Market Overview

The UAE Electric Vehicle Battery market is valued at USD 720 million in 2024 with an approximated compound annual growth rate (CAGR) of 18.41% from 2024-2030, reflecting the growing demand for electric vehicles and the subsequent requirement for efficient battery solutions. This market is primarily driven by the substantial government support for electric mobility initiatives and the increasing consumer awareness regarding environmental sustainability. The robust investments in charging infrastructure and renewable energy further augment battery demand, enhancing market viability and growth potential.

Dubai and Abu Dhabi dominate the UAE Electric Vehicle Battery market due to their strategic initiatives that promote electric vehicles. Dubai is recognized for its ambitious goals of achieving a significant percentage of electric vehicles in its transport system. Abu Dhabi’s commitment to sustainability, backed by substantial investments in research and development, positions it as a key player. The proactive policies and infrastructural developments in these cities create an attractive landscape for electric vehicle manufacturers and battery producers.

The UAE government has been proactive in promoting electric vehicle adoption through various initiatives and regulations. For instance, the UAE’s National Energy Strategy aims to achieve a 44% share of renewable energy in total energy consumption by 2050, which directly supports the electric vehicle ecosystem. Additionally, the Dubai Green Mobility Initiative encourages the use of eco-friendly vehicles, with a target of having 10% of all cars used in Dubai being electric or hybrid by 2030.

Market Segmentation

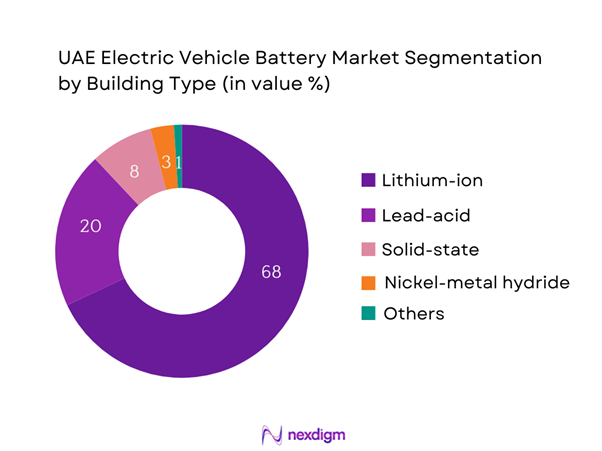

By Battery Type

The UAE Electric Vehicle Battery market is segmented by battery type into lithium-ion, lead-acid, solid-state, nickel-metal hydride, and others. Recently, lithium-ion batteries have a dominant market share in the UAE Electric Vehicle Battery market due to their superior energy density, lightweight nature, and ability to charge quickly. Moreover, advancements in lithium-ion technology continue to enhance battery efficiency and capacity, attracting manufacturers and consumers alike. Leading companies are investing in R&D to further optimize the performance and lifecycle of lithium-ion batteries, solidifying their dominance in the market.

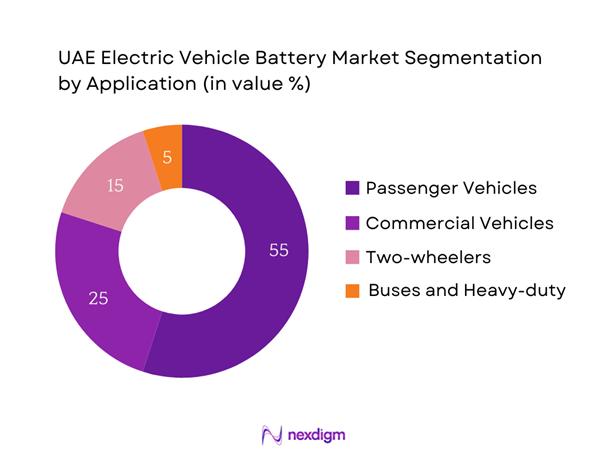

By Application

The market is also segmented based on application into passenger vehicles, commercial vehicles, two-wheelers, and buses and heavy-duty vehicles. Currently, passenger vehicles represent the largest share of the UAE Electric Vehicle Battery market due to the rise of electric SUVs and sedans driven by government incentives. The growing number of electric vehicle models available, along with enhanced performance and affordability, is leading personal consumers to adopt electric vehicles for their low operational costs and sustainability benefits.

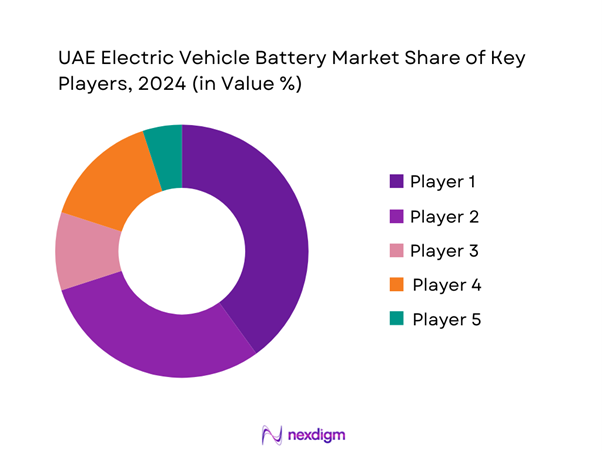

Competitive Landscape

The UAE Electric Vehicle Battery market is characterized by a competitive landscape dominated by a few major players. These companies include local and international manufacturers that influence market dynamics through innovative technologies and partnerships. Leading firms are focusing on sustainability and efficiency, which are critical for gaining market traction in a rapidly evolving environment.

| Company | Establishment Year | Headquarters | Battery Type Focus | Market Strategies | Regional Presence |

| LG Chem | 1947 | South Korea | – | – | – |

| BYD | 1995 | China | – | – | – |

| Tesla | 2003 | USA | – | – | – |

| Panasonic | 1918 | Japan | – | – | – |

| A123 Systems | 2001 | USA | – | – | – |

UAE Electric Vehicle Battery Market Analysis

Growth Drivers

Rising Demand for Electric Vehicles

The demand for electric vehicles in the UAE is escalating, driven by various factors, including environmental awareness and favorable financing options. As of 2024, the employment rate in the UAE is projected to hit around 94.5%, significantly impacting consumer spending power and, consequently, the demand for electric vehicles. The increasing oil prices are prompting consumers to shift towards more fuel-efficient and eco-friendly alternatives. Furthermore, over 2,000 electric charging stations are available in the UAE as of now, indicating robust infrastructure development that supports the growing electric vehicle market. This infrastructure directly influences consumer choices favorably towards electric vehicles.

Technological Advancements

Technological advancements are a critical factor in the growth of the electric vehicle battery market in the UAE. Innovations in battery technology, particularly lithium-ion batteries, have resulted in enhanced energy densities that promote longer vehicle ranges. The operational efficiency of electric vehicles has improved, with battery life extending up to 500 km on a single charge recently. Research indicates that the energy density of lithium-ion batteries has risen to approximately 250 Wh/kg, significantly impacting vehicle design and performance. This progression in technology facilitates increased consumer acceptance and contributes to the growth of electric vehicle adoption in the UAE.

Market Challenges

High Manufacturing Costs

Manufacturing costs in the electric vehicle battery sector present significant challenges for market players. The prices of critical raw materials like lithium, nickel, and cobalt have risen dramatically, with lithium prices reaching around USD 78,000 per ton, highlighting the volatile nature of raw material supply chains. These increases put pressure on manufacturers to maintain competitive pricing while ensuring profitability. Additionally, the installation of state-of-the-art production facilities involves high capital investment, making the entry barrier steep for new companies, as existing players invest heavily in technology to enhance production efficiency.

Supply Chain Disruptions

Supply chain disruptions have been prevalent in the electric vehicle battery sector, impacting the timely availability of components. The pandemic highlighted vulnerabilities in global supply chains, with many manufacturers reporting delays in the sourcing of raw materials essential for battery production. The conflict in key mining regions and geopolitical tensions have contributed to inconsistencies in supply chains. Reports indicate a shortfall of up to 50% in lithium supply compared to demand, causing delays in battery production timelines, directly affecting electric vehicle availability in the market. Such disruptions necessitate that manufacturers diversify their supplier bases and develop local production capabilities.

Opportunities

Growing Charging Infrastructure

The proliferation of electric vehicle charging infrastructure in the UAE signifies a robust opportunity for market growth. As of the latest data, the UAE has over 2,000 charging stations, among which fast chargers constitute about 50%, providing convenient access for EV users. The government plans to expand this infrastructure as part of its Green Mobility initiative, which encourages investments in sustainable mobility solutions. The growing network of charging outlets not only enhances the attractiveness of electric vehicles but also encourages more consumers to transition from traditional combustion engines. This infrastructural enhancement indicates a future alignment towards electric mobility and battery reliance.

Battery Recycling Initiatives

Sustainable practices surrounding battery recycling are gaining momentum in the UAE, offering significant future growth potential. The country is actively pursuing a circular economy approach, with initiatives focusing on the lifecycle of batteries to minimize waste and promote recycling. Currently, the UAE produces approximately 80,000 tons of waste batteries annually, prompting the government to invest in advanced recycling technologies to reclaim valuable materials. With advancements in battery recycling methods starting to emerge, such as hydrometallurgical processes, this sector is expected to grow, providing market players with opportunities to tap into reclaimed materials, reducing dependency on raw material imports.

Future Outlook

Over the next five years, the UAE Electric Vehicle Battery market is expected to witness significant growth driven by continuous governmental support, advancements in electrical vehicle technology, and increasing consumer demand for eco-friendly transportation solutions. As sustainability becomes a focal point for urban planning and development in the UAE, we anticipate an influx of innovations that will enhance battery performance and safety. Furthermore, as manufacturers leverage cleaner energy sources for battery production, overall market dynamics will shift favorably towards sustainable practices.

Major Players

- LG Chem

- BYD

- Tesla

- Panasonic

- A123 Systems

- CATL

- Samsung SDI

- Energizer Holdings

- Northvolt

- Farasis Energy

- EVE Energy Co.

- Toshiba

- Vehicle Energy Japan

- Amperex Technology Co. Ltd. (ATL)

- Hitachi Chemical

Key Target Audience

- Electric Vehicle Manufacturers

- Automotive OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Energy and Infrastructure, Emirates Authority for Standardization and Metrology)

- Battery Technology Developers

- Charging Infrastructure Providers

- Retailers and Distributors of Electric Vehicles

- Logistics and Transportation Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE Electric Vehicle Battery market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the UAE Electric Vehicle Battery market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. An evaluation of service quality statistics will also be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple electric vehicle battery manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the UAE Electric Vehicle Battery market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview and Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives and Regulations

Rising Demand for Electric Vehicles

Technological Advancements - Market Challenges

High Manufacturing Costs

Supply Chain Disruptions - Opportunities

Growing Charging Infrastructure

Battery Recycling Initiatives - Trends

Shift Towards Sustainable Energy Solutions

Enhanced Energy Density Technologies - Government Regulation

Import Tariffs and Duties

Environmental Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Battery Type (In Value %)

Lithium-ion Batteries

Lead-acid Batteries

Solid-state Batteries

Nickel-metal Hydride Batteries

Others - By Application (In Value %)

Passenger Vehicles

Commercial Vehicles

Two-wheelers

Bus and Heavy-duty Vehicles - By End-User (In Value %)

Original Equipment Manufacturers (OEMs)

Aftermarket - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Retail - By Region (In Value %)

Northern Emirates

Abu Dhabi

Dubai

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Battery Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

LG Chem

BYD

Panasonic

CATL

Samsung SDI

A123 Systems

Toshiba

Hitachi Chemical

OXIS Energy

Energizer Holdings

Vehicle Energy Japan

EVE Energy Co.

Amperex Technology Co. Ltd. (ATL)

Farasis Energy

Northvolt

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030