Market Overview

The Australia IPL Hair Removal Devices Market is valued at USD 120 million in 2024, based on a comprehensive analysis of relevant market data and consumer trends. This market is driven by increasing consumer awareness regarding personal grooming and beauty, coupled with the rising technology adoption that enhances the efficiency of hair removal devices. Additionally, the growing demand for at-home beauty solutions has propelled the market, reflecting a shift in consumer preferences towards convenience and cost-effectiveness.

Major metropolitan areas such as Sydney, Melbourne, and Brisbane dominate the market due to their higher disposable incomes and a strong trend towards personal care and wellness. These cities showcase a robust consumer base that is increasingly investing in beauty and grooming products, facilitating a higher penetration of IPL devices in retail and e-commerce channels. Moreover, the influence of beauty salons and spas in these regions highlights a significant adoption of IPL technology for professional and home-use applications.

An increasing focus on beauty and personal care is evident among Australian consumers, reflected in the country’s robust beauty and personal care market projected to exceed AUD 6 billion by end of 2025. The rise of social media platforms, where beauty influencers play a key role, has amplified awareness surrounding personal grooming practices. Furthermore, promotions concerning hygiene and aesthetics are being heavily emphasized, leading to a culture that values self-care.

Market Segmentation

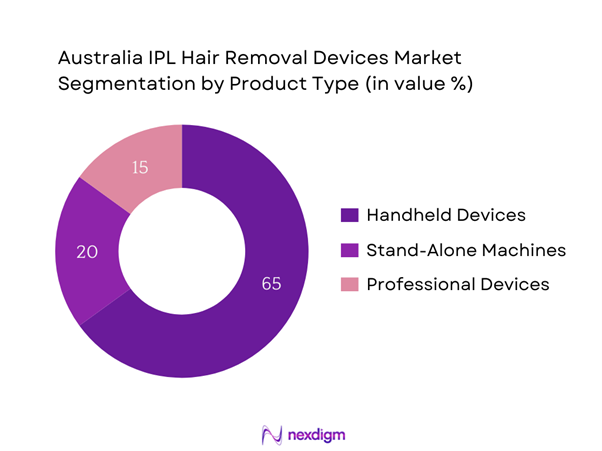

By Product Type

The Australia IPL Hair Removal Devices Market is segmented by product type into handheld devices, stand-alone machines, and professional devices. Among these segments, handheld devices currently hold a dominant market share as they offer convenience and cost-effectiveness for home users. The growing trend of DIY beauty treatments has boosted the popularity of handheld IPL devices. Brands have successfully marketed their handheld options as effective, convenient, and safe for personal use at home. With advancements in technology, these devices have become more efficient, lightweight, and user-friendly, appealing to a wider audience seeking easy-to-use hair removal solutions.

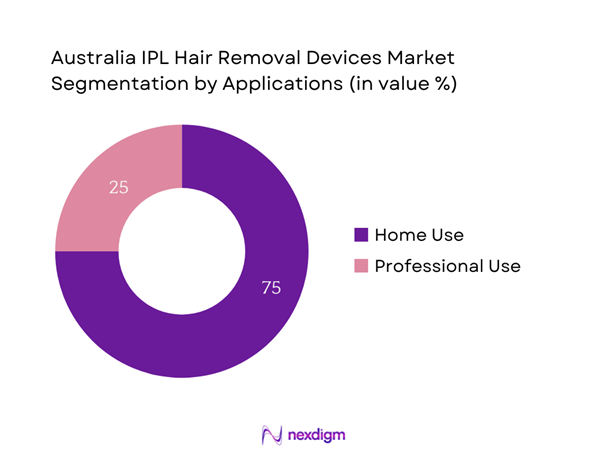

By Application

The market is also segmented by application into home use and professional use. The home-use segment is currently leading in market share, attributed primarily to the rising consumer trend towards self-care and convenience. With more consumers preferring to avoid salon visits for regular treatments, home-use IPL devices provide a practical alternative. The efficiency and increasing effectiveness of these devices for long-term hair reduction have made them popular among consumers looking to invest in their own beauty routines. Moreover, home use presents a significant advantage in terms of cost savings over time compared to professional treatments.

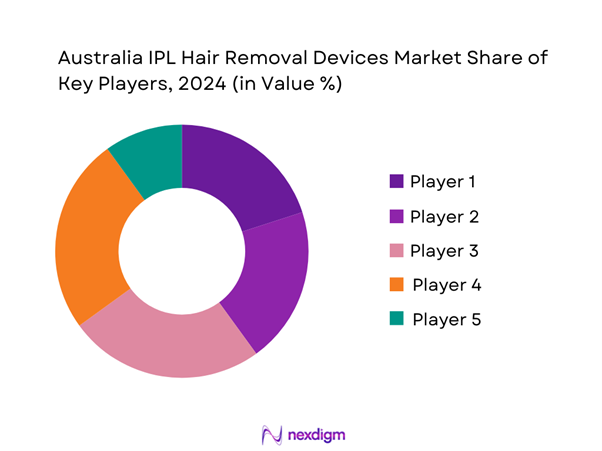

Competitive Landscape

The Australia IPL Hair Removal Devices market is dominated by several key players, including both local and international brands that influence consumer preferences significantly. Major players in the industry include Philips, Braun, and Tria Beauty, among others. This consolidation highlights the competitive nature of the market, as these brands continuously innovate and expand their product offerings to maintain their market positions and respond to evolving consumer demands. The presence of established brands fosters consumer loyalty and trust, which is crucial in the beauty tech segment.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Type | Target Audience | Marketing Strategy |

| Philips | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Braun | 1921 | Kronberg, Germany | – | – | – | – |

| Tria Beauty | 2003 | San Francisco, USA | – | – | – | – |

| Remington | 1937 | Little Rock, USA | – | – | – | – |

| Silken | 2009 | Vancouver, Canada | – | – | – | – |

Australia IPL Hair Removal Devices Market Analysis

Growth Drivers

Increasing Demand for At-Home Hair Removal

The demand for at-home hair removal solutions is significantly increasing, with a notable rise in the number of consumers opting for convenience and cost-effectiveness associated with such products. According to the Australian Bureau of Statistics, the number of households with a disposable income exceeding AUD 1,500 weekly has grown to approximately 55% of the population in the last two years, which translates to a higher capacity and willingness to invest in personal grooming products. Consumers are increasingly seeking personal care solutions that can save time and reduce the frequency and cost of salon visits, further driving the preferences toward IPL devices for home use.

Advancements in Technology

Technological advancements have paved the way for improved efficacy and safety in IPL hair removal devices, attracting more consumers. The global beauty tech market is projected to reach USD 144 billion by end of 2025, highlighting a strong inclination toward innovative devices that leverage advanced technology. Furthermore, developments in IPL technology have led to the introduction of devices that promise painless hair removal, resulting in a more user-friendly experience. Enhanced safety features, such as skin tone sensors and UV protection, make these devices appealing to a broader demographic, ultimately enhancing demand in the personal grooming sector.

Market Challenges

High Initial Investment Costs

The high initial investment associated with IPL hair removal devices presents a significant barrier for many consumers considering these products. Costs range from AUD 300 to AUD 800, which can deter price-sensitive individuals from purchasing. Although the long-term savings against going to salons can justify these expenses, upfront costs remain a challenge, especially in the current economic climate where the Reserve Bank of Australia reports inflation at 3.5%. This situation compels consumers to prioritize essential expenditures over luxury items, impacting market penetration rates.

Competition from Alternative Hair Removal Methods

Competition from traditional hair removal methods, such as waxing and shaving, remains a substantial challenge for the IPL market. With the commonality of these alternatives and their lower price points—e.g., a waxing session typically costs around AUD 50—the appeal of IPL devices must be convincing enough to shift consumer behavior. The high availability and accessibility of alternative methods mean that companies in the IPL sector must continuously innovate and improve product offerings to genuinely sway consumers toward longer-term investments like IPL devices. The Australian government’s support for small businesses also keeps prices competitive across the market.

Opportunities

Emerging Trends in Beauty Technology

Emerging trends in beauty technology offer significant market growth opportunities. Current analytics suggest a 25% increase in consumer expenditures on beauty technology products year-over-year, highlighting a strong interest in personal care innovations. Collaboration between beauty-tech companies and skincare brands is also becoming more prevalent, seeing the launch of multifunctional devices that cater to diverse cosmetic needs. The integration of artificial intelligence for personalized recommendations may further increase market engagement, indicating that investments in research and development are likely to yield fruitful returns in the long run. Such integrations signal a future where IPL devices can be enhanced through technology, attracting wider consumer interest.

Growing E-commerce Sales

The growth of e-commerce presents a critical opportunity for increased market reach and sales of IPL hair removal devices. Current statistics indicate that 90% of Australians’ online shopping is concentrated in beauty and personal care segments, with e-commerce sales in the beauty market expected to surpass AUD 5.4 billion in 2025. This uptrend is largely propelled by the rising preference for online shopping as consumers seek convenience, especially amid the global pandemic. As IPL devices become more accessible through online retailing platforms, brands can expand their market share and reach previously untapped demographics.

Future Outlook

Over the next five years, the Australia IPL Hair Removal Devices market is expected to show significant growth, spurred by advancements in technology, an enhanced focus on personal health and wellness, and increasing consumer demand for at-home beauty solutions. Additionally, the ongoing development of more effective and user-friendly devices is likely to capture a wider audience. This growth trajectory will be supported by marketing efforts focusing on demonstrating the convenience and efficiency of IPL technology, alongside competitive pricing strategies aimed at making these devices more accessible to a broader demographic.

Major Players

- Philips

- Braun

- Tria Beauty

- Remington

- Silken

- Lumea

- Homiley

- SmoothSkin

- BoSidin

- Iluminage

- Hair Removal Laser

- Cosbeauty

- Nood

- MCH

Key Target Audience

- Beauty and Personal Care Retailers

- E-commerce Platforms

- Consumer Electronics Retailers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Australian Competition and Consumer Commission, Therapeutic Goods Administration)

- Beauty Salons and Spas

- Health and Wellness Industry Stakeholders

- Advertising and Marketing Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all significant stakeholders within the Australia IPL Hair Removal Devices market. This step is founded on extensive desk research, utilizing a combination of secondary and proprietary databases to compile a detailed overview of the industry. The primary aim is to identify and define the critical factors influencing market dynamics, such as consumer behavior, technology trends, and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, we focus on gathering and analyzing historical data regarding the Australia IPL Hair Removal Devices market. This includes assessing sales volume, revenue generation, and the competitive landscape. Furthermore, we will evaluate user experiences and satisfaction, which are essential in understanding the effectiveness and acceptance of different product types in the marketplace.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the earlier stages will be validated through consultations with industry experts via computer-assisted telephone interviews (CATI). This comprehensive outreach aims to include diverse insights from various segments in the beauty and personal care sectors. This input is vital in refining market data and ensuring its accuracy and relevancy.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing insights from multiple sources, including manufacturers, suppliers, and consumer feedback. We will consolidate this information to offer a thorough understanding of trends, sales performance, and consumer needs, which will result in a validated analysis of the Australian IPL Hair Removal Devices market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for At-Home Hair Removal

Advancements in Technology

Rising Awareness of Beauty and Personal Care - Market Challenges

High Initial Investment Costs

Competition from Alternative Hair Removal Methods - Opportunities

Emerging Trends in Beauty Technology

Growing E-commerce Sales - Trends

Rise in Influencer Marketing

Sustainability and Eco-friendly Innovations - Government Regulation

Safety Standards and Compliance

Certification Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Handheld Devices

Stand-Alone Machines

Professional Devices - By Application (In Value %)

Home Use

Professional Use - By Distribution Channel (In Value %)

Online Retail

Specialty Stores

Supermarkets and Hypermarkets - By Region (In Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia - By End User Demographics (In Value %)

Age Group

Gender

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Market Share of Major Players by Product Type, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Pricing Strategies, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Philips

Braun

Remington

Tria Beauty

Silken

Lumea

Homiley

SmoothSkin

BoSidin

Iluminage

Hair Removal Laser

Cosbeauty

Nood

MCH

ylaser

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030