Market Overview

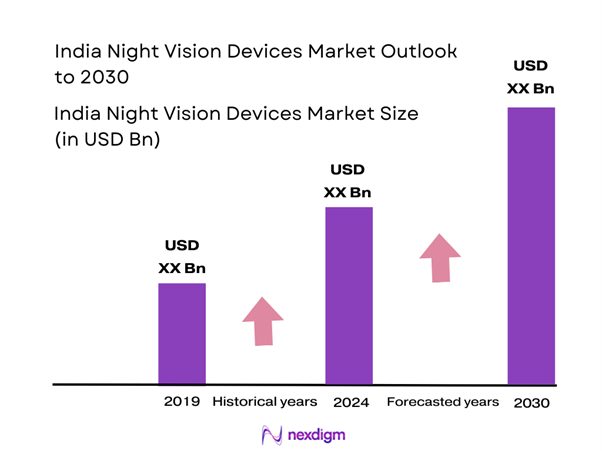

The India Night Vision Devices Market is valued at USD 218 million in 2024 with an approximated compound annual growth rate (CAGR) of 10.2% from 2024-2030, demonstrating robust growth driven by increasing security concerns and rising demand for advanced military technology. The market size is underscored by government initiatives focusing on defense and surveillance capabilities, with a particular increase in spending on night vision technologies. This rapid development is a reflection of the market’s expansion due to advancements in infrared and digital technologies.

Key cities such as Delhi, Mumbai, and Bangalore dominate the India Night Vision Devices Market due to their significant defense establishments and technological hubs. These metropolitan areas serve as the centers for research and development, manufacturing, and distribution, allowing for better logistics and accessibility. Additionally, the presence of major security firms and military bases in these regions further contributes to their dominance in the market.

The Indian government’s stringent import and export regulations for defense technologies significantly impact the night vision devices market. Effective from 2022, the Ministry of Defense has implemented a more rigorous scrutiny process for the import of dual-use technologies, which includes night vision devices. In 2023, over 50% of the military-related imports were subject to new compliance measures, resulting in delays and increased costs for companies looking to access advanced technologies from international markets.

Market Segmentation

By Product Type

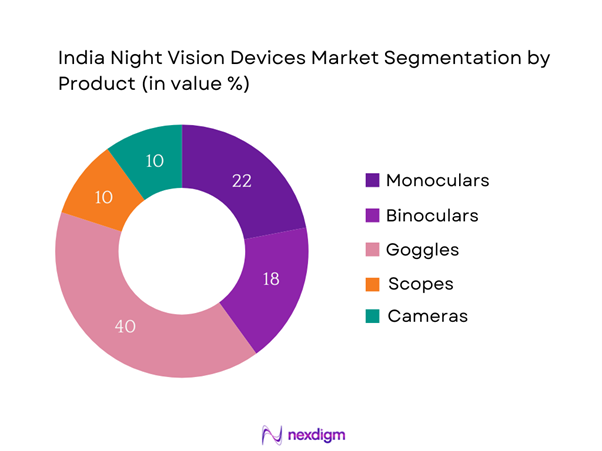

The India Night Vision Devices Market is segmented by product type into monoculars, binoculars, goggles, scopes, and cameras. Among these, goggles have established a dominant market share primarily due to their versatile applications in various sectors, including military, law enforcement, and recreational uses. The increasing need for hands-free operations and enhanced situational awareness has propelled the popularity of night vision goggles, particularly in military and security operations. Prominent brands in this space continuously innovate, offering lightweight and compact designs, thereby further solidifying the demand for this sub-segment.

By Technology

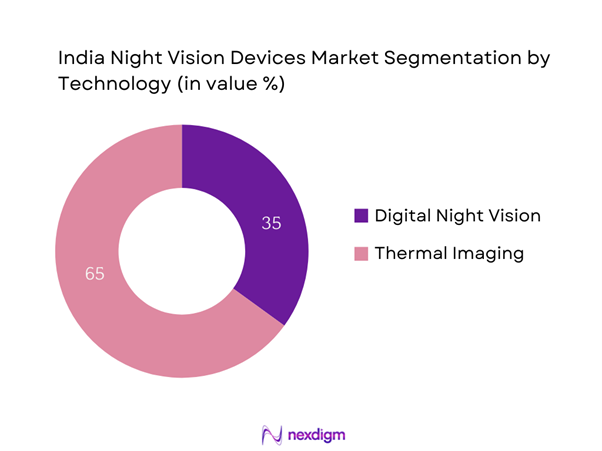

The market is also segmented by technology into digital night vision and thermal imaging. Thermal imaging, in particular, has emerged as the leading technology due to its ability to detect heat signatures, making it highly effective for nocturnal surveillance and various application ranges. Its applicability in search and rescue missions, wildlife observation, and security systems has heightened demand. Moreover, advancements in thermal imaging technology, including improved resolution and compactness, have further facilitated its growth, thereby fortifying its dominant position within the market.

Competitive Landscape

The India Night Vision Devices Market is dominated by a few major players, including both local and global manufacturers specializing in innovative night vision technologies. This consolidation underscores the significant influence of these key companies, which maintain strong competitive positions due to their robust product offerings and strategic partnerships.

| Company | Establishment Year | Headquarters | R&D Investment | Product Range | Key Partnerships | Market Focus |

| FLIR Systems | 1978 | Oregon, USA | – | – | – | – |

| ATN Corporation | 1995 | California, USA | – | – | – | – |

| BAE Systems | 1999 | London, UK | – | – | – | – |

| L3Harris Technologies | 2019 | Florida, USA | – | – | – | – |

| Night Owl Optics | 1993 | California, USA | – | – | – | – |

India Night Vision Devices Market Analysis

Growth Drivers

Increasing Defense Expenditure

India’s defense expenditure has been steadily increasing, with the allocated budget for defense exceeding USD 75 billion in 2024, marking a 10% increase from the previous year. This surge in spending reflects the government’s commitment to enhancing national security capabilities, which includes substantial investments in advanced technologies such as night vision devices. The focus on modernizing military equipment aligns with the global trend of rising defense budgets, which reached approximately USD 2 trillion globally in 2023, driven by geopolitical tensions. This increased defense expenditure serves as a robust driver for growth in the night vision devices market.

Rising Demand in Civil Security

The demand for night vision devices in civil security is driven by increasing crime rates and the need for enhanced surveillance. India witnessed a 6% rise in crime rates in urban areas in 2022, prompting higher security investments. In response, various state governments have strengthened community policing and surveillance programs, leading to an increased adoption of advanced surveillance technologies, including night vision. As a result, public spending on safety and security initiatives is projected to exceed USD 10 billion in 2024, creating substantial opportunities for the night vision devices market.

Market Challenges

High Costs of Advanced Technologies

The integration of cutting-edge technologies in night vision devices presents a significant challenge due to their high costs, with advanced thermal imaging systems priced upwards of USD 5,000. Economic conditions in India, including an inflation rate projected to reach 5.5% in 2024, directly impact consumers’ purchasing power and government budgets. Consequently, organizations and consumers may be reluctant to invest in expensive advanced technologies, potentially stifling growth within the night vision devices market. This economic strain can inhibit wider adoption, especially in smaller sectors of the market.

Regulatory Compliance

Compliance with stringent regulatory standards and quality assurance protocols poses a challenge for manufacturers in the night vision devices market. The Bureau of Indian Standards (BIS) mandates compliance with specifications outlined under the Electronics and Information Technology Act, 2000, leading to additional costs for manufacturers and potentially delaying product launches. As of 2024, compliance can take up to 18 months for certain technologies, which can be a barrier to entry for new players. With an increasingly competitive market, these regulatory hurdles may inhibit innovation and market evolution.

Opportunities

Technological Advancements

The current technological advancements in night vision devices present significant opportunities for market growth. Innovations such as the development of compact thermal imaging sensors due to a reduction in manufacturing costs have made these devices more accessible. In 2023, the global market for thermal imaging was approximately USD 6.48 billion, driven by innovations that allow for efficient heat detection and user-friendly applications in law enforcement and security sectors. This trend indicates a favorable environment for innovation, presenting opportunities for Indian manufacturers to enhance product offerings in the night vision segment.

Increasing Use in Recreational Activities

There has been a noticeable increase in demand for night vision devices for recreational activities such as wildlife observation and camping. With India’s domestic tourism revenue reaching USD 100 billion in 2023 and expected to continue growing, more outdoor enthusiasts are investing in high-quality night vision equipment. The emphasis on nighttime wildlife safaris, particularly in national parks such as Jim Corbett, is stimulating demand in the consumer market segment. This growing trend signals a distinct opportunity for market expansion and showcases the diversification of applications for night vision technologies.

Future Outlook

Over the next five years, the India Night Vision Devices Market is expected to witness substantial growth driven by increasing government investments in defense and security, advancements in night vision technology, and rising consumer demand for high-quality surveillance solutions. The burgeoning trend toward enhanced security measures across various sectors, combined with the integration of smart technologies in night vision devices, will further propel market advancements.

Major Players

- FLIR Systems

- ATN Corporation

- BAE Systems

- L3Harris Technologies

- Night Owl Optics

- Sightmark

- Yukon Advanced Optics Worldwide

- Leupold & Stevens

- Vortex Optics

- Pulsar

- Armasight

- Insight Technology

- AGM Global Vision

- Infrared Solutions

- Hikvision

Key Target Audience

- Defense and Military Agencies (Ministry of Defense, Indian Army)

- Law Enforcement Agencies (Central Reserve Police Force, State Police Departments)

- Outdoor Enthusiasts and Wildlife Observers

- Security Service Providers

- Government and Regulatory Bodies (Ministry of Home Affairs, BIS)

- Investments and Venture Capitalist Firms

- Manufacturers of Optical Devices

- Distributors and Suppliers of Night Vision Equipment

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Night Vision Devices Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Night Vision Devices Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple night vision device manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Night Vision Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Defense Expenditure

Rising Demand in Civil Security - Market Challenges

High Costs of Advanced Technologies

Regulatory Compliance - Opportunities

Technological Advancements

Increasing Use in Recreational Activities - Trends

Miniaturization of Devices

Integration with Smart Technologies - Government Regulation

Import and Export Regulations

Safety and Quality Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Monoculars

Binoculars

Goggles

Scopes

Cameras - By Technology (In Value %)

Digital Night Vision

Thermal Imaging - By Application (In Value %)

Defense & Military

Industrial

Law Enforcement

Outdoor and Wildlife Observation

Security & Surveillance - By Distribution Channel (In Value %)

Online Retail

Offline Retail - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

FLIR Systems

ATN Corporation

BAE Systems

L3Harris Technologies

Night Owl Optics

Sightmark

Yukon Advanced Optics Worldwide

Leupold & Stevens

Vortex Optics

Pulsar

Armasight

Insight Technology

AGM Global Vision

Infrared Solutions

Hikvision

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030