Market Overview

The USA Pre-Engineered Metal Building Market is valued at approximately USD 12.99 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8.4% from 2024-2030, based on a comprehensive historical analysis. The growth of this market is primarily driven by increased demand for energy-efficient buildings, rapid urbanization, and the rise in industrial and commercial construction. As companies and consumers alike become more conscientious about environmental sustainability, pre-engineered metal buildings are recognized for their efficiency and durability. This demand is further reinforced by favorable governmental regulations promoting sustainable construction practices.

The market is dominated by cities with significant construction and manufacturing activities, such as Los Angeles, Chicago, and Dallas. These urban centers showcase a blend of strong economic infrastructure, facilitating large-scale industrial projects and fast-tracked commercial developments. The presence of major manufacturing hubs in these regions, along with a skilled workforce, enhances their attractiveness for deploying pre-engineered metal building solutions, thus contributing to their dominance in the market.

The USA has witnessed a substantial increase in both public and private investments in construction, further driving the pre-engineered metal building market. In 2023, total construction spending in the USA exceeded USD 1.8 trillion, as reported by the U.S. Census Bureau. The infrastructure investments, bolstered by the Bipartisan Infrastructure Law, amount to an investment of approximately USD 1.2 trillion aimed at enhancing transportation, clean water, and energy structures.

Market Segmentation

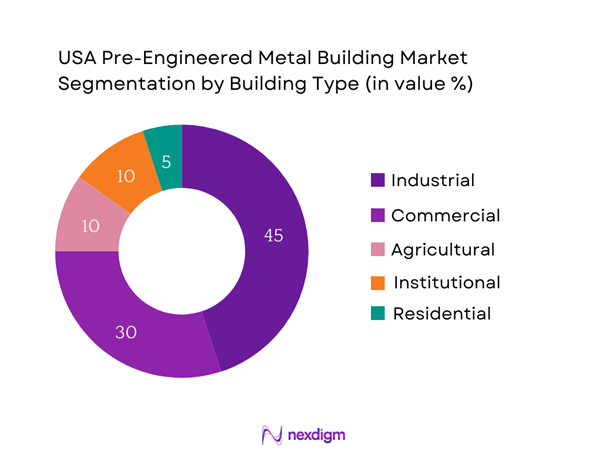

By Building Type

The USA Pre-Engineered Metal Building market is segmented by building type into industrial buildings, commercial buildings, agricultural structures, institutional buildings, and residential buildings. Among these, industrial buildings have emerged as the dominant segment. This dominance is attributed to the rising demand for warehouses and distribution centers, driven by the growth of e-commerce and the need for efficient logistical operations. Manufacturers prefer pre-engineered metal buildings for their ideal structural properties, which provide a cost-efficient and time-effective solution compared to traditional building methods. The flexibility and scalability offered by these structures further enhance their attractiveness to industries that require quick expansion and versatile space usage.

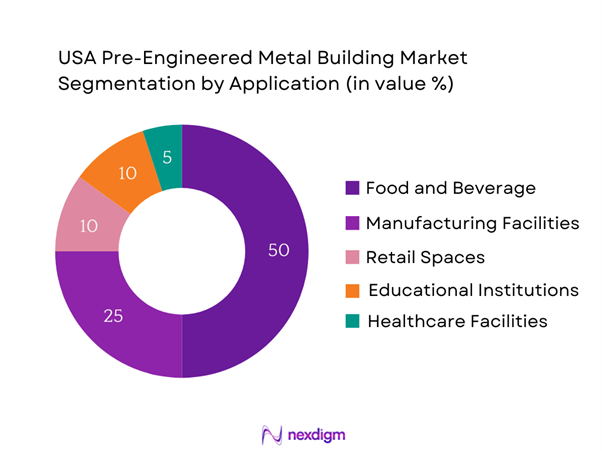

By Application

The USA Pre-Engineered Metal Building market is segmented by application into warehousing, manufacturing facilities, retail spaces, educational institutions, and healthcare facilities. Warehousing represents the leading application segment, driven by the increasing demand for storage spaces due to e-commerce growth and supply chain optimization. As inventory management becomes more pivotal for businesses, the need for efficient warehousing solutions rises. Pre-engineered metal buildings provide expansive, flexible, and customizable spaces that significantly enhance operational efficiencies, leading to heightened popularity within the warehousing segment.

Competitive Landscape

The USA Pre-Engineered Metal Building market is characterized by a few major players, which include both local manufacturers and global brands. This consolidation accentuates the competitive environment and showcases the impact these key players have on the marketplace. The market features companies that have established strong brand loyalty, efficient manufacturing capabilities, and extensive distribution networks, which are critical for maintaining their competitive edge.

| Companies | Establishment Year | Headquarters | Annual Revenue | Product Offerings | Market Reach |

| Nucor Corporation | 1905 | Charlotte, NC | – | – | – |

| Butler Manufacturing | 1901 | Kansas City, MO | – | – | – |

| Ceco Building Systems | 1996 | Fort Worth, TX | – | – | – |

| General Steel | 1995 | Denver, CO | – | – | – |

| Star Building Systems | 1927 | Oklahoma City, OK | – | – | – |

USA Pre-Engineered Metal Building Market Analysis

Growth Drivers

Rising Demand for Sustainable Construction

The growing emphasis on sustainable construction practices is driving demand in the USA Pre-Engineered Metal Building market. In recent reports, sustainable buildings, which include energy-efficient materials and designs, accounted for over 40% of the construction market in the USA. With federal initiatives like the Inflation Reduction Act promoting sustainable infrastructure, investments in green buildings are expected to reach USD 1 trillion by end of 2025. Such trends reflect a significant shift towards eco-friendly construction practices, reinforcing the demand for pre-engineered metal buildings known for their sustainability and minimal environmental impact.

Efficiency of Prefabrication Techniques

Prefabrication techniques significantly enhance construction efficiency, contributing to the rising popularity of pre-engineered metal buildings. The construction sector in the USA observed a 25% reduction in construction time for projects utilizing modular and prefabricated components. According to the National Institute of Standards and Technology (NIST), adopting off-site construction approaches can lower total labor costs by up to 30%, while also decreasing construction waste by as much as 50%. This efficiency is pivotal in an increasingly competitive market, compelling builders to consider prefabricated solutions that expedite project timelines and reduce overall project costs.

Market Challenges

Fluctuating Raw Material Costs

Fluctuating raw material costs present a significant challenge for the pre-engineered metal building market. The World Bank projects that raw material price instability will continue, affecting profitability and project feasibility. Such fluctuations not only increase project costs for builders but also deter potential investments in construction, particularly in sectors that rely heavily on steel as a primary material. The market’s sensitivity to these costs necessitates adaptive strategies among manufacturers and builders.

Regulatory Compliance Issues

Regulatory compliance issues are another critical challenge facing the USA Pre-Engineered Metal Building market. In 2023, the U.S. government introduced new building codes aimed at enhancing safety and sustainability standards. For example, an increase in stringent codes for energy efficiency aiming to reduce greenhouse gas emissions by 35% have been anticipated, complicating the compliance landscape. Compliance with evolving regulations adds to the complexity of projects, often resulting in additional costs and time delays for builders. Failure to adhere to these regulations can lead to penalties, further complicating operational processes within the industry.

Opportunities

Innovation in Design and Technology

The USA Pre-Engineered Metal Building market is open to opportunities brought about by innovations in design and technology. In 2022, investments in construction technology solutions, including advanced Building Information Modeling (BIM) and smart building technologies, reached USD 150 billion. Such innovations empower builders to enhance efficiency, improve design flexibility, and foster sustainability in construction. As the demand for smart buildings grows, integrating automation, energy management, and IoT systems into pre-engineered solutions stands to provide substantial growth opportunities, allowing developers to offer enhanced functionality while reducing operational costs.

Growth in Industrialization and Urbanization

The ongoing trends of industrialization and urbanization are pivotal for the USA Pre-Engineered Metal Building market. The urban population in the USA is projected to grow by 8 million people by end of 2025, intensifying the need for efficient housing and commercial structures. Concurrently, manufacturing output in the USA is anticipated to reach USD 5 trillion by 2025, according to the U.S. Bureau of Economic Analysis. This rapid urbanization promotes the need for smart and durable infrastructure, of which pre-engineered metal buildings offer an attractive solution due to their adaptability and cost-effectiveness. As urban areas expand, integrating these building systems into new developments will be crucial for meeting demand and contributing to economic resilience.

Future Outlook

Over the next five years, the USA Pre-Engineered Metal Building market is expected to experience significant growth fueled by continuous advancements in construction technology, increasing consumer demand for sustainable building solutions, and the expansion of e-commerce driving the need for more warehouses. The strengthening support from government initiatives promoting energy efficiency will further augment market opportunities, positioning pre-engineered metal buildings as a preferred choice for commercial and industrial projects.

Major Players

- Nucor Corporation

- Butler Manufacturing

- Ceco Building Systems

- General Steel

- Star Building Systems

- American Buildings Company

- Rhino Steel Buildings

- com

- PEB Steel Buildings

- PulteGroup

- Thermasteel

- Aegis Metal Framing

- International Steel Structures

- KMLEA Metal Buildings

- Metal Sales Manufacturing Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Construction Companies

- Manufacturing Firms

- Retail Enterprises

- Government and Regulatory Bodies (U.S. Department of Energy, Environmental Protection Agency)

- Infrastructure Development Agencies

- Architectural Design Firms

- Real Estate Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Pre-Engineered Metal Building market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics effectively.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Pre-Engineered Metal Building market. This includes assessing market penetration, evaluating the ratio of market participants to service providers, and the resultant revenue generation. Furthermore, we will conduct an evaluation of service quality statistics to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pre-engineered metal building manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the USA Pre-Engineered Metal Building market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Key Market Trends

- Historical Development of the Market

- Supply Chain and Value Chain Analysis

- Regulatory Framework and Compliance Standards

- Growth Drivers

Rising Demand for Sustainable Construction

Efficiency of Prefabrication Techniques - Market Challenges

Fluctuating Raw Material Costs

Regulatory Compliance Issues - Opportunities

Innovation in Design and Technology

Growth in Industrialization and Urbanization - Trends

Adoption of Smart Building Technologies

Increasing Focus on Energy Efficiency - Government Regulations

Building Codes and Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Project Type, 2019-2024

- By Building Type (In Value %)

Industrial Buildings

Commercial Buildings

Agricultural Structures

Institutional Buildings

Residential Buildings - By Application (In Value %)

Warehousing

Manufacturing Facilities

Retail Spaces

Educational Institutions

Healthcare Facilities - By End-User Industry (In Value %)

Construction

Transportation

Energy

Agriculture

Food & Beverage - By Region (In Value %)

Northeast

Midwest

South

West - By Design Specification (In Value %)

Standard Building Designs

Custom Configurations

Green Buildings

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Nucor Corporation

Butler Manufacturing

Ceco Building Systems

General Steel

Midwest Steel

Hadley Industries

American Buildings Company

Champion Buildings

Arco Steel

METALBUILDINGS.com

Steel Master Buildings

Rhino Steel Buildings

Precon: Pre-Engineered Buildings

Aegis Metal Framing

Star Building Systems

- Market Demand Analysis

- Consumer Behavior and Preferences

- Decision-Making Process

- Budget Allocation by Sector

- Pain Points and Requirements of End Users

- By Value, 2025-2030

- By Volume, 2025-2030

- By Project Type, 2025-2030