Market Overview

The Australia Medical Supplies Market is valued at USD 7.4 billion in 2024, based on comprehensive industry analyses. The driving factors for this market include the increasing demand for advanced healthcare solutions and the growing burden of chronic diseases that necessitate innovative medical supplies. According to a report by IBISWorld, this market is expected to see steady growth, stemming from continuous technological advancements and a shift towards outpatient care, influencing product innovation and distribution channels.

Dominance in the Australia Medical Supplies Market is primarily observed in major cities such as Sydney, Melbourne, and Brisbane. These cities are home to a significant concentration of healthcare facilities, research institutions, and medical technology companies, fostering a collaborative environment for innovation. The presence of leading medical universities and research centers also drives demand, contributing to the market’s robust growth trajectory.

Australia’s healthcare expenditure has seen a considerable increase, projected to reach AUD 224 billion by end of 2025, reflecting a growing commitment to maintaining health standards and improving public health outcomes. Increased government funding and individual expenditure are facilitating greater access to medical supplies. Notably, the Australian government’s Health Care Business Investment Fund is designed to stimulate innovative business models in healthcare, further emphasizing the role of financial support in driving expenditure on medical supplies.

Market Segmentation

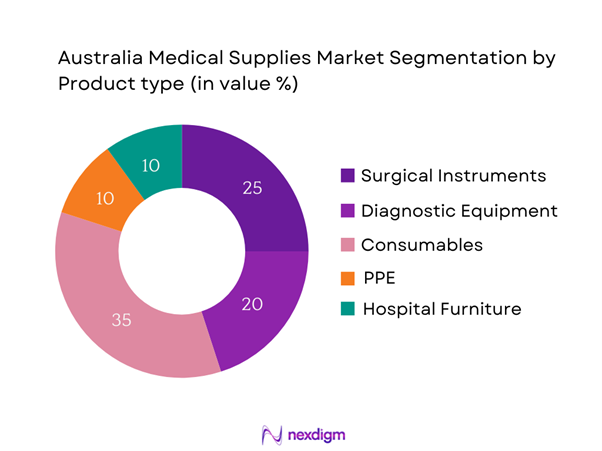

By Product Type

The Australia Medical Supplies Market is segmented by product type into surgical instruments, diagnostic equipment, consumables, personal protective equipment (PPE), and hospital furniture. The consumables sub-segment holds a dominant market share due to the rising demand for disposable items, particularly in hospitals and clinics where hygiene and safety are paramount. The convenience of usage and the compliance with infection control protocols have made consumables crucial in a healthcare setting. Key players actively invest in expanding their consumables product line, ensuring a consistent supply to meet the soaring healthcare demands.

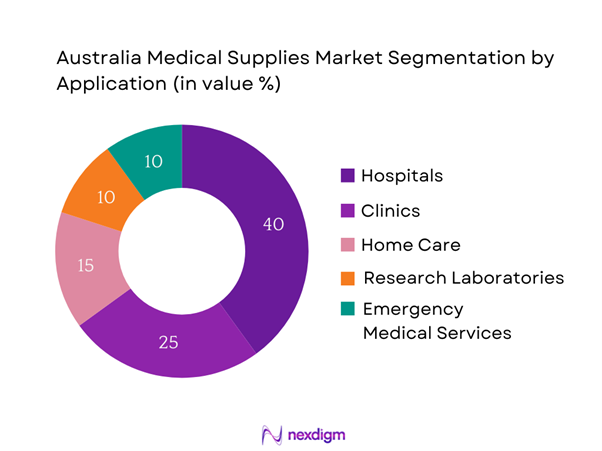

By Application

The market is also segmented by application, which includes hospitals, clinics, home care, research laboratories, and emergency medical services. Hospitals are the leading application segment due to the high volume of medical procedures requiring advanced medical supplies. The increasing patient influx and demand for innovative treatment options drive hospitals to adopt cutting-edge medical technologies. Furthermore, significant investments in healthcare infrastructure and technological upgrades within hospitals continue to support this segment’s growth.

Competitive Landscape

The Australia Medical Supplies Market is dominated by several key players, including global leaders and local entities. The competitive landscape is characterized by the presence of established companies that dominate through extensive product portfolios and innovation capabilities. The consolidation of major manufacturers ensures a diverse offering of medical solutions, ranging from surgical instruments to advanced diagnostic equipment. This focus on technological advancement and market expansion highlights the intrinsic competitive dynamics shaping the industry.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Range | R&D Investment | Global Presence |

| CSL Limited | 1991 | Parkville, Australia | – | – | – | – |

| Ramsay Health Care | 1964 | St Leonards, Australia | – | – | – | – |

| Cochlear Limited | 1981 | Sydney, Australia | – | – | – | – |

| ResMed | 1989 | Bella Vista, Australia | – | – | – | – |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

Australia Medical Supplies Market Analysis

Growth Drivers

Aging Population

Australia’s aging population is a significant driver of the medical supplies market, as individuals aged 65 and older are projected to account for 23% of the total population by end of 2025. This demographic shift correlates with an increased demand for medical supplies, given that older adults typically require more healthcare interventions and chronic disease management. The population of seniors is expected to reach approximately 6.3 million, creating a substantial need for medical intervention products to support conditions prevalent in older age, such as diabetes and cardiovascular diseases. This growing segment underscores the importance of expanding medical supply offerings tailored to senior care needs.

Technological Advancements

The continuous advancement in medical technology plays a pivotal role in transforming the medical supplies landscape in Australia. In 2022, Australia invested approximately AUD 1.3 billion in health-related research and development, indicating a commitment to innovation in medical technology. Breakthroughs such as minimally invasive surgical techniques, telehealth platforms, and connected medical devices are enhancing clinical outcomes and operational efficiencies. As healthcare providers increasingly adopt these technologies, there is a direct correlation with the rising demand for sophisticated medical supplies designed to complement and facilitate these innovations, positioning the market favorably for sustained growth.

Market Challenges

Regulatory Hurdles

The Australian medical supplies market faces stringent regulatory requirements that can create barriers to entry for new products and companies. The Therapeutic Goods Administration (TGA) oversees the regulation of medical devices and supplies and has implemented rigorous compliance measures to ensure the safety and effectiveness of medical products. In 2022, the TGA reviewed over 12,000 medical devices, which highlights the complexity and depth of the evaluation process. These regulatory hurdles can lead to delays in product launch and increased costs, presenting a significant challenge for innovators within the medical supplies space.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge for the medical supplies market, particularly in the wake of global events such as the COVID-19 pandemic. In 2023, 65% of Australian medical suppliers reported facing delays in product delivery and disruptions affecting raw material availability. The reliance on international suppliers often complicates logistics, leading to shortages and increased costs. With growing dependence on just-in-time inventory systems, these disruptions can severely impact healthcare delivery, highlighting the urgent need for robust supply chain management strategies in the medical supplies sector.

Opportunities

Telemedicine Growth

The rapid adoption of telemedicine solutions presents significant opportunities for the medical supplies market in Australia. In 2022, about 30% of consultations in Australia were conducted via telehealth, an increase necessitating the integration of remote monitoring devices and other medical supplies that facilitate virtual patient care. The Australian government has invested significantly in telehealth infrastructure, allocating AUD 20 million for telehealth initiatives in response to the health challenges posed by the pandemic. This growth trajectory in telemedicine highlights an expanding market for medical supplies geared toward remote patient management and monitoring systems, positioning stakeholders to capitalize on this trend.

Emerging Markets

The emergence of new healthcare markets presents a promising avenue for growth within the Australia Medical Supplies Market. As Australia expands its role as a medical supplies exporter, associated industries in the Asia-Pacific region are experiencing rapid development. For instance, Australia’s health exports reached AUD 9 billion in 2022, indicating significant interest in Australian medical technologies in emerging markets. With strengthening trade partnerships and collaborative healthcare projects, Australian companies can leverage existing capabilities to meet rising demands for medical supplies in neighboring countries, providing opportunities for market expansion and investment in new markets.

Future Outlook

Over the next five years, the Australia Medical Supplies Market is poised for significant growth, driven by technological advancements, an aging population, and increasing healthcare expenditure. The ongoing trend towards telehealth and outpatient services is expected to fuel the demand for innovative medical solutions, thus enhancing market dynamics. Furthermore, government initiatives to strengthen healthcare infrastructure will create a favorable environment for both local and international players in the medical supplies sector.

Major Players

- CSL Limited

- Ramsay Health Care

- Cochlear Limited

- ResMed

- Philips Healthcare

- McKesson Australia

- Johnson & Johnson Medical

- Braun Australia

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific

- GE Healthcare

- Baxter International

- Cardinal Health

- Stryker Corporation

Key Target Audience

- Hospitals and Healthcare Providers

- Medical Supply Distributors

- Pharmaceutical Companies

- Private Clinics and Healthcare Practitioners

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Australian Therapeutic Goods Administration, Department of Health)

- Health Insurance Providers

- Research and Development Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the Australia Medical Supplies Market. This step incorporates extensive desk research, utilizing a combination of secondary and proprietary databases to gather detailed industry-level information. The primary goal is to identify and define the critical variables influencing market dynamics, including trends, consumer behaviors, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Australia Medical Supplies Market will be compiled and analyzed. This involves assessing market penetration rates, the balance between marketplaces and service providers, and the resulting revenue generation. An evaluation of service quality metrics will also be conducted to ensure the accuracy and reliability of revenue estimates, providing a solid foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts. These experts, representing a diverse array of companies across the medical supplies sector, will provide valuable operational and financial insights. Their perspectives will be instrumental in refining the market data and ensuring that the analysis aligns with real-world conditions.

Step 4: Research Synthesis and Final Output

The final phase involves active engagement with multiple medical supplies manufacturers to acquire in-depth insights into product segments, sales performance, consumer preferences, and other critical factors. This interaction will serve to verify and complement the statistics derived from the bottom-up methodological approach, ensuring a comprehensive, accurate, and validated analysis of the Australia Medical Supplies Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Aging Population

Technological Advancements

Rising Health Expenditure - Market Challenges

Regulatory Hurdles

Supply Chain Disruptions - Opportunities

Telemedicine Growth

Emerging Markets - Trends

Digital Health Innovations

Sustainability in Medical Supplies - Government Regulation

- SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Surgical Instruments

Diagnostic Equipment

Consumables

Personal Protective Equipment (PPE)

Hospital Furniture - By Application (In Value %)

Hospitals

Clinics

Home Care

Research Laboratories

Emergency Medical Services - By Distribution Channel (In Value %)

Direct Sales

Wholesalers/Distributors

Online Retail

Medical Supply Stores - By Region (In Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia - By End User (In Value %)

Public Sector

Private Sector

Nonprofit Organizations

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Regulatory Compliance & Quality Standards, Supply Chain Efficiency, Research & Development (R&D) Investment, Customer Reviews and Satisfaction, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

CSL Limited

Ramsay Health Care

Cochlear Limited

ResMed

Sonic Healthcare

HCA Healthcare Australia

Philips Healthcare

McKesson Australia

Cardinal Health

GE Healthcare

Baxter International

Siemens Healthineers

Johnson & Johnson Medical

B. Braun Australia

Thermo Fisher Scientific

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030