Market Overview

The Malaysia car rental market is valued at USD 595.97 Million in 2025 with an approximated compound annual growth rate (CAGR) of 8.50% from 2025-2030, following a consistent five-year growth period. This market size is primarily driven by the surge in tourism and business travel, enhanced road connectivity, and a growing demand for flexible transportation options. The expansion of online booking platforms has further facilitated market penetration, making car rentals more accessible to both local and international customers.

Kuala Lumpur and Penang stand out as the dominant cities in the car rental market. Their dominance is attributed to being major tourism and business hubs, hosting significant corporate offices, tourist attractions, and an influx of business travelers. The strategic geographic location and established infrastructure support their leading positions in the car rental landscape.

The digital transformation impacting the car rental industry is notable, with a significant rise in mobile app usage for booking services. A report by the Malaysian Communications and Multimedia Commission states that internet penetration reached 98% in 2022, allowing widespread access to digital platforms for transportation services. Additionally, the introduction of vehicle tracking technology and automated systems for rental management enhances operational efficiency and customer experience, fostering greater adoption of car rentals for both business and leisure purposes. These advancements contribute to the overall growth of the sector as convenience drives consumer choices.

Market Segmentation

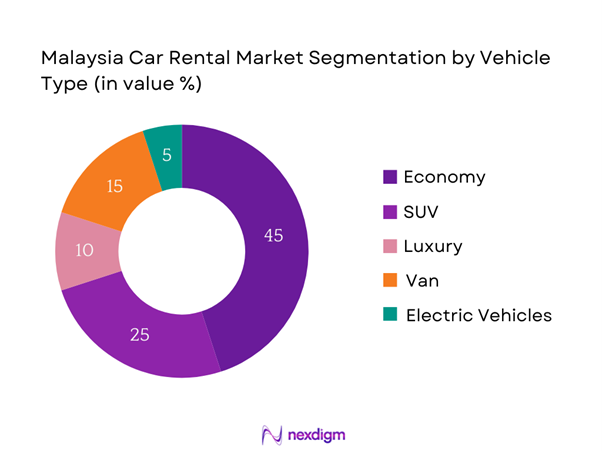

By Vehicle Type

The Malaysia car rental market is segmented by vehicle type into economy, SUV, luxury, van, and electric vehicles. Recently, the economy segment has dominated the market due to the affordability and fuel efficiency sought by consumers, particularly those traveling for leisure or on a budget. Brands like Proton and Perodua offer reliable and economical options, further supporting the strong preference for this segment.

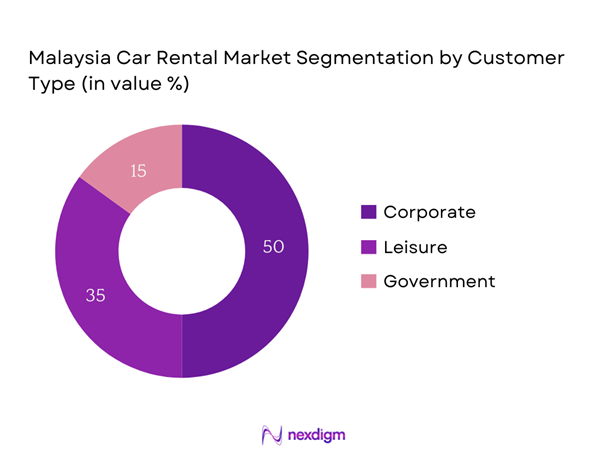

By Customer Type

The market is further segmented by customer type into corporate, leisure, and government customers. The corporate segment commands a significant market share because companies frequently provide rental cars for employees’ business trips and client transportation, ensuring consistent demand. The reliability and long-standing relationships built with leading corporate clients boost this segment’s prominence.

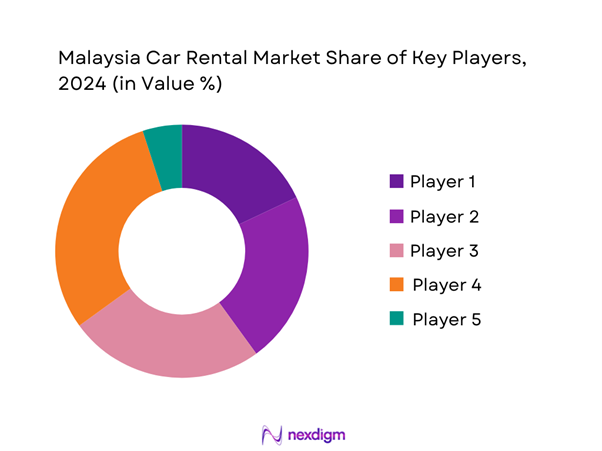

Competitive Landscape

The Malaysia car rental market is dominated by a few key players, including prominent companies such as Hertz Malaysia and Avis Malaysia. This competitive landscape showcases the influence of these major players who have cemented their positions through extensive networks and comprehensive service offerings.

| Company Name | Established | Headquarters | Fleet Size | Market Presence | Innovation Capability | Service Quality | Customer Base | Partnerships | Sustainability Initiatives |

| Hertz Malaysia | 1965 | Kuala Lumpur | – | – | – | – | – | – | – |

| Avis Malaysia | 1946 | Petaling Jaya | – | – | – | – | – | – | – |

| Sixt Rent a Car | 1912 | Kuala Lumpur | – | – | – | – | – | – | – |

| Green Matrix Solutions | 2005 | Shah Alam | – | – | – | – | – | – | – |

| GrabCar Rentals | 2012 | Kuala Lumpur | – | – | – | – | – | – | – |

Malaysia Car  Rental Market Analysis

Rental Market Analysis

Growth Drivers

Rise in Tourism

Malaysia has seen a remarkable influx of tourists, with over 26 million arrivals in 2022, according to the Ministry of Tourism and Culture Malaysia. This robust growth is expected to continue, providing a solid foundation for the car rental market, as tourists often prefer rental vehicles to explore diverse attractions. The tourism sector is projected to contribute around USD 110 billion to the country’s GDP, highlighting its crucial role in the economy. Furthermore, the government’s initiatives to promote Malaysia as a top travel destination further stimulate demand for car rentals, providing travelers with more options and convenience.

Urbanization and Infrastructure Development

Urbanization in Malaysia is accelerating, with the urban population expected to reach approximately 80% by end of 2025, as reported by the World Bank. This rapid urban growth is catalyzing infrastructure development, including road networks and public transportation, which enhances accessibility for vehicle rentals. Notably, the development of major expressways and road projects, such as the Pan-Borneo Highway, not only facilitates smoother travel but also increases the demand for car rental services among urban dwellers and visitors alike. As transportation infrastructure matures, the car rental market can expect sustained growth.

Market Challenges

Regulatory Compliance

The car rental market in Malaysia faces challenges concerning regulatory compliance, particularly relating to licensing and vehicle safety standards. The Ministry of Transport mandates comprehensive licensing requirements to ensure operational legitimacy and safety on public roads. As part of compliance, companies must adhere to the Road Transport Act and other regulatory frameworks that enforce strict guidelines for vehicle maintenance and insurance. Failure to comply with these regulations can lead to penalties and operational disruptions, creating an urgent need for market players to remain cognizant of changing legal requirements.

Fluctuating Fuel Prices

Fuel prices in Malaysia have seen significant fluctuations, with the average price of RON 95 gasoline reported at RM 2.05 per liter in 2022, as stated by the Ministry of Finance. Such volatility affects both consumers and rental companies, as higher fuel costs can deter customers from opting for car rentals. Furthermore, it drives operational costs for rental companies, as many rely on internal combustion engines, prompting some to consider transitioning to fuel-efficient or hybrid vehicles to mitigate rising expenses. This challenge necessitates strategic planning to manage operational costs effectively while meeting consumer demands.

Opportunities

Growth in Ride-sharing Services

The rise of ride-sharing services such as Grab offers notable opportunities for car rental companies in Malaysia. With a reported 4.1 million people using Grab in 2022, the preference for shared mobility solutions indicates a significant shift in consumer behavior toward convenient transport options. Additionally, the integration of car rental services into ride-sharing platforms can reach an expanded customer base, particularly tourists and urban residents looking for flexible transport solutions. The existing infrastructure can easily support such models, fostering innovation within the car rental industry.

Increasing Demand for Electric and Hybrid Vehicles

The Malaysian government has set an ambitious target for a 20% electric vehicle penetration rate by 2030, aiming to sustain environmental sustainability and reduce carbon emissions. As of 2022, sales of electric vehicles saw approximately 25,000 units sold, representing a notable increase compared to the previous years. This trend creates significant growth potential for car rental companies to expand their fleets of electric and hybrid vehicles. Companies that pivot towards sustainable transport solutions are likely to attract environmentally conscious consumers, tapping into a burgeoning market that is aligned with global trends towards sustainability.

Future Outlook

Over the next few years, the Malaysia car rental market is poised for robust growth, propelled by the continual expansion of the tourism sector and rising urbanization. The integration of technology and digitization in car rental services is expected to streamline operations and enhance customer convenience. Moreover, growing environmental awareness and government support for sustainable transportation options are anticipated to increase the demand for electric and hybrid vehicle rentals.

Major Players

- Hertz Malaysia

- Avis Malaysia

- Sixt Rent a Car

- Green Matrix Solutions

- Budget Rent a Car

- Europcar Malaysia

- Own The Road

- MaHao Rentals

- DFT Car Rental

- Kozi Car Rental

- GrabCar Rentals

- Asia Express Rent A Car

- DriveMyCar

- Lalamove Rentals

- Royal Car Rental

Key Target Audience

- Corporate Business Firms

- Travel and Tourism Agencies

- Car Rental Companies

- Vehicle Manufacturers

- Investment and Venture Capitalist Firms

- IT and Technology Solution Providers

- Government and Regulatory Bodies (Ministry of Transport Malaysia)

- Environmental Agencies (Malaysian Green Technology Corporation)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia car rental market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Malaysia car rental market. This includes assessing market penetration, the ratio of rental services to customers, and the resultant revenue generation. Furthermore, evaluating operational statistics related to vehicle utilization and customer satisfaction enables us to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing various companies within the car rental sector. These consultations provide valuable insights directly from industry practitioners, enhancing the precision of the market data and illuminating trends and operational challenges faced by companies in the segment.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple car rental companies to acquire detailed insights into product segments, sales performance, customer preferences, and the competitive landscape. This engagement serves to validate and complement the statistics gathered from the earlier steps, ensuring a comprehensive, accurate, and validated analysis of the Malaysia car rental market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Tourism

Urbanization and Infrastructure Development

Technological Advancements - Market Challenges

Regulatory Compliance

Fluctuating Fuel Prices - Opportunities

Growth in Ride-sharing Services

Increasing Demand for Electric and Hybrid Vehicles - Trends

Shift Towards Digital Platforms for Rentals

Focus on Sustainability and Eco-friendly Practices - Government Regulation

Licensing Requirements

Safety Standards for Rental Vehicles - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Rental Rate, 2019-2024

- By Vehicle Type (In Value %)

Economy

SUV

Luxury

Van

Electric Vehicles - By Customer Type (In Value %)

Corporate

Leisure

Government - By Rental Duration (In Value %)

Short-term

Long-term - By Region (In Value %)

Northern Region

Southern Region

Eastern Region

Western Region - By Distribution Channel (In Value %)

Online Booking

Travel Agents

Walk-in

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Number of Locations, Fleet Size, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Vehicle Types for Major Players

- Detailed Profiles of Major Companies

Hertz Malaysia

Avis Malaysia

Sixt Rent a Car

Green Matrix Solutions

Budget Rent a Car

Europcar Malaysia

Own The Road

MaHao Rentals

DFT Car Rental

Kozi Car Rental

GrabCar Rentals

Asia Express Rent A Car

DriveMyCar

Lalamove Rentals

Royal Car Rental

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Rental Rate, 2025-2030