Market Overview

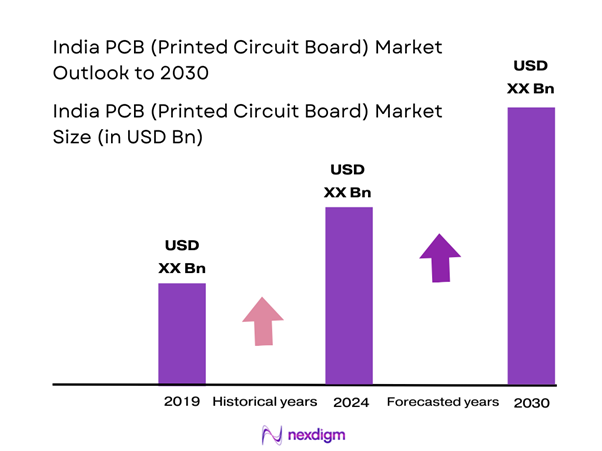

The India PCB market is valued at USD 6.3 billion in 2024 with an approximated compound annual growth rate (CAGR) of 16% from 2024-2030, reflecting robust growth driven by the escalating demand from various sectors such as consumer electronics, automotive, and telecommunications. This growth trajectory is attributed to the surging production of electronic devices, coupled with government initiatives aimed at bolstering domestic manufacturing capabilities. This market size is reinforced by a steady rise in manufacturing activities, particularly in electronics, which is foundational to the PCB industries.

Dominant cities such as Bengaluru, Pune, and Hyderabad lead the India PCB market due to their well-established electronics manufacturing hubs and favorable governmental policies for technology innovation. These urban centers benefit from a concentration of talent, technological advancements, and infrastructure. Additionally, the increasing presence of multinational corporations and local startups in the electronics domain amplifies the demand for advanced PCBs, solidifying their market dominance.

The Indian government has implemented stringent environmental compliance standards that impact the PCB manufacturing sector significantly. As part of the Environmental Protection Act, all manufacturers must adhere to regulations concerning e-waste management, hazardous substance control, and pollution prevention. In 2022 alone, it was reported that over 2 million tons of electronic waste was generated in India, necessitating rigorous compliance with e-waste management policies to promote sustainability in manufacturing practices.

Market Segmentation

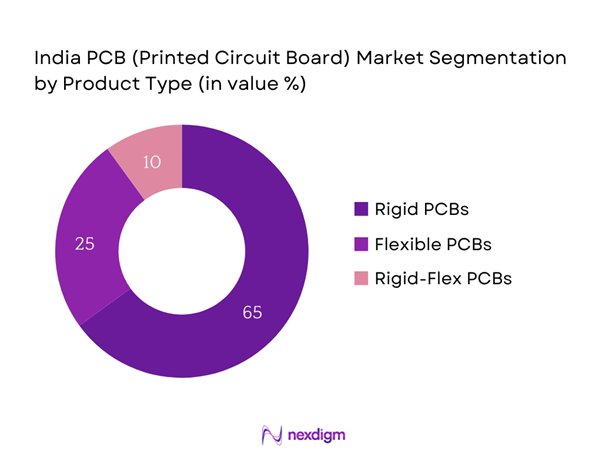

By Product Type

The India PCB market is segmented by product type into rigid PCBs, flexible PCBs, and rigid-flex PCBs. Rigid PCBs have a dominant market share in India under this segmentation due to their widespread use in consumer electronics and industrial applications. They are favored for their robustness and reliability, making them essential in the construction of complex electronic circuits. Many manufacturers and consumers prefer rigid PCBs for traditional applications, including computing devices and appliances, driving the need for high-quality, durable PCBs in the sector.

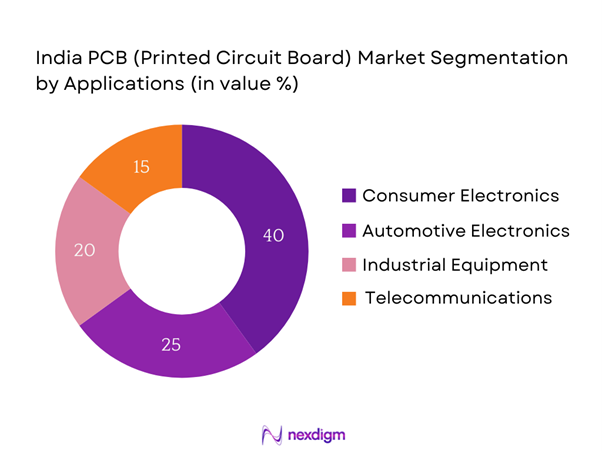

By Application

The market is also segmented based on application, which includes consumer electronics, automotive electronics, industrial equipment, and telecommunications. Consumer electronics hold a significant share of the market, primarily due to the relentless growth of smartphone, tablet, and wearable device production in India. The continuous evolution of technology and consumer preferences for advanced electronics drive the demand for sophisticated PCBs, thereby cementing the dominance of this application segment within the market.

Competitive Landscape

The India PCB market is characterized by a few major players including local manufacturers and international corporations. The competition underscores the significance of innovation and quality in driving business success. Leading players such as AT&S and Foxconn are at the forefront, leveraging technological advancements and efficient production capabilities. These companies stand out due to their established brand reputation, extensive product portfolios, and ability to meet varied client requirements.

| Company Name | Establishment Year | Headquarters | Market Parameter 1 | Market Parameter 2 | Market Parameter 3 | Market Parameter 4 | Market Parameter 5 | Market Parameter 6 |

| AT&S | 1987 | Austria | – | – | – | – | – | – |

| Foxconn | 1974 | Taiwan | – | – | – | – | – | – |

| Sanmina | 1980 | USA | – | – | – | – | – | – |

| Jabil | 1966 | USA | – | – | – | – | – | – |

| Wistron | 2001 | Taiwan | – | – | – | – | – | – |

India PCB Market Analysis

Growth Drivers

Rise in Electronics Manufacturing

The electronics manufacturing sector in India has experienced substantial growth, driven by increasing domestic consumption and a favorable business environment. In the fiscal year 2022-2023, the Indian electronics market reached approximately USD 76.5 billion, propelled by rising smartphone and consumer electronics production. This growth aligns with the Indian government’s target to increase electronics manufacturing to USD 300 billion by end of 2025. Furthermore, the government reported that the sector has the potential to employ over 1 million people by end of 2025, signifying a robust expansion across various segments of electronics.

Government Initiatives for Make in India

The “Make in India” initiative has catalyzed a significant enhancement in manufacturing capabilities across various sectors, especially electronics. Since its launch, the initiative has attracted over USD 20 billion in Foreign Direct Investment (FDI) in electronics manufacturing during 2021-2022. A report by the Ministry of Commerce indicates that policies under this initiative aim to increase manufacturing’s contribution to the GDP from the current level of about 16% to 25% in the coming years. The promotion of local production and technology transfer enhances the PCB market, facilitating growth across multiple applications.

Market Challenges

High Production Costs

One of the significant challenges facing the PCB market in India is the high cost of production, primarily due to the rising prices of raw materials and labor. In 2023, the average wage for skilled labor in the electronics sector was around USD 600 per month, reflecting a 10% increase from the previous year. Additionally, fluctuations in the prices of copper, which constitutes a significant portion of PCB production costs, have seen an increase of approximately 15% over the past year. This volatility impacts profit margins and pricing strategies in the PCB sector, posing a substantial challenge for manufacturers to remain competitive.

Supply Chain Disruptions

The PCB industry has faced significant supply chain disruptions, notably due to the pandemic and global geopolitical tensions which have led to logistical constraints and longer lead times for key materials. Reports indicate that 70% of manufacturers experienced delays in the procurement of essential components and materials in 2022. This hindered production schedules and increased operational costs. For instance, the shortage of semiconductor components, crucial for PCB production, led to an estimated loss of USD 300 billion in global sales for electronics in 2022 alone. These disruptions underline vulnerabilities within the supply chain that affect the output capacity of PCB manufacturers in India.

Opportunities

Innovation in PCB Design

The demand for innovative PCB design solutions presents significant growth opportunities within the market. The shift toward complex electronic devices with advanced features—spurred by trends such as Internet of Things (IoT) and smart technology—has resulted in a surge in demand for multi-layered and flexible PCBs. In 2022, the market for flexible printed circuits reached USD 35 billion, and with the increasing trend of miniaturization, the need for innovative PCB designs is expected to expand further. Innovations in design capability not only streamline production processes but also enhance product performance, thereby opening new avenues for manufacturers across India.

Growing Demand in Emerging Markets

Emerging markets present a significant opportunity for the growth of the PCB sector as they continue to modernize their electronic infrastructures. As of 2023, the growth rate of consumer electronics sales in Asia-Pacific has been reported at 7.3%, and countries like India, Vietnam, and Indonesia are increasingly investing in technology and electronic manufacturing. Furthermore, an increase in disposable incomes in these regions has led to higher spending on electronic devices, driving demand for PCBs. Manufacturers in India can capitalize on this growing demand by leveraging competitive pricing and quality assurance, targeting these emerging economies as key export markets for their products.

Future Outlook

Over the next few years, the India PCB market is expected to witness significant growth driven by ongoing advancements in technology and increasing demand from various electronic sectors. The government’s focus on initiatives such as “Make in India” and the push for self-reliance in electronics manufacturing are set to propel the market further. Moreover, trends towards miniaturization of devices and increased integration of smart technologies will enhance the demand for advanced PCB solutions, establishing a favorable growth environment.

Major Players

- AT&S

- Foxconn

- Sanmina

- Jabil

- Wistron

- Infosys (PCB Division)

- Elpida Memory

- Pioneer Circuits

- Unimicron Technology Corporation

- Celestica

- Nanya Technology Corporation

- Shennan Circuits

- Ventec China

- PCB Solutions

- Jtronics

Key Target Audience

- Electronics Manufacturers

- Automotive OEMs and Suppliers

- Telecommunication Companies

- Government and Regulatory Bodies (e.g., Department of Electronics and Information Technology, Ministry of Electronics and IT)

- Investments and Venture Capitalist Firms

- Industrial Equipment Manufacturers

- Research and Development Organizations

- Component Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the India PCB market. This step encompasses extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India PCB market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Moreover, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, providing a clear view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data, ensuring that our findings are grounded in real-world perspectives.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple PCB manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India PCB market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle and Ecosystem

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Electronics Manufacturing

Government Initiatives for Make in India - Market Challenges

High Production Costs

Supply Chain Disruptions - Opportunities

Innovation in PCB Design

Growing Demand in Emerging Markets - Trends

Shift Towards Miniaturization

Advancements in Material Technology - Government Regulation

Environmental Compliance Standards

Intellectual Property Rights - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Type, 2019-2024

- By Product Type (In Value %)

Rigid PCBs

Flexible PCBs

Rigid-Flex PCBs - By Application (In Value %)

Consumer Electronics

Automotive Electronics

Industrial Equipment

Telecommunications - By End-User Industry (In Value %)

Aerospace

Healthcare

Computing

Defense - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Surface Mount Technology (SMT)

Through-Hole Technology

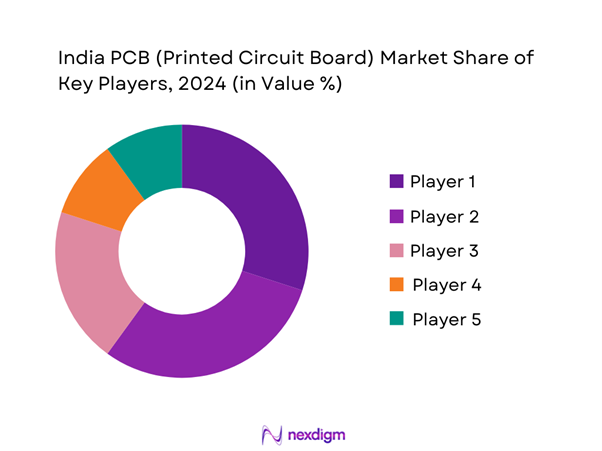

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of PCB Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type, Number of Touchpoints, Distribution Channels, Distribution Strategies, Technological Advancements, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Product Types

- Detailed Profiles of Major Companies

AT&S

Foxconn Technology Group

Jabil

Infosys (PCB Division)

Sanmina Corporation

Wistron Corporation

Pioneer Circuits

Elpida Memory

Unimicron Technology Corporation

Ventec China

Simmtech

Shennan Circuits

Celestica

PCB Solutions

Nanya Technology Corporation

- Market Demand and Utilization

- Purchasing Trends

- Regulatory Requirements

- Consumer Preferences

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Type, 2025-2030