Market Overview

The Indonesia Diabetes Care Device Market is valued at USD 148.06 Million in 2025 with an approximated compound annual growth rate (CAGR) of 5.73 % from 2025-2030, reflecting a growing awareness and increasing prevalence of diabetes among the population. Factors driving this market include advancements in technology for diabetes management, coupled with rising healthcare expenditure and government initiatives aimed at improving health outcomes. The market is further supported by a growing middle class increasingly adopting modern healthcare practices.

Key cities driving the market include Jakarta, Surabaya, and Bandung. Jakarta, being the capital, has a higher concentration of healthcare facilities and awareness programs for diabetes care, while Surabaya and Bandung contribute significantly due to their large urban populations and rising disposable incomes. This urbanization trend fosters demand for advanced diabetes care devices ensuring better management of diabetes in urban settings.

Certification standards set by the Indonesian government play a critical role in regulating the diabetes care device market. Manufacturers must comply with the local standards under the Medical Device Regulation enacted by the National Agency of Drug and Food Control (BPOM). Device classification, compliance procedures, and efficacy testing requirements can take considerable time and resources. In 2023, only 30% of new medical devices submitted for approval received timely certifications, causing delays in market access for innovative products that could benefit diabetic patients.

Market Segmentation

By Device Type

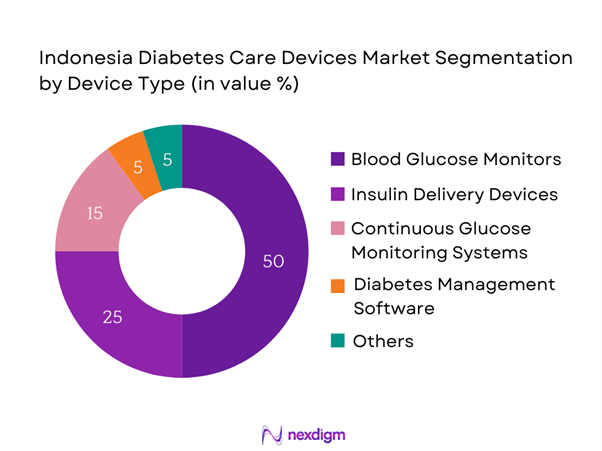

The Indonesia Diabetes Care Device Market is segmented by device type into Blood Glucose Monitors, Insulin Delivery Devices, Continuous Glucose Monitoring Systems, Diabetes Management Software, and Other Related Devices. Blood Glucose Monitors dominate the market share due to their widespread acceptance among consumers and healthcare providers. This segment is popular because they offer ease of use and affordability, making them a preferred choice among both patients and healthcare practitioners for regular monitoring of blood glucose levels. Brands such as Accu-Chek and OneTouch have established significant brand loyalty, further solidifying their market position.

By Application

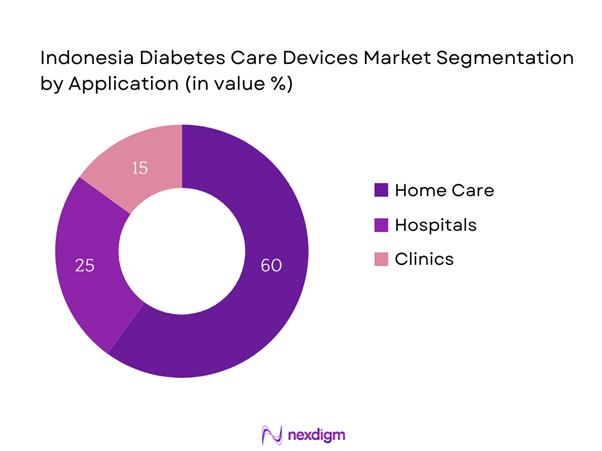

The market is also segmented by application into Home Care, Hospitals, and Clinics. The Home Care segment leads the market as patients increasingly prefer managing their diabetes in the comfort of their homes, which promotes adoption of various diabetes management devices. With the pandemic accelerating the trend toward home health solutions, this segment has seen strong growth as patients seek convenience and ease of use. The rising focus on self-care and the development of user-friendly devices facilitate the dominance of home care in this market.

Competitive Landscape

The competitive landscape of the Indonesia Diabetes Care Device Market is concentrated with several major players capturing significant market share. Key companies include established global brands and local manufacturers. These players compete through technological advancements, pricing strategies, and customer service enhancements to capture consumer interest.

| Company Name | Establishment Year | Headquarters | Market Reach | Product Offerings | R&D Investments | Partnerships |

| Roche Diagnostics | 1896 | Basel, Switzerland | – | – | – | – |

| Abbott Laboratories | 1888 | Abbott Park, Illinois | – | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – |

| B Braun Melsungen AG | 1839 | Melsungen, Germany | – | – | – | – |

| Novo Nordisk | 1923 | Bagsværd, Denmark | – | – | – | – |

Indonesia Diabetes Care Device Market Analysis

Growth Drivers

Rising Incidence of Diabetes

The rising incidence of diabetes in Indonesia significantly drives the demand for diabetes care devices. As per the International Diabetes Federation, the number of adults with diabetes in Indonesia is expected to reach approximately 16.2 million by end of 2025. This alarming rise emphasizes the urgent need for effective diabetes management solutions, thereby boosting market potential for glucose monitors and insulin delivery devices. The Indonesian Ministry of Health recognizes diabetes as one of the critical health issues, prompting the government to prioritize diabetes management programs and empower patients through regular monitoring and better access to medical devices.

Increasing Awareness and Education

Increasing awareness and education regarding diabetes management are pivotal growth drivers for the market. Efforts from the Indonesian government, NGOs, and health organizations have led to enhanced awareness campaigns focusing on diabetes prevention and management. For instance, the Ministry of Health initiated a national diabetes awareness campaign, reaching millions of citizens by providing information on risk factors and the importance of regular monitoring. In 2022, 63% of adults reported being aware of diabetes, marking a notable increase from previous years, thus propelling the market demand for diabetes care devices among informed consumers.

Market Challenges

High Cost of Devices

High costs associated with advanced diabetes care devices present significant challenges in Indonesia’s market. Reports indicate that many diabetes devices, especially continuous glucose monitors and insulin pumps, are relatively expensive, with prices ranging from IDR 2 million to IDR 30 million (USD 140 to USD 2,100), which many consumers find prohibitive. As a result, only a fraction of the diabetes patient population can access these essential devices. The disparity in income—where approximately 25% of the population lives below the national poverty line—further exacerbates the challenge, limiting device affordability and accessibility for low-income households.

Regulatory Constraints

Regulatory constraints hinder the growth of the diabetes care device market in Indonesia. Manufacturers face significant bureaucratic hurdles when it comes to obtaining licenses for product distribution. The Indonesian FDA mandates extensive testing and certifications before devices can be marketed, prolonging approval times. In recent reports, it was highlighted that regulatory approval for new medical devices could take up to 18 months or more. These lengthy processes can delay market entry for innovative solutions that could benefit patients, constraining growth and limiting the availability of the latest technologies in the Indonesian diabetes care sector.

Opportunities

Growth of Telemedicine

The growth of telemedicine offers promising opportunities for the diabetes care device market. The COVID-19 pandemic has accelerated the adoption of telehealth services, with a reported increase of over 650% in telehealth appointments in 2020 alone. In 2023, approximately 75% of specialists reported integrating telemedicine into their practice, providing patients with easier access to diabetes management consultations. This trend encourages the utilization of digital devices and remote monitoring solutions, paving the way for enhanced engagement in diabetes management and ultimately driving rise in demand for related devices within the market.

Expansion of Health Insurance Programs

The expansion of health insurance programs in Indonesia presents a significant growth opportunity for diabetes care device manufacturers. With the Indonesian government working towards universal health coverage, the number of insured citizens is expected to increase dramatically, providing a larger population access to health services, including diabetes management. Reports state that approximately 80% of Indonesians could be covered by the national health insurance program by 2024. This coverage would lower the financial burden of acquiring diabetes care devices, ultimately encouraging more patients to invest in their health management through advanced products and solutions.

Future Outlook

Over the next five years, the Indonesia Diabetes Care Device Market is expected to show robust growth driven by an increasing prevalence of diabetes, advancements in medical technology, heightened awareness of self-management, and governmental health policies aiming to improve overall healthcare quality. The expansion of telehealth services and continuous glucose monitoring technology will further augment market potential, supported by a shift towards personalized healthcare solutions.

Key Players in the Market

- Roche Diagnostics

- Abbott Laboratories

- Medtronic

- B Braun Melsungen AG

- Novo Nordisk

- Ascensia Diabetes Care

- Sanofi

- Johnson & Johnson

- Eli Lilly

- Terumo Corporation

- Ypsomed

- Dexcom

- Cardiomo

- Lifescan

- Omron Healthcare

Key Target Audience

- Healthcare Providers

- Pharmaceutical Companies

- Insurance Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, BPJS Kesehatan)

- Hospitals and Clinics

- Distributors and Retailers

- Consumer Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Diabetes Care Device Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as key devices, applications, and demographics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Diabetes Care Device Market. This includes assessing market penetration, the ratio of various healthcare providers to consumers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. This analysis allows for a deeper understanding of market trends and competitive positioning.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. This qualitative dimension enhances the quantitative analysis, leading to more reliable findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple diabetes care device manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Diabetes Care Device Market. The collated data will culminate in a focused report that meets the needs of stakeholders.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Landscape Analysis

- Historical Development and Key Milestones

- Business Cycle Assessment

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Incidence of Diabetes

Technological Advancements

Increasing Awareness and Education - Market Challenges

High Cost of Devices

Regulatory Constraints - Opportunities

Growth of Telemedicine

Expansion of Health Insurance Programs - Trends

Rise in Wearable Technology

Increasing Preference for Remote Monitoring - Government Regulation

Import Policies

Certification Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Device Type (In Value %)

Blood Glucose Monitors

Insulin Delivery Devices

Continuous Glucose Monitoring Systems

Diabetes Management Software

Other Related Devices - By Application (In Value %)

Home Care

Hospitals

Clinics - By Distribution Channel (In Value %)

Retail Pharmacies

Online Retail

Hospitals and Health Care Providers - By Region (In Value %)

Java

Sumatra

Bali and Nusa Tenggara

Sulawesi

Kalimantan - By Income Group (In Value %)

Low-Income Group

Middle-Income Group

High-Income Group

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Diabetes Care Devices Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Market Penetration Strategies, Strengths, Weaknesses, Product Offerings, Distribution Reach, Customer Satisfaction Metrics, Market Positioning, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis of Major Players

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott Laboratories

Medtronic

B Braun Melsungen AG

Novo Nordisk

Sanofi

Ascensia Diabetes Care

Eli Lilly

Johnson & Johnson

Dexcom

Terumo Corporation

Ypsomed

Omron Healthcare

Cardiomo

Lifescan

- Market Demand Dynamics

- User Preferences and Behavior

- Regulatory Compliance and Quality Assurance

- Pain Points and Needs Analysis

- Decision-Making Influencers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030