Market Overview

The India Flex Fuel Vehicle market is valued at USD 855.77 billion in 2025 with an approximated compound annual growth rate (CAGR) of 15% from 2025-2030, based on a comprehensive analysis of current trends and consumer adoption rates. The growth is primarily driven by government initiatives aimed at promoting greener transportation solutions and the increasing consumer awareness surrounding environmental sustainability. Demand for flexible fuel systems is expected to rise due to regulatory frameworks that favor alternative fuels, coupled with initiatives to reduce dependence on fossil fuels.

India’s major urban centers like Delhi, Mumbai, Bangalore, and Hyderabad dominate the Flex Fuel Vehicle market. The dominance of these cities is attributed to their large populations, increasing vehicular density, and supportive state policies that encourage the adoption of cleaner fuels. Additionally, the presence of a robust infrastructure and rapid urbanization contribute to the strong market demand in these areas.

The Indian government has implemented various incentives and subsidies to promote the adoption of flex fuel vehicles, enhancing the country’s efforts to reduce greenhouse gas emissions and dependence on fossil fuels. For instance, the government announced a budget allocation of INR 10,000 crores for the biofuel sector, specifically targeting ethanol production, which is a primary component of flex fuel. Additionally, policies aimed at increasing ethanol blending in petrol up to 20% by end of 2025 demonstrate the government’s commitment to incentivizing the shift toward flex fuel vehicles.

Market Segmentation

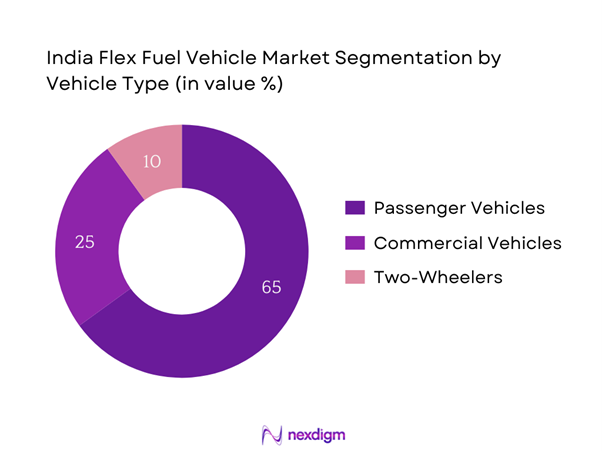

By Vehicle Type

The India Flex Fuel Vehicle market is segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. Currently, passenger vehicles hold a dominant market share within this segment. The primary reason for this dominance lies in the rising middle-class population, who are increasingly seeking affordable, environmentally friendly transportation options. Additionally, manufacturers are focusing on making genuine flex fuel models accessible and cost-competitive, alongside traditional alternatives. The increased availability of flexible fuel models, combined with government incentives for owner’s transition from conventional to flex fuel vehicles, further encourages their adoption among consumers.

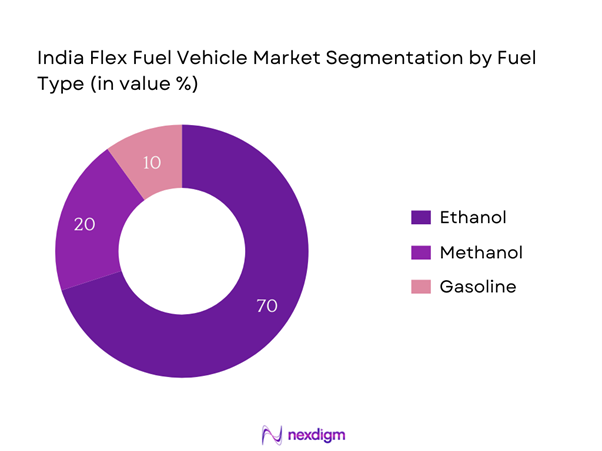

By Fuel Type

The market is also segmented by fuel type, which includes ethanol, methanol, and gasoline. Ethanol has emerged as the leading sub-segment within this category. This is due to the Indian government’s strong promotion of ethanol blending in fuel, driven by agricultural policy to utilize locally produced crops. With a rapidly growing biofuels industry, ethanol receives increasing recognition for its lower carbon footprint and potential to reduce air pollution. Given this focus, ethanol blends are expected to dominate the flex fuel landscape, reinforcing the market’s transition towards sustainable transportation solutions.

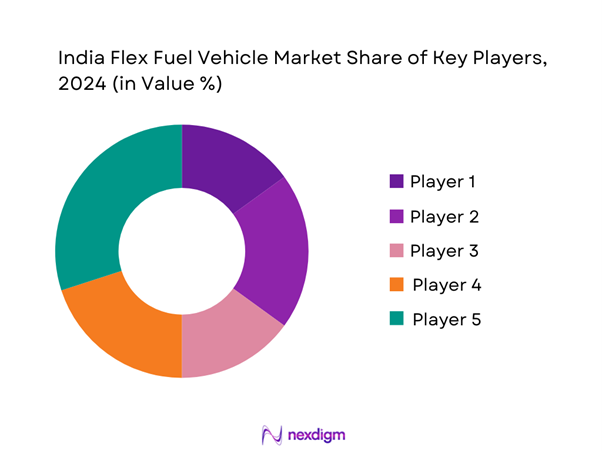

Competitive Landscape

The India Flex Fuel Vehicle market is characterized by a mix of established automotive giants and new entrants aiming to capture a share of this evolving market landscape. Major players include those with extensive R&D capabilities and established distribution networks. Tata Motors, Mahindra & Mahindra, Maruti Suzuki, and Hyundai lead the competition, leveraging their advanced technologies and varying product lines.

| Company Name | Establishment Year | Headquarters | Market Focus | Production Capacity | R&D Investment | Recent Innovations |

| Tata Motors | 1945 | Mumbai, India | – | – | – | – |

| Mahindra & Mahindra | 1945 | Mumbai, India | – | – | – | – |

| Maruti Suzuki | 1981 | New Delhi, India | – | – | – | – |

| Hyundai | 1967 | Seoul, South Korea | – | – | – | – |

| Ford India | 1903 | Chennai, India | – | – | – | – |

India Flex Fuel Vehicle Market Analysis

Growth Drivers

Increasing Environmental Awareness

There is a significant rise in environmental awareness among consumers in India, with studies revealing that 75% of urban citizens express concern about air pollution and its impact on health. This increased consciousness is translated into consumer choices, with many opting for cleaner fuel vehicles. Reports indicate that cities like Delhi and Mumbai experience PM2.5 pollution levels above 200 µg/m³, which is substantially higher than the World Health Organization’s safe level of 25 µg/m³. As awareness grows, more consumers are inclined to consider flex fuel vehicles, which contribute to reduced vehicular emissions.

Rising Fuel Prices

The continuous escalation of fuel prices significantly influences consumer behavior towards alternative fuel vehicles, including flex fuel vehicles. As of late 2023, the average price of petrol in India reached INR 112 per liter, creating an urgent push for consumers to seek more economical and sustainable alternatives. Additionally, the price of ethanol, which serves as a feasible substitute, remains more stable. The Indian government’s push to increase ethanol production aims to alleviate fuel costs for consumers while providing a renewable energy source that can help mitigate reliance on conventional fossil fuels.

Market Challenges

Infrastructure Limitations

Despite the potential for flex fuel vehicles, significant infrastructure limitations pose a challenge to widespread adoption. As of 2023, there are only 1,500 ethanol fueling stations across India, concentrated mainly in urban centers, creating a disparity in access for rural consumers. Furthermore, government programs to expand this infrastructure are encountering obstacles such as funding gaps and lengthy approval processes. This limited infrastructure hampers the convenience and practicality of adopting flex fuel vehicles, making it a critical challenge for market penetration.

Consumer Awareness

Although there is a rising trend in environmental awareness, consumer knowledge regarding flex fuel vehicles remains low. Surveys indicate that only 30% of potential buyers are aware of what flex fuel vehicles entail and their environmental benefits. This gap in awareness prevents prospective buyers from considering these vehicles, which in turn stunts market growth. Notably, without widespread understanding, the transition to flex fuel technology may be slow, indicating a need for concerted educational efforts by stakeholders to bridge this knowledge gap.

Opportunities

Innovations in Flex Fuel Technology

The ongoing innovations in flex fuel technology hold great potential for enhancing the efficiency and appeal of these vehicles. Currently, companies are investing heavily in developing advanced flex fuel engines that promise higher performance and better fuel efficiency than traditional models. For instance, auto manufacturers in India are collaborating with research institutions to create hybrid systems that optimize both gasoline and ethanol combustion. This innovative direction is expected to drive increased consumer interest and market expansion, as technological advancements often lead to enhanced vehicle reliability and lower operational costs.

Strategic Partnerships and Collaborations

Strategic partnerships between government entities, auto manufacturers, and fuel suppliers can significantly enhance the market for flex fuel vehicles. Currently, several automotive companies are forming alliances with biofuel producers to ensure a steady supply of renewable fuels. These collaborations are crucial for creating integrated supply chains that support the availability of ethanol and other alternative fuels. For instance, a recent partnership between a leading automaker and a bioethanol supplier aims to streamline production processes, thereby improving supply reliability and potentially leading to lower fuel prices, which can significantly bolster flex fuel vehicle adoption in India.

Future Outlook

Over the next five years, the India Flex Fuel Vehicle market is expected to experience substantial growth driven by continuous government support, significant advancements in flex fuel technology, and a rising demand for environmentally friendly and sustainable transportation solutions. The transition towards flex fuel vehicles presents considerable opportunities for manufacturers to innovate and improve vehicle offerings in response to consumer preferences. Coupled with increasing investments in infrastructure and enhanced public awareness, the market is poised for robust expansion.

Major Players

- Tata Motors

- Mahindra & Mahindra

- Maruti Suzuki

- Hyundai

- Ford India

- Honda Cars India

- Nissan

- Volkswagen India

- Toyota Kirloskar Motor

- Bajaj Auto

- Ashok Leyland

- TVS Motor Company

- Hero MotoCorp

- Piaggio Vehicles

- Mahindra Electric Mobility

Key Target Audience

- Automotive Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Road Transport and Highways, Ministry of Environment, Forest and Climate Change)

- Automotive Distributors and Dealers

- Fleet Management Companies

- Vehicle Rental Services

- NGOs and Environmental Advocacy Groups

- Research and Development Institutions

- Energy Sector Companies (Focusing on Renewable Fuels)

- Logistics and Supply Chain Management Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Flex Fuel Vehicle market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Flex Fuel Vehicle market. This includes assessing market penetration, ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple flex fuel vehicle manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Flex Fuel Vehicle market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Historical Context

- Major Players Timeline

- Industry Life Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Incentives and Subsidies

Increasing Environmental Awareness

Rising Fuel Prices - Market Challenges

Infrastructure Limitations

Consumer Awareness - Opportunities

Innovations in Flex Fuel Technology

Strategic Partnerships and Collaborations - Trends

Shift Towards Sustainable Energy Solutions

Development of Alternative Fuel Infrastructure - Government Regulation

Policy Framework for Flex Fuel Vehicles

Standards and Compliance Levels - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Two-Wheelers - By Fuel Type (In Value %)

Ethanol

Methanol

Gasoline - By Distribution Channel (In Value %)

Direct Sales

Dealers/Showrooms

Online Sales - By Region (In Value %)

Northern Region

Southern Region

Western Region

Eastern Region - By End User Application (In Value %)

Government Fleets

Private Fleets

Ride Sharing Services

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Vehicle, Number of Distribution Points, Customer Engagement Strategies, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Major Players

Tata Motors

Mahindra & Mahindra

Maruti Suzuki

Hyundai Motors

Honda Cars India

Ford India

Volkswagen India

Toyota Kirloskar Motor

Ashok Leyland

Bajaj Auto

TVS Motor Company

Hero MotoCorp

Mahindra Electric Mobility

Piaggio Vehicles

Renault India

- Market Demand and Utilization Trends

- Purchasing Behaviors and Budget Allocations

- Regulatory Impacts on Consumer Choices

- User Needs, Desires, and Pain Point Analysis

- Decision-Making and Purchase Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030