Market Overview

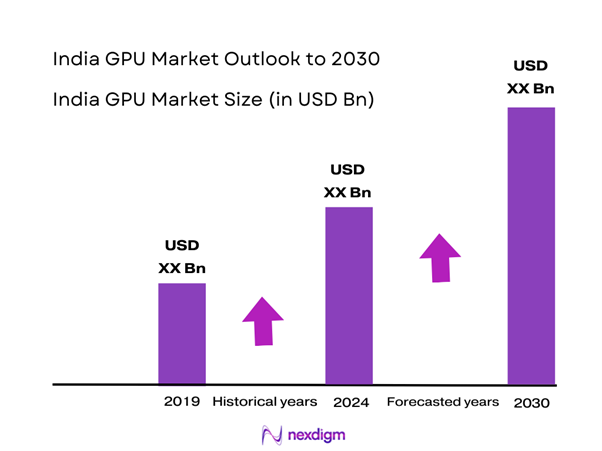

The India Graphics Processing Unit market is valued at USD 4.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 33% from 2024-2030, based on a comprehensive analysis of industry growth and revival post pandemic. The robust growth of the market can be attributed to rising demand across various sectors such as gaming, AI, and video editing, which are increasingly reliant on high-performance computing technologies.

Major cities that dominate the Graphics Processing Unit market in India are Bengaluru, Hyderabad, and Pune. These cities have established themselves as tech hubs, housing numerous IT and gaming startups, leading multinational corporations like NVIDIA and AMD, and educational institutions dedicated to technology. The ecosystem in these regions encourages innovation and development, which further fuels demand for advanced GPUs, making them the focal point of the Indian GPU market.

Investment in artificial intelligence technologies is expected to escalate significantly, with the Indian AI market projected to reach USD 7.8 billion in 2025 from USD 3.1 billion in 2022, marking a growth trajectory that reflects increasing corporate adoption of AI-driven solutions. The integration of AI and machine learning in sectors such as healthcare, finance, and logistics is rapidly advancing, leading to a burgeoning need for high-performance GPUs capable of processing large datasets efficiently.

Market Segmentation

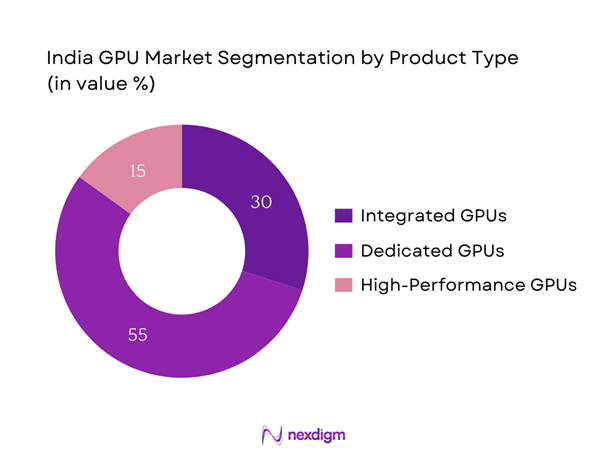

By Product Type

The India Graphics Processing Unit market is segmented by product type into Integrated GPUs, Dedicated GPUs, and High-Performance GPUs. Among these, Dedicated GPUs are notably dominating the market share in India due to their superior processing power and ability to handle intense graphical tasks. With the proliferation of gaming and content creation, dedicated GPUs have become essential for enthusiasts and professionals alike. Leading brands such as NVIDIA and AMD have established a loyal consumer base, driven by significant advancements in graphics performance and memory capabilities. These features make dedicated GPUs the go-to choice for users seeking the best performance for gaming, rendering, and computational tasks.

By Application

The India Graphics Processing Unit market is segmented by application into Gaming, Data Centers, AI & Machine Learning, Video Editing, and Graphics & Visualization. The Gaming segment dominates the market primarily due to the rapid expansion of the gaming industry in India. As more individuals engage in gaming, fueled by the emergence of eSports and online gaming, the demand for high-performance GPUs to deliver optimal gaming experiences has surged. Companies like ASUS and MSI have tailored their products to cater to gamers, incorporating features such as enhanced cooling and overclocking capabilities, further establishing this segment as the leader in market share.

Competitive Landscape

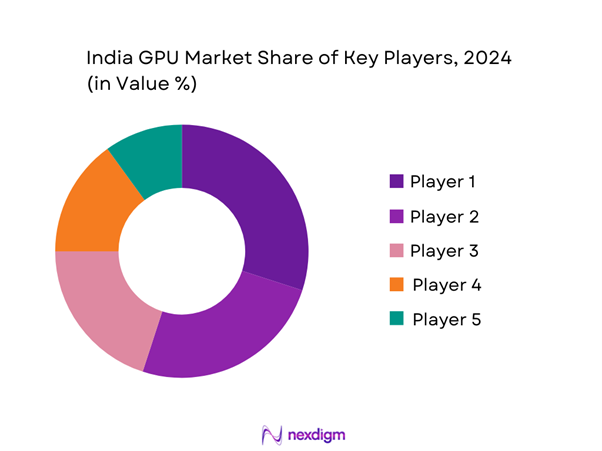

The India Graphics Processing Unit market is characterized by the presence of several key players, including NVIDIA, AMD, Intel, Qualcomm, and Xilinx. This competitive landscape emphasizes a mix of local and global manufacturers, each contributing to innovation and market growth. As a result of their advanced technology, these firms collectively shape the market through extensive product offerings tailored to various applications, thus highlighting their significant impact within the industry.

| Company | Establishment Year | Headquarters | Product Focus | Market Segment Focus | Revenue (Est.) | Competition Level |

| NVIDIA | 1993 | California, USA | – | – | – | – |

| AMD | 1969 | California, USA | – | – | – | – |

| Intel | 1968 | California, USA | – | – | – | – |

| Qualcomm | 1985 | California, USA | – | – | – | – |

| Xilinx | 1984 | California, USA | – | – | – | – |

India Graphics Processing Unit Market Analysis

Growth Drivers

Growing Gaming Industry

The gaming industry in India has expanded rapidly, with revenues projected to reach USD 4.8 billion in 2023, fueled by a growing population of gamers and improved internet connectivity. The surge in mobile gaming, which constitutes about 90% of the market, is significant. Additionally, as of late 2022, there were approximately 500 million gamers in India, a number set to increase further. This growth in the gaming user base is directly driving demand for advanced graphics processing units, as high-performance GPUs are essential for delivering immersive gaming experiences that attract a larger audience.

Rise in Digital Content Creation

The digital content creation market in India is currently valued at USD 2.74 billion and is expected to grow significantly, driven by an increase in content consumption across social media platforms and streaming services. With the proliferation of tools for video editing, motion graphics, and comprehensive digital artistry, there has been a corresponding rise in demand for GPUs that can handle intensive graphic tasks. The expansion of the influencer marketing industry, which was projected to be worth USD 2 billion by end of 2025, further amplifies the need for advanced GPUs as creators seek higher-quality rendering and editing capabilities to engage their audiences.

Market Challenges

Supply Chain Disruptions

The GPU market faces significant challenges due to ongoing supply chain disruptions, which originated from the global semiconductor shortage exacerbated by the COVID-19 pandemic. Notably, global chip production was down by around 1.7% as of 2022, primarily affecting electronics and technology sectors. This hurdle causes delays in product launches and leads to increased lead times for manufacturers, which could stifle the demand as consumers are unable to acquire the latest technology in a timely manner. Furthermore, geopolitical tensions, particularly in the Asia-Pacific region, have further complicated logistics and distribution channels, intensifying the struggle for timely component availability.

High Costs of Advanced GPUs

The price of high-performance GPUs remains a barrier to broader market adoption, with significant fluctuations over the past years causing concerns among both consumers and manufacturers. In 2022, the average price of high-end graphics cards was around USD 1,200, a trend influenced by component shortages and high demand. Additionally, retail prices for GPUs have risen by about 30% over the past year due to ongoing demand pressures, leading consumers to delay upgrades. High production costs, coupled with inflationary pressures, are likely to continue hindering the market’s growth trajectory as manufacturers strive to manage efficient pricing strategies without sacrificing quality.

Opportunities

Emerging VR/AR Markets

The Virtual Reality (VR) and Augmented Reality (AR) market in India is currently at a budding stage, valued at approximately USD 1 billion in 2022, with major growth predicted as industries such as gaming, retail, and healthcare adopt these technologies. The expansion of VR/AR applications enhances consumer engagement and experience, which necessitates the deployment of advanced GPUs. As VR headsets become more affordable and integration with global gaming platforms increases, this segment presents a promising avenue for GPU manufacturers to expand their market presence. Companies focusing on this technology can reap substantial rewards due to the compelling demand for high-performance solutions.

Expansion of Cloud Gaming

The cloud gaming segment in India is gaining momentum, projected to grow from USD 290 million in 2022 to an anticipated USD 1.5 billion by end of 2025 as internet infrastructure continues to improve. This burgeoning market entails the streaming of video games directly to devices, eliminating the need for high-end hardware at the consumer’s end. As a result, there is a growing dependence on powerful servers equipped with advanced GPUs to ensure seamless online gaming experiences.

Future Outlook

Over the next five years, the India Graphics Processing Unit market is expected to experience significant growth driven by continuous advancements in GPU technology, rising demand for immersive gaming experiences, and increased application of AI across industries. Innovations such as real-time ray tracing and enhanced VR capabilities will further stimulate market expansion. Additionally, consumer awareness around high-performance computing solutions is paving the way for growth, indicating a flourishing future for the GPU market.

Major Players

- NVIDIA

- AMD

- Intel

- Qualcomm

- Xilinx (A part of AMD)

- Micron Technology

- Samsung Electronics

- Apple Inc.

- AsusTek Computer Inc.

- MSI

- Gigabyte Technology

- Razer Inc

- Zotac

- Sapphire Technology

- EVGA

Key Target Audience

- Gaming Companies

- Animation and Graphics Design Studios

- Data Center Operators

- AI and Machine Learning Developers

- Software Development Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Electronics and IT, Telecom Regulatory Authority of India)

- Hardware Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map that includes all major stakeholders within the India Graphics Processing Unit market. This step draws on extensive desk research, utilizing secondary data sources such as industry reports, market analysis, and proprietary databases, to gather detailed industry-level information. The primary goal is to identify and define critical variables influencing market dynamics and trends.

Step 2: Market Analysis and Construction

This phase comprises compiling and analyzing historical data concerning the Graphics Processing Unit market. This includes assessing market penetration rates, the ratio of key players to service providers, and assessing overall revenue generation within the sector. In parallel, evaluating service quality metrics ensures the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed and subsequently validated through interviews with industry experts. This step utilizes computer-assisted telephone interviews (CATIs) with a diverse array of companies to gain insights into operational and financial aspects. These consultations help refine and corroborate collected market data, ensuring validity and accuracy in the analysis.

Step 4: Research Synthesis and Final Output

The final phase emphasizes direct engagement with multiple manufacturers and market players to gain in-depth insights into product segments, consumer preferences, and sales performance. This interaction will validate and complement statistics gathered from the bottom-up approach, ensuring a thorough and justified analysis of the India Graphics Processing Unit market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Growing Gaming Industry

Advances in AI and Machine Learning

Rise in Digital Content Creation - Market Challenges

Supply Chain Disruptions

High Costs of Advanced GPUs - Opportunities

Emerging VR/AR Markets

Expansion of Cloud Gaming - Trends

Increased Adoption of RT and DLSS Technologies

Sustainability in Production Processes - Government Regulation

Import Tariffs and Duties

Compliance Standards for Technology Products - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Integrated GPUs

Dedicated GPUs

High-Performance GPUs - By Application (In Value %)

Gaming

Data Centers

AI & Machine Learning

Video Editing

Graphics & Visualization - By Distribution Channel (In Value %)

Online Retail

Offline Retail

Direct Sales - By Region (In Value %)

North India

South India

East India

West India - By Technology (In Value %)

Ray Tracing

Virtual Reality

AI Integration

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Variability in Product Offering, Market Reach, Customer Segments)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Players

NVIDIA Corporation

AMD

Intel

Xilinx

Qualcomm

ARM Holdings (Acquired by NVIDIA)

Micron Technology

Samsung Electronics

Apple Inc.

AsusTek Computer Inc.

MSI

Gigabyte Technology

Razer Inc.

Zotac

Sapphire Technology

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030