Market Overview

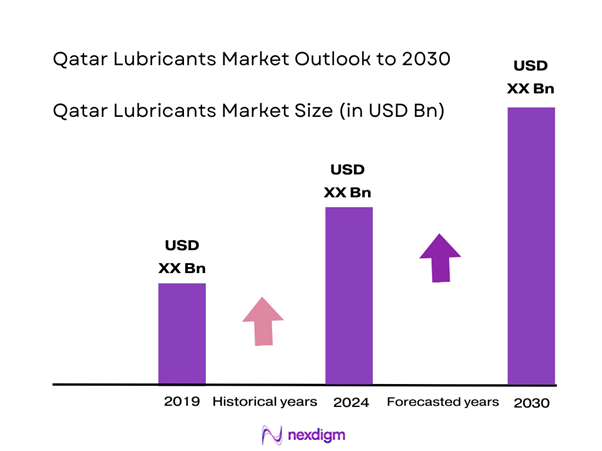

The Qatar Lubricant Market is valued at 59.28 million liters in 2025 with an approximated compound annual growth rate (CAGR) of 3% from 2025-2030, based on a thorough assessment of historical data and trends. This growth is primarily driven by the rapid expansion of the automotive and industrial sectors. The increasing demand for high-performance lubricants in these industries, influenced by technological advancements and higher vehicle ownership, contributes significantly to market growth.

Doha is the dominant city in the Qatar Lubricant Market due to its significant industrial base and growing automotive industry. Being the capital, it hosts a majority of the major lubricant companies along with substantial distribution networks. Other cities such as Al Rayyan and Al Wakrah also showcase growth as they contribute to the expanding infrastructure projects and increasing vehicle registrations, which add to the overall demand for lubricants.

The implementation of stringent environmental compliance standards by the Qatar government is shaping the lubricant market. The Qatar National Strategy focuses on reducing the carbon footprint of various industries, including manufacturing and automotive sectors. Regulatory bodies have established specific mandates requiring low-emission lubricants to ensure compliance with international environmental agreements. As of 2024, the government is enforcing these standards more rigorously, compelling lubricant manufacturers to invest in research and development for compliant products.

Market Segmentation

By Product Type

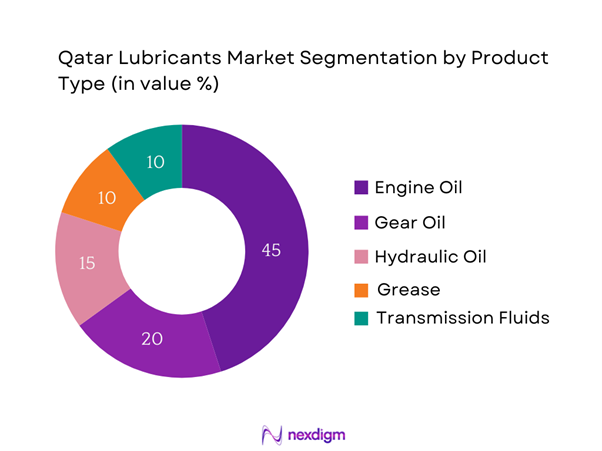

The Qatar Lubricant Market is segmented by product type into engine oil, gear oil, hydraulic oil, grease, and transmission fluids. Engine oil holds a dominant market share within this segment in Qatar due to its critical role in automotive performance and maintenance. With an increasing number of vehicles on the road, both private and commercial, the demand for high-quality engine oils has surged. Additionally, technological advancements in engine design require specialized lubricants that ensure optimal protection and efficiency, thereby solidifying engine oil’s position at the forefront of this market segment.

By Application

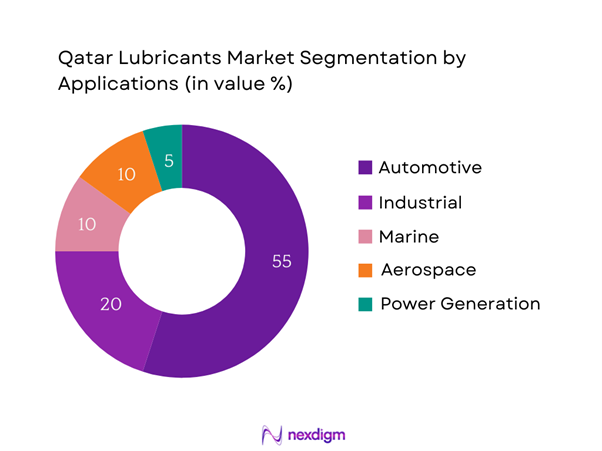

The Qatar Lubricant Market is also segmented by application into automotive, industrial, marine, aerospace, and power generation. The automotive segment is the largest contributor to market share as it encompasses a wide range of sub-segments, including passenger vehicles, commercial transportation, and two-wheelers. The growth in this sub-segment is driven by rising vehicle ownership, technological advancements in vehicle manufacturing, and the push for higher engine efficiency. Moreover, with an increase in awareness regarding vehicle upkeep, more consumers are opting for premium lubricants, enhancing its dominance in the overall application segment.

Competitive Landscape

The Qatar Lubricant Market is characterized by strong competition among a select group of companies. The consolidation in this market highlights the influence of major players who dominate through brand loyalty and extensive distribution networks. Companies such as Qatar Petroleum and Total Lubricants command a significant presence while also driving innovations in lubricant formulations. Their established market position allows them to leverage economies of scale to deliver quality products.

| Company Name | Establishment Year | Headquarters | Product Types Offered | Market Segment Focus | Revenue (approx.) |

| Qatar Petroleum | 1974 | Doha | – | – | – |

| Total Lubricants | 1924 | Doha | – | – | – |

| Qatar Lubricants Company | 2002 | Doha | – | – | – |

| Fuchs Petrolub SE | 1931 | Germany | – | – | – |

| Castrol | 1899 | UK | – | – | – |

Qatar Lubricant Market Analysis

Growth Drivers

Increasing Vehicle Ownership

The increasing vehicle ownership in Qatar is a significant driver for the lubricant market, with registered vehicles reaching approximately 1.6 million in 2023. This surge in vehicle ownership, driven by a growing population and urbanization, is expected to translate into higher demand for engine oils and other lubricants. The Qatar Ministry of Interior reported a year-on-year increase in vehicle registrations, indicating an expanding automotive market. This trend is further supported by government initiatives aimed at enhancing transportation infrastructure, which ultimately leads to a growing need for vehicle maintenance products such as lubricants.

Industrial Growth

Qatar’s industrial growth, particularly in sectors like manufacturing and construction, significantly boosts lubricant demand. The country’s non-oil GDP growth rate was estimated at 4.9% in 2023, as reported by the Qatar Planning and Statistics Authority. This growth in industrial activity correlates with increased machinery and equipment use, thereby driving the need for hydraulic oils, gear oils, and greases. The expansion of Qatar’s National Vision 2030, which encourages diversification of the economy, is also fueling investments in these sectors, leading to greater lubricant consumption across various industrial applications.

Market Challenges

Fluctuations in Raw Material Prices

Volatility in raw material prices poses a significant challenge to the lubricant market in Qatar. The cost of base oils and additives, which constitute about 40-60% of lubricant production costs, can be impacted by global crude oil prices, which averaged around USD 80 per barrel in August 2023 after experiencing fluctuations from USD 60 to USD 90 during the preceding year, according to the US Energy Information Administration. This unpredictability leads to constraints on pricing strategies and profit margins for lubricant manufacturers in Qatar, impacting overall market stability.

Environmental Regulations

Stringent environmental regulations related to emissions and waste management are increasingly challenging the lubricant market in Qatar. Recent initiatives by the Qatar Ministry of Environment aim to reduce harmful emissions from vehicles and industrial machinery, leading to the adoption of stricter specifications for lubricants. The Qatar National Development Strategy emphasizes sustainable environmental practices, which require lubricant companies to innovate in product formulations, ensuring compliance while maintaining efficiency. These regulations may lead to increased operational costs as companies invest in research and development for eco-friendly offerings.

Opportunities

Rise of Bio-lubricants

The growing interest in bio-lubricants presents a substantial opportunity for market growth in Qatar. The global bio-lubricant market was valued at approximately USD 4 billion in 2022, and the demand for environmentally friendly products is increasing due to heightened consumer awareness regarding sustainability. Current initiatives from various organizations and government bodies in Qatar advocate for the adoption of renewable resources, which aligns with the global trend towards bio-lubricants. This movement not only presents an ecological advantage but also offers lubricant manufacturers a chance to diversify their product portfolios and capture emerging market segments.

Technological Advancements

Technological advancements in lubricant formulations and manufacturing processes are paving the way for innovation in the Qatar lubricant market. Enhanced manufacturing techniques such as advanced refining processes and additive technologies result in better product offerings that improve engine efficiency and performance. As the automotive industry evolves, there is a notable trend toward higher mileage intervals and better fuel economy, necessitating the use of advanced lubricants. Companies that focus on developing high-performance synthetic and semi-synthetic lubricants are likely to find lucrative opportunities in this rapidly changing landscape.

Future Outlook

Over the next few years, the Qatar Lubricant Market is anticipated to witness steady growth driven by the automotive sector’s expansion and an increasing focus on sustainability in lubricant formulations. As regulations become stricter concerning vehicle emissions and efficiency, the demand for high-performance synthetic lubricants is expected to surge. Additionally, technological advancements in automotive and industrial machinery will further propel the adoption of advanced lubricant solutions designed to meet evolving market needs.

Major Players

- Qatar Petroleum

- Total Lubricants

- Qatar Lubricants Company

- Fuchs Petrolub SE

- Castrol

- ExxonMobil

- Shell Lubricants

- Gulf Oil

- Abu Dhabi National Oil Company (ADNOC)

- Sinopec

- Valvoline

- BP

- Chevron

- Amsoil

- Lukoil

Key Target Audience

- Automotive Manufacturers

- Industrial Equipment Manufacturers

- Logistics and Transportation Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Qatar Ministry of Energy and Industry, Qatar Investment Authority)

- Oil and Gas Industry Stakeholders

- Retail Distributors and Suppliers

- Automotive Maintenance and Repair Shops

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Lubricant Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Qatar Lubricant Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple lubricant manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar Lubricant Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Trends

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Industrial Growth - Market Challenges

Fluctuations in Raw Material Prices

Environmental Regulations - Opportunities

Rise of Bio-lubricants

Technological Advancements - Trends

Shift Towards Synthetic Lubricants

Increase in Eco-Friendly Products - Government Regulation

Environmental Compliance Standards

Taxation Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Engine Oil

Gear Oil

Hydraulic Oil

Grease

Transmission Fluids - By Application (In Value %)

Automotive

Industrial

Marine

Aerospace

Power Generation - By End-user Industry (In Value %)

OEMs

Aftermarket - By Distribution Channel (In Value %)

Direct Sales

Retail Stores

Online Sales - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Al Khor

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Lubricants Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Product Categories

- Detailed Profiles of Major Companies

Qatar Petroleum

Total Lubricants

Qatar Lubricants Company

Fuchs Petrolub SE

Castrol

ExxonMobil

Shell Lubricants

Gulf Oil

Abu Dhabi National Oil Company (ADNOC)

Sinopec

Valvoline

BP

Chevron

Amsoil

Lukoil

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030