Market Overview

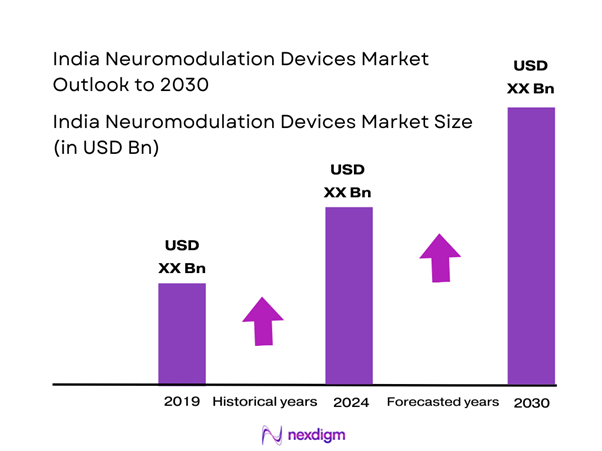

The India Neuromodulation Devices Market is valued at USD 234.5 million in 2024 with an approximated compound annual growth rate (CAGR) of 12.2% from 2024-2030, driven by the growing prevalence of neurological disorders and advancements in innovative medical technologies. This market is propelled by increasing healthcare expenditure and an expanding aging population, which contributes significantly to the demand for effective treatment options.

Dominant cities in this market include Mumbai, New Delhi, and Bengaluru, attributed to their well-established healthcare infrastructure and accessibility to advanced medical facilities. These urban areas serve as hubs for medical technology firms and healthcare service providers, integrating cutting-edge technologies and clinical services. The concentration of research institutions and healthcare professionals in these cities reinforces their status in the neuromodulation devices market, facilitating collaborative advances in treatment options.

The increasing geriatric population in India is influencing the demand for neuromodulation devices. According to the United Nations, India’s elderly population aged over 60 is projected to reach 340 million by 2050. This demographic trend indicates a higher prevalence of age-related neurological disorders like Parkinson’s disease and Alzheimer’s, which necessitate effective therapeutic interventions. Furthermore, a report from the Registrar General of India reveals that nearly 8.6% of the population was above 60 years in 2022, marking a critical segment for healthcare services.

Market Segmentation

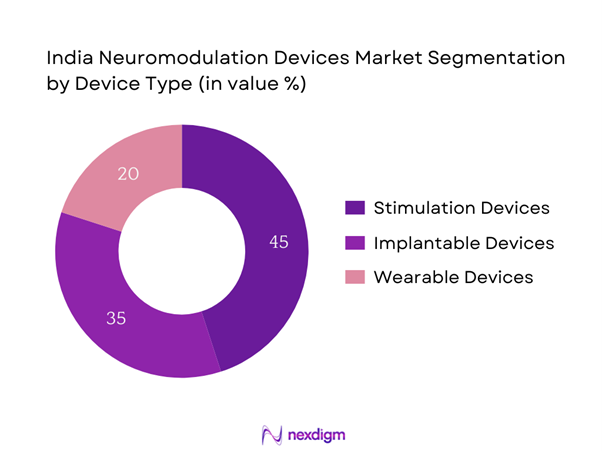

By Device Type

The India Neuromodulation Devices Market is segmented by device type into stimulation devices, implantable devices, and wearable devices. Currently, stimulation devices hold a dominant market share due to their established applications in pain management and neurological disorder treatments. The rising number of patients seeking non-invasive or minimally invasive solutions for chronic pain relief is the primary driver for the stimulation devices segment. Esteemed brands and increased availability of these devices contribute to their market prevalence, making them a popular choice among healthcare providers and patients alike.

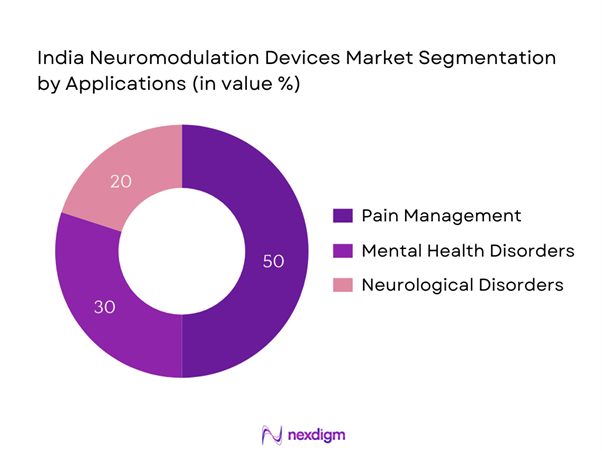

By Application

The market is further segmented by application into pain management, mental health disorders, and neurological disorders. Pain management currently dominates this segment, bolstered by the escalating incidences of chronic pain conditions. Factors such as sedentary lifestyles leading to increased back pain, migraines, and fibromyalgia directly influence the demand for effective pain management solutions. Neuromodulation devices designed for pain relief are gaining traction, thus solidifying their position within this space.

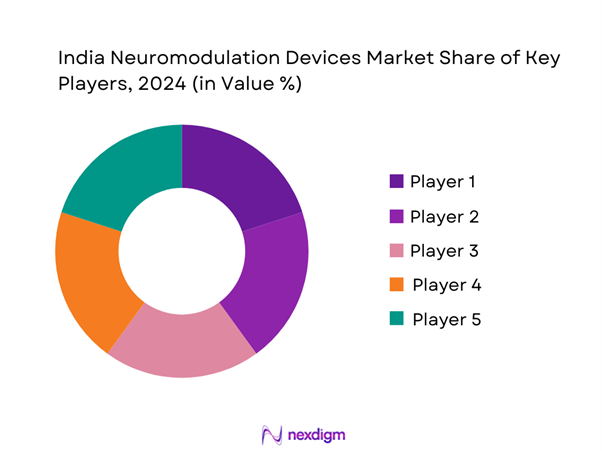

Competitive Landscape

The India Neuromodulation Devices Market is dominated by a few major players, including Medtronic, Boston Scientific, and Abbott Laboratories. This consolidation underscores the significant influence that these key companies have on the market dynamics, driven by their strong R&D capabilities and extensive distribution networks.

| Company | Establishment Year | Headquarters | Device Type Focus | Market Reach | Innovation Capabilities |

| Medtronic | 1949 | Dublin, Ireland | – | – | – |

| Boston Scientific | 1979 | Marlborough, MA, USA | – | – | – |

| Abbott Laboratories | 1888 | Abbott Park, IL, USA | – | – | – |

| Stryker Corporation | 1941 | Kalamazoo, MI, USA | – | – | – |

| Envoy Medical | 2010 | Minneapolis, MN, USA | – | – | – |

India Neuromodulation Devices Market Analysis

Growth Drivers

Increasing Prevalence of Neurological Disorders

The rising incidence of neurological disorders in India significantly contributes to the growth of the neuromodulation devices market. As per the World Health Organization (WHO), around 7.8 million people in India suffered from epilepsy in 2022, a common neurological disorder. In addition, the Indian Ministry of Health and Family Welfare reported that mental health issues affect approximately 150 million individuals, exacerbating the need for effective treatment options. With such a large patient population, the demand for neuromodulation technologies aimed at treating these disorders is expected to surge.

Advancements in Technology

Technological innovations in neuromodulation devices are driving market growth in India. The emergence of precise implantation techniques and sophisticated device functionalities, such as closed-loop systems, has enhanced treatment outcomes. According to research conducted by the Indian Institute of Technology (IIT), advancements like brain-machine interfaces and novel stimulation paradigms are significantly improving therapeutic efficacy. By integrating technology with medical devices, patients are experiencing faster recovery times and better management of conditions. This trend is underscored by a government initiative that supports the development of innovative medical technologies, reflecting a commitment to improving healthcare delivery in India.

Market Challenges

High Cost of Devices

The high cost of neuromodulation devices poses a significant challenge to market growth in India. A comprehensive analysis found that advanced stimulation devices can range from INR 30,000 to INR 2,00,000, depending on complexity. Such prices can be prohibitive for a large proportion of the Indian population, where the average per capita income is around INR 1,20,000 a year as reported by the Reserve Bank of India (RBI) in 2022. This financial barrier limits access to innovative therapeutic solutions, hindering the potential expansion of the neuromodulation devices market.

Regulatory Hurdles

Regulatory challenges in the approval process of neuromodulation devices represent a hurdle for market entry and expansion. The Medical Device Rules, 2017, stipulated by the Central Drugs Standard Control Organization (CDSCO), require extensive clinical trials and safety assessments before any device can enter the market. The time-consuming process, which can take years, affects the availability of new treatment options. For instance, a recent study identified that only about 40% of devices submitted for approval manage to receive timely clearance, undermining the market’s responsiveness to evolving patient needs and technological advancements.

Opportunities

Growing Demand for Personalized Treatment

There is a substantial opportunity in the India Neuromodulation Devices Market due to the increasing demand for personalized treatment solutions. As patients seek more tailored health interventions, there’s a shift toward customizing neuromodulation therapies to individual conditions and responses. According to an industry report, personalized medicine could address up to 90 million patients in the neurological disorder segment by leveraging genetic and physiological data for treatment personalization. Companies focusing on developing adaptive stimulation protocols will likely capture significant market share as the emphasis on individualized care continues to rise.

Expansion of Telehealth Services

The expansion of telehealth services is creating opportunities for neuromodulation device manufacturers in India. The COVID-19 pandemic accelerated the adoption of telehealth, with usage rising to 40% in 2022 according to reports from the Ministry of Health and Family Welfare. Telehealth provides a platform for ongoing patient management and follow-ups, allowing for timely interventions using neuromodulation devices.

Future Outlook

Over the next five years, the India Neuromodulation Devices Market is expected to demonstrate significant growth, driven by continuous advancements in technology, rising healthcare spending, and an increasing geriatric population. The integration of digital technologies and telehealth solutions is anticipated to enhance patient engagement and access to neuromodulation therapies. Furthermore, the growing awareness of mental health and aging disorders will lead to rising demand for innovative treatment options.

Major Players

- Medtronic

- Boston Scientific

- Abbott Laboratories

- Stryker Corporation

- Envoy Medical

- NeuroPace

- Zynex Medical

- Neuronetics

- Pain Therapeutics

- EtonBio

- Stimwave

- Axonics Modulation Technologies

- Cerecor

- Neuralimplants

- Nuvectra

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- Patients with Neurological Disorders

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Drugs Controller General of India, Ministry of Health and Family Welfare)

- Medical Device Distributors

- Pharmaceutical Companies

- Insurance Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Neuromodulation Devices Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India Neuromodulation Devices Market will be compiled and analyzed. This includes assessing market penetration, the ratio of device types avail able, and resultant revenue generation. Additionally, an evaluation of service quality and patient satisfaction metrics will be conducted to ensure the reliability of the revenue estimates and market size calculations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing various stakeholders, including healthcare providers, manufacturers, and regulatory authorities. These consultations will provide valuable operational and financial insights directly from practitioners, essential for refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple neuromodulation device manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction will help verify and complement the statistics derived from the bottom-up approach, ultimately ensuring a comprehensive and validated analysis of the India Neuromodulation Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Neurological Disorders

Advancements in Technology

Rising Geriatric Population - Market Challenges

High Cost of Devices

Regulatory Hurdles - Opportunities

Growing Demand for Personalized Treatment

Expansion of Telehealth Services - Trends

Increasing Adoption of Minimally Invasive Procedures

Integration of AI in Neuromodulation Devices - Government Regulation

Product Approval Processes

Safety Standards and Compliance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Device Type (In Value %)

Stimulation Devices

Implantable Devices

Wearable Devices - By Application (In Value %)

Pain Management

Mental Health Disorders

Neurological Disorders - By End-User (In Value %)

Hospitals

Homecare Settings

Rehabilitation Centers - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Sales - By Region (In Value %)

North India

West India

South India

East India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Device Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Device Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Medtronic

Boston Scientific

NeuroPace

Abbott Laboratories

Stryker Corporation

St. Jude Medical

Envoy Medical

Nuvectra

Neuronetics

Zynex Medical

Axonics Modulation Technologies

Pain Therapeutics

Cerecor

EtonBio

Stimwave

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030