Market Overview

The Saudi Arabia EMG machines market is valued at approximately USD 95 million in 2024, driven by increasing neurological disorders and advancements in electromyography technology. The growing prevalence of conditions such as multiple sclerosis and amyotrophic lateral sclerosis necessitates the enhanced capabilities provided by modern EMG machines, contributing to growth in this market. As more healthcare facilities adopt advanced EMG systems, there is an ongoing trend towards increased demand for these machines, supported by the rising adoption of telemedicine and home healthcare solutions.

The market is primarily dominated by key cities like Riyadh, Jeddah, and Dammam. Riyadh stands out due to its advanced healthcare infrastructure and concentration of specialist medical facilities. Jeddah, known for its commercial and medical tourism, attracts patients seeking specialized neurological treatments. Dammam’s strategic position as an industrial hub facilitates significant investments in healthcare technologies, thereby fostering growth in the EMG machines market. This geographical concentration aids in driving sales and the availability of advanced medical equipment across the region.

Government regulations, particularly those set by the Saudi Food and Drug Authority (SFDA), play a crucial role in shaping the EMG machines market. The SFDA enforces rigorous standards for the approval and sale of medical devices, aiming to ensure safety and efficacy for users. In recent years, there have been approximately 250 new regulations introduced aimed at improving the quality of medical devices within Saudi Arabia.

Market Segmentation

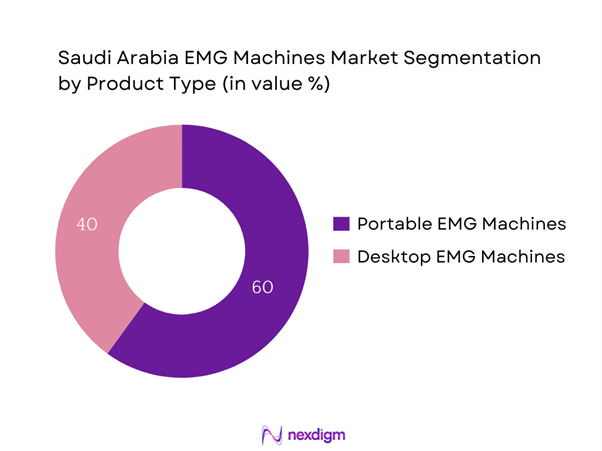

By Product Type

The Saudi Arabia EMG machines market is segmented by product type into portable EMG machines and desktop EMG machines. Among these, portable EMG machines dominate the market due to their versatility, ease of use, and growing preference for outpatient diagnostic services. Their compact design enables healthcare providers to conduct tests at various locations, including clinics and home settings, thus meeting the demand for telemedicine. Additionally, their affordability compared to desktop machines enhances accessibility for smaller healthcare facilities, further solidifying their market position.

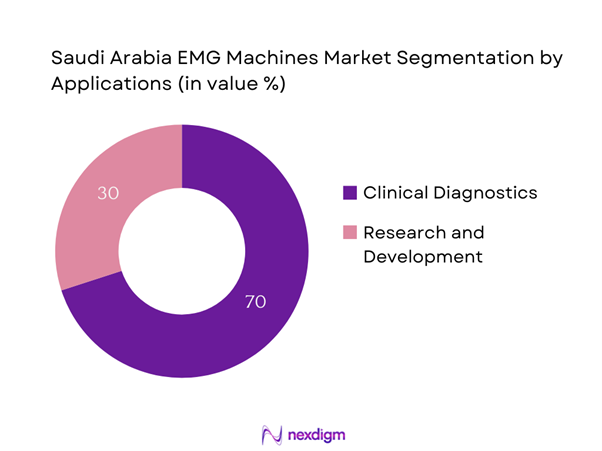

By Application

The market is further segmented by application, primarily into clinical diagnostics and research & development. Clinical diagnostics maintains a dominant position as a key driver due to the increasing need for accurate diagnostic tools in neurology. This segment benefits from a growing patient base suffering from neuromuscular disorders, fostering a significant demand for EMG testing. Medical institutions seek to enhance patient care through advanced diagnostic technologies, reinforcing the clinical diagnostics segment’s prominence in the EMG machines market.

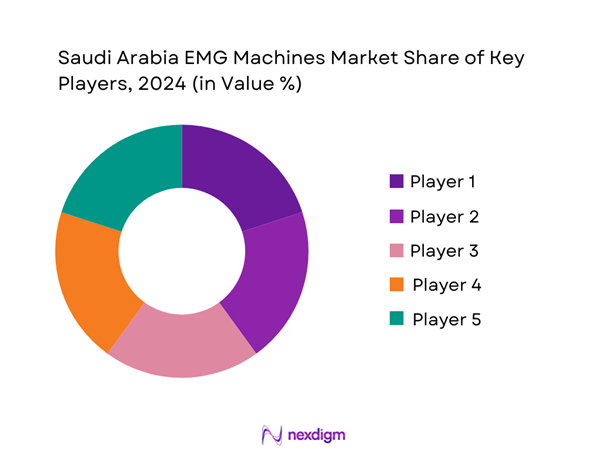

Competitive Landscape

The Saudi Arabia EMG machines market is competitive, marked by the presence of major players including established global brands and regional manufacturers. Key companies like Siemens Healthineers, Natus Medical Incorporated, and Nihon Kohden dominate the landscape, leveraging innovative technologies and extensive distribution networks. This consolidation reflects the significant influence these companies possess in shaping market dynamics, aided by strategic partnerships and advancements in EMG technology.

| Company Name | Year Established | Headquarters | Market Focus | Technology Offerings | Distribution channels | R&D Investments | Market Position |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – | – |

| Natus Medical Incorporated | 1989 | San Carlos, USA | – | – | – | – | – |

| Nihon Kohden | 1951 | Tokyo, Japan | – | – | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – | – |

| Conmed Corporation | 1970 | Utica, USA | – | – | – | – | – |

Saudi Arabia EMG Machines Market Analysis

Growth Drivers

Rising Prevalence of Neurological Disorders

The rising prevalence of neurological disorders significantly drives the demand for EMG machines in Saudi Arabia. According to the World Health Organization, approximately 2.74 million people in Saudi Arabia suffer from neurological disorders, which include ailments like multiple sclerosis, epilepsy, and stroke. The growing awareness among healthcare providers regarding early diagnosis and treatment of these disorders has led to an increased utilization of EMG machines, as they are essential for assessing nerve and muscle function. This growing patient base also aligns with broader global trends in healthcare investing, where nations are focusing on enhancing neurological care through advanced diagnostic tools.

Technological Advancements in EMG

Technological advancements in EMG devices are key growth drivers in the Saudi market. Innovative features such as enhanced signal processing, wireless technology, and improved usability enable clinicians to perform accurate and efficient diagnostics. In recent years, the market has seen significant advancements, such as the implementation of machine learning algorithms for better interpretation of EMG signals. Reports from the Saudi Arabian Ministry of Health show that integrating these advanced technologies into clinical settings has led to a 40% reduction in diagnostic time, consequently fueling the demand for modern EMG machines among healthcare providers.

Market Challenges

High Equipment Costs

High equipment costs pose significant challenges to the Saudi Arabia EMG machines market. The initial investment for acquiring advanced EMG equipment often falls between USD 15,000 to USD 50,000, depending on the technology and features incorporated. According to data published by the Saudi Arabian Ministry of Health, funding for medical equipment represents a substantial burden on healthcare budgets, which are anticipated to reach around USD 47 billion in allocations by end of 2025. Many smaller facilities may struggle to keep up with these financial demands, limiting equipment accessibility and slowing overall market growth.

Regulatory Compliance Challenges

Regulatory compliance presents another challenge for the EMG machines market. The Saudi Food and Drug Authority (SFDA) has established stringent guidelines for medical devices, which can complicate the approval process and increase time-to-market. Recent data from the SFDA indicates that average approval times can range from 6 to 18 months, delaying product accessibility in an ever-evolving technological landscape. As healthcare providers increasingly demand the latest devices for improved patient outcomes, the lengthy compliance process could hinder the overall responsiveness of the market to new innovations and alter purchasing decisions from medical facilities.

Opportunities

Rising Adoption of Wearable EMG Devices

The rise of wearable EMG devices presents crucial growth opportunities for the Saudi Arabia market. With the global wearables market expected to reach USD 62 billion by end of 2025, there is significant interest from various stakeholders within the region to invest in these technologies. A recent study by the Health Information Technology Committee reported that around 35% of healthcare providers in Saudi Arabia are actively incorporating wearable technologies into their practices. This trend not only aligns with the increasing consumer demand for convenient health monitoring but also promotes a proactive approach to health management among patients, further enhancing the appeal for investment in EMG wearable solutions.

Increased Research Funding

Increased research funding aimed at neuromuscular diseases is creating ample opportunities for expansion within the EMG devices market. The Saudi Arabian government has allocated approximately USD 3 billion in research funding for healthcare innovations, with a substantial portion focused on neurological and muscular health. Reports indicate that dedicated research institutions have been established to address the growing concern over neuromuscular disorders, enhancing partnerships between academia and industry. The commitment to increasing research initiatives is expected to drive forward the development of new and more effective EMG products, aligning closely with market needs and enhancing accessibility for clinicians.

Future Outlook

The next few years are set to witness substantial growth in the Saudi Arabia EMG machines market, propelled by continuous advancements in medical technologies, increasing government support for healthcare, and rising demand for accurate diagnostic solutions. Growth in the population coupled with increasing incidences of neurological disorders will drive the need for innovative EMG devices and solutions that enhance patient outcomes in clinical settings. As healthcare transitions towards more integrated care models, EMG machines will play a pivotal role in diagnostics and monitoring.

Major Players

- Siemens Healthineers

- Natus Medical Incorporated

- Nihon Kohden

- Medtronic

- Conmed Corporation

- BioMedix

- Ameda

- Braun Melsungen AG

- Philips Healthcare

- GE Healthcare

- Compumedics

- Roche Diagnostics

- Analog Devices

- Curative Technologies

- Abbott Laboratories

Key Target Audience

- Hospitals and Medical Centers

- Rehabilitation Clinics

- Neurology Specialties

- Research Institutions

- Government and Regulatory Bodies (Saudi Food and Drug Authority)

- Insurance Companies

- Investments and Venture Capitalist Firms

- Medical Equipment Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the key variables that impact the Saudi Arabia EMG machines market. This requires an ecosystem map that encompasses all major stakeholders, including manufacturers, hospitals, regulators, and end-users. Extensive desk research is conducted, leveraging both secondary and proprietary databases to gather comprehensive information on market dynamics, trends, and growth factors, thereby establishing a foundational understanding of the operational landscape.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data related to the Saudi Arabia EMG machines market will be compiled and analyzed. This includes evaluating market penetration rates, assessing the prevalence of related medical conditions, and understanding the factors contributing to revenue generation. By examining detailed statistics of service quality and distribution, the reliability of revenue estimates can be secured and cross-validated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed in collaboration with industry experts through structured interviews. The consultations are conducted with representatives from various segments, including hospitals and medical device manufacturers. These insights provide an operational and financial perspective that is critical for validating assumptions, refining market data, and ensuring accuracy in findings.

Step 4: Research Synthesis and Final Output

Direct engagement with various stakeholders in the EMG machines ecosystem will be carried out to gather detailed insights into product features, technological advancements, consumer preferences, and sales trends. These interactions will solidify and enhance the statistical data derived from the more quantitative approaches, ensuring a comprehensive, accurate, and validated analysis of the Saudi Arabia EMG machines market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Trends

- Key Developments Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Prevalence of Neurological Disorders

Technological Advancements in EMG - Market Challenges

High Equipment Costs

Regulatory Compliance Challenges - Opportunities

Rising Adoption of Wearable EMG Devices

Increased Research Funding - Trends

Shift Towards Integrated Health Solutions

Growing Interest in Telemedicine - Government Regulation

FDA and Saudi Arabia Food and Drug Authority Guidelines - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Type (In Value %)

Portable EMG Machines

Desktop EMG Machines - By Application (In Value %)

Clinical Diagnostic

Research and Development - By End-User (In Value %)

Hospitals

Rehabilitation Centers

Research Institutions - By Distribution Channel (In Value %)

Direct Sales

Online Retail - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of EMG Machine Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis Based on Product SKUs

- Detailed Profiles of Major Companies

Siemens Healthineers

Medtronic

Natus Medical Incorporated

Nihon Kohden

Conmed Corporation

BioMedix

Ameda

B. Braun Melsungen AG

Philips Healthcare

GE Healthcare

Compumedics

Roche Diagnosis

Analog Devices

Curative Technologies

ABBOTT Laboratories

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements Analysis

- Consumer Needs, Desires, and Pain Point Analysis

- Decision-Making Process Trends

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030