Market Overview

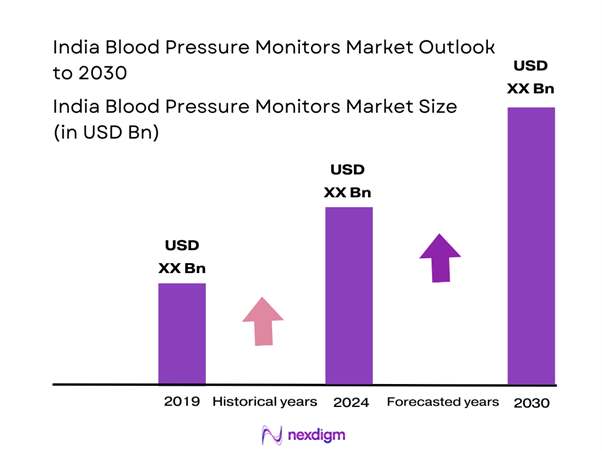

The India Blood Pressure Monitors Market is valued at USD 181.6 million in 2024 with an approximated compound annual growth rate (CAGR) of 13% from 2024-2030, supported by a growing population increasingly aware of health management and hypertension concerns. The demand for effective monitoring solutions for cardiovascular health is driven by a substantial rise in lifestyle-related diseases and government initiatives promoting preventive healthcare. The market is projected to reach USD 1.5 billion, reflecting a commitment to enhancing healthcare accessibility and technology integration.

Cities such as Mumbai, Delhi, and Bengaluru dominate the blood pressure monitor market due to their advanced healthcare infrastructure and urbanization trends. Mumbai, as the financial capital, enjoys significant investments in healthcare, while Delhi and Bengaluru boast large populations actively seeking reliable and user-friendly medical devices. These cities are also home to many healthcare providers and distributors, which support extensive reach and availability of blood pressure monitoring devices.

Health awareness campaigns initiated by the Government of India and various NGOs are boosting awareness about the importance of monitoring blood pressure. Initiatives such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) emphasize regular health check-ups and screenings for chronic diseases.

Market Segmentation

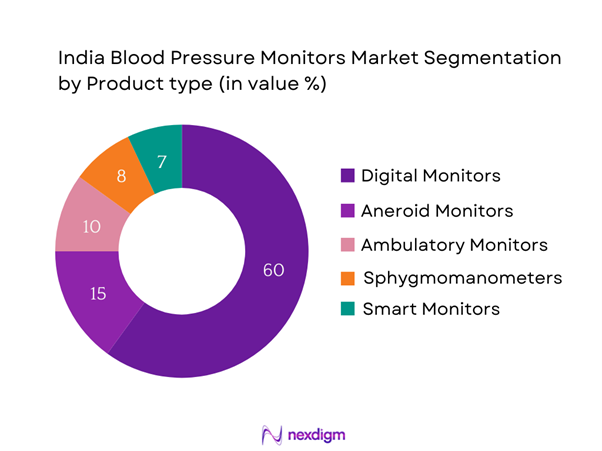

By Product Type

The India Blood Pressure Monitors Market is segmented by product type into digital monitors, aneroid monitors, ambulatory monitors, sphygmomanometers, and smart monitors. Among these, digital monitors are currently dominating the market share. Their ease of use, accuracy, and quick readings make them highly preferred options for both healthcare professionals and consumers. The technological advancements cater to consumer demands for smart features, such as Bluetooth connectivity and mobile app compatibility, enhancing user experience and allowing for better long-term health monitoring. Digital monitors provide real-time data tracking, essential for managing blood pressure effectively, further driving their popularity.

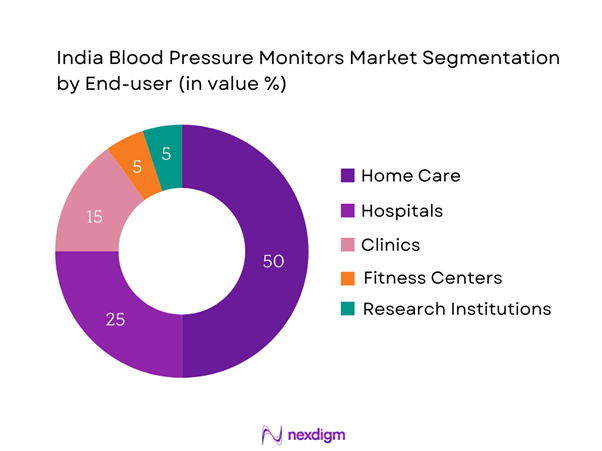

By End-user

The market segmentation by end-user includes home care, hospitals, clinics, fitness centers, and research institutions. Home care dominates the market due to the increasing preference for self-monitoring and management of blood pressure among consumers. The rise in health-conscious individuals opting for home-based healthcare solutions is driving this segment’s growth. Additionally, the convenience and accessibility of monitoring devices at home support routine health checks, allowing timely interventions and adherence to prescribed treatments. The ongoing focus on preventive care and telehealth services is expected to further bolster the home care segment’s market share in the coming years.

Competitive Landscape

The India Blood Pressure Monitors Market is dominated by key players, including Omron Healthcare, Philips Healthcare, A&D Medical, Withings, and iHealth Labs. These companies maintain substantial influence through their broad product offerings, innovative technology, and strong distribution networks. Their established reputations in the healthcare sector further solidify their competitive position.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Types | Distribution Channels | Technological Innovations |

| Omron Healthcare | 1933 | Kyoto, Japan | – | – | – | – |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

| A&D Medical | 1957 | Tokyo, Japan | – | – | – | – |

| Withings | 2008 | Issy-les-Moulineaux, France | – | – | – | – |

| iHealth Labs | 2009 | Cupertino, USA | – | – | – | – |

India Blood Pressure Monitors Market Analysis

Growth Drivers

Rising Hypertension Prevalence

The prevalence of hypertension in India is increasing, with estimates indicating that nearly 250 million adults are affected by high blood pressure. According to the World Health Organization (WHO), approximately 29% of Indian adults aged over 18 suffer from hypertension, which poses significant health risks, such as cardiovascular diseases. The rising prevalence of hypertension is largely driven by factors such as sedentary lifestyle and unhealthy dietary habits. Furthermore, the Indian heart disease burden reached an alarming 8.1 million deaths in 2022, highlighting the urgent need for effective blood pressure monitoring solutions across the country.

Increasing Older Population

India’s elderly population is growing rapidly, with projections indicating that by 2025, the number of individuals aged 60 and older will reach 330 million. This demographic shift is significant, as older adults are at a higher risk for developing chronic health conditions such as hypertension. The United Nations has highlighted that India will experience a considerable change in its age structure, with approximately 20% of the population being over the age of 60 by end of 2025. This demographic trend will increase the demand for blood pressure monitors, as senior citizens often require regular health checks to manage chronic diseases effectively.

Market Challenges

Pricing Pressures

The blood pressure monitors market faces challenges due to pricing pressures arising from intense competition among manufacturers. Many affordable product options flood the market as companies strive to meet consumer demand for cost-effective solutions. As of 2023, the average annual healthcare spending per capita in India was approximately USD 131, reflecting a limited budget for healthcare expenditures among consumers. This focus on affordability can negatively impact the profitability of manufacturers and may lead to compromised quality in some instances, hindering market growth in the long run.

Device Accuracy Concerns

Accurate blood pressure measurements are essential for effective healthcare management; however, varying device quality raises concerns among healthcare professionals and consumers alike. A study by the International Society of Hypertension revealed that nearly 50% of the blood pressure devices tested exhibited significant measurement inaccuracies. This issue can lead to misdiagnosis or inadequate treatment for hypertension, potentially undermining patient trust in monitoring devices. With the growing emphasis on precision medicine, ensuring the accuracy and reliability of blood pressure monitors is imperative for the market’s success.

Opportunities

Technological Advancements

The integration of advanced technology in blood pressure monitors presents significant opportunities for growth in the India market. Innovations such as artificial intelligence (AI) in health monitoring devices facilitate real-time data analysis and personalized health insights, enhancing user experience. In 2022, the global smart health wearables market reached USD 39 billion, fueled by rising demand for wearable technology in health management. India’s burgeoning digital health ecosystem and increasing adoption of health tech solutions highlight future prospects for incorporating advanced features into blood pressure monitors, making them a vital aspect of preventive healthcare.

Growing Health Tech Integration

The integration of health tech with blood pressure monitoring systems offers new avenues for market expansion. Health applications on smartphones, combined with IoT devices, provide users with advanced analytics and seamless connectivity for enhanced health management. The Indian telemedicine market, valued at USD 30 billion in 2022, conveys the rising acceptance of technology-driven healthcare solutions. As consumers increasingly seek convenience and connectivity in their health management routines, leveraging health tech capabilities will prove vital for companies aiming to capture the growing market segment of digitally connected blood pressure monitors, thereby driving their usage in day-to-day health management.

Future Outlook

The India Blood Pressure Monitors Market is expected to exhibit robust growth over the next five years, propelled by continuous innovations in technology, increasing consumer awareness about the significance of blood pressure monitoring, and the rising prevalence of hypertension and related health issues. As telehealth services gain momentum, the integration of advanced features in monitoring devices will cater to a broader audience seeking convenience and efficiency in healthcare management.

Major Players

- Omron Healthcare

- Philips Healthcare

- A&D Medical

- Withings

- iHealth Labs

- Sun Tech Medical

- American Diagnostic Corporation

- Welch Allyn

- Beurer

- Xiaomi

- Boehringer Ingelheim

- GE Healthcare

- Sanofi

- Medtronic

- Johnson & Johnson

Key Target Audience

- Healthcare Providers

- Medical Device Distributors

- Home Healthcare Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

- Hospitals and Clinics

- Health and Wellness Centers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Blood Pressure Monitors Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technological trends, consumer preferences, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data relating to the India Blood Pressure Monitors Market will be compiled and analyzed. This includes assessing market penetration rates, the ratio of various product types to end-users, and the resultant revenue generation. By utilizing statistical tools and quantitative methods, this analysis aims to develop a nuanced understanding of market performance and growth patterns, ensuring a reliable forecast for the future.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies involved in the blood pressure monitoring sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, offering a practical perspective that helps in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple blood pressure monitor manufacturers and other stakeholders to gather detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Blood Pressure Monitors Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Market Evolution

- Key Industry Trends

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Hypertension Prevalence

Increasing Older Population

Health Awareness Initiatives - Market Challenges

Pricing Pressures

Device Accuracy Concerns - Opportunities

Technological Advancements

Growing Health Tech Integration - Trends

Shift Towards Home Monitoring

Integration with Mobile Health Apps - Government Regulation

Compliance Standards

Quality Control Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Digital Monitors

Aneroid Monitors

Ambulatory Monitors

Sphygmomanometers

Smart Monitors - By End-user (In Value %)

Home Care

Hospitals

Clinics

Fitness Centers

Research Institutions - By Distribution Channel (In Value %)

Online Retail

Offline Retail

Pharmacies

Medical Supply Stores - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Bluetooth-enabled

Wi-Fi-enabled

Standard digital technology

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Regulatory Compliance and Certifications, Pricing Strategy, Customer Support and After-Sale Services, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Omron Healthcare

Philips Healthcare

A&D Medical

Withings

iHealth Labs

Sun Tech Medical

American Diagnostic Corporation

Welch Allyn

Beurer

Xiaomi

Boehringer Ingelheim

GE Healthcare

Sanofi

Medtronic

Johnson & Johnson

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Insights

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030