Market Overview

The Indonesia logistics and supply chain market is valued at USD 131.2 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 6.29% from 2025-2030, based on historical data analysis. This growth is driven primarily by increasing urbanization, a rising middle class, and the expansion of e-commerce which enhances the demand for efficient logistics solutions. The infrastructure development undertaken by the government, especially in transportation and digital logistics, has further accelerated this market’s growth.

Key cities dominating the Indonesia logistics market include Jakarta, Surabaya, and Bandung. Jakarta, as the capital, serves as the country’s economic hub, housing various multinational corporations and thriving e-commerce platforms. Surabaya functions as a crucial port city facilitating the import and export of goods, while Bandung’s proximity to Jakarta makes it an attractive site for logistics and distribution centers. These cities benefit from strategic locations, enhanced connectivity, and substantial investments in logistics infrastructure, thereby maintaining their dominance in the market.

Technological innovations are reshaping the logistics landscape in Indonesia. The adoption of advanced technologies, including Artificial Intelligence (AI), Machine Learning, and automation in warehousing, is on the rise, with nearly 40% of logistics companies investing in technology upgrades as of 2023. The government is also promoting initiatives that foster tech innovation, indicated by the increasing number of technology startups in the logistics sector.

Market Segmentation

By Mode of Transport

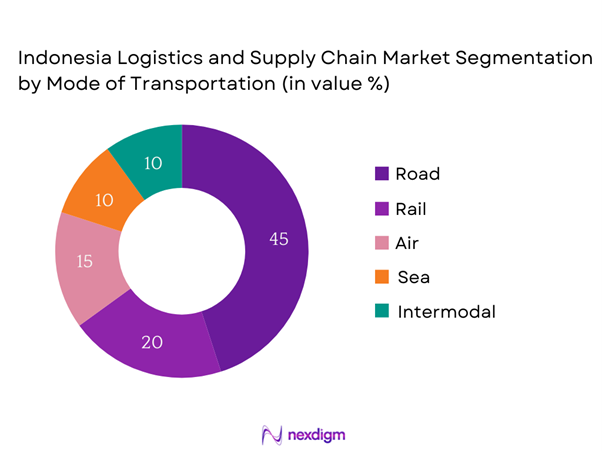

The Indonesian logistics market is segmented by mode of transport into road, rail, air, sea, and intermodal transportation. Among these, the road transport segment holds the largest market share, accounting for 45% of the total logistics market. Road transport plays a predominant role due to its flexibility, extensive reach, and essential connectivity for urban and rural areas. The expansive road network allows for door-to-door delivery, which is crucial for e-commerce and retail sectors, further enhancing road transport’s appeal. Companies prefer road transportation for its quick turnaround and adaptability to varying consumer demands, significantly impacting the overall logistics landscape.

By Service Type

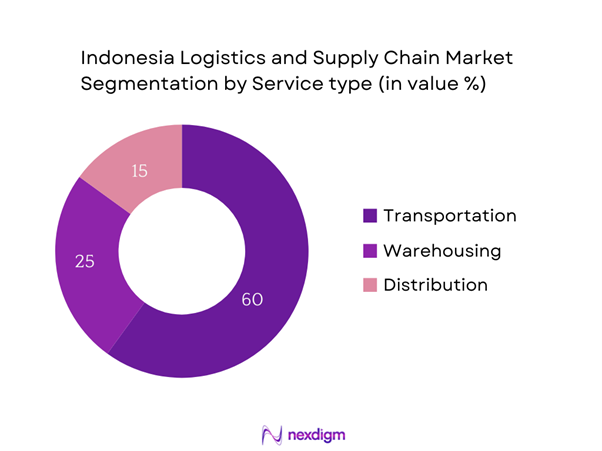

The market is also segmented by service type, which includes transportation services, warehousing services, and distribution services. Transportation services dominate this segment with a market share of 60% due to the growing need for reliable and fast delivery solutions, especially fueled by the rapid growth of e-commerce. Businesses are increasingly outsourcing their transportation needs to logistics providers to enhance efficiency while reducing operational costs. Additionally, advancements in technology such as GPS tracking and route optimization are transforming transportation services into a competitive advantage for companies.

Competitive Landscape

The Indonesia logistics and supply chain market is characterized by the presence of several key players, including both local and international companies. The market features major players such as JNE, TIKI, and DHL Supply Chain, indicating a mix of established domestic carriers and global logistics providers. This competitive landscape highlights the significance of operational efficiency, customer service quality, and innovative logistics solutions, which are essential for gaining market share in the rapidly evolving industry.

| Company | Establishment Year | Headquarters | Transportation Services | Warehousing Services | Distribution Services | Technology Adoption | Market Reach |

| JNE | 1990 | Jakarta | – | – | – | – | – |

| TIKI | 1970 | Jakarta | – | – | – | – | – |

| DHL Supply Chain | 1969 | Bonn, Germany | – | – | – | – | – |

| J&T Express | 2015 | Jakarta | – | – | – | – | – |

| Ninja Van | 2014 | Singapore | – | – | – | – | – |

Indonesia Logistics and Supply Chain Market Analysis

Growth Drivers

Urbanization and Economic Growth

The rapid urbanization in Indonesia, currently reflecting a 56% urbanization rate, contributes significantly to the logistics and supply chain market. This urban growth translates to approximately 150 million people residing in urban areas as of 2023, creating increased demand for goods distribution and transportation services. Furthermore, the World Bank projects Indonesia’s GDP to grow by approximately 4.9% in 2024, which will stimulate consumer spending and, consequently, the need for efficient logistics operations to meet the rising demands. The urban populace is demanding faster delivery times, which drives logistics companies to enhance their operational capabilities and expand their services.

Rising E-commerce Trends

The growth of e-commerce is a critical driver behind the logistics market in Indonesia, with reports indicating that online sales reached USD 48 billion in 2023, driven by a burgeoning middle class and increased internet penetration, which reached 77% of the population. The ease of online shopping encourages more consumers to turn to digital platforms, accentuating the necessity for robust logistics frameworks to ensure timely deliveries. Given that e-commerce stalwarts like Tokopedia and Bukalapak continue expanding their operations, the logistics sector is consequently under pressure to optimize supply chains and improve delivery speeds to enhance customer satisfaction.

Market Challenges

Infrastructure Limitations

Despite the growing demand, infrastructure limitations are significant challenges facing the Indonesian logistics market. The logistics performance index is hindered by inadequate transportation networks, with the World Economic Forum ranking Indonesia 57th out of 139 countries in 2023 for logistics infrastructure quality. Furthermore, the Indonesian government has allocated around USD 6.5 billion in the 2024 budget for infrastructure development, focusing on improving roads, ports, and airports to bridge the gap of diminishing logistics efficiency. Enhanced infrastructure is crucial to support the increasing freight volume, which is expected to exceed 1.3 billion tons by end of 2025.

Regulatory Barriers

Regulatory hurdles remain a challenge for logistics operations in Indonesia, as the government implements various regulations that can complicate compliance. As of 2023, new regulations on import tariffs and customs procedures have posed substantial difficulties for logistics firms, impacting their ability to streamline operations. The World Bank highlights that the time taken for import procedures can last up to 20 days, significantly affecting operational efficiency.

Opportunities

Investments in Infrastructure

Current investments in logistics infrastructure present substantial opportunities for market growth. The Indonesian government is highly committed to improving logistics infrastructure, with estimated investments reaching USD 23 billion planned for the next five years. Projects include the development of the National Logistics System, designed to optimize distribution networks across the country. The expansion of key transport hubs, roads, and ports will facilitate smoother supply chain operations. These improvements will be critical for enhancing the efficiency of logistics services, directly supporting the rising demand from the growing e-commerce sector and urban population expansion.

Adoption of Sustainable Practices

The growing emphasis on sustainability provides a unique opportunity in the logistics market. Currently, about 30% of logistics companies are beginning to adopt sustainable practices, including reducing carbon emissions and optimizing resource usage. As international companies increasingly demand eco-friendly logistics solutions, local firms can capitalize on this trend. According to the Ministry of Environment and Forestry, sustainable logistics investment is expected to grow significantly by end of 2025, with a focus on increasing energy efficiency and decreasing reliance on fossil fuels in transportation networks.

Future Outlook

The future of Indonesia’s logistics and supply chain market is poised for formidable growth, driven by ongoing investments in infrastructure development, the digitalization of logistics processes, and a thriving e-commerce sector. As consumer demand continues to rise and businesses seek more efficient logistics solutions, advancements in technology and expansion of service capabilities will be paramount. The growing emphasis on sustainable practices within the logistics sector further adds to the future momentum for market growth.

Major Players

- JNE

- TIKI

- DHL Supply Chain

- J&T Express

- Ninja Van

- SiCepat

- Bluebird Group

- Agility Logistics

- Kargo Technologies

- DB Schenker

- Linde Material Handling

- 3PL Logistics

- Cargill

- FedEx

- UPS

Key Target Audience

- Chief Logistics Officers

- Supply Chain Managers

- Transportation Planners

- E-commerce Businesses

- Manufacturing Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transportation, Ministry of Trade)

- Retail Chains

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive framework that maps out all significant stakeholders in the Indonesian logistics and supply chain market. Extensive desk research is conducted, utilizing a blend of secondary and proprietary databases to collect detailed industry insights. The objective is to pinpoint and characterize the critical variables that influence market dynamics and overall growth.

Step 2: Market Analysis and Construction

This stage focuses on compiling and analyzing historical and current data regarding the Indonesian logistics and supply chain market. It includes the assessment of market penetration, the relationship between various marketplaces and service providers, and the resulting revenue channels. Additionally, evaluating statistics related to service quality will help in ensuring that the revenue estimates are reliable and accurate.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market dynamics will be formulated and validated through a series of computer-assisted telephone interviews (CATIs) with industry experts from a diverse range of companies. These discussions will yield essential operational and financial insights directly from practitioners, aiding in refining and corroborating the data collected.

Step 4: Research Synthesis and Final Output

The final phase encompasses engagement with multiple logistics and supply chain service providers to obtain in-depth insights into different product segments, sales performance metrics, consumer trends, and other vital factors. This interaction will serve to verify and enhance the statistics derived from the bottom-up approach, ensuring a thorough, precise, and validated analysis of the Indonesian logistics and supply chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Economic Growth

Technological Advancements

Rising E-commerce Trends - Market Challenges

Infrastructure Limitations

Regulatory Barriers - Opportunities

Investments in Infrastructure

Adoption of Sustainable Practices - Trends

Digital Transformation in Industry

Shift Towards Automation - Government Regulation

Industry Policies

Compliance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport (In Value %)

Road

Rail

Air

Sea

Intermodal - By Service Type (In Value %)

Transportation Services

Warehousing Services

Distribution Services - By End-User Industry (In Value %)

Retail

Manufacturing

Automotive

E-Commerce

Pharmaceuticals - By Region (In Value %)

Java

Sumatra

Kalimantan

Sulawesi - By Technology Adoption (In Value %)

Traditional Logistics

Digital Logistics Solutions

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Service Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Market Reach, Distribution Channels, Technology Utilization, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

JNE

TIKI

POS Indonesia

DHL Supply Chain

J&T Express

Ninja Van

SiCepat

Linde Material Handling

Kargo Technologies

Bluebird Group

3PL Logistics

DB Schenker

Kuehne + Nagel

Agility Logistics

CEVA Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030