Market Overview

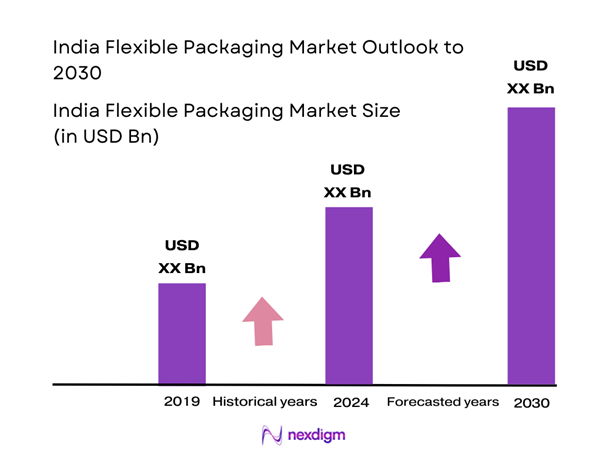

The India Flexible Packaging Market is valued at USD 20.41 billion in 2025 with an approximated compound annual growth rate (CAGR) of 11.46% from 2025-2030, based on a five-year historical analysis. Factors driving this growth include the increasing demand for packaged food, beverages, and consumer goods, alongside the rise in e-commerce. The shift towards convenience packaging and sustainable solutions further enhances market dynamics. Additionally, a growing middle-class population and urbanization are fueling this demand, making flexible packaging a preferred choice across various sectors.

Major cities such as Mumbai, Delhi, and Bengaluru dominate the flexible packaging market due to their large populations and concentration of industries. These urban centers serve as significant manufacturing hubs and have a high consumption demand for packaged products. Furthermore, the presence of established packaging companies and robust distribution networks in these regions fosters unparalleled growth opportunities, leading to increased market activity and investments.

India’s e-commerce sales reached USD 84 billion in 2023, with projections indicating a rise to approximately USD 100 billion by end of 2025. The COVID-19 pandemic has further accelerated this shift as consumers increasingly prefer online shopping for groceries and packaged goods. The retail sector is also experiencing growth, with retail sales hitting USD 860 billion in 2023.

Market Segmentation

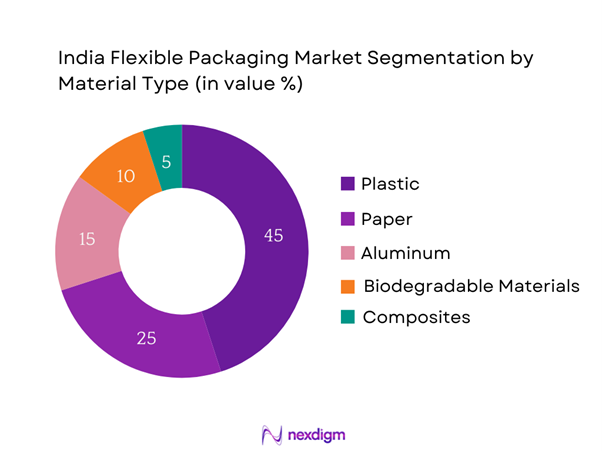

By Material Type

The India Flexible Packaging Market is segmented by material type into plastic, paper, aluminum, biodegradable materials, and composites. Among these, plastic has a dominant market share, primarily due to its versatility, lightweight nature, and cost-effectiveness. The growth of the food and beverage sector fuels the demand for plastic packaging solutions, as brands seek innovative ways to enhance shelf life and maintain product quality. Additionally, advancements in plastic recycling technologies are contributing to a more sustainable image, further solidifying its position in the market.

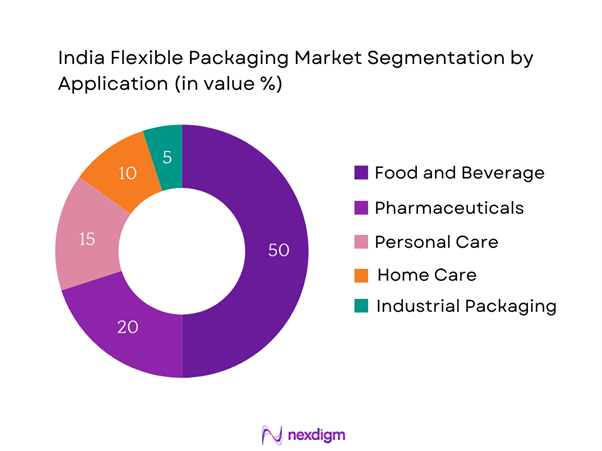

By Application

The market is also segmented by application into food and beverage, pharmaceuticals, personal care, home care, and industrial packaging. The food and beverage segment holds a significant market share, driven by the need for convenient and portable packaging solutions. This sub-segment’s dominance stems from changing consumer lifestyles, which prioritize on-the-go consumption. Leading brands are increasingly focusing on innovative packaging designs that enhance user experience while ensuring product safety and freshness, making the food and beverage application the largest contributor to the flexible packaging market.

Competitive Landscape

The India Flexible Packaging Market is competitive and dominated by a few key players, reflecting the industry’s consolidation. Major companies like Uflex Ltd., Amcor Limited, and Huhtamaki lead the market, each bringing innovations and sustainability initiatives that influence market trends and consumer preferences. This competitive landscape highlights the significant influence of these major players in shaping industry standards and driving growth.

| Company Name | Established Year | Headquarters | Major Products | Market Focus | Sustainability Initiatives |

| Uflex Ltd. | 1983 | Noida, India | – | – | – |

| Amcor Limited | 1860 | Zürich, Switzerland | – | – | – |

| Huhtamaki | 1920 | Espoo, Finland | – | – | – |

| Constantia Flexibles | 2005 | Vienna, Austria | – | – | – |

| Smurfit Kappa | 1934 | Dublin, Ireland | – | – | – |

India Flexible Packaging Market Analysis

Growth Drivers

Rising Consumer Preference for Convenient Packaging

The shift towards convenience in consumer products has been largely influenced by a growing urban population, now estimated at over 600 million. The rising disposable incomes and changing lifestyles have resulted in increased demand for packaged foods and ready-to-eat meals. This trend is evident as the organized retail sector in India has grown to USD 99 billion in 2023, with flexible packaging solutions positioning themselves as an essential aspect of product differentiation. With the rise of consumers who prioritize speed and convenience, especially in metropolitan areas, the demand for flexible packaging is projected to increase even further.

Rapid Urbanization and Infrastructural Development

India’s urbanization rate has been accelerating, with about 34% of its population currently living in urban areas, projected to reach 37% by end of 2025. This rapid urbanization leads to expansive infrastructural development, generating demand for more efficient food distribution channels. In 2023, the Indian government announced a total investment of USD 1.4 trillion in infrastructure development under the National Infrastructure Pipeline (NIP), significantly enhancing supply chain efficiency. Such improvements allow for better logistics and transportation, thereby increasing the volume of packaged products, further driving demand for flexible packaging solutions.

Market Challenges

Environmental Regulations and Sustainability Challenges

The Indian government is actively promoting sustainable practices in packaging to combat ecological concerns, recognizing that plastic waste has reached alarming levels, with 3.4 million tons generated annually. The implementation of the Extended Producer Responsibility (EPR) mandates manufacturers to ensure responsible packaging disposal. As a result, companies face significant pressure to innovate eco-friendly alternatives, which may initially increase production costs and complicate supply chains. Stricter compliance with environmental regulations is pushing firms to adapt quickly to alternative packaging materials or risk potential legal repercussions.

Fluctuations in Raw Material Costs

The volatility of raw material costs remains a significant challenge for the flexible packaging industry in India. As global demand for plastics increases, pricing for commodities such as polyethylene and polypropylene has surged, rising by 15% between 2022 and 2023. Moreover, crude oil prices have shown volatility, reaching USD 85 per barrel recently, which adds to production unpredictability for manufacturers. These fluctuations strain profit margins and compel businesses to explore alternative materials, making it a crucial hurdle for market growth in the near term.

Opportunities

Innovations in Eco-friendly Packaging Solutions

The current trend toward sustainability indicates a substantial opportunity for the flexible packaging market. In 2023, nearly 60% of consumers expressed a preference for brands that use sustainable packaging, with 72% willing to pay more for products that come in eco-friendly packaging. Investments in bio-based materials are on the rise, with the market for biodegradable plastics reached USD 4.5 billion in 2024. Such consumer preferences are prompting manufacturers to pivot towards sustainable options, thereby establishing a growth frontier in eco-friendly flexible packaging.

Demand for Customized Packaging

Customization is accelerating in consumer products; approximately 45% of millennials expect personalized experiences from brands. The growth of e-commerce has paved the way for tailored packaging solutions that enhance brand image and consumer engagement. In 2023, the demand for customized packaging solutions surged, evidenced by an increase in niche brands leveraging creative packaging designs to attract customers. This trend reflects the opportunity for flexible packaging manufacturers to capitalize on personalization and differentiation strategies that cater to this growing consumer demand for unique product experiences.

Future Outlook

Over the next several years, the India Flexible Packaging Market is expected to witness significant growth driven by the rising demand for convenience, increasing consumer awareness regarding sustainability, and advancements in packaging technologies. Growing urbanization and the expansion of the e-commerce sector are anticipated to boost market demand further, encouraging innovation and investment in sustainable packaging solutions. As consumers become more environmentally conscious, companies will increasingly focus on sustainable materials and practices, shaping the future of flexible packaging.

Major Players

- Uflex Ltd.

- Amcor Limited

- Huhtamaki

- Constantia Flexibles

- Smurfit Kappa

- Berry Global Inc.

- Sealed Air Corporation

- Mondi Group

- Reynolds Group Holdings

- Pregis LLC

- DS Smith

- Novolex Holdings, Inc.

- Sonoco Products Company

- Printpack Inc.

- Bischof + Klein

Key Target Audience

- Packaging manufacturers

- Food and beverage companies

- Pharmaceuticals companies

- Retail chains

- E-commerce platforms

- Investments and venture capitalist firms

- Government and regulatory bodies (e.g., Ministry of Food Processing Industries, Bureau of Indian Standards)

- Supply chain and logistics companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Flexible Packaging Market. This step is underpinned by extensive desk research, utilizing various secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics such as material types, applications, competitors, and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Flexible Packaging Market. This includes assessing market penetration, the distribution of various packaging materials, and the resultant revenue generation by different applications. An evaluation of service quality statistics is also conducted to ensure the reliability and accuracy of the revenue estimates, thus building a holistic view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the collected data and are subsequently validated through consultations with industry experts and practitioners. This involves conducting interviews and surveys with professionals across the flexible packaging value chain, providing insights that aid in refining and corroborating market data. These consultations also provide real-time feedback on market trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with various flexible packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and emerging trends. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Flexible Packaging Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Industry Trends and Growth Insights

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Consumer Preference for Convenient Packaging

Rapid Urbanization and Infrastructural Development - Market Challenges

Environmental Regulations and Sustainability Challenges

Fluctuations in Raw Material Costs - Opportunities

Innovations in Eco-friendly Packaging Solutions

Demand for Customized Packaging - Trends

Shift to Sustainable Materials

Growth of Smart Packaging Technologies - Government Regulation

Compliance with Packaging Standards

Import/Export Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (In Value %)

Plastic

Paper

Aluminum

Biodegradable Materials

Composites - By Application (In Value %)

Food and Beverage

Pharmaceuticals

Personal Care

Home Care

Industrial Packaging - By Product Type (In Value %)

Pouches

Bags

Wraps

Films - By Region, (In Value %)

North India

West India

South India

East India - By Technology (In Value %)

Printing Technology

Lamination Technology

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Market Positions, Technological Capabilities, Pricing Strategies, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis by Category for Major Players

- Detailed Profiles of Major Companies

Amcor Limited

Sealed Air Corporation

Uflex Ltd.

Tetra Pak

Huhtamaki

Mondi Group

Berry Global Inc.

WestRock

DS Smith

Bisch

Bischof + Klein

Constantia Flexibles

Glenroy, Inc.

Smurfit Kappa

Sonoco Products Company

Detmold Group

- Market Demand and Utilization

- Consumer Behavior and Preferences

- Regulatory Compliance Requirements

- Needs Analysis and Pain Point Investigation

- Decision-Making Criteria in Purchases

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030