Market Overview

The India Perimeter Security Market for 2024 is projected to reach a valuation of USD 4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 14% from 2024-2030, showcasing significant growth driven by increasing security concerns and rapid urbanization across the country. As crime rates rise and the need for enhanced safety measures becomes paramount, both private and governmental sectors are investing heavily in perimeter security solutions, which encompass physical barriers, electronic surveillance, and intrusion detection systems.

The market is dominated by major urban centers such as Delhi, Mumbai, and Bengaluru, which are pivotal due to their high population density, booming businesses, and significant foreign investment. These cities are also home to various essential infrastructures, including corporate offices, industrial hubs, and residential complexes that require robust perimeter security solutions. Furthermore, the presence of leading security technology firms and access to advanced manufacturing facilities in these regions contribute to their dominance in the perimeter security market.

There is an increasing awareness of security solutions among Indian businesses and households, primarily driven by rising crime rates and terrorist activities. The government has recognized this growing concern and has initiated various campaigns to promote security awareness and the adoption of advanced technologies. The Bureau of Police Research and Development reported that more than 70% of urban citizens now prioritize safety.

Market Segmentation

By Technology Type

The India Perimeter Security market is segmented by technology type into physical barriers, electronic surveillance, access control systems, and intrusion detection systems. Among these segments, electronic surveillance has emerged as the dominant market share holder. This prominence is attributed to the increasing deployment of CCTV cameras, advanced monitoring systems, and integrated security solutions that provide real-time alerts and remote monitoring capabilities. The surge in security requirements from both private and public sectors has propelled electronic surveillance technology forward, as organizations seek to enhance their security while benefiting from modern technological advancements such as AI and machine learning.

By Application Sector

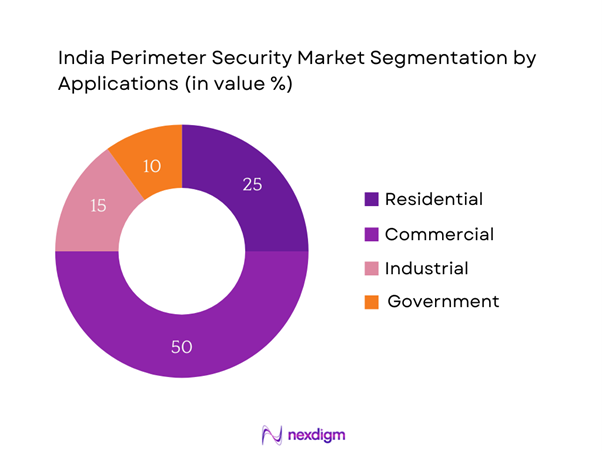

The India Perimeter Security market is also segmented by application sector, including residential, commercial, industrial, and government. The commercial sector is currently dominating the market share, primarily due to increasing investments in office buildings, retail spaces, and commercial establishments. Security concerns arising from vandalism, theft, and workplace violence have compelled businesses to invest in comprehensive perimeter security solutions. Furthermore, corporate responsibility towards employee safety alongside legal obligations to comply with security regulations has catalyzed growth in this segment. As urbanization continues, the need for secure commercial spaces is foreseen to rise, indicating a sustained dominance of this segment.

Competitive Landscape

The India Perimeter Security market is dominated by several key players, highlighting a mix of global and domestic companies that contribute significantly to the industry’s growth. Key players include ADT Security, Honeywell, Axis Communications, Bosch Security Systems, and Zicom, showcasing a competitive environment where companies continuously innovate and strive to meet the changing demands of security solutions.

| Company | Establishment Year | Headquarters | Market Share (%) | Key Technology Focus | Recent Innovations |

| ADT Security | 1874 | Boca Raton, USA | – | – | – |

| Honeywell | 1906 | Charlotte, USA | – | – | – |

| Axis Communications | 1984 | Lund, Sweden | – | – | – |

| Bosch Security Systems | 1886 | Stuttgart, Germany | – | – | – |

| Zicom | 1994 | Mumbai, India | – | – | – |

India Perimeter Security Market Analysis

Growth Drivers

Increasing Crime Rates

Increasing crime rates significantly amplify the demand for perimeter security solutions across India. In 2022, reported incidents of crime rose to approximately 6.5 million, a stark reminder of the need for enhanced protective measures. Moreover, the National Crime Records Bureau (NCRB) reported that property-related crimes accounted for nearly 38% of the total crime incidents. The urgent need to address these safety concerns drives investments in security technologies, highlighting the importance of perimeter security systems in protecting properties and lives. As crime rates continue to trend upward, the demand for these solutions is expected to remain high.

Rising Infrastructure Development

India’s ambitious infrastructure development projects are highly influential in driving the market for perimeter security systems. The Indian government launched the National Infrastructure Pipeline (NIP) initiative, planning to invest USD 1.4 trillion over five years to modernize and expand infrastructure. Major urban centers are undergoing significant development, with cities like Delhi and Mumbai projected to grow substantially. This infrastructural boom inherently necessitates enhanced security measures as construction sites, transportation hubs, and new residential and commercial properties require reliable perimeter security solutions to safeguard assets and personnel during these expansive developments.

Market Challenges

High Initial Investment Costs

Despite the increasing demand for perimeter security solutions, high initial investment costs pose a significant barrier to market growth. Advanced security systems can require substantial upfront costs which range from USD 5,000 to USD 150,000 depending on the technology and size of the installation. This financial burden can deter small and medium-sized enterprises (SMEs) and individual consumers from implementing advanced security solutions. Moreover, ongoing maintenance and operational costs further exacerbate these challenges, limiting the adoption of critical security measures in economically constrained environments. This situation necessitates government incentives to support smaller entities in acquiring robust perimeter security systems.

Regulatory Compliance Issues

The perimeter security market faces significant challenges due to regulatory compliance issues across India. Numerous regulations govern surveillance, data privacy, and safety standards, which must be adhered to by organizations deploying security systems. For instance, the Information Technology Act stipulates strict guidelines on capturing and storing surveillance data. Failure to comply can result in hefty fines and legal consequences, deterring some companies from investing in new security technologies. In recent years, compliance-related penalties have increased significantly, with reported fines reaching over USD 1.5 million in 2023, further highlighting the landscape’s challenges.

Opportunities

Technological Innovation

Current advancements in technology present an unparalleled opportunity within the India Perimeter Security Market. Innovations such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) have begun to revolutionize perimeter security systems. Smart security cameras equipped with AI have seen significant adoption, with a current market penetration of about 10%, allowing for sophisticated threat detection and response capabilities. The introduction of cloud-based solutions is also enhancing operational efficiency and ease of access to real-time surveillance footage, prompting businesses to transition toward these innovative technologies, thus spurring future market growth.

Increased Government Initiatives

The Indian government has been proactive in increasing its support for security measures, providing substantial opportunities for growth within the market. Initiatives supporting smart city projects are a prime illustration; the government has allocated approximately USD 1.2 billion to enhance urban safety and security integration into urban planning. Such initiatives are enlisting advanced perimeter security technologies, creating a conducive environment for market players to capitalize on these governmental projects while aligning with the national agenda on improving public safety and urban resilience.

Future Outlook

Looking ahead, the India Perimeter Security market is anticipated to exhibit substantial growth driven by a mixture of technological advancements, evolving consumer demands, and increasing government initiatives aimed at promoting safety and security measures. As urban infrastructure expands, the necessity for sophisticated perimeter security systems will grow accordingly. Increased awareness regarding the importance of security solutions across both residential and commercial sectors will also contribute to market expansion, shaping a robust future landscape for this industry.

Major Players

- ADT Security

- Honeywell

- Axis Communications

- Bosch Security Systems

- Zicom Electronic Security Systems

- Hikvision

- Dahua Technology

- Johnson Controls

- FLIR Systems

- SecureTech

- Tyco Security Products

- Siemens Building Technologies

- Genetec

- D-Link Corporation

- Matrix Comsec

Key Target Audience

- Corporate Security Managers

- Facility Management Companies

- Real Estate Developers

- Investments and Venture Capitalist Firms

- Government Agencies (Ministry of Home Affairs, Ministry of Urban Development)

- Law Enforcement Agencies

- Insurance Companies

- Private Security Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of key stakeholders within the India Perimeter Security Market. This step is supported by comprehensive desk research that utilizes a mix of secondary and proprietary databases to collate extensive industry-level data. The primary objective is to pinpoint and define critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data on the India Perimeter Security Market is compiled and analyzed. This includes examining market trends, the ratio of security providers to consumers, and revenue generated within various application segments. An evaluation of service quality metrics will also be performed to confirm the validity and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through Computer-Assisted Telephone Interviews (CATI) with industry experts from an array of companies involved in perimeter security systems. These consultations will yield valuable insights directly from practitioners, which will be crucial for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase consists of direct engagement with multiple perimeter security solution providers to gain in-depth insights into product specifications, market performance, user preferences, and other relevant factors. This interaction is meant to affirm and enrich the statistics derived from previous research stages, ensuring a comprehensive and validated analysis of the India Perimeter Security Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Crime Rates

Rising Infrastructure Development

Growing Awareness of Security Solutions - Market Challenges

High Initial Investment Costs

Regulatory Compliance Issues - Opportunities

Technological Innovation

Increased Government Initiatives - Trends

Adoption of Smart Security Solutions

Utilization of IoT in Security Systems - Government Regulations

Security Standards and Compliance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Physical Barriers

Electronic Surveillance

Access Control Systems

Intrusion Detection Systems - By Application Sector (In Value %)

Residential

Commercial

Industrial

Government - By Region (In Value %)

North India

West India

South India

East India - By End User Type (In Value %)

Corporate Sector

Educational Institutions

Healthcare Institutions - By Distribution Channel (In Value %)

Direct Sales

Online Retail

Distributors

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Perimeter Security Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenue Streams, Key Partnerships, Customer Engagement Strategies, Distribution Channels, Number of Dealers and Distributors, Margins, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

ADT Security

Honeywell International Inc.

Bosch Security Systems

Tyco Security Products

Siemens Building Technologies

Axis Communications

D-Link Corporation

Hikvision Digital Technology

Dahua Technology

Johnson Controls

FLIR Systems

Genetec

SecureTech

Zicom Electronic Security Systems

Matrix Comsec

- Market Demand and Utilization

- Budget Allocations

- Regulatory Compliance Requirements

- Needs and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Average Price, 2025-2030