Market Overview

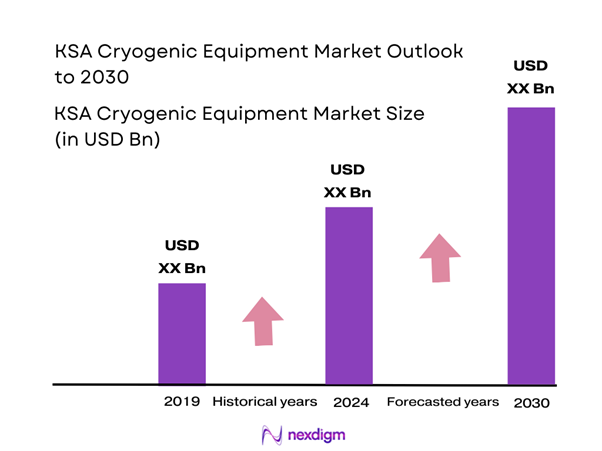

The KSA cryogenic equipment market is valued at approximately USD 330 million in 2024 with an approximated compound annual growth rate (CAGR) of 7% from 2024-2030, based on rigorous analysis of historical data and current market trends. This market is primarily driven by the growing demand for liquefied natural gas (LNG) and industrial gases, bolstered by the Kingdom’s push toward economic diversification and development of its energy sector.

Dominant cities and regions in the KSA cryogenic equipment market include Riyadh, Dammam, and Jeddah. Riyadh’s strategic location as the capital city facilitates major government and corporate investments in infrastructure projects. Dammam plays a vital role due to its proximity to the Eastern Province’s oil and gas facilities, while Jeddah serves as a key trade hub, enhancing logistical capabilities for cryogenic equipment in the region. The concentration of industries and investments in these urban areas has invigorated local demand for advanced cryogenic technologies.

Government regulations in Saudi Arabia are increasingly focused on ensuring safety and efficiency in cryogenic operations. The Saudi Standards, Metrology and Quality Organization (SASO) has issued standards aimed at regulating operations within the cryogenic sector. Compliance with these regulations often requires investments in safety measures and operational upgrades by companies engaged in the cryogenic market. With increasing pressure on industries to meet these standards, the associated costs and adaptations can impact operational timelines.

Market Segmentation

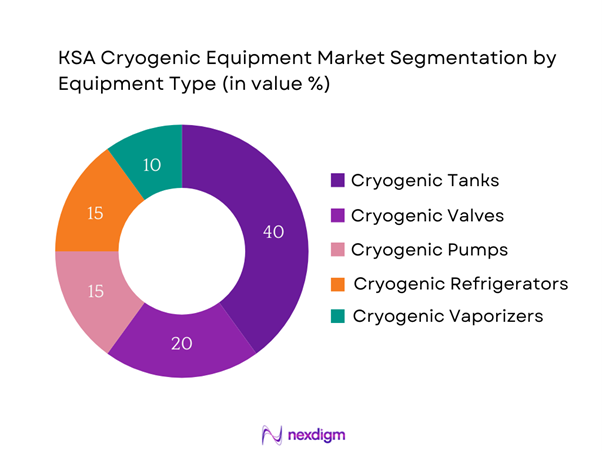

By Equipment Type

The KSA cryogenic equipment market is segmented by equipment type into cryogenic tanks, cryogenic valves, cryogenic pumps, cryogenic refrigerators, and cryogenic vaporizers. Among these, cryogenic tanks dominate the market share due to their essential role in storage solutions for various gases at ultra-low temperatures. The increasing application of LNG in both industrial and residential sectors is contributing to the expansion of cryogenic tank installations, driven by a surge in energy demand and the necessity for efficient storage technologies. As major oil and gas firms and energy companies seek to enhance their operational efficiency, cryogenic tanks have emerged as pivotal components in the supply chain, epitomizing safety and reliability.

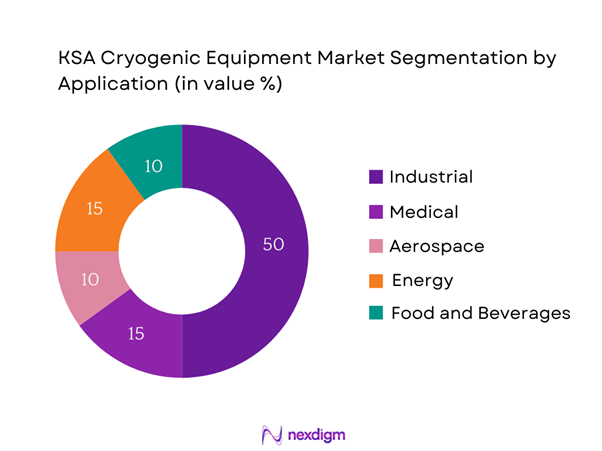

By Application

The market is segmented by application into industrial, medical, aerospace, energy, and food and beverages. The industrial application segment holds the largest market share, as various manufacturing sectors and chemical industries require reliable cryogenic equipment for efficient gas handling and processing. The continuous industrial growth and increasing usage of cryogenic applications in sectors like petrochemicals and pharmaceuticals drive this segment’s dominance. Furthermore, innovations in cryogenic technologies and the rising emphasis on operational efficiency and safety across industries further propel the demand for cryogenic solutions within industrial applications.

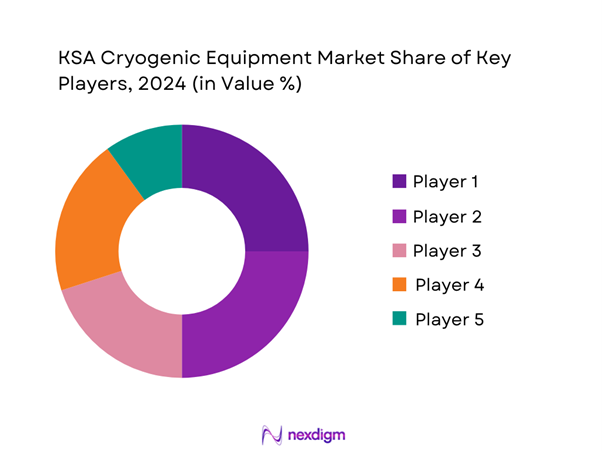

Competitive Landscape

The KSA cryogenic equipment market is characterized by the presence of several major players, creating a dynamic competitive landscape. Leading companies include Air Products and Chemicals, Linde plc, Cryogenic Industries, Chart Industries, and Messer Group. These companies dominate the market through strategic investments in technology, research and development, and their extensive distribution networks. This competitive consolidation not only ensures high quality and efficient supply mechanisms but also intensifies the focus on innovation and customer-centric solutions.

| Company | Establishment Year | Headquarters | Number of Employees | Revenue (USD Million) | Product Diversification | Market Focus |

| Air Products and Chemicals | 1940 | Allentown, PA, USA | – | – | – | – |

| Linde plc | 1879 | London, UK | – | – | – | – |

| Cryogenic Industries | 1968 | Santa Ana, CA, USA | – | – | – | – |

| Chart Industries | 1992 | Ball Ground, GA, USA | – | – | – | – |

| Messer Group | 1898 | Bad Soden, Germany | – | – | – | – |

KSA Cryogenic Equipment Market Analysis

Growth Drivers

Increasing Demand for LNG and Industrial Gases

The demand for liquefied natural gas (LNG) in the Kingdom of Saudi Arabia is projected to escalate, as the country aims to enhance its energy security and reduce dependence on oil. In 2022, Saudi Arabia’s total natural gas consumption reached approximately 127 billion cubic meters, with LNG imports anticipated to rise as the government expands its LNG infrastructure. The Ministry of Energy in Saudi Arabia has outlined initiatives to increase LNG production to meet both domestic and international demands, which directly propels the growth of the cryogenic equipment sector essential for LNG handling and transportation.

Rising Investments in Cryogenic Applications

Significant investments have been made into cryogenic applications across various sectors, particularly in energy and healthcare. For instance, the Saudi government allocated SAR 500 billion (around USD 133 billion) in its Vision 2030 framework to enhance infrastructure, including the development of gas processing plants, which utilize cryogenic technologies. This investment trend underpins the escalation in demand for cryogenic equipment, crucial for handling high-pressure gas and liquefied gases efficiently. The rising focus on industrial gas applications highlights the importance of cryogenic technologies in facilitating these processes.

Market Challenges

High Infrastructure Costs

The establishment of cryogenic facilities involves considerable capital investment, with estimated setup costs ranging from USD 1 billion to USD 3 billion per facility depending on capacity and technology. Navigating these high initial costs poses a challenge to market entry for new players and expansions for established firms. Additionally, the economic conditions in Saudi Arabia, including the slight contraction in GDP growth due to oil price fluctuations, further complicate the financing of new infrastructure projects while emphasizing the risks tied to high capital requirements.

Competition from Alternative Technologies

The introduction of alternative technologies such as hydrogen production and various renewable energy sources has increased competition for cryogenic equipment. These alternatives are gaining traction due to their promise of lower long-term costs and environmental benefits. For example, Saudi Arabia’s National Renewable Energy Program plans to invest SAR 50 billion (USD 13.3 billion) to incorporate renewable energy sources, which could potentially divert investment from traditional cryogenic technologies to greener solutions. This shifting focus represents a challenge for the established cryogenic market as it confronts investment reallocations.

Opportunities

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in Saudi Arabia represents a burgeoning opportunity for cryogenic applications, especially in medical sectors requiring cryogenic storage solutions. The Saudi government has earmarked around SAR 40 billion (USD 10.7 billion) for new healthcare facilities and enhancements by end of 2025, generating substantial demand for cryogenic technologies used in the preservation of biological samples and pharmaceuticals. Enhanced healthcare services positioned within the Vision 2030 initiative promote the integration of advanced technologies, offering a prime opportunity for the cryogenic sector to interlink with the medical industry.

Development of Sustainable Energy Solutions

The Saudi Arabia government’s commitment to diversifying its energy sources into sustainable alternatives fosters opportunities for innovation and investment in cryogenic technology. Current advancements in carbon capture and storage technologies, which incorporate cryogenic processes, are a compelling area of focus. Additionally, the country’s aim to achieve net-zero emissions by 2060 creates a robust policy framework that supports the development of sustainable energy solutions, including cryogenic applications in LNG and hydrogen production. This development signifies forward-looking investment opportunities for companies specializing in cryogenic technologies.

Future Outlook

Over the next five years, the KSA cryogenic equipment market is expected to experience significant growth fueled by increasing investments in the oil and gas sector, advancements in cryogenic technologies, and rising demand in industrial applications. The ongoing efforts of the Saudi government to diversify the economy and capitalize on natural resources are likely to translate into enhanced infrastructure for energy and industrial projects. This growth is further supported by the global shift towards cleaner energy solutions, leading to a higher requirement for efficient cryogenic systems in gas processing and liquefaction. Additionally, the expansion of healthcare-related applications of cryogenics will broaden the scope for innovation and development within this sector.

Major Players

- Air Products and Chemicals

- Linde plc

- Cryogenic Industries

- Chart Industries

- Messer Group

- ACD Cryo

- Taylor-Wharton International

- PDC Machines, Inc.

- Emerson Electric Co.

- FIBA Technologies, Inc.

- HOHENSTEIN AG

- Cryoquip

- Airgas

- GEA Group

- ITM Power

Key Target Audience

- Government and Regulatory Bodies (e.g., Saudi Arabian Ministry of Energy, Saudi Geological Survey)

- Energy Firms

- Industrial Manufacturers

- Healthcare Providers

- Aerospace and Defense Contractors

- Food Processing Companies

- Investments and Venture Capitalist Firms

- Logistics and Supply Chain Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA cryogenic equipment market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technological advancements, regulatory frameworks, and investment trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA cryogenic equipment market. This includes assessing market penetration rates and the ratio of equipment types to service providers, as well as resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies involved in cryogenic solutions. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data obtained through secondary research.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cryogenic equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. These interactions will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA cryogenic equipment market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Major Players Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for LNG and Industrial Gases

Rising Investments in Cryogenic Applications

Innovations in Cryogenic Technologies - Market Challenges

High Infrastructure Costs

Competition from Alternative Technologies - Opportunities

Expansion of Healthcare Infrastructure

Development of Sustainable Energy Solutions - Trends

Advances in Cryogenic Storage Technologies

Shift Towards Modular and Portable Solutions - Government Regulation

Industry Standards and Compliance Requirements

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Equipment Type (In Value %)

Cryogenic Tanks

Cryogenic Valves

Cryogenic Pumps

Cryogenic Refrigerators

Cryogenic Vaporizers - By Application (In Value %)

Industrial

Medical

Aerospace

Energy

Food and Beverages - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Sales - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Material Type (In Value %)

Stainless Steel

Aluminum

Composites

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Cryogenic Equipment Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Equipment Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Major Product SKUs

- Detailed Profiles of Major Companies

Air Products and Chemicals, Inc.

Linde plc

Cryogenic Industries

Chart Industries, Inc.

Messer Group

ITM Power

GEA Group

ACD Cryo

Taylor-Wharton International

PDC Machines, Inc.

Cryoquip

Airgas

HOHENSTEIN AG

FIBA Technologies, Inc.

Emerson Electric Co.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030