Market Overview

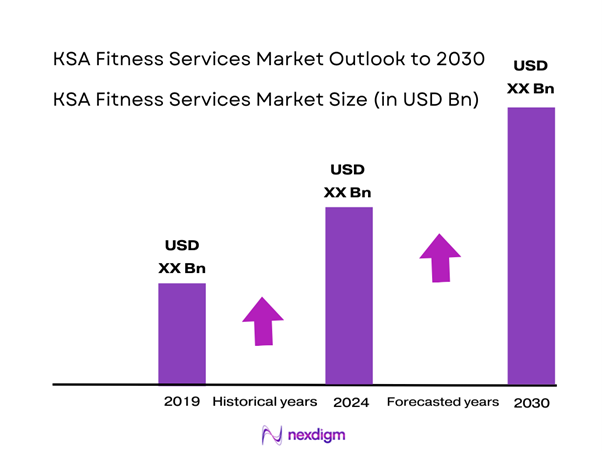

The KSA Fitness Services market is valued at USD 1.06 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 10.90% from 2025-2030, based on a five-year historical analysis. This market size growth is driven primarily by increasing health consciousness among the population, which has spurred demand for fitness-related services. Furthermore, the rise in disposable income has allowed more individuals to invest in premium fitness memberships and personal training services.

The cities that dominate the KSA Fitness Services market include Riyadh, Jeddah, and Dammam. These metropolitan areas have a high concentration of fitness facilities and greater participation in fitness activities due to their urban populations and evolving lifestyle preferences. The presence of international gym franchises alongside local fitness chains enhances competition, driving innovation and diversified fitness offerings in these regions. Additionally, the focus on community health through corporate wellness programs adds to the prominence of these cities in the fitness landscape.

According to the IMF, Saudi Arabia’s GDP per capita reached USD 20,800 in 2022, reflecting a 2.4% growth from the previous year. An increase in disposable income has positively impacted consumer spending on health and fitness. The average household expenditure on leisure activities, which includes fitness services, has risen by approximately 12% between 2021 and 2023.

Market Segmentation

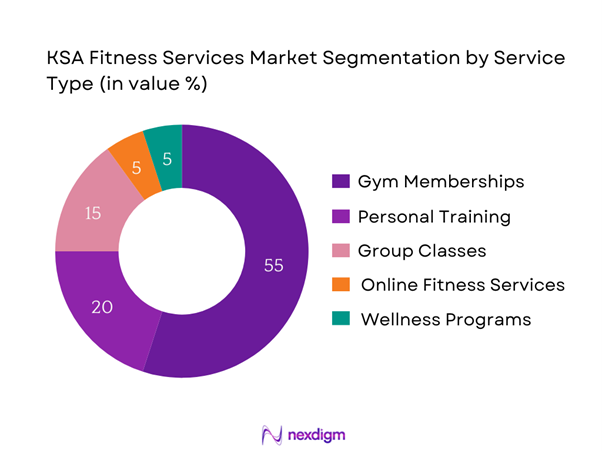

By Service Type

The KSA Fitness Services market is segmented by service type into gym memberships, personal training, group classes, online fitness services, and wellness programs. Gym memberships dominate this segmentation, capturing a significant market share in 2024. This trend is predicated on the established popularity of traditional gyms and fitness centers, which provide extensive facilities and a community environment that encourages consistent participation. Brands such as Fitness Time and Gold’s Gym have successfully cultivated member loyalty through diverse offerings, making gym memberships an attractive choice for consumers.

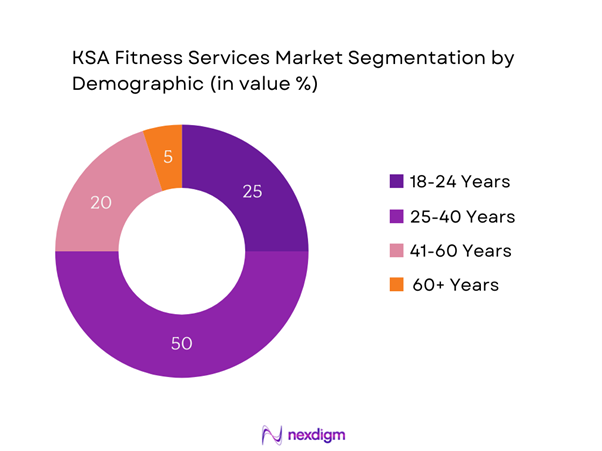

By Demographic

The KSA Fitness Services market is also segmented by demographics into age groups, gender, and fitness levels. Among these, the age group of 25-40 years is the most significant segment for market share in 2024, primarily due to lifestyle changes favoring fitness and health. This demographic is more engaged with fitness trends and technology, often participating in group classes and personal training sessions. Their increasing awareness of fitness benefits has led to a rise in gym memberships and community fitness initiatives tailored for this age group.

Competitive Landscape

The KSA Fitness Services market is dominated by a few major players, including Fitness Time and Gold’s Gym, along with other influential companies like Anytime Fitness and Virgin Active. This concentration highlights the significant role these key companies play in shaping market dynamics.

| Company | Establishment Year | Headquarters | Service Offerings | Pricing Model | Membership Count | Digital Presence |

| Fitness Time | 2004 | Riyadh | – | – | – | – |

| Gold’s Gym | 1965 | Jeddah | – | – | – | – |

| Anytime Fitness | 2002 | Riyadh | – | – | – | – |

| Virgin Active | 1999 | Jeddah | – | – | – | – |

| O2 Fitness | 2007 | Dammam | – | – | – | – |

KSA Fitness Services Market Analysis

Growth Drivers

Increasing Health Awareness

Health awareness in Saudi Arabia is on the rise, influenced by government campaigns promoting healthy living and disease prevention. According to the Saudi Ministry of Health, non-communicable diseases, including obesity and diabetes, accounted for approximately 60% of all deaths in the Kingdom in 2022. The increased emphasis on health education has resulted in more citizens participating in fitness activities, with a reported 33% of the population engaging in regular physical exercise in 2023. The country’s Vision 2030 initiative further promotes health and wellness, setting targets to reduce obesity rates and enhance community health awareness.

Rising Urbanization

Urbanization is a key driver of the KSA fitness services market, with over 84% of the population residing in urban areas as of 2022, according to the World Bank. This demographic shift is resulting in increased access to fitness facilities, as urban centers develop more gyms and recreational spaces. The urban population exhibits a growing demand for fitness services, leading to a 5% annual increase in gym openings in metropolitan areas like Riyadh and Jeddah. Urban living is also associated with lifestyle changes that emphasize convenience and health, fueling the growth of fitness-related businesses in these regions.

Market Challenges

High Competition

The KSA fitness services market is highly competitive, with over 2,000 gyms and fitness centers operating nationwide as of 2023. This competition is intensifying due to the rapid entry of international fitness brands and local startups. Existing market players must continuously innovate and improve service offerings to maintain their market position. Despite growing demand, excess supply can lead to pricing pressures and lower profit margins. Additionally, many facilities struggle to differentiate themselves in terms of services and memberships, resulting in a challenging landscape for operators within the fitness industry.

Regulatory Compliance Issues

Businesses in the KSA fitness services market must navigate a complex regulatory landscape while adhering to health and safety standards. The Saudi General Authority for Competition enforces regulations that promote fair competition, but compliance can be burdensome for small operators. Furthermore, gyms must also meet licensing requirements mandated by the Ministry of Municipal and Rural Affairs, which include adhering to safety codes and maintaining health protocols. In 2022, non-compliance led to fines amounting to SAR 1 million across various facilities, underlining the importance of maintaining regulatory standards within the industry.

Opportunities

Expansion of Digital Fitness Solutions

The increasing adoption of technology presents vast opportunities in the KSA fitness services market, particularly in digital fitness solutions. The growth of smartphone penetration in Saudi Arabia reached 90% in 2023, with over 33 million users using fitness and wellness applications. Furthermore, the global fitness app market is expected to grow significantly as more users engage with virtual workout programs and mobile interfaces. This trend presents an opportunity for fitness providers to expand their services online, thereby reaching a broader audience. Innovative products such as online coaching and digital workout plans are poised for substantial growth, appealing to tech-savvy consumers eager for flexibility and personalization in their fitness journey.

Demand for Eco-Friendly Practices

Sustainability in fitness practices is becoming increasingly relevant, with growing consumer interest in eco-friendly initiatives. As of 2022, surveys indicated that 62% of consumers in Saudi Arabia consider sustainable practices when choosing gym facilities. There is considerable room for expansion in adopting sustainable practices such as eco-friendly equipment and energy-efficient facilities. Companies implementing eco-conscious practices can establish a competitive advantage, attracting environmentally conscious consumers. Eco-friendly initiatives not only resonate with the target audiences but also align with the broader goals of the Vision 2030 initiative, which emphasizes sustainability for the kingdom’s future.

Future Outlook

Over the next five years, the KSA Fitness Services market is expected to show significant growth driven by the continuous rise of health awareness initiatives, encouraging governmental support, and advancements in fitness technology. The trend of integrating online fitness programs is also anticipated to accelerate as digital engagement becomes a standard expectation for members seeking flexibility in their workouts. The market’s expansion will be further aided by innovations in gym equipment and the evolving landscape of fitness offerings tailored to meet diverse consumer needs.

Major Players

- Fitness Time

- Gold’s Gym

- Anytime Fitness

- Virgin Active

- O2 Fitness

- Snap Fitness

- FitStop

- Studio A

- Powerhouse Gym

- Ahlan Fitness

- Body Masters

- Urban Fitness

- The Warehouse Gym

- Life Health & Fitness

- Aspire Zone

Key Target Audience

- Fitness Enthusiasts

- Health and Wellness Buyers

- Corporate Fitness Program Managers

- Gyms and Fitness Center Owners

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Ministry of Health, Saudi General Sports Authority)

- Sports Organizations

- Fitness Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Fitness Services market. This step utilizes a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including demographics, preferences, and regional trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA Fitness Services market. This includes assessing market penetration, the ratio of various service types, and resultant revenue generation. An evaluation of service quality statistics is also conducted to ensure the reliability and accuracy of the revenue estimates across different service segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via structured interviews. These consultations involve key representatives from fitness centers, health clubs, and corporate wellness program managers to provide operational and financial insights. Such feedback is invaluable for refining market data and ensuring it reflects current realities.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with various fitness service providers to collect detailed insights into service offerings, member preferences, and the operational landscape. This interaction serves to verify and complement the statistics derived from both qualitative and quantitative approaches, leading to a comprehensive and validated analysis of the KSA Fitness Services market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Awareness

Rising Urbanization

Increasing Disposable Income - Market Challenges

High Competition

Regulatory Compliance Issues - Opportunities

Expansion of Digital Fitness Solutions

Demand for Eco-Friendly Practices - Trends

Rising Popularity of Boutique Fitness Studios

Growth of Wearable Fitness Technology - Government Regulation

Licensing Requirements

Health & Safety Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Membership Count, 2019-2024

- By Average Revenue Per Member, 2019-2024

- By Service Type (In Value %)

Gym Memberships

Personal Training

Group Classes

Online Fitness Services

Wellness Programs - By Demographic (In Value %)

Age Groups

Gender

Fitness Levels - By Geography (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Facility Type (In Value %)

Commercial Gyms

Corporate Fitness Centers

Community Centers - By Pricing Models (In Value %)

Subscription-Based

Pay-As-You-Go

- Market Share of Major Players on the Basis of Value, 2024

Market Share by Service Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Locations, Membership Capabilities, Digital Presence, Operations Scale)

- SWOT Analysis of Major Players

- Pricing Analysis of Services for Major Players

- Detailed Profiles of Major Companies

Fitness Time

Gold’s Gym

Aspire Zone

Anytime Fitness

O2 Fitness

Snap Fitness

FitStop

Virgin Active

Studio A

Powerhouse Gym

Ahlan Fitness

Body Masters

Urban Fitness

The Warehouse Gym

Life Health & Fitness

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Membership Count, 2025-2030

- By Average Revenue Per Member, 2025-2030