Market Overview

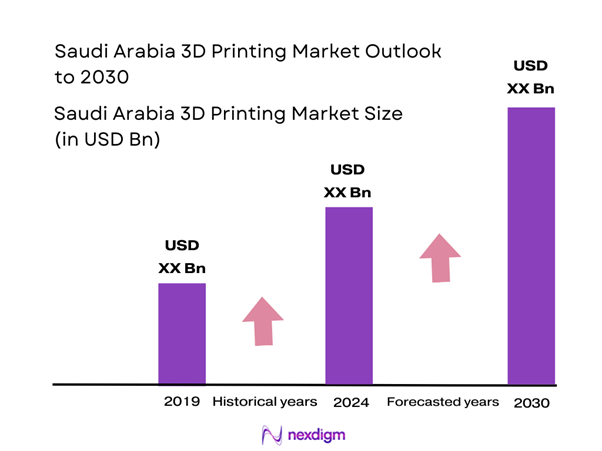

The Saudi Arabia 3D Printing Market is valued at approximately USD 398.1 million in 2024 with an approximated compound annual growth rate (CAGR) of 23% from 2024-2030, supported by a thriving manufacturing sector, rapid advancements in printing technology, and increasing demand for customized production solutions. The growth is fueled by both local enterprises and foreign direct investment, with a strong emphasis on digital transformation initiatives by the government to enhance the industrial base.

Dominance in the Saudi Arabia 3D Printing Market is particularly evident in key cities such as Riyadh, Jeddah, and Dammam. These urban centers benefit from robust infrastructure, substantial industrial activity, and strong educational institutions that foster research and development. Riyadh, being the capital, is a hub for government initiatives and technology-driven enterprises, making it a focal point for 3D printing advancements. Jeddah’s strategic location as a trade gateway and Dammam’s industrial base contribute to the overall market robustness in these areas.

The Saudi Standards, Metrology, and Quality Organization (SASO) plays a pivotal role in this aspect, having established rigorous certification requirements for 3D printed products and materials as of 2024. Moreover, with an increasing number of international collaborations, there is a concerted effort to align such standards with global best practices to facilitate trade and technology exchange. The presence of these standards supports market growth by fostering consumer confidence and compliance across the industry.

Market Segmentation

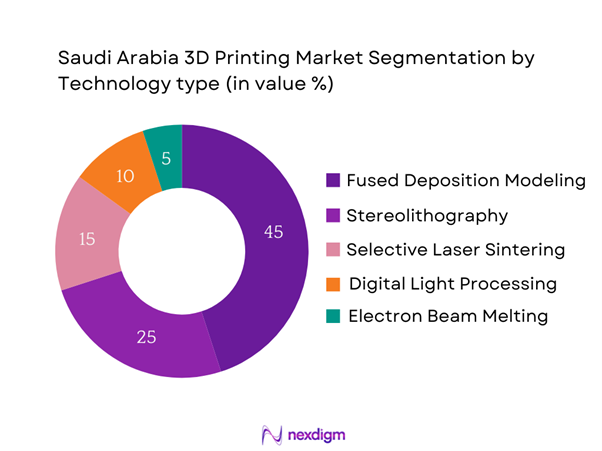

By Technology Type

The Saudi Arabia 3D Printing Market is segmented by technology type into Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), Digital Light Processing (DLP), and Electron Beam Melting (EBM). Among these, FDM technology holds a dominant market share due to its affordability and versatility, making it the preferred choice for various applications from prototyping to small-scale production. The simplicity of FDM technology, alongside the availability of numerous materials for diverse applications, further cements its popularity in the local market. Companies are increasingly utilizing FDM for rapid prototyping and manufacturing, reinforcing its leading position in the market.

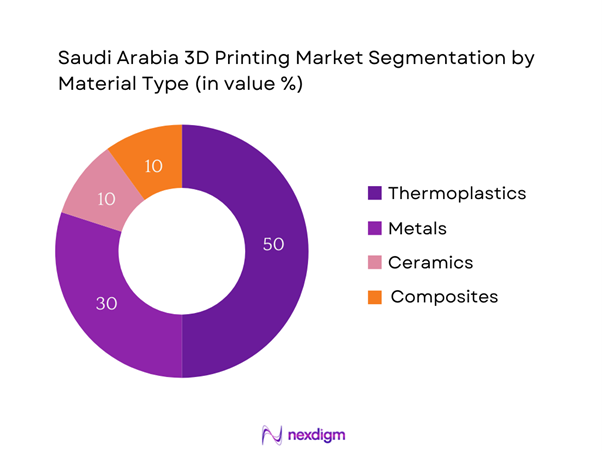

By Material Type

The market segmentation of Saudi Arabia 3D Printing by material type includes Thermoplastics, Metals, Ceramics, and Composites. Thermoplastics dominate this segment owing to their wide-ranging applications and ease of use, particularly in industries such as consumer goods and automotive. The material’s flexibility and adaptability in different printing processes enable significant customization, leading to a growing preference for thermoplastics among manufacturers. With the continuous evolution of materials available for 3D printing, thermoplastics are expected to maintain their leading market position.

Competitive Landscape

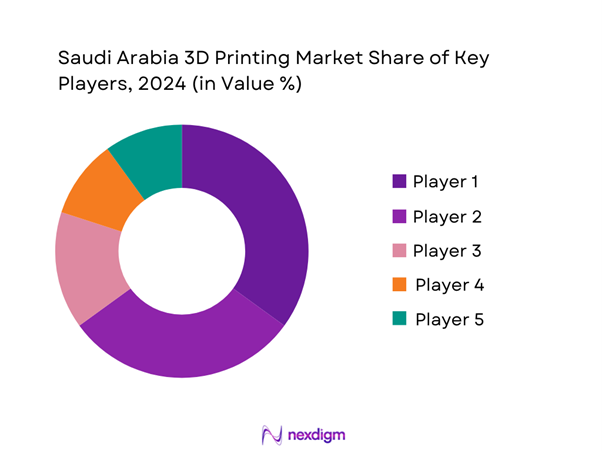

The Saudi Arabia 3D Printing Market is dominated by a few major players, including international manufacturers and local firms. This consolidation underscores the significant influence these key companies have in shaping market trends and driving innovation. Major players continuously invest in research and development to stay competitive, thereby propelling the market forward.

| Company | Established Year | Headquarters | Technology Focus | Market Segment | Customer Base | Recent Innovations |

| Stratasys Ltd. | 1989 | USA | – | – | – | – |

| 3D Systems Corp. | 1986 | USA | – | – | – | – |

| EOS GmbH | 1989 | Germany | – | – | – | – |

| Ultimaker | 2011 | Netherlands | – | – | – | – |

| HP Inc. | 1939 | USA | – | – | – | – |

Saudi Arabia 3D Printing Market Analysis

Growth Drivers

Increasing Demand for Customization

The Saudi Arabia 3D Printing Market is witnessing a surge in demand for customized products, substantially driven by the growing consumer preference for personalized solutions. The increasing participation of small and medium-sized enterprises (SMEs) in light manufacturing is expected to rise significantly, with a report noting that SMEs will constitute approximately 95% of all businesses in Saudi Arabia. This growth indicates a shift towards tailored products, as SMEs utilize 3D printing technology for rapid prototyping and custom orders. In addition, the retail sector is anticipated to grow to $15 billion, fueling the need for customized production.

Rapid Technological Advancements

Technological advancements in the 3D printing sector are creating a fertile ground for growth within the Saudi Arabia market. As of 2023, the region has experienced a threefold increase in the adoption of Industrial 4.0 technologies, reflecting businesses’ commitment to integrating advanced manufacturing solutions. Furthermore, research indicates that investments in advanced manufacturing technologies, including 3D printing, are projected to exceed $2.7 billion as they integrate with automation, robotics, and artificial intelligence. This evolution supports the increased efficiency and capabilities of 3D printing systems, thus driving demand.

Market Challenges

High Equipment Costs

A predominant challenge for the Saudi Arabia 3D printing market is the high costs associated with advanced printing equipment. As of 2022, the average cost of commercially viable industrial 3D printers ranges from $50,000 to over $300,000, which can deter smaller firms from entering the market. This barrier is particularly significant in a country where over 75% of the businesses are classified as SMEs, which typically operate on tighter budgets. The financial constraints faced by these enterprises highlight the need for affordable financing options and government incentives to promote tech adoption.

Material Limitations

The limited availability of specialized materials for 3D printing presents a significant challenge to the Saudi Arabia market. Currently, the majority of high-quality printable materials, such as advanced polymers and metal powders, must be imported from Europe and North America, leading to supply chain complexities. In 2022, it was reported that material import costs reached approximately $150 million annually. This reliance on external sources not only increases production costs but also hampers the ability of local manufacturers to innovate and expand their service offerings effectively.

Opportunities

Emerging Demand in Healthcare

The healthcare sector in Saudi Arabia is increasingly embracing 3D printing technology to improve patient care and operational efficiencies. As of now, the sector accounts for about 9.5% of the national GDP, with healthcare expenditure anticipated to surpass $40 billion in the next few years. This creates fertile ground for innovation, including the use of 3D printing in prosthetics, dental implants, and custom medical devices. The Ministry of Health is actively promoting the adoption of cutting-edge technologies, signaling strong potential growth opportunities for 3D printing applications in healthcare.

Innovations in Bioprinting

Bioprinting is an emerging segment within the Saudi Arabia 3D Printing Market, necessitated by rapid developments in regenerative medicine and tissue engineering. The global bioprinting market is currently valued at $1.3 billion, and early investments in tissue engineering within Saudi Arabia are expected to benefit from an increasing focus on research and healthcare innovation. Currently, Saudi universities and research centers are collaborating with leading international firms to develop bioinks and techniques for printing organic tissues, indicating substantial future growth potential in this sector.

Future Outlook

Over the next five years, the Saudi Arabia 3D Printing Market is expected to expand significantly driven by advancements in technology, government initiatives promoting additive manufacturing, and increasing demand across various industries for efficient and customizable production solutions. As market players enhance their product offerings and local expertise in 3D printing techniques, the sector will likely witness higher penetration into traditionally conservative industries like construction and healthcare. The rapid evolution of materials and technologies will facilitate new applications and broaden the market scope.

Major Players in the Market

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- Ultimaker

- HP Inc.

- Materialise NV

- Carbon, Inc.

- Desktop Metal

- Markforged

- Sinterit

- Arcam (GE Additive)

- BCN3D Technologies

- Formlabs

- Nexa3D

- Zortrax

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Arabian Standards Organization)

- Aerospace Manufacturers

- Automotive Industry Stakeholders

- Healthcare Providers and Medical Device Manufacturers

- Educational and Research Institutions

- Construction and Architecture Firms

- Supply Chain and Manufacturing Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Saudi Arabia 3D Printing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Saudi Arabia 3D Printing Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple 3D printing manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia 3D Printing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Background and Evolution of 3D Printing in Saudi Arabia

- Timeline of Major Players and Innovations

- Business Cycle and Market Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Customization

Rapid Technological Advancements

Government Initiatives Supporting Additive Manufacturing - Market Challenges

High Equipment Costs

Material Limitations - Opportunities

Emerging Demand in Healthcare

Innovations in Bioprinting - Trends

Adoption of Sustainable Practices

Shift Towards Digital Manufacturing - Government Regulation

Standards and Certifications

Funding and Incentives for Research - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Fused Deposition Modeling (FDM)

Stereolithography (SLA)

Selective Laser Sintering (SLS)

Digital Light Processing (DLP)

Electron Beam Melting (EBM) - By Material Type (In Value %)

Thermoplastics

Metals

Ceramics

Composites - By Application (In Value %)

Aerospace

Automotive

Medical

Consumer Products

Industrial Prototyping - By End-User Industry (In Value %)

Healthcare

Education

Defense

Engineering Services - By Application (In Value %)

Prototyping

Tooling

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of 3D Printing Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Technology Segment, Production Capacity, Customer Base, Distribution Channels, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Technology and Material

- Detailed Profiles of Major Companies

Stratasys Ltd.

Systems Corporation

EOS GmbH

Ultimaker

HP Inc.

Formlabs

Xometry

Carbon, Inc.

Materialise

Arcam

Desktop Metal

Markforged

BCN3D Technologies

Sinterit

Nexa3D

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations

- Regulatory Compliance and Industry Standards

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030