Market Overview

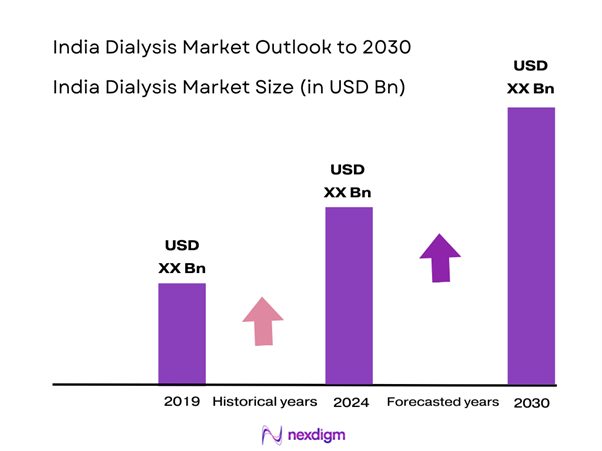

The India Dialysis Market is valued at USD 5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8.83% from 2024-2030, based on historical data analysis and current assessments. The market is primarily driven by the increasing prevalence of kidney diseases primarily due to diabetes and hypertension, which has resulted in a growing need for dialysis treatments. Additionally, advancements in dialysis technologies and increasing awareness about renal healthcare are further enhancing market growth.

Several cities are dominant in the India Dialysis Market due to a combination of factors such as advanced healthcare infrastructure, a higher concentration of nephrologists and dialysis centers, and government initiatives to improve renal care. Major cities like Delhi, Mumbai, and Bengaluru lead the market as they provide better access to healthcare facilities, innovative treatment options, and a well-developed network of healthcare professionals. Furthermore, these urban centers attract investments and foster collaborations between healthcare providers and private organizations.

Government regulation plays a crucial role in shaping the dialysis market through policies and reimbursement frameworks. Recent healthcare policies have started to favor the expansion of renal care services, with the National Health Mission adopting a more inclusive approach to dialysis service reimbursement. By end of 2025, it is expected that more than 70% of new healthcare insurance plans will provide comprehensive coverage for dialysis treatments, thus promoting increased access and utilization.

Market Segmentation

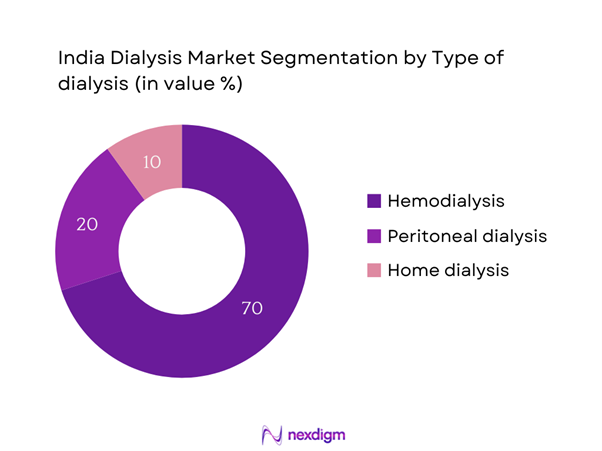

By Type of Dialysis

The India Dialysis Market is segmented by type of dialysis into hemodialysis, peritoneal dialysis, and home dialysis. Hemodialysis is currently the most dominant sub-segment, capturing a significant share of the market. This dominance can be attributed to the widespread availability of hemodialysis machines and the existence of numerous dialysis centers across urban areas. Additionally, the established medical protocols and better accessibility of professionals skilled in administering hemodialysis support its preference among patients. As a life-sustaining treatment, hemodialysis remains the first choice for many patients seeking immediate intervention for renal failure.

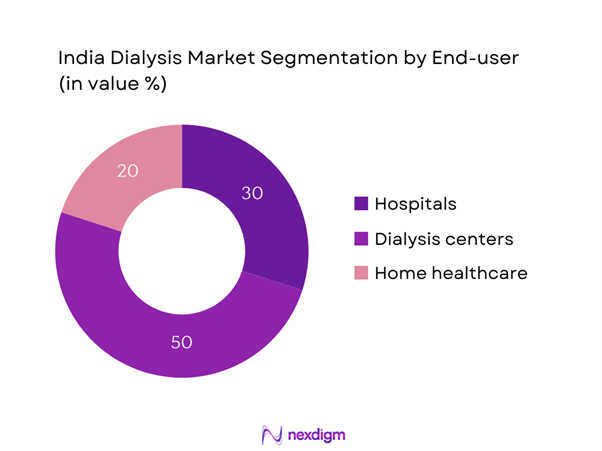

By End-user

The market is also segmented by end-user into hospitals, dialysis centers, and home healthcare. Dialysis centers are expected to hold a significant share of the market primarily due to their specialization in renal care and availability of dedicated resources for dialysis procedures. These centers not only provide higher volumes of dialysis treatments but also cater to a growing patient base seeking specialized and efficient treatment options. The establishment of more dialysis centers across key urban locations has made them a vital part of the healthcare infrastructure, leading to increased patient trust and preference.

Competitive Landscape

The India Dialysis Market is characterized by a few key players dominating the landscape. The market is led by major companies such as Fresenius Medical Care, DaVita, and Baxter International, which have established extensive networks and comprehensive treatment offerings. The competitive environment reflects significant influence from both local enterprises and international firms, highlighting the need for innovation and improvement in service delivery.

| Companies | Establishment Year | Headquarters | Market Specific Parameters | Key Products/Services | Market Strategies |

| Fresenius Medical Care | 1912 | Germany | – | – | – |

| DaVita | 1997 | USA | – | – | – |

| Baxter International | 1931 | USA | – | – | – |

| B. Braun Melsungen AG | 1839 | Germany | – | – | – |

| Nipro Corporation | 1954 | Japan | – | – | – |

India Dialysis Market Analysis

Growth Drivers

Rising Prevalence of Kidney Diseases

The rising prevalence of kidney diseases in India is alarming. Currently, approximately 200,000 people in India begin renal replacement therapy each year, with chronic kidney disease (CKD) affecting around 180 million individuals. The increase can be attributed to factors such as diabetes and hypertension, which affect over 80 million people and are responsible for about 40% of kidney disease cases in the country. This trend signifies a pressing need for dialysis treatments and will likely accelerate the demand for various renal care solutions. India’s healthcare system is now recognizing kidney disease as a public health concern that mandates urgent resources.

Increasing Aging Population

India has one of the fastest-aging populations in the world, with an estimated 140 million elderly persons projected by end of 2025. The proportion of the elderly population, defined as individuals aged 60 and above, is expected to soar to 10% from 8.1% currently. An aging demographic significantly contributes to the rising incidence of chronic diseases, including kidney disorders, making this a critical driver for renal healthcare services like dialysis. Given the correlation between age and health problems, an increase in the elderly population necessitates accessible and comprehensive dialysis solutions.

Market Challenges

High Treatment Costs

The cost of dialysis treatments poses a significant barrier to equitable access in India. The average cost for a single session of hemodialysis ranges from INR 1,000 to INR 3,500, depending on facility type and location, resulting in an annual cost burden of approximately INR 1-3 lakhs for patients requiring thrice-weekly treatment. This substantial financial strain hampers treatment accessibility for many individuals, particularly those from low-income backgrounds or without adequate health insurance coverage. Addressing these economic barriers remains vital for improving patient access to life-saving dialysis care.

Patient Compliance Issues

Patient compliance with prescribed dialysis treatments is another major challenge. Studies show that approximately 30% of patients do not adhere to their treatment plans due to various factors such as lack of awareness about the importance of regular treatment, financial constraints, and transportation challenges. Noncompliance can lead to severe health consequences, including increased mortality risk and hospital readmissions, compounding healthcare costs. Addressing these compliance barriers through education, patient engagement strategies, and community support initiatives is crucial for enhancing health outcomes among the dialysis population.

Opportunities

Government Initiatives and Support

The Indian government has initiated various schemes aimed at improving the landscape of kidney care, which presents an opportunity for market growth. Schemes like the Pradhan Mantri National Dialysis Programme aim to facilitate the establishment of dialysis units in public hospitals, thereby increasing access to essential renal healthcare. As of 2024, over 1,500 dialysis centers have been established under this initiative, providing thousands of patients with subsidized treatment. These governmental efforts will likely catalyze further investments in the dialysis sector and improve overall patient care accessibility in the coming years.

Growth in Home Healthcare Services

The rise in home healthcare services for dialysis patients signifies a pivotal opportunity for the market’s expansion. Currently, around 15% of dialysis patients are being managed through home-based services, reflecting a growing trend toward patient-centered care. In 2024, the number of patients opting for home dialysis is projected to increase, supported by advancements in portable dialysis technologies and investment in training for in-home care providers. This transition not only improves patient quality of life but also reduces the strain on healthcare facilities and enhances the market’s potential for growth and diversification.

Future Outlook

Over the next few years, the India Dialysis Market is expected to witness substantial growth fueled by increasing healthcare expenditure, a higher prevalence of lifestyle-related kidney diseases, and advancements in dialysis technologies. As government policies increasingly support better renal care access and enhance infrastructure, coupled with rising consumer awareness about kidney health, the market is set to expand significantly. Innovations in home dialysis and patient-centric care models will further dominate market dynamics.

Major Players

- Fresenius Medical Care

- DaVita

- Baxter International

- Braun Melsungen AG

- Nipro Corporation

- Medtronic

- Asahi Kasei Medical Co. Ltd.

- Terumo Corporation

- Siemens Healthineers

- Dialysis Clinic, Inc.

- Renal Ventures

- S. Renal Care

- NephroPlus

- Quanta Dialysis Technologies

- Jiangsu Kangjin Medical Instruments

Key Target Audience

- Hospitals and Healthcare Providers

- Dialysis Centers

- Home Healthcare Services

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare, National Health Mission)

- Medical Equipment Distributors

- Health Insurance Companies

- Patient Advocacy Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Dialysis Market. This step relies on extensive desk research, integrating secondary and proprietary databases to gather comprehensive information related to industry-level dynamics. The primary goal is to identify and define the critical variables that influence the dialysis treatment landscape.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data concerning the India Dialysis Market. Key metrics to be evaluated are market penetration, the ratio of dialysis centers to the population needing treatment, and revenue generation from the dialysis sector. Additionally, we assess service quality metrics to ensure reliability and accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed from earlier stages will be validated through consultations with industry experts across various companies in the dialysis field. Computer-assisted telephone interviews (CATIs) with these professionals will provide beneficial insights on operational, financial, and market dynamics, refining the analysis in line with actual market conditions.

Step 4: Research Synthesis and Final Output

The final stage engages with multiple dialysis manufacturers and service providers to acquire detailed insights into their product segments, performance metrics, consumer preferences, and overall market adaptability. This interaction serves to corroborate and enrich the statistics derived from the bottom-up approach, ensuring a thorough and validated examination of the India Dialysis Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Genesis

- Timeline of Major Developments

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Prevalence of Kidney Diseases

Increasing Aging Population

Technological Advancements - Market Challenges

High Treatment Costs

Patient Compliance Issues - Opportunities

Government Initiatives and Support

Growth in Home Healthcare Services - Trends

Shift Towards Automated Dialysis

Innovations in Dialysis Access Devices - Government Regulation

Healthcare Policies and Reimbursements

Quality Control Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Revenue, 2019-2024

- By Patient Volume, 2019-2024

- By Average Treatment Cost, 2019-2024

- By Type of Dialysis (In Value %)

Hemodialysis

Peritoneal Dialysis

Home Dialysis - By End-user (In Value %)

Hospitals

Dialysis Centers

Home Healthcare - By Region (In Value %)

Northern Region

Southern Region

Western Region

Eastern Region - By Product Type (In Value %)

Dialysis Machines

Dialyzers

Consumables - By Modality (In Value %)

In-center Dialysis

Home Dialysis

- Market Share of Major Players on the Basis of Revenue/ Patient Volume, 2024

Market Share of Major Players by Type of Dialysis Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Dialysis Service Network, R&D Investment, Customer Feedback Rating, Treatment Outcomes, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Dialysis Products and Services

- Detailed Profiles of Major Companies

Fresenius Medical Care

Baxter International

DaVita

B. Braun Melsungen AG

Nipro Corporation

Medtronic

Asahi Kasei Medical Co. Ltd.

Terumo Corporation

Siemens Healthineers

Dialysis Clinic, Inc.

Renal Ventures

U.S. Renal Care

NephroPlus

Quanta Dialysis Technologies

Jiangsu Kangjin Medical Instruments

- Market Demand and Utilization

- Purchasing Power and Budget Considerations

- Regulatory Compliance and Quality Standards

- Patient Needs and Pain Point Analysis

- Decision-Making Process in Dialysis Adoption

- By Revenue

- By Patient Volume

- By Average Treatment Cost