Market Overview

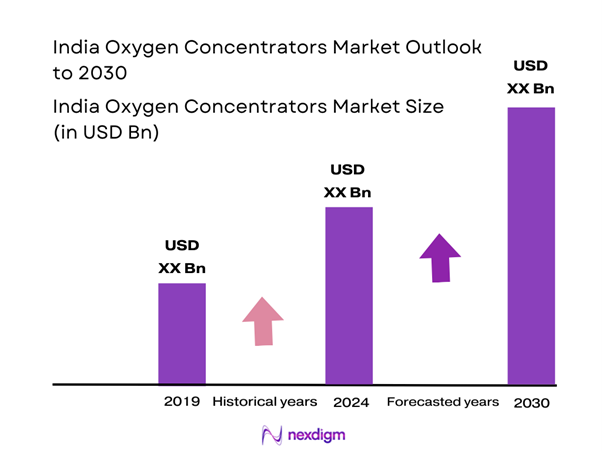

The India Oxygen Concentrators Market is valued at USD 128.45 million in 2024 with an approximated compound annual growth rate (CAGR) of 0.41% from 2024-2030 and is backed by increasing demand due to a surge in respiratory ailments, particularly in light of the COVID-19 pandemic. The growing aging population and a rise in health awareness among consumers are key contributors to the market’s growth.

Key cities dominating the India Oxygen Concentrators Market include Mumbai, Delhi, and Bangalore. These urban centers are witnesses to significant healthcare infrastructure development and have a higher prevalence of respiratory conditions due to pollution. Furthermore, hospitals and healthcare facilities in these cities have increasingly adopted advanced medical technologies, making them crucial hubs for oxygen concentrator usage. The concentration of larger hospitals, healthcare providers, and better accessibility to advanced medical equipment are pivotal in driving market growth in these cities.

Recent advancements in medical technology have played a vital role in enhancing the functionality and accessibility of oxygen concentrators. As of 2023, the introduction of smart portable oxygen concentrators that integrate battery life management and mobile app connectivity has revolutionized the user experience. The Indian healthcare sector invests approximately INR 2,000 crore annually in medical devices, and this investment is predicted to rise due to rapid technological innovations.

Market Segmentation

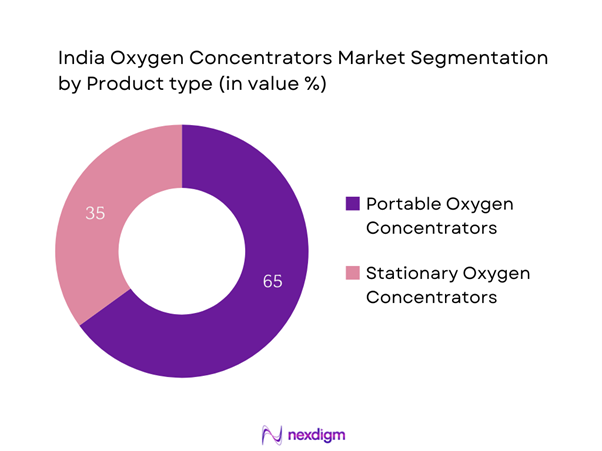

By Product Type

The India Oxygen Concentrators Market is segmented by product type into portable oxygen concentrators and stationary oxygen concentrators. The portable oxygen concentrator segment holds a dominant market share due to increasing demand from homecare services and patients requiring mobility. Portable units offer ease of use and accessibility, making them a preferred choice for consumers who seek a higher level of convenience and mobility while managing their respiratory conditions.

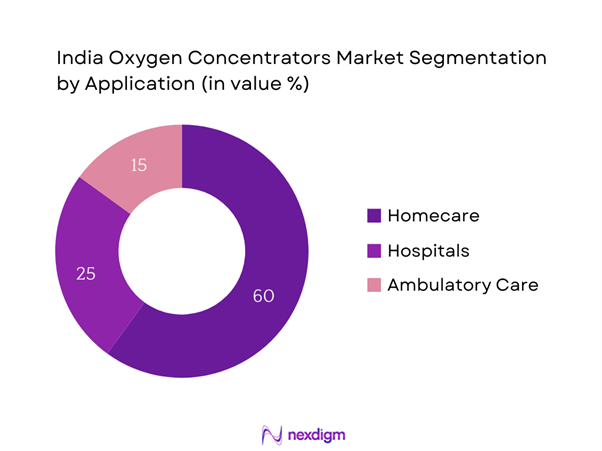

By Application

The market is also segmented by application into homecare, hospitals, and ambulatory care. Homecare applications dominate the market due to the rising trend of managing chronic conditions at home, making oxygen therapy more accessible and affordable for patients. Moreover, during the pandemic, more patients opted for home-based healthcare solutions, significantly boosting demand for oxygen concentrators in this segment.

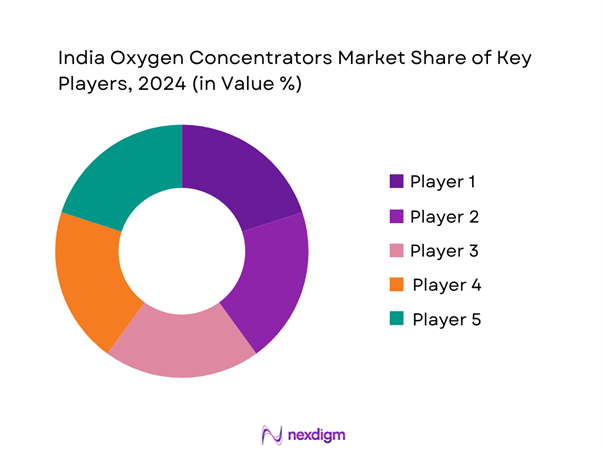

Competitive Landscape

The India Oxygen Concentrators Market is dominated by several major players, including both local and global companies. This competitive landscape emphasizes the importance of technological advancement and strong distribution networks in maintaining market presence. Key companies include Philips Healthcare, ResMed, and OxyGo, among others. The consolidation of such significant players in the industry enhances competitive dynamics, with various innovations leading the charge in market growth and expansion.

| Company Name | Establishment Year | Headquarters | Market Share | Product Range | Distribution Channels | Sales Strategy |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

| ResMed | 1989 | San Diego, USA | – | – | – | – |

| OxyGo | 2011 | Denver, USA | – | – | – | – |

| Inogen | 2001 | Goleta, USA | – | – | – | – |

| Caire Inc. | 2013 | Ball Ground, USA | – | – | – | – |

India Oxygen Concentrators Market Analysis

Growth Drivers

Rising Respiratory Disorders

The growing incidence of respiratory disorders is notably influencing the demand for oxygen concentrators in India. As per the World Health Organization, in 2022, approximately 8.6 million people died due to respiratory diseases globally, with India contributing significantly to this statistic. Chronic respiratory diseases, including Chronic Obstructive Pulmonary Disease (COPD) and asthma, affect about 15% of the urban population in India. Furthermore, the Global Burden of Disease Study has established that India reported 11.6 million disability-adjusted life years (DALYs) lost due to respiratory ailments in the same year. The rising health concerns and need for respiratory support are driving the growing adoption of oxygen concentrators.

Increased Prevalence of COVID-19

The COVID-19 pandemic has significantly impacted the India Oxygen Concentrators Market, leading to a surge in the need for respiratory support devices. In 2021, India faced a severe COVID-19 wave, accounting for over 500,000 deaths, which heightened awareness regarding respiratory health. The Ministry of Health and Family Welfare reported that over 30 million cases of COVID-19 were confirmed in India, resulting in a substantial demand for oxygen therapy. With respiratory complications being a significant outcome of severe infections, the increased focus on respiratory care has made oxygen concentrators crucial in healthcare systems.

Market Challenges

High Product Cost

The high cost of oxygen concentrators poses significant challenges to widespread adoption, especially in low and middle-income households. Typical prices for these devices range from INR 50,000 to INR 1,00,000, which is prohibitively expensive for many families given a vast portion of India’s population lives on less than INR 27 per day. Furthermore, the average healthcare expenditure accounted for only 3.5% of GDP in India in 2022, limiting access to medical devices. These economic factors contribute to slower market penetration and limit the availability of oxygen concentrators regionally.

Regulatory Challenges

Regulatory hurdles have been a significant obstacle for manufacturers and suppliers in the oxygen concentrators market. Compliance with rigorous clinical testing and quality assurance standards set forth by the Central Drugs Standard Control Organization (CDSCO) can delay product launches significantly. Moreover, India’s regulatory landscape is complex, with multiple government bodies involved in approvals, often leading to lengthy processes. In 2022, only 144 of the 247 domestic and international medical device manufacturers registered their products efficiently due to such challenges, impacting the availability of essential healthcare devices like oxygen concentrators.

Opportunities

Growing Demand in Home Healthcare

The demand for home healthcare solutions, particularly oxygen therapy, is rapidly increasing, driven by a shift in patient care preferences. As of 2023, nearly 75% of patients with chronic respiratory diseases preferred receiving treatment at home, as reported by the Indian Academy of Sciences. This trend is reinforced by government policies promoting health at home, emphasizing the need for high-quality home care solutions. With an estimated 65 million people suffering from chronic respiratory diseases, the growing inclination towards home healthcare represents a lucrative opportunity for oxygen concentrator manufacturers to expand their reach and offer tailored solutions.

Innovations in Product Design

Innovations in product design are expected to create significant opportunities for manufacturers within the India Oxygen Concentrators Market. The introduction of lightweight and portable concentrators alongside user-friendly interfaces appeals to a wide range of consumers seeking flexibility. The growing interest in personalized healthcare devices further underscores the opportunities for manufacturers to innovate and capture market share effectively.

Future Outlook

Over the next several years, the India Oxygen Concentrators Market is projected to experience substantial growth due to ongoing advancements in healthcare technologies, increasing awareness of respiratory ailments, and the continuous rise of home healthcare services. Additionally, government initiatives aimed at improving healthcare access and technological development in medical devices will further accelerate market expansion.

Major Players

- Philips Healthcare

- ResMed

- OxyGo

- Inogen

- Caire Inc.

- DeVilbiss Healthcare

- Maxx Oxygen

- AirSep Corporation

- Nidek Medical Products

- Longfian Scitech Co.

- AEROS Medical

- Breathe Technologies

- Yuyue Medical

- Innovation Health

- Amcare

Key Target Audience

- Hospitals and Healthcare Providers

- Home Healthcare Service Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (DIPC, CDSCO)

- Pharmaceutical Companies

- Medical Device Distributors

- Respiratory Therapy Practices

- Rehabilitation Centers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive map of stakeholders within the India Oxygen Concentrators Market. This is achieved through extensive desk research, utilizing a combination of secondary and proprietary databases. The primary objective is to identify and define the critical influencing variables across the market landscape.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Oxygen Concentrators Market is compiled and analyzed. This includes evaluating market penetration rates, the ratio of medical devices to healthcare facilities, and the resultant revenue generation influences. An assessment of quality statistics helps ensure the reliability and accuracy of revenue estimates, establishing a solid basis for market predictions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts from various companies within the oxygen concentrator ecosystem. This process gathers valuable operational and financial insights directly from practitioners, enabling the refinement and corroboration of the market data, ensuring it reflects real-world dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple key players in the oxygen concentrators sector to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction not only validates the statistics derived from the previous steps but also provides a comprehensive, accurate, and validated analysis of the India Oxygen Concentrators Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Respiratory Disorders

Increased Prevalence of COVID-19

Technological Advancements - Market Challenges

High Product Cost

Regulatory Challenges - Opportunities

Growing Demand in Home Healthcare

Innovations in Product Design - Trends

Increased Adoption of Telehealth

Shift towards Portable Devices - Government Regulation

Licensing and Compliance

Quality Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Portable Oxygen Concentrators

Stationary Oxygen Concentrators - By Application (In Value %)

Homecare

Hospitals

Ambulatory Care - By Distribution Channel (In Value %)

Online Sales

Retail Pharmacies

Hospitals - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Continuous Flow

Pulse Dose

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Philips Healthcare

ResMed

OxyGo

Inogen

Caire Inc.

DeVilbiss Healthcare

Amcare

Breathe Technologies

Yuyue Medical

Nidek Medical Products

Maxx Oxygen

AirSep Corporation

Innovation Health

AEROS Medical

Longfian Scitech Co.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030