Market Overview

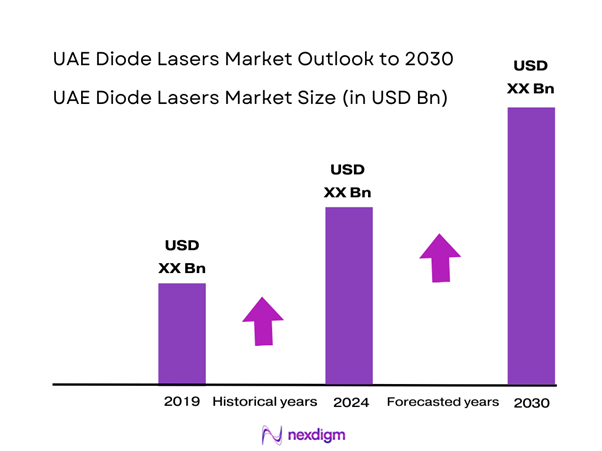

The UAE Diode Lasers Market is valued at USD 20 million in 2024 with an approximated compound annual growth rate (CAGR) of 15% from 2024-2030, based on a comprehensive analysis of the region’s technological advancements and expanding applications in sectors such as telecommunications and healthcare. Growth is significantly driven by increasing demand for high-performance laser technologies across various industries, alongside continuous investments in research and development. The market witnessed a year-on-year increase fueled by the rapid adoption of laser systems, particularly in medical applications like diagnostics and minimally invasive surgeries.

The market is predominantly dominated by key cities such as Dubai and Abu Dhabi due to their status as technological and commercial hubs in the Middle East. Robust infrastructural support and government initiatives to foster innovation further establish these cities as leaders in the diode lasers market. Their strategic geographical positioning also facilitates trade and collaboration with other technology-driven regions globally, enhancing the market’s competitive edge.

The UAE is witnessing rapid advancements in laser technology, specifically in diode lasers, which have become critical to various industries. As of 2023, the value of the global laser market is projected to reach USD 15.22 billion, with significant advancements in applications such as cutting, welding, and medical treatments. Innovations in solid-state diode laser sources and beam shaping technologies enable more efficient and versatile applications.

Market Segmentation

By Product Type

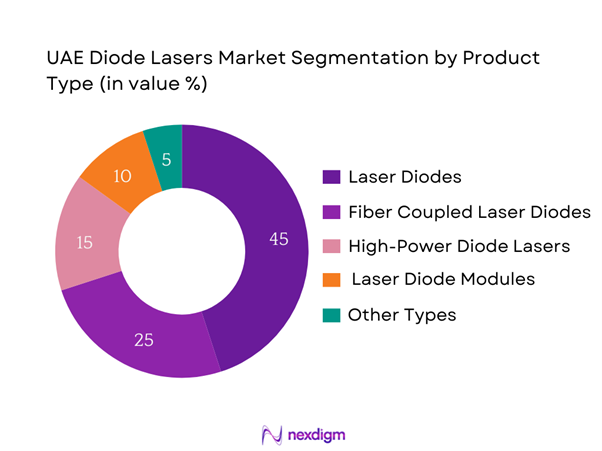

The UAE Diode Lasers Market is segmented by product type into Laser Diodes, Fiber Coupled Laser Diodes, High-Power Diode Lasers, Laser Diode Modules, and Other Types. Laser Diodes dominate the market due to their wide range of applications in consumer electronics, medical devices, and industrial setups. Their compact size and efficiency lead to increased adoption in applications such as laser printing and optical communications. Additionally, advancements in manufacturing processes have made laser diodes more cost-effective, contributing significantly to their market share in the UAE.

By Application

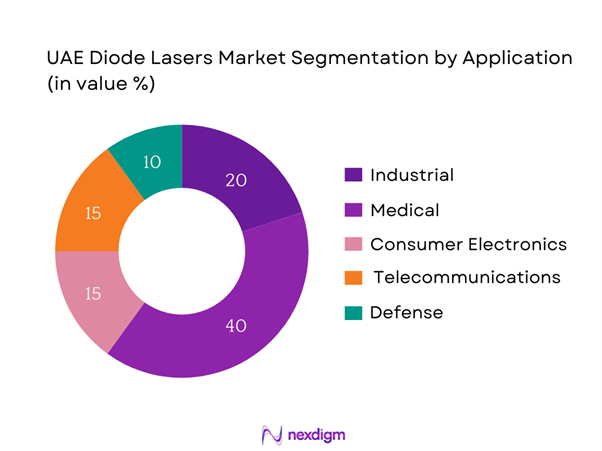

The market segmentation by application includes Industrial, Medical, Consumer Electronics, Telecommunications, and Defense. The medical application segment is currently dominating the market, primarily driven by the increasing utilization of diode lasers in surgical procedures and dermatology. The precision and minimal invasiveness offered by laser technologies enhance patient recovery, driving the adoption of medical laser systems in hospitals and clinics throughout the UAE.

Competitive Landscape

The UAE Diode Lasers Market is characterized by strong competition among a few major players, including both local and international companies. Market participants focus on technological innovation and strategic partnerships to enhance their competitive positions. The presence of global players with vast resources and technological expertise exacerbates the competitive landscape, leading to continuous advancements in product offerings.

| Company | Established Year | Headquarters | R&D Investment | Product Range | Market Focus |

| Coherent, Inc. | 1966 | California, USA | – | – | – |

| Jenoptik AG | 1991 | Jena, Germany | – | – | – |

| TRUMPF GmbH + Co. KG | 1923 | Ditzingen, Germany | – | – | – |

| II-VI Incorporated | 1971 | Pennsylvania, USA | – | – | – |

| Osram Opto Semiconductors | 1972 | Regensburg, Germany | – | – | – |

UAE Diode Lasers Market Analysis

Growth Drivers

Rising Demand in Medical Applications

The medical sector in the UAE is increasingly adopting diode laser technologies, evident by the installation of over 150 new laser systems in hospitals and clinics across the country as of 2024. The rising number of outpatient procedures, exceeded 1 million in 2024, is a driving force behind this demand. Furthermore, according to the UAE Health Authority, the contribution of advanced medical technologies, including diode lasers, to healthcare expenditures is estimated to reach AED 14.9 billion in the same year. This engagement highlights the growing reliance on laser technologies for precise diagnostic and treatment options.

Growth in the Telecommunications Sector

The telecommunications sector in the UAE is undergoing significant expansion, with a reported investment exceeding AED 40 billion in network infrastructure by 2023. With the rise of 5G technology, the demand for high-speed data transmission using laser technologies, particularly in fiber optics, is becoming increasingly crucial. The Telecommunications Regulatory Authority has noted that the productivity of fiber optic installations has improved by 30% since 2022, indicating a robust market for laser applications in this sector. This continued investment is expected to drive an increase in diode laser usage in telecommunications significantly.

Market Challenges

High Initial Investment Costs

The high initial capital required for implementing advanced laser systems remains a significant challenge within the UAE diode lasers market. According to the UAE Ministry of Finance, companies in the manufacturing and healthcare sectors are facing upfront costs that can range from AED 250,000 to AED 2 million based on the complexity and type of laser technology adopted. This financial burden can restrict smaller firms from transitioning to modern laser solutions, thus limiting overall market growth. Additionally, the costs associated with skilled training for personnel who can operate laser technologies pose further economic challenges.

Regulatory Compliance

Navigating the complex landscape of regulatory compliance in the UAE poses significant hurdles for the diode lasers market. The UAE Ministry of Health & Prevention mandates strict safety and efficiency standards for medical devices, requiring companies to invest in compliance processes. As of early 2023, approximately 35% of businesses surveyed reported significant challenges due to complex regulatory frameworks, leading to compliance delays. This results in prolonged market entry timelines for new technologies, thereby hindering innovation and expansion in the market as firms struggle to align their operations with these regulatory demands.

Opportunities

Increasing Focus on Energy Efficiency

With the rising global emphasis on sustainability, the UAE’s focus on energy efficiency offers significant growth opportunities for the diode lasers market. Recent data shows that the transportation sector starts implementing robust energy efficiency protocols, with power consumption reduction measures expected to save around AED 1 billion annually by end of 2025. Moreover, industries using diode laser technology for processes like cutting and welding report energy savings of up to 50% compared to traditional technologies. This creates an appealing growth avenue for companies investing in energy-efficient laser applications.

Growth in Renewable Energy Sector

The UAE is rapidly advancing its renewable energy objectives, with investments projected to surge past USD 163 billion by 2030 in solar and wind energy projects. Diode lasers are becoming increasingly relevant in these applications, particularly for precision tasks in photovoltaic panel manufacturing and maintenance. The Masdar Clean Energy initiative was set to install 100 megawatts of solar capacity by 2024, which will significantly enhance the demand for laser technologies used for improving production efficiency and monitoring. Thus, positioning diode lasers as an essential component of the renewable energy landscape.

Future Outlook

Over the next several years, the UAE Diode Lasers Market is projected to experience significant growth driven by advancements in laser technology, an uptick in demand for laser-based medical treatments, and the continuous development of consumer electronics. The market is also expected to benefit from supportive government policies fostering innovation and technology investments, as well as rising awareness of the advantages of laser solutions across various industries.

Major Players

- Coherent, Inc.

- Jenoptik AG

- TRUMPF GmbH + Co. KG

- II-VI Incorporated

- Osram Opto Semiconductors

- Luminus Devices, Inc.

- Nichia Corporation

- Mitsubishi Electric Corporation

- QSI Laser, LLC

- American Laser Enterprises

- Sharp Corporation

- Amplitude Laser

- Corning Incorporated

- LightPath Technologies, Inc.

- Laserline GmbH

Key Target Audience

- Government and Regulatory Bodies (e.g., Ministry of Health)

- Investments and Venture Capitalist Firms

- Healthcare Providers

- Industrial Equipment Manufacturers

- Telecommunications Companies

- Research and Development

- Technology Integrators

- Medical Device Companies

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the UAE Diode Lasers Market. A combination of extensive desk research and secondary data sources is utilized to gather insights into industry-level information. The primary objective is to identify and define critical variables, such as market drivers, challenges, and the various applications of diode lasers.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data relevant to the UAE Diode Lasers Market. This includes assessing market penetration across different applications and industries, as well as examining revenue generation statistics. An evaluation of both qualitative and quantitative service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on gathered data and are validated through consultations with industry experts across diverse companies and sectors in the diode lasers market. These consultations are conducted through structured interviews and surveys, aiming to provide operational and financial insights that are fundamental for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase focuses on engaging with multiple diode laser manufacturers and users to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction is vital for verifying and complementing the statistics derived from both top-down and bottom-up approaches, ensuring that the analysis of the UAE Diode Lasers Market is comprehensive, accurate, and validated.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements

Rising Demand in Medical Applications - Market Challenges

High Initial Investment Costs

Regulatory Compliance - Opportunities

Increasing Focus on Energy Efficiency

Growth in Renewable Energy Sector - Trends

Adoption of Laser Technology in Emerging Markets

Innovations in Laser Technology - Government Regulations

Import Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Laser Diodes

Fiber Coupled Laser Diodes

High-Power Diode Lasers

Laser Diode Modules

Other Types - By Application (In Value %)

Industrial

Medical

Consumer Electronics

Telecommunications

Defense - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Platforms - By End-User Sector (In Value %)

Automotive

Manufacturing

Healthcare

Robotics - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market Share of Major Players, By Value/Volume, 2024

- Market Share by Type of Diode Laser Segment, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Financial Performance, Revenue, Margin, Distribution Channels, Unique Value Offerings, R&D Investment)

- SWOT Analysis of Major Players

- Pricing Analysis by Product Type of Major Players

- Detailed Profiles of Major Companies

Coherent, Inc.

Jenoptik AG

TRUMPF GmbH + Co. KG

Laserline GmbH

II-VI Incorporated

Osram Opto Semiconductors GmbH

Luminus Devices, Inc.

Nichia Corporation

Mitsubishi Electric Corporation

QSI Laser, LLC

American Laser Enterprises

Sharp Corporation

Amplitude Laser

Corning Incorporated

LightPath Technologies, Inc.

- Market Demand and Utilization

- Purchasing Patterns and Budgeting

- Regulatory Considerations and Compliance

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030