Market Overview

The India Plastic Additives market is valued at USD 4.3 billion in 2024 with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, backed by increased industrial growth and rising consumption of plastics across various sectors. The demand for innovative and high-performance additives drives market growth, as manufacturers seek ways to enhance polymer performance.

The market is dominated by key metropolitan regions such as Mumbai, Delhi, and Chennai, which are hubs for manufacturing and industrial activities. These cities benefit from robust infrastructure, availability of skilled labor, and proximity to major consumption centers and ports, making them critical locations for the production and distribution of plastic additives. The strategic location and economic activities in these areas play a significant role in shaping the market dynamics.

Government regulations in India play a pivotal role in shaping the plastic additives market, focusing on sustainability, safety, and waste management. In 2022, the Ministry of Environment issued revised Plastic Waste Management Rules, mandating the implementation of Extended Producer Responsibility (EPR) to ensure manufacturers manage plastic waste post-consumption. Compliance with these regulatory standards requires companies to innovate, which drives market demand for additives that facilitate recycling or enhance biodegradability.

Market Segmentation

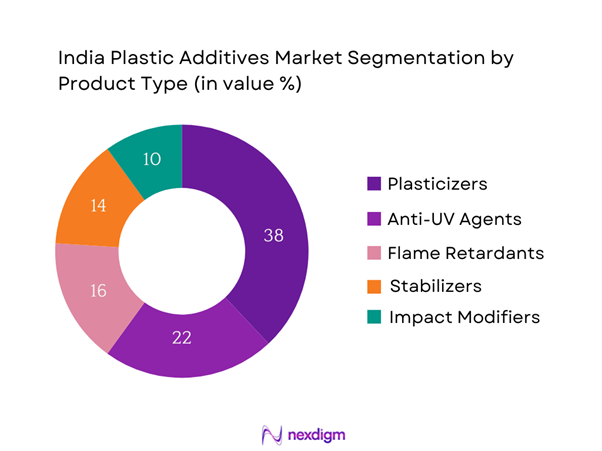

By Product Type

The India Plastic Additives market is segmented by product type into plasticizers, anti-UV agents, flame retardants, stabilizers, and impact modifiers. Among these, plasticizers hold the dominant market share due to their crucial role in enhancing the flexibility and durability of plastic products. The increasing demand for flexible plastics in packaging, automotive, and consumer goods sectors is driving the plasticizers segment. Major brands have positioned themselves strategically in this segment to cater to evolving consumer preferences, which favor high-performance and durable materials.

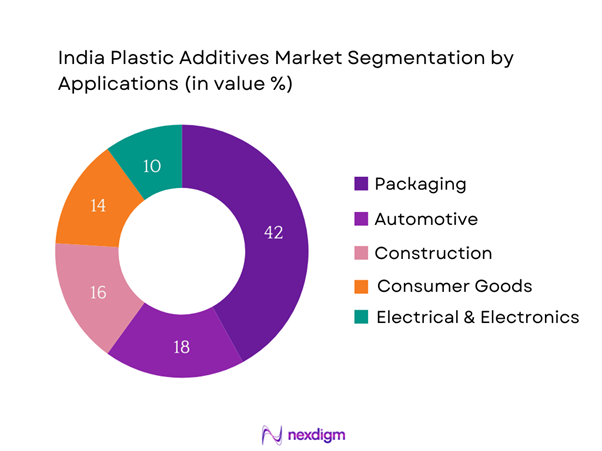

By Application

The market is further segmented by application into packaging, automotive, construction, consumer goods, and electrical & electronics. The packaging segment has a dominating share owing to the rising e-commerce sector and the demand for flexible packaging solutions. The emphasis on sustainability and biodegradable alternatives is enhancing the market for plastic additives in packaging. This segment leverages technological advancements to innovate and cater to the health and convenience-oriented modern consumer.

Competitive Landscape

The India Plastic Additives market is dominated by several key players, reflecting a competitive landscape characterized by innovation and strategic collaborations. Major companies include BASF, Evonik Industries, and Clariant, among others. This consolidation underscores their substantial influence and the critical role they play in shaping market dynamics through advanced product portfolios and expansive distribution networks.

| Companies | Established Year | Headquarters | Market Share | Product Offering | Key Regions | R&D Investment |

| BASF | 1865 | Ludwigshafen, Germany | – | – | – | – |

| Evonik Industries | 2007 | Essen, Germany | – | – | – | – |

| Clariant | 1995 | Muttenz, Switzerland | – | – | – | – |

| LANXESS | 2004 | Cologne, Germany | – | – | – | – |

| A. Schulman | 1928 | Akron, Ohio, USA | – | – | – | – |

India Plastic Additives Market Analysis

Growth Drivers

Rising Demand for Lightweight Materials

The demand for lightweight materials in India is witnessing significant growth, driven by industries such as automotive and packaging. In 2022, the Indian automotive industry produced approximately 4.4 million passenger vehicles. Lightweight materials like plastic additives enhance fuel efficiency and reduce emissions, aligning with the government’s goal to reduce carbon emissions based on India’s commitment to the Paris Agreement. Moreover, the lightweight market is expected to see substantial growth, with the overall plastics consumption expected to reach 20 million metric tons by 2025. This increasing shift towards lightweight materials is reflective of broader global trends in sustainability and energy efficiency.

Increasing Urbanization

Urbanization in India is accelerating, with the urban population projected to reach 600 million by 2031, representing about 40% of the total population. This rapid increase in urban areas drives demand for consumer goods, construction, and infrastructure, all of which heavily rely on plastic products. In 2022, around 31% of India’s total population lived in urban areas, leading to greater housing and consumer product demands. Furthermore, urban centers will witness continuous growth, accentuating the need for plastic products, thus, positively impacting the plastic additives market as industries adapt to urban consumer needs and sustainable development practices.

Market Challenges

Environmental Concerns

Environmental concerns are increasingly prevalent in the Indian plastic sector, leading to stricter regulations and the need for sustainable practices. The Country generated about 3.5 million tons of plastic waste in 2020, presenting critical waste management and recycling challenges. The rapid plastic pollution issue has prompted government action, including the Plastic Waste Management Rules, mandating proper disposal and recycling practices. As a result, companies in the additives sector are pressured to develop biodegradable and eco-friendly alternatives to address these challenges, impacting production processes and investment in sustainability innovations.

Volatility of Raw Material Prices

The volatility of raw material prices is another major challenge facing the India Plastic Additives market. As global prices for petrochemicals, crucial for plastic production, experienced fluctuations, companies faced increased input costs. For instance, the prices of polypropylene surged by 20% from 2021 to 2022 due to rising crude oil prices and supply chain disruptions exacerbated by geopolitical tensions. Such volatile pricing impacts the overall profitability of manufacturers, compelling them to strategize pricing and supply chain management efficiently to mitigate adverse effects; ultimately affecting the price structure of additives in the market.

Opportunities

Growth in Automotive Applications

The automotive sector presents substantial opportunities for plastic additives, driven by India’s push towards electric vehicles (EVs) and lightweight materials. In 2023, the Indian government announced plans to allocate INR 18,000 crore (approximately USD 2.4 billion) in subsidies for battery-powered electric vehicles under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. This initiative promotes the use of advanced materials, enhancing the capabilities of plastic additives crucial for vehicle safety and performance. Thus, the focus on sustainable automotive manufacturing represents a significant market opportunity for innovative plastic additives that improve properties such as durability and resilience.

Innovations in Biodegradable Additives

The current market environment is ripe for opportunities in biodegradable additives, addressing the increasing demand for sustainable materials. In 2022, the global biodegradable plastics market was valued at USD 4.46 billion and is expected to grow, driven by consumer awareness and environmental regulations. With the Indian government actively promoting the use of biodegradable products, the production of biodegradable plastics and additives is gaining momentum. Companies are investing in research and development to create high-performance biodegradable additives, which enhance the functionality of traditional plastics while fulfilling environmental standards. Innovations in this area not only offer growth avenues but also align with global sustainability goals, giving manufacturers a competitive advantage in the evolving market landscape.

Future Outlook

The India Plastic Additives market is expected to witness considerable growth driven by increasing investment in innovation, technological advancements, and a growing emphasis on sustainability. The expansion of the packaging sector, coupled with favorable government regulations supporting the use of advanced materials, will further sustain market growth. Additionally, rising environmental concerns are prompting demand for biodegradable and eco-friendly additives, which is anticipated to reshape industry standards and practices.

Major Players

- BASF

- Evonik Industries

- Clariant

- LANXESS

- Schulman

- Adeka Corporation

- Solvay

- DuPont

- ExxonMobil Chemical

- Henkel AG

- Momentive Specialty Chemicals

- SABIC

- Kaneka Corporation

- Trelleborg

- Shin-Etsu Chemical

Key Target Audience

- Plastic Manufacturers

- Packaging Companies

- Automotive Industries

- Building and Construction Firms

- Electrical & Electronics Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Agencies (Department of Chemicals and Petrochemicals, Bureau of Indian Standards)

- Industry Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map of the India Plastic Additives market. This step is underpinned by extensive desk research utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, including major stakeholders, regional demands, and product innovations.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data pertaining to the India Plastic Additives market. This includes a thorough assessment of market penetration rates, the ratio of marketplaces to service providers, and resultant revenue generation. A detailed evaluation of service quality statistics will also be performed to ensure the reliability and accuracy of the revenue data estimates, aiming for a well-rounded understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts. This engagement will involve representatives from various companies, providing crucial operational and financial insights directly from practitioners in the field. These consultations will be instrumental in refining and corroborating the market data, ensuring that the report reflects the most current and accurate trends.

Step 4: Research Synthesis and Final Output

In this final phase, direct engagement with multiple plastic additive manufacturers will yield deep insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will help verify and complement the statistics derived from the previous bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Plastic Additives market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand for Lightweight Materials

Increasing Urbanization

Expanding Packaging Industries - Market Challenges

Environmental Concerns

Volatility of Raw Material Prices - Opportunities

Growth in Automotive Applications

Innovations in Biodegradable Additives - Trends

Shift Towards Sustainable Products

Advancements in Plastic Recycling - Government Regulation

Compliance and Standards

Import Tariffs and Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Plasticizers

Anti-UV Agents

Flame Retardants

Stabilizers

Impact Modifiers - By Application (In Value %)

Packaging

Automotive

Construction

Consumer Goods

Electrical & Electronics - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Sales - By Region (In Value %)

North

South

East

West

Central - By End Product (In Value %)

Rigid Plastics

Flexible Plastics

Thermoplastics

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Plastic Additives Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Market Penetration Strategies, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

BASF

Evonik Industries

Clariant

LANXESS

A. Schulman

Adeka Corporation

Solvay

DuPont

ExxonMobil Chemical

Henkel AG

Momentive Specialty Chemicals

SABIC

Kaneka Corporation

Trelleborg

Shin-Etsu Chemical

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030