consultation

We will develop market hypotheses that will be validated through computer-assisted telephone interviews (CATIs) with industry experts and practitioners. This process will involve gathering insights from a diverse range of companies, providing valuable operational and financial data that will refine our market understanding and validate our findings.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with various circuit breaker manufacturers to gain detailed insights into market trends, consumer preferences, product performance, and sales data. This interactive approach will help verify the statistics obtained through both bottom-up and top-down methodologies, ensuring a comprehensive analysis of the KSA Circuit Breakers Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Infrastructure Development

Rising Urbanization

Adoption of Renewable Energy - Market Challenges

Fluctuations in Raw Material Costs

Regulatory Compliance - Opportunities

Increasing Demand for Smart Circuit Breakers

Growth of the Renewable Energy Market - Trends

Technological Advancements

Shift Towards Automation - Government Regulation

Safety Standards

Energy Efficiency Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Miniature Circuit Breakers (MCB)

Molded Case Circuit Breakers (MCCB)

Residual Current Circuit Breakers (RCCB)

Earth Leakage Circuit Breakers (ELCB)

Air Circuit Breakers (ACB) - By Application (In Value %)

Residential

Commercial

Industrial - By Voltage Rating (In Value %)

Low Voltage

Medium Voltage - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Retail - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Circuit Breakers Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Financial Performance, Revenue by Circuit Breaker Type, Distribution Channels, Number of Dealers and Distributors, Margins, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

ABB Ltd.

Siemens AG

Schneider Electric SE

General Electric Company

Eaton Corporation plc

Mitsubishi Electric Corporation

Hitachi Energy Ltd.

Larsen & Toubro Limited

Alfanar Company Ltd.

Hyosung Corporation

Hyundai Electric & Energy Systems Co., Ltd.

Wahah Electric Supply Company of Saudi Arabia Ltd.

TAVANIR

Lucy Electric

Powell Industries, Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030