Market Overview

The Indonesia lubricants market is valued at 1.06 billion Liters in 2025 with an approximated compound annual growth rate (CAGR) of 3.85% from 2025-2030, driven by increasing automotive production and a robust manufacturing sector. The expansive automotive industry, coupled with rising demand for industrial lubricants, propels the growth of this market. Additionally, the growing trend of eco-friendly lubricants and government initiatives to promote their usage also contribute to expanding market dynamics.

Dominant regions within the market include Java and Sumatra, primarily due to their industrial hubs and high population densities. These areas hold a large share of manufacturing and automotive activities, driving demand for various lubricants. Java is home to numerous automotive production plants and industrial manufacturers, while Sumatra supports significant oil and gas operations, making them key contributors to the lubricants market.

The expansion of the automotive aftermarket sector provides promising opportunities for lubricant vendors. The number of vehicles in Indonesia is projected to reach 20 million by end of 2025, leading to a substantial demand for replacement lubricants as maintenance and repair services grow. In 2022, the aftermarket sector was valued at USD 7 billion and continues to thrive as vehicle ownership rises and consumers prioritize regular vehicle upkeep. This significant market segment enables lubricant manufacturers to capitalize on consumer maintenance needs, driving potential profitability and increasing product visibility in the market.

Market Segmentation

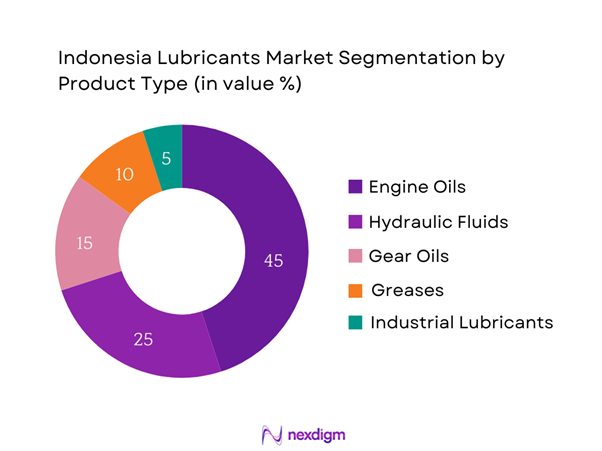

By Product Type

The Indonesia lubricants market is segmented by product type into engine oils, hydraulic fluids, gear oils, greases, and industrial lubricants. Among these, engine oils hold a dominant market share driven by the increasing number of vehicles on the road and the continuous demand for high-performing automotive products. Engine oils have become essential for not just vehicle performance but also for enhancing engine life and efficiency. Renowned brands are continually innovating with synthetic options to cater to environmentally conscious consumers, further solidifying the position of engine oils in the market.

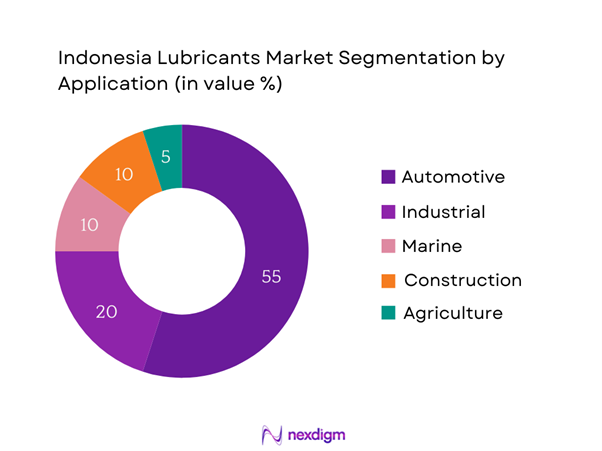

By Application

The Indonesia lubricants market is segmented by application into automotive, industrial, marine, construction, and agriculture. The automotive segment currently dominates the market, primarily due to the burgeoning vehicle population and a robust transportation infrastructure. The shift towards automated vehicles and enhanced mobility fuels demand for efficient lubricant products. Furthermore, rising awareness regarding regular vehicle maintenance has heightened the dependence on quality lubricants, cementing the automotive segment’s noteworthy contribution to the overall market.

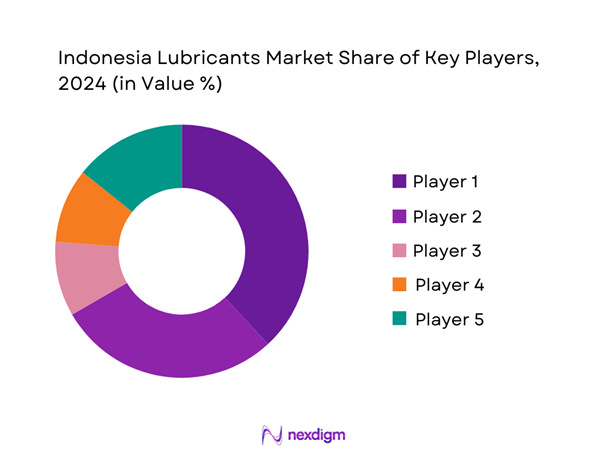

Competitive Landscape

The Indonesia lubricants market is dominated by several key players, including both local and global brands. These companies leverage their extensive distribution networks, strong brand equity, and innovative product offerings to maintain competitive advantage. Major players include PT Pertamina Lubricants, PT Shell Indonesia, TotalEnergies, and ExxonMobil, who are known for their substantial market influence and investment in research and development to meet evolving consumer needs.

| Company Name | Establishment Year | Headquarters | Market Product Types | Distribution Channels | Revenue |

| PT Pertamina Lubricants | 1957 | Jakarta, Indonesia | – | – | – |

| PT Shell Indonesia | 1891 | Jakarta, Indonesia | – | – | – |

| TotalEnergies | 1924 | Paris, France | – | – | – |

| ExxonMobil | 1870 | Irving, Texas, USA | – | – | – |

| BP Castrol | 1899 | London, UK | – | – | – |

Indonesia Lubricants Market Analysis

Growth Drivers

Increasing automotive production and sales

Increasing automotive production and sales in Indonesia have a substantial influence on the lubricants market. In 2022, vehicle sales reached approximately 1.05 million units, with a projection of 1.1 million units in 2023, according to the Association of Indonesia Automotive Industries (GAIKINDO). This trend signifies a strong recovery in the automotive sector post-pandemic, driven by rising urbanization and increasing disposable income. Furthermore, the government aims to expand infrastructure, supporting the automotive supply chain and stimulating further growth in the lubricants segment as higher vehicle counts translate into increased lubricant demand.

Rise in industrial activities

The rise in industrial activities in Indonesia is another pivotal growth driver for the lubricants market. The manufacturing sector, which contributes around 20% to the country’s GDP, has been on an upward trajectory. In 2022, the manufacturing output rose by 4.5%, as reported by the Indonesia Central Bureau of Statistics (BPS). As industries ramp up production, the demand for various lubricants increases, especially in sectors such as textiles, food and beverages, and chemicals. This industrial growth is supported by government initiatives aiming to bolster infrastructure and manufacturing capabilities.

Market Challenges

Fluctuations in crude oil prices impacting raw materials

Fluctuations in crude oil prices pose a significant challenge to the Indonesia lubricants market as they directly affect the cost of raw materials used in lubricant production. In 2022, the price of crude oil varied between USD 80 and USD 120 per barrel, creating instability and unpredictability for manufacturers. The Asian Development Bank (ADB) reported that rising global demand for oil has led to price volatility, which inhibits the ability of lubricants manufacturers to maintain consistent pricing. Manufacturers often face difficulties in passing on these costs to consumers, impacting profitability margins and overall market stability.

Stringent environmental regulations and compliance issues

Stringent environmental regulations represent another challenge for the lubricants sector in Indonesia. The government has implemented various regulations aimed at reducing environmental impacts, such as restricting the use of certain additives in lubricants, in line with international standards. The Ministry of Environment and Forestry has mandated compliance with specific environmental protection policies that require significant investment in product reformulation. This trend not only impacts production costs but also necessitates a shift in manufacturing processes, which can create additional burdens for lubricants producers and could deter new entrants in the market.

Opportunities

Growing demand for bio-based and eco-friendly lubricants

The growing demand for bio-based and eco-friendly lubricants presents a significant opportunity for the Indonesia lubricants market. As awareness regarding environmental conservation increases, consumers and industries are progressively seeking alternatives that minimize ecological footprints. In 2022, the demand for bio-lubricants surged, with some estimates indicating a rise of up to 30% in consumption rates. Companies producing bio-lubricants can leverage this trend, tapping into several lucrative customer segments eager for sustainable products. This shift not only reflects a market opportunity but also resonates with the Indonesian government’s push for greener product regulations, paving the way for sustainable practices within the lubricants sector.

Technological innovations in lubricant formulation

Technological innovations in lubricant formulation are another avenue of growth, enhancing performance qualities and enabling manufacturers to differentiate their products. Investments in research and development within major lubricant companies have increased, with expenditures exceeding USD 50 million in 2022 for developing next-gen products. Adoption of advanced technologies, such as nanotechnology and improved additive formulations, enables better performance at lower volumes, subsequently attracting consumers and industries looking for cost-effective lubrication solutions that also enhance equipment efficiency.

Future Outlook

Over the next five years, the Indonesia lubricants market is anticipated to witness significant growth owing to rising industrial activities, government support for the automotive sector, and advancements in lubricant technology. The market will likely experience a compound annual growth rate (CAGR) of 3.85%, spurred by the increasing adoption of eco-friendly products and enhancements in engine technology that require advanced lubrication solutions. The push for sustainability is expected to open new avenues for product development and market penetration.

Major Players

- PT Pertamina Lubricants

- PT Shell Indonesia

- TotalEnergies

- ExxonMobil

- BP Castrol

- FUCHS Lubricants

- PT Idemitsu Lube Techno Indonesia

- PT Astra International

- Valvoline

- Repsol

- PT Medco Energi Internasional

- Phillips 66

- SK Lubricants

- Sinopec

- Chevron Corporation

Key Target Audience

- Automotive Manufacturers

- Industrial Manufacturers

- Fleet Management Companies

- Oil Refineries

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Energy and Mineral Resources, Ministry of Industry)

- Logistics and Transportation Companies

- Maintenance and Repair Shops

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia lubricants market. This step relies on extensive desk research, utilizing a combination of secondary data sources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including product types, applications, and regional demand.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Indonesia lubricants market will be compiled and analysed. This includes assessing market penetration, evaluating the ratio of various segments, and analysed revenue generation across the product categories. Furthermore, an evaluation of service quality metrics will be conducted to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts representing a variety of companies in the lubricants sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will aid in refining and corroborating the market data, ensuring accuracy and completeness.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple lubricants manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, aiming for a comprehensive, accurate, and validated analysis of the Indonesia lubricants market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Industry Interviews for Market Potential, Primary Research Approach)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Supply and Value Chain Analysis

- Growth Drivers

Increasing automotive production and sales

Rise in industrial activities

Growing demand for energy-efficient products

Expanding construction sector

Increase in exports and imports of lubricants - Market Challenges

Fluctuations in crude oil prices impacting raw materials

Stringent environmental regulations and compliance issues

Intense competition leading to pricing wars

High costs of synthetic lubricants compared to conventional oils - Opportunities

Growing demand for bio-based and eco-friendly lubricants

Technological innovations in lubricant formulation

Expansion of the automotive aftermarket sector

Increasing investments in renewable energy sectors - Trends

Shift towards synthetic and high-performance lubricants

Implementation of Industry 4.0 in lubricant manufacturing

Eco-friendly packaging solutions gaining traction

Digitalization in supply chain and distribution channels - Government Regulation

Overview of quality assurance standards

Import tariffs and duty regulations impacting pricing

Environmental regulations affecting production practices - SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Engine Oils

Hydraulic Fluids

Gear Oils

Greases

Industrial Lubricants - By Application (In Value %)

Automotive

Industrial

Marine

Construction

Agriculture - By Distribution Channel (In Value %)

Retail

Direct Sales

Online Sales - By End-user Industry (In Value %)

Manufacturing

Automotive

Energy

Transport

Agriculture - By Region (In Value %)

Java

Sumatra

Sulawesi

Bali

Nusa Tenggara

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Lubricants Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

PT Pertamina Lubricants

PT Shell Indonesia

TotalEnergies

ExxonMobil

BP Castrol

Chevron Corporation

FUCHS Lubricants

PT Idemitsu Lube Techno Indonesia

PT Astra International

Valvoline

Repsol

PT Medco Energi Internasional

Phillips 66

SK Lubricants

Sinopec

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030