Market Overview

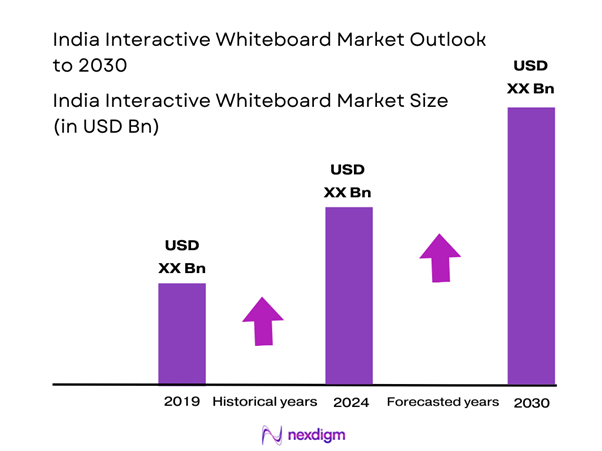

The India Interactive Whiteboard Market is valued at USD 200 million in 2024 with an approximated compound annual growth rate (CAGR) of 10.8% from 2024-2030 and is driven by the increasing adoption of digital education tools and the growing emphasis on interactive learning environments in educational institutions. This market’s dynamics are influenced by rising investments in infrastructure aimed at enhancing student engagement and learning outcomes.

Major cities such as Delhi, Bangalore, and Mumbai predominantly drive the India Interactive Whiteboard Market due to their status as educational and commercial hubs. Delhi is a center for policy-making and education technology innovations, while Bangalore, often referred to as the Silicon Valley of India, hosts numerous tech startups focusing on educational tools.

Government initiatives play a crucial role in promoting the adoption of interactive whiteboards in educational institutions. Programs such as the Samagra Shiksha Abhiyan aim to enhance the quality of education through smart classrooms and digital learning initiatives, with an allocated budget of approximately INR 48,000 crore dedicated to educational improvements in recent fiscal years. Furthermore, the emphasis on the digitalization of education is reflected in the National Education Policy, which envisions a framework where 75% of educational institutions will adopt smart technologies by end of 2025, paving the way for interactive solutions like whiteboards.

Market Segmentation

By Technology Type

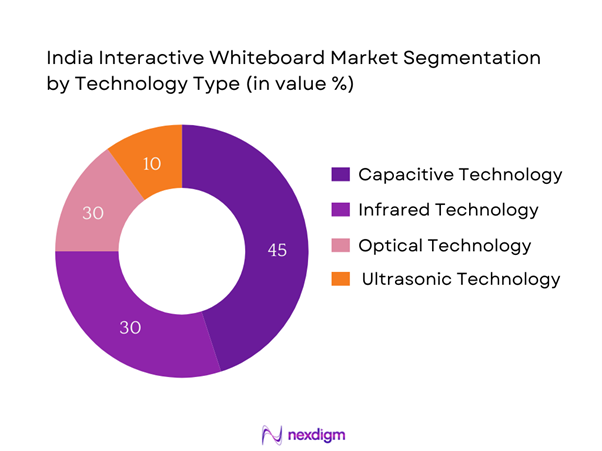

The India Interactive Whiteboard Market is segmented by technology type into capacitive technology, infrared technology, optical technology, and ultrasonic technology. Capacitive technology currently holds a significant share in the market due to its superior touch sensitivity and integrated functionalities that foster user interactivity. This technology enables multi-user interaction, making it ideal for collaborative settings in classrooms and corporate workplaces.

By Application

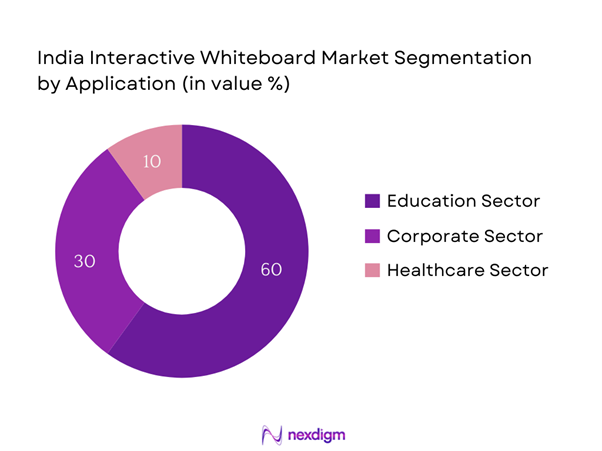

The India Interactive Whiteboard Market is further segmented by application into the education sector, corporate sector, and healthcare sector. The education sector is the largest segment, predominantly due to the widespread shift towards digital learning and the necessity for interactive teaching methods in schools and universities. The demand for interactive whiteboards in classrooms has been amplified by government initiatives promoting technology in education and the desire for improved learner engagement.

Competitive Landscape

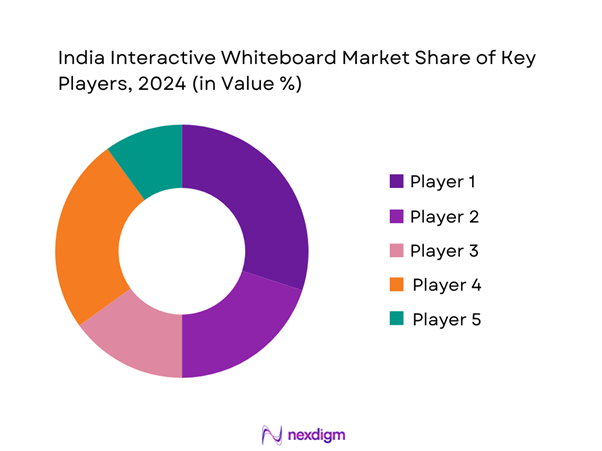

The India Interactive Whiteboard Market is characterized by the presence of major players such as Smart Technologies, Promethean, Epson, Panasonic, and Samsung. These companies dominate the landscape due to their innovative technology offerings, strong distribution networks, and commitment to enhancing user experience. The competitive dynamics underscore the impact of technology improvements and adaptability in meeting market needs.

| Company Name | Year Established | Headquarters | Product Range | Distribution Channels | Market Position |

| Smart Technologies | 1987 | Calgary, Canada | – | – | – |

| Promethean | 1996 | Blackburn, UK | – | – | – |

| Epson | 1942 | Suwa, Japan | – | – | – |

| Panasonic | 1918 | Osaka, Japan | – | – | – |

| Samsung | 1938 | Seoul, South Korea | – | – | – |

India Interactive Whiteboard Market Analysis

Growth Drivers

Increasing Adoption of ICT in Education

The increasing adoption of Information and Communication Technology (ICT) in education is a pivotal growth driver for the India Interactive Whiteboard Market. The Government of India’s National Policy on Education aims to integrate technology into educational settings, with nearly 60% of Indian schools reported to have implemented digital teaching tools as of 2023. This shift towards ICT is further supported by the growing internet penetration, which reached 800 million users in 2023, equating to 60% of the population. The emphasis on creating smart classrooms is expected to fuel further investments in interactive technologies.

Rising Demand for Digital Learning Tools

The demand for digital learning tools has seen significant escalation, paralleling the global shift towards e-learning and hybrid education models. The education technology market in India was evaluated at USD 3 billion in 2022, demonstrating a robust appetite for innovative educational solutions. This demand has been bolstered by the increase in online learning platforms, which accounted for over 200 million registered users as of 2023. The necessity for effective remote teaching tools amid the COVID-19 pandemic highlighted the urgent requirement for interactive whiteboards and associated technologies.

Market Challenges

High Initial Investment Costs

One of the significant challenges hindering the adoption of interactive whiteboards is the high initial investment required for procurement and installation. The average cost for a single interactive whiteboard can range between INR 50,000 to INR 1,00,000, depending on the specifications and technology used. Many institutions, particularly in rural areas, face budget constraints, with over 30% of schools in these regions lacking adequate funding for such technologies. Moreover, additional costs related to training teachers and maintenance further compound these investment barriers.

Limited Technological Awareness

Limited technological awareness among educators and administrators presents another challenge for the interactive whiteboard market. A study reported that approximately 40% of teachers in India lack familiarity with digital educational tools, which impedes effective implementation in classrooms. This skill gap often leads to reluctance in adopting advanced teaching technologies, forcing schools to explore alternative pedagogical methods instead of leveraging interactive tools, despite their benefits. Addressing this issue through targeted professional development programs is crucial for enhancing technology adoption rates in schools.

Opportunities

Growth in EdTech Innovations

The incessant growth in EdTech innovations presents a plethora of opportunities for the interactive whiteboard market. The Indian EdTech sector is expected to reach USD 10.4 billion by end of 2025, driven by advancements in technology and increasing demand for personalized learning experiences. The proliferation of startups focusing on innovative educational solutions has led to the emergence of integrated platforms that facilitate seamless use of interactive whiteboards alongside other teaching tools. With over 1,500 EdTech startups in India as of early 2023, investment and collaboration opportunities are anticipated to surge, positively influencing the market landscape.

Demand for Remote Learning Solutions

The persistent demand for remote learning solutions is set to revolutionize the interactive whiteboard market. As remote and hybrid learning environments become mainstream, the need for tools that enhance engagement and collaboration is paramount. The significant rise in online learning users to over 200 million opens new channels for integrating interactive whiteboards with digital classrooms. Additionally, the trend of blended learning is expected to persist, creating ongoing demand for interactive technologies that enable teachers to deliver interactive and engaging content effectively, highlighting an area of robust market potential.

Future Outlook

Over the next five years, the India Interactive Whiteboard Market is expected to display robust growth driven by the ongoing digital transformation across the educational landscape, increasing emphasis on collaborative learning, and continuous advancements in interactive technologies. The expansion of smart classroom initiatives and corporate training programs will significantly contribute to market growth, with the integration of artificial intelligence (AI) and Internet of Things (IoT) further enhancing the functionality of interactive whiteboards.

Major Players

- Smart Technologies

- Promethean

- Epson

- Panasonic

- Samsung

- ViewSonic

- Sharp

- Cisco Systems

- Microsoft

- Logitech

- BenQ

- Acebil

- Lifesize

- Newline Interactive

- i3 Tecnology

Key Target Audience

- Educational Institutions (Schools, Colleges, Universities)

- Corporate Training Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Education, Ministry of Electronics and Information Technology)

- System Integrators

- EdTech Startups

- Technology Distributors

- Retailers and Resellers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map encompassing all significant stakeholders within the India Interactive Whiteboard market. This phase is supported by extensive desk research, employing a combination of secondary and proprietary databases to gather detailed industry-level insights. The primary objective is to identify and define critical variables that influence market dynamics, including technological advancements, market adoption rates, and purchasing behaviors across various sectors.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the India Interactive Whiteboard Market is compiled and analyzed. This includes assessing market penetration rates, the ratio of marketplaces to service providers, and resultant revenue generation metrics. A thorough evaluation of service quality statistics is also conducted to ensure the reliability and accuracy of the revenue estimates, thereby enabling a robust understanding of market trends and performance indicators.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a plethora of companies operating within the interactive whiteboard ecosystem. These consultations yield valuable operational and financial insights from industry practitioners, crucial for refining and corroborating the market data and ensuring the analysis remains relevant and accurate.

Step 4: Research Synthesis and Final Output

The final phase entails engaging directly with multiple interactive whiteboard manufacturers to obtain detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This engagement serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Interactive Whiteboard Market that reflects current realities and future opportunities.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Adoption of ICT in Education

Rising Demand for Digital Learning Tools

Government Initiatives Supporting Smart Classrooms - Market Challenges

High Initial Investment Costs

Limited Technological Awareness - Opportunities

Growth in EdTech Innovations

Demand for Remote Learning Solutions - Trends

Integration with Learning Management Systems

Rise of Interactive Content - Government Regulation

Educational Policy Framework

Compliance with Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Capacitive Technology

Infrared Technology

Optical Technology

Ultrasonic Technology - By Application (In Value %)

Education Sector

Corporate Sector

Healthcare Sector - By Distribution Channel (In Value %)

Online Channels

Retail Outlets

Direct Sales - By Region (In Value %)

North India

South India

East India

West India - By Size of Whiteboards (In Value %)

Portable Interactive Whiteboards

Fixed Interactive Whiteboards

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share by Technology Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels Efficiency, Product Differentiation, After-Sales Support, Brand Recognition, Product Innovation, Global Reach, Sustainable Practices)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Smart Technologies

Promethean

Epson

Panasonic

Samsung

ViewSonic

Sharp

Cisco Systems

Microsoft

Logitech

BenQ

Acebil

Lifesize

Newline Interactive

i3 Tecnology

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030