Market Overview

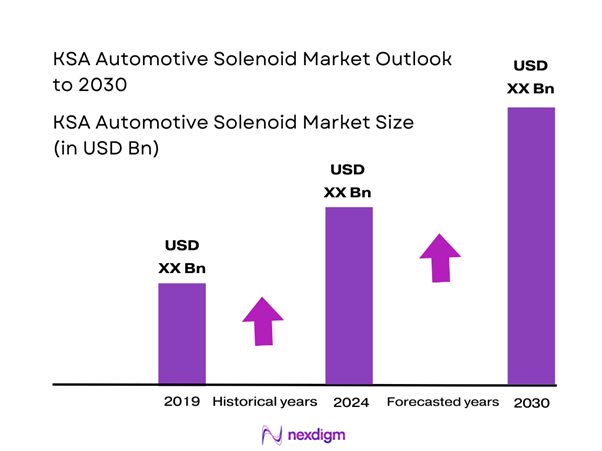

The KSA Automotive Solenoid Market is valued at USD 5.72 billion in 2024 with an approximated compound annual growth rate (CAGR) of 9% from 2024-2030, driven by the increasing demand for advanced automotive technologies and rising vehicle production. Notably, the growth can be attributed to the burgeoning automotive manufacturing industry in the region, which is supported by government initiatives aimed at promoting local production.

Dominant cities in the KSA Automotive Solenoid Market include Riyadh, Jeddah, and Dammam. These cities are pivotal due to their strategic locations, proximity to key automotive manufacturers, and well-developed infrastructure. The concentration of automotive assembly plants and major suppliers in these areas creates a robust ecosystem that supports the solenoid market. Additionally, government incentives geared toward enhancing local manufacturing capabilities play a crucial role in this dominance.

In response to global environmental challenges, there’s an increasing focus on fuel efficiency within the automotive sector of Saudi Arabia. The Saudi government has set stringent emission guidelines as part of its National Environment Strategy, which aligns with international environmental agreements. As global oil prices are projected to rise to an average of USD 75 per barrel, the push for fuel-efficient vehicles has become crucial. Automakers are increasingly adopting advanced technologies to produce lighter vehicles and more efficient engine systems, necessitating the use of effective solenoids to optimize performance.

Market Segmentation

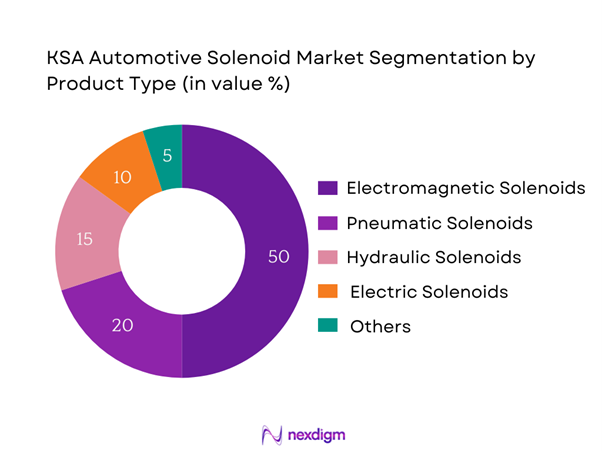

By Product Type

The KSA Automotive Solenoid Market is segmented by product type into electromagnetic solenoids, pneumatic solenoids, hydraulic solenoids, electric solenoids, and others. Among these, electromagnetic solenoids hold a dominant market share due to their widespread application in automotive systems such as locking mechanisms, ignition systems, and airbags. The reliability and efficiency of electromagnetic solenoids, combined with their ability to function effectively under varying load conditions, make them preferred choices for vehicle manufacturers. Major automotive companies increasingly incorporate these solenoids for their production lines, reflecting their critical role in enhancing vehicle performance and safety.

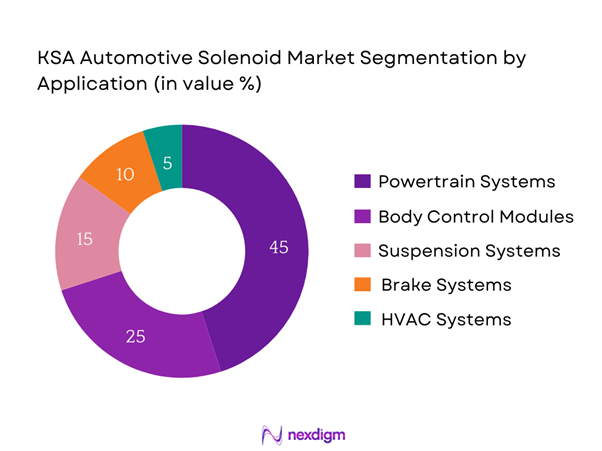

By Application

The KSA Automotive Solenoid Market is also segmented by application into powertrain systems, body control modules, suspension systems, brake systems, and HVAC systems. Powertrain systems dominate the market share due to the critical role solenoids play in controlling various functions such as fuel injection and valve timing, ultimately impacting engine performance. Increasing consumer preferences for fuel-efficient and high-performance vehicles drive the demand for advanced solenoid technologies in powertrain applications. Automakers are focused on integrating innovative solenoids to improve efficiency, contributing significantly to this segment’s growth.

Competitive Landscape

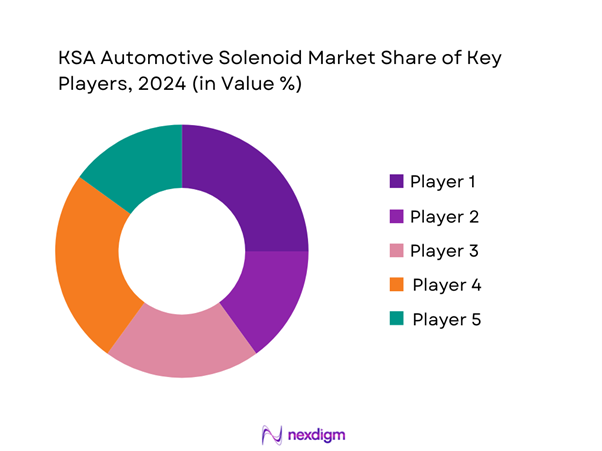

The KSA Automotive Solenoid Market is characterized by a competitive landscape featuring several major players. The market is dominated by established companies that possess significant expertise in manufacturing high-quality solenoid products. The presence of local manufacturers alongside global brands enhances competition, driving innovation and improving product offerings across the board.

| Companies | Establishment Year | Headquarters | Product Range | Market Focus | Recent Developments |

| Bosch | 1886 | Gerlingen, Germany | – | – | – |

| Delphi Technologies | 1994 | Gillingham, UK | – | – | – |

| Denso | 1949 | Kariya, Japan | – | – | – |

| Continental AG | 1871 | Frankfurt, Germany | – | – | – |

| Aisin Seiki | 1965 | Kuroiwa, Japan | – | – | – |

KSA Automotive Solenoid Market Analysis

Growth Drivers

Demand for Advanced Automotive Technologies

The growth in the KSA automotive sector can be significantly attributed to the rising demand for advanced automotive technologies, particularly with the shift towards electric and high-performance vehicles. The Saudi Arabian automotive market is projected to reach a production level of 1 million vehicles annually by 2026, according to the Ministry of Industry and Mineral Resources. This notable industry expansion necessitates the integration of sophisticated components, such as solenoids, enhancing vehicle functionality and safety features. The drive for technological advancements and increased production is vital for sustaining economic development in the region.

Rising Vehicle Production

With the Saudi government’s initiatives to strengthen the domestic manufacturing landscape, vehicle production is on a steady rise. The country’s Vision 2030 plan aims to develop the automotive sector, targeting a 50% localization of automotive parts production, translating into an expected total vehicle production of approximately 1.6 million units by end of 2025. This surge highlights a robust manufacturing commitment that fosters increased demand for key automotive parts, including solenoids, which are essential for operational efficiency in modern vehicles. The enhancement of local production capabilities aligns with broader economic diversification goals.

Market Challenges

Supply Chain Disruptions

The automotive industry in Saudi Arabia has been facing significant supply chain disruptions, largely due to geopolitical tensions and the lingering effects of the COVID-19 pandemic, which has affected global supply systems. For example, in 2022, nearly 60% of automotive manufacturers reported difficulties securing components, such as semiconductors, which are critical for the production of solenoids and other automotive technologies. This disruption has created bottlenecks, leading to production delays and increased operational costs, hindering the growth potential of the automotive solenoid market in the Kingdom.

Highly Competitive Landscape

The KSA Automotive Solenoid Market operates within a highly competitive landscape characterized by the presence of numerous local and international enterprises. The local automotive parts manufacturing segment has seen substantial investment, resulting in over 250 firms involved in this sector as of 2023. This abundance of competitors leads to pricing pressure and innovation demands, where companies must continuously evolve to maintain their market share. Maintaining a competitive edge through product differentiation has become crucial for businesses striving to succeed in a market that becomes increasingly saturated with solutions for automotive components.

Opportunities

Electrification of Vehicles

The electrification of vehicles presents a remarkable opportunity for the KSA Automotive Solenoid Market, with the Saudi government announcing plans to produce over 1 million electric vehicles by 2030. This enhancement in manufacturing aligns with the global shift towards sustainability and renewable energy usage. The reliance on electric drivetrains in EVs creates a robust demand for solenoids to manage various electronic control functions, making it crucial for manufacturers in the region to adapt their offerings to cater to this emerging segment effectively. The shift toward electrification is set to revolutionize the automotive landscape in Saudi Arabia.

Adoption of Automation

The ongoing trend towards automation in manufacturing processes stands as a substantial opportunity for the KSA Automotive Solenoid Market. As industries integrate Industry 4.0 technologies, the adoption of automation is projected to increase significantly, fostering enhanced production efficiencies. The manufacturing output in Saudi Arabia is expected to grow to USD 50 billion by end of 2025, driven in part by automation technologies that enhance operational efficiency, reduce errors, and lower production costs.

Future Outlook

The KSA Automotive Solenoid Market is projected to experience steady growth in the next several years, underpinned by continuous advancements in automotive technologies and increasing production of electric and hybrid vehicles. As the automotive sector increasingly shifts towards electrification and automation, the demand for solenoids is expected to grow significantly. Innovative applications and government incentives promoting local manufacturing further strengthen the market outlook, aligning with global trends towards energy efficiency and sustainability.

Major Players

- Bosch

- Delphi Technologies

- Denso

- Continental AG

- Aisin Seiki

- Siemens

- Hitachi Automotive Systems

- Parker Hannifin

- Brembo

- Johnson Electric

- Hella

- Schaeffler

- Valeo

- ZF Friedrichshafen AG

- Aptiv

Key Target Audience

- Automotive Manufacturers

- Automotive Component Suppliers

- Original Equipment Manufacturers (OEMs)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Industry and Mineral Resources)

- Automotive Industry Associations

- Fleet Management Companies

- Research and Development Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Automotive Solenoid Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA Automotive Solenoid Market. This includes assessing market penetration, the ratio of manufacturers to service providers, and the resultant revenue generation. Moreover, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple solenoid manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Automotive Solenoid Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Demand for Advanced Automotive Technologies

Rising Vehicle Production

Increased Focus on Fuel Efficiency - Market Challenges

Supply Chain Disruptions

Highly Competitive Landscape

Regulatory Compliance - Opportunities

Electrification of Vehicles

Adoption of Automation - Trends

Integration of Smart Technologies

Sustainability in Production Processes - Government Regulation

Emission Norms

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Electromagnetic Solenoids

Pneumatic Solenoids

Hydraulic Solenoids

Electric Solenoids

Others - By Application (In Value %)

Powertrain Systems

Body Control Modules

Suspension Systems

Brake Systems

HVAC Systems - By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles

Two-Wheeler Vehicles

Electric Vehicles

Hybrid Vehicles - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Distribution Channel (In Value %)

OEMs

Aftermarket

Online Retail

Distributors

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Automotive Solenoid Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Solenoid, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Bosch

Delphi Technologies

Denso

Aisin Seiki

Continental AG

Siemens

Hitachi Automotive Systems

Parker Hannifin

Brembo

Johnson Electric

Hella

Schaeffler

Valeo

ZF Friedrichshafen AG

Aptiv

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030