Market Overview

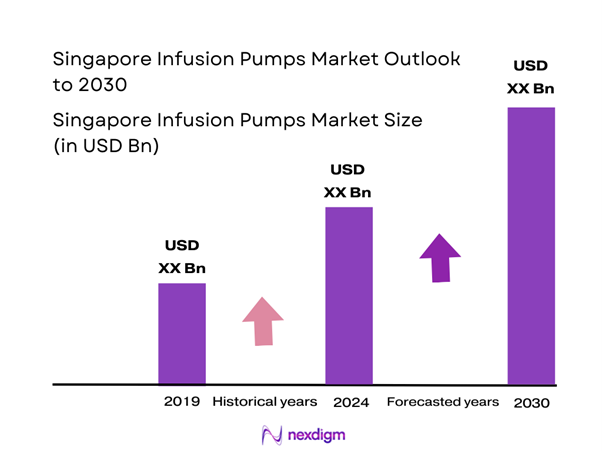

The Singapore Infusion Pumps Market is valued at USD 180 million in 2024 with an approximated compound annual growth rate (CAGR) of 6.2% from 2024-2030, based on a thorough analysis of historical data and robust market dynamics. The market is primarily driven by the increasing prevalence of chronic diseases such as diabetes and cancer, coupled with the growing demand for advanced healthcare solutions. As healthcare providers invest in modern infusion technologies, the market is further propelled by innovation in product design and functionality, which enhances patient safety and improves treatment efficacies.

The market is dominated by key regions within Singapore, particularly central urban areas such as Singapore City, due to their advanced healthcare infrastructure and the presence of leading hospitals and medical facilities. This concentration of healthcare resources fosters adoption and demand for infusion pumps, as the hospitals continually upgrade their medical equipment to incorporate the latest technology. The focus on patient-centric care in these urban centers further contributes to their dominance in the infusion pumps market.

Significant advancements in infusion technologies, including the development of smart infusion pumps and integrated electronic health record systems, have transformed patient care practices. These innovations enhance medication accuracy and reduce the risk of adverse drug events, thereby increasing patient safety and operational efficiency in healthcare facilities. The global infusion systems market has observed investments exceeding USD 7.3 billion in recent years, indicating robust R&D endeavors that fuel market growth.

Market Segmentation

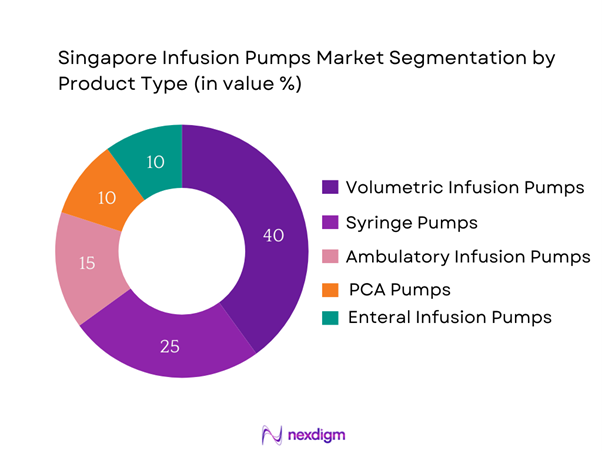

By Product Type

The Singapore Infusion Pumps Market is segmented by product type into volumetric infusion pumps, syringe pumps, ambulatory infusion pumps, PCA pumps, and enteral infusion pumps. Within this segmentation, volumetric infusion pumps have a dominant market share owing to their versatility and reliability in a wide range of clinical settings. These pumps are integral for delivering precise quantities of fluids and medication, essential in critical care and surgical departments. The advanced features such as smart technology integration and customizable settings enhance their appeal, driving increased demand among healthcare providers.

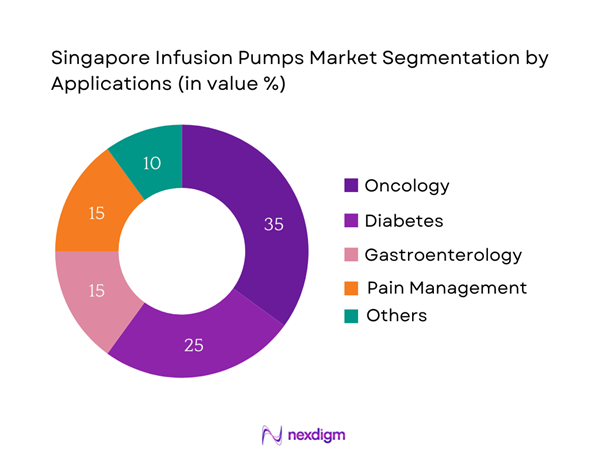

By Application

The market is segmented by application into oncology, diabetes, gastroenterology, pain management, and others. Oncology is a leading segment due to the rising incidence of cancer treatments necessitating the use of infusion pumps for chemotherapy and supportive care. The precision and control provided by infusion pumps are critical in oncology, where dosage accuracy is paramount. Hospitals are increasingly adopting these pumps as part of their treatment protocols, significantly contributing to the market share of this segment.

Competitive Landscape

The Singapore Infusion Pumps Market is characterized by a competitive landscape featuring several major players, including Baxter International Inc., B. Braun Melsungen AG, and Medtronic Plc. This consolidation highlights the significant influence of these key companies, each leveraging advanced technologies and innovative solutions to capture market share and maintain leadership positions in the infusion pumps sector.

| Company | Establishment Year | Headquarters | Product Portfolio | Annual Revenue (USD) | Market Position | Innovation Focus |

| Baxter International Inc. | 1931 | Deerfield, Illinois | – | – | – | – |

| B. Braun Melsungen AG | 1839 | Melsungen, Germany | – | – | – | – |

| Medtronic Plc | 1949 | Dublin, Ireland | – | – | – | – |

| ICU Medical Inc. | 1984 | San Clemente, California | – | – | – | – |

| Smiths Medical | 1856 | Dublin, Ireland | – | – | – | – |

Singapore Infusion Pumps Market Analysis

Growth Drivers

Increasing Healthcare Expenditure

Singapore’s healthcare expenditure continues to rise significantly, reaching approximately USD 15.6 billion in 2022, reflecting a trend toward increased investment in healthcare infrastructure. The country’s spending on healthcare is projected to constitute around 5.5% of its GDP by end of 2025. This investment is crucial for advancements in medical technologies, including infusion pumps, as it drives the adoption of sophisticated healthcare solutions necessary for delivering quality patient care. As the government prioritizes health as part of its national policy agenda, the infusion pumps market is set to benefit from this upward trajectory in funding and development.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in Singapore is increasing at a concerning rate, with the Ministry of Health indicating that 1 in 3 Singaporeans aged 18 and above is expected to develop diabetes. Furthermore, there were 424,000 diagnosed cases of diabetes reported in 2022, which necessitates continuous and accurate medication delivery systems like infusion pumps. This changing demographic landscape, coupled with a growing aging population that requires more healthcare services, emphasizes the rising demand for efficient medical devices, thus propelling the growth of the infusion pumps market significantly.

Market Challenges

Regulatory Compliance

Navigating complex regulatory requirements poses a challenge for the infusion pumps market in Singapore. The Health Sciences Authority (HSA) oversees medical device regulations, and compliance can often involve lengthy approval processes that can delay product launches and innovations. Notably, in 2022, it was reported that the HSA received over 1,200 applications for medical devices, with scrutiny leading to an average processing time exceeding 210 days for certain devices. This extended timeframe can hinder rapid market responsiveness, impacting the overall growth of the infusion pumps sector as companies face hurdles in introducing timely innovations.

High Initial Investment Costs

High initial investment costs associated with advanced infusion systems can be a barrier for healthcare providers aiming to upgrade their equipment. The budgetary burden on hospitals and clinics, which faced an average annual operating cost increase of about USD 4 million in 2022 due to inflation and rising operational expenses, affects their capacity to invest in new infusion technologies. As a result, despite the potential benefits of modern infusion pumps, strict budget constraints can limit procurement, impacting market expansion and adoption rates.

Opportunities

Growth in Home Healthcare

The home healthcare segment in Singapore is witnessing significant growth, driven by the country’s push towards providing care in home settings. The number of home care service users in Singapore has increased to approximately 15,000 in 2022, reflecting a growing preference for receiving care at home, especially for chronic disease management. The demand for infusion pumps designed for home use presents a lucrative opportunity for manufacturers, reinforcing the importance of patient-centric solutions. As healthcare systems evolve, companies offering portable and user-friendly infusion devices can expect a favorable market response, indicating strong potential for future growth in this area.

Increasing Demand for Smart Infusion Pumps

The infusion pumps market is observing a rising demand for smart infusion pumps, which integrate advanced technology, including wireless connectivity and real-time monitoring capabilities. With the rise in chronic diseases and the increasing complexity of medication regimens, healthcare providers are actively seeking smart solutions that improve efficiency and patient safety. As of 2023, it was noted that nearly 30% of hospitals in Singapore have already adopted smart infusion technologies, which cater to a trend towards automation and specialty care. This trend will only expand as healthcare institutions increasingly invest in innovative technologies to enhance patient treatment outcomes.

Future Outlook

Over the next several years, the Singapore Infusion Pumps Market is anticipated to experience significant growth driven by continuous advancements in medical technology, increasing regulatory approvals for innovative infusion devices, and a more robust healthcare expenditure directed towards advanced treatment modalities. The rising prevalence of chronic diseases coupled with a demographic shift towards an aging population will further drive demand for reliable infusion solutions. As hospitals and healthcare facilities strive to enhance treatment efficiency and patient safety, the infusion pumps market is poised for steady expansion.

Major Players

- Baxter International Inc.

- Braun Melsungen AG

- Medtronic Plc

- ICU Medical Inc.

- Smiths Medical

- Terumo Corporation

- Johnson & Johnson

- Moog Inc.

- Hospira (a Pfizer Company)

- R. Bard

- Convatec Group

- Roche Holding AG

- Philips Healthcare

- Stryker Corporation

- Smiths Medical Ltd.

Key Target Audience

- Hospitals and Healthcare Providers

- Home Healthcare Agencies

- Pharmaceutical Companies

- Medical Device Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Health Sciences Authority)

- Research Institutions and Laboratories

- Healthcare Technology Investors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that outlines all major stakeholders within the Singapore Infusion Pumps Market. This step relies on extensive desk research, utilizing a blend of secondary and proprietary databases to gather thorough industry-level information. The objective is to identify and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data pertaining to the infusion pumps market. This includes assessing market penetration rates, the ratio of suppliers to service providers, and subsequent revenue generation. Additionally, an evaluation of service quality metrics is conducted to ensure the reliability and accuracy of revenue estimates, contributing to a robust market profile.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through computer-assisted telephone interviews (CATIs) with industry experts, representing a diverse cross-section of companies. These consultations yield valuable insights into operational practices and financial trends, playing a critical role in refining the collected data and ensuring its accuracy.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with multiple infusion pump manufacturers to gather detailed insights on product segments, sales performance, consumer preferences, and other relevant factors. This interaction serves to verify and complement the data collected through top-down and bottom-up approaches to ensure a comprehensive, accurate, and validated analysis of the Singapore Infusion Pumps Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Healthcare Expenditure

Rising Incidence of Chronic Diseases

Advancements in Infusion Technologies - Market Challenges

Regulatory Compliance

High Initial Investment Costs - Opportunities

Growth in Home Healthcare

Increasing Demand for Smart Infusion Pumps - Trends

Shift Towards Patient-Centric Care

Focus on Innovation and R&D - Government Regulation

Healthcare Policies and Standards

Import Regulations and Tariffs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Volumetric Infusion Pumps

Syringe Pumps

Ambulatory Infusion Pumps

PCA Pumps

Enteral Infusion Pumps - By Application (In Value %)

Oncology

Diabetes

Gastroenterology

Pain Management

Others - By End User (In Value %)

Hospitals

Home Care Settings

Ambulatory Surgical Centers

Specialty Clinics

Other Healthcare Facilities - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Channels

Retail Pharmacies

Others - By Region (In Value %)

Central Singapore

East Singapore

West Singapore

North Singapore

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Infusion Pump Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Infusion Pump Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Baxter International Inc.

B. Braun Melsungen AG

Fresenius Kabi AG

Smiths Medical

Medtronic Plc

ICU Medical Inc.

Terumo Corporation

Johnson & Johnson

Moog Inc.

Hospira (a Pfizer Company)

C.R. Bard

Convatec Group

Roche Holding AG

Philips Healthcare

Stryker Corporation

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030