Market Overview

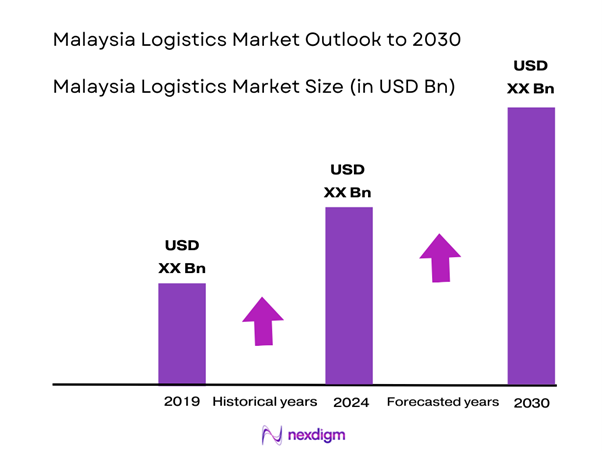

The Malaysia Logistics Market is valued at USD 29.7 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 5.20% from 2025-2030, reflecting a robust growth trajectory driven by an increase in e-commerce activities, infrastructure advancements, and burgeoning manufacturing sectors. Key factors contributing to market expansion include the rising demand for efficient supply chain management and logistics solutions to cater to the growing consumer base.

The dominant cities in Malaysia’s logistics market include Kuala Lumpur, Penang, and Johor Bahru. Their strategic geographical positioning, coupled with well-established transport infrastructure, drives logistics activities in these regions. Kuala Lumpur serves as the economic hub, drastically enhancing logistics connectivity. Meanwhile, Penang’s free trade zones and Johor Bahru’s proximity to Singapore enhance cross-border trade, positioning them as key players in the regional logistics ecosystem.

The Malaysian e-commerce sector has seen significant growth, with the market projected to reach USD 11.2 billion in 2024, reflecting an increase from USD 9.2 billion in 2022. This growth is driven by increasing internet penetration, which stands at 92.1% of the population, and a growing urban middle-class population with a rising disposable income, which is estimated to reach USD 12,100 per capita in 2025.

Market Segmentation

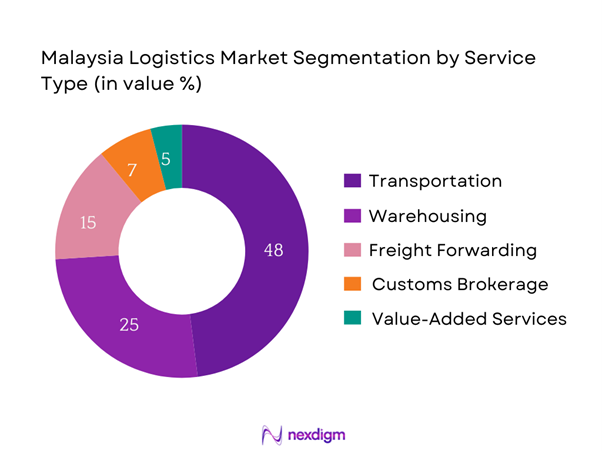

By Service Type

The Malaysia Logistics Market is segmented by service type into transportation, warehousing, freight forwarding, customs brokerage, and value-added services. The transportation segment takes the lead, primarily due to the increasing demand for efficient cargo movement across various modalities. This growth is attributed to the expanding e-commerce sector, which necessitates rapid delivery solutions, and the burgeoning manufacturing industry focusing on cost-effective transport solutions.

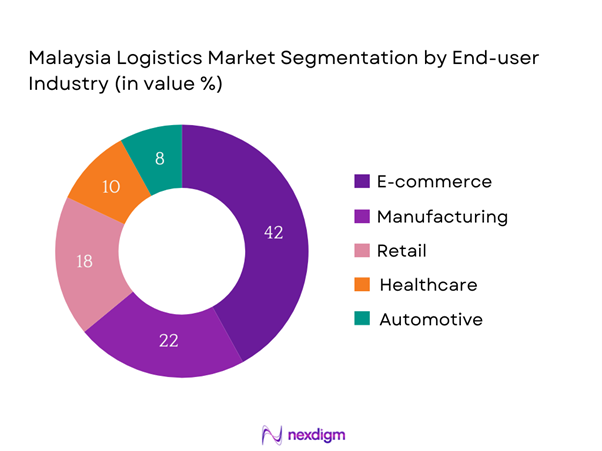

By End-User Industry

The logistics market is also segmented by end-user industry, comprising e-commerce, manufacturing, retail, healthcare, and automotive sectors. The e-commerce segment holds the dominant market share due to the immense growth in online retailing, which requires sophisticated logistics networks for timely order fulfillment. The rise in consumer preferences for online shopping has prompted businesses to enhance their logistics capabilities, leading to increased demand for comprehensive logistics solutions.

Competitive Landscape

The Malaysia Logistics Market is characterized by a competitive landscape featuring significant players such as POS Malaysia Berhad, GD Express Carrier Bhd, DHL Supply Chain Malaysia, YTL Corporation, and Transcom Services. These companies leverage their extensive networks and technological advancements to streamline operations and enhance service delivery, thereby solidifying their market positions.

| Company | Establishment Year | Headquarters | Services Offered | Market Strategy | Technological Adoption | Fleet Size |

| POS Malaysia Berhad | 1800s | Kuala Lumpur | – | – | – | – |

| GD Express Carrier Bhd | 1992 | Kuala Lumpur | – | – | – | – |

| DHL Supply Chain Malaysia | 1975 | Petaling Jaya | – | – | – | – |

| YTL Corporation | 1955 | Kuala Lumpur | – | – | – | – |

| Transcom Services | 1997 | Selangor | – | – | – | – |

Malaysia Logistics Market Analysis

Growth Drivers

Infrastructure Development Initiatives

The Malaysian government has invested substantially in infrastructure development, allocating approximately MYR 10.5 billion to upgrade transportation facilities in 2024, which includes enhancements to road, rail, and port facilities. This investment aligns with the government’s goal to improve logistics efficiency and connectivity. Notably, the Port of Port Klang, ranked among the top 20 busiest ports globally, handled over 12 million TEUs in 2022, underscoring the capacity expansion and infrastructural improvements pivotal to meet growing logistics demands.

Rising Demand for Supply Chain Optimization

Supply chain optimization has become critical as businesses face increasing pressures to improve efficiency and responsiveness. The World Bank reports that logistics costs in Malaysia constitute around 13.7% of the GDP in 2023, indicating substantial room for optimization. With businesses focusing on cost reduction and operational improvements, demand for advanced logistics solutions, including real-time tracking systems and improved inventory management, is on the rise. This trend is driving investments in technologies aimed at streamlining supply chains and reducing bottlenecks, catalyzing market growth.

Market Challenges

Regulatory and Compliance Issues

The logistics industry in Malaysia faces numerous regulatory challenges that can hinder operational efficiency. Compliance with guidelines set by Malaysia’s Ministry of Transport, such as the Land Public Transport Act and regulations on vehicle and driver standards, can pose considerable operational overheads. The World Bank indicates that the regulatory burden on businesses in Malaysia costs the logistics sector approximately MYR 5 billion annually. Navigating these regulations requires time and financial resources, potentially limiting the agility of logistics providers in a rapidly changing market landscape.

Fluctuations in Fuel Prices

Fluctuations in global fuel prices remain a significant challenge for the logistics market. The Malaysian Institute of Economic Research observed that diesel prices, crucial for transportation, increased to MYR 2.15 per liter in early 2024 from MYR 1.98 in 2023, raising operational costs for logistics providers. As fuel costs constitute a substantial part of logistics expenses, these fluctuations can severely impact profit margins and compel companies to increase service charges, affecting overall market competitiveness and pricing strategies.

Opportunities

Implementation of Technology and Automation

The current landscape reveals a significant opportunity for logistics companies to invest in technology and automation to enhance efficiency. The value of the global logistics automation market is projected to reach USD 77 billion by end of 2025, with Malaysia capitalizing on this trend across its logistics operations. Companies implementing robotics and AI technologies in warehousing and inventory management can enhance throughput by up to 25%. With the increasing adoption of such technologies, Malaysian firms can significantly improve operational efficiency, reduce labor costs, and meet the growing demand for fast and reliable service.

Growing Sustainability Practices

Sustainability is becoming a core focus for logistics providers in Malaysia as regulatory bodies push for greener practices. Malaysia targets to reduce its carbon emissions intensity by 45% by 2030, which can stimulate the adoption of sustainable logistics practices, such as electric vehicles and alternative fuel use. Current usage of fossil fuels stands at 96% in the transportation sector, indicating a strong push toward transitioning to greener alternatives. This shift offers logistics companies significant opportunities to innovate, enhance brand reputation, and meet consumer demand for environmentally friendly practices.

Future Outlook

Over the next five years, the Malaysia Logistics Market is anticipated to experience substantial growth bolstered by government investments in infrastructure, technological advancements, and an increasing demand for optimized logistics solutions. The ongoing digital transformation across logistics operations is expected to enhance service efficiency and customer satisfaction, further driving market expansion. The rise of e-commerce will likely continue to be a catalyst in reshaping the logistics landscape, emphasizing the need for agile and responsive supply chains.

Major Players

- POS Malaysia Berhad

- GD Express Carrier Bhd

- DHL Supply Chain Malaysia

- YTL Corporation

- Transcom Services

- Kuehne + Nagel

- Nippon Express

- J&T Express

- Maersk Logistics

- Kerry Logistics

- Schenker Logistics Malaysia

- Seino Transportation

- JAS Worldwide

- United Parcel Service (UPS)

- ABX Logistics

Key Target Audience

- Investment and venture capitalist firms

- Government and regulatory bodies (e.g., Ministry of Transport Malaysia)

- Shipping and freight forwarding companies

- Retail and e-commerce businesses

- Manufacturing firms

- Logistics technology providers

- Transportation service providers

- Warehousing and distribution companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of stakeholders within the Malaysia Logistics Market. This step relies heavily on comprehensive desk research utilizing secondary and proprietary databases to gather industry-level information. The primary objective is to identify and define the variables critical to influencing market dynamics, particularly in relation to supply chain functions, service offerings, and consumer behaviors.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Malaysia Logistics Market is compiled and analyzed. This includes examining market penetration, comparing service providers, and their resultant revenue generation. An assessment of service quality statistics will also be conducted to ensure the reliability and accuracy of revenue estimates, enabling the development of a clearer market picture.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts via computer-assisted telephone interviews (CATIs). This step will involve consulting professionals representing a diversity of market segments within logistics, yielding valuable operational and financial insights directly from industry practitioners and enhancing market data integrity.

Step 4: Research Synthesis and Final Output

The final phase involves engagement with multiple logistics companies to obtain detailed insights into specific service segments, operational performance, consumer preferences, and key industry trends. This interaction will serve to verify and complement the statistics derived from both top-down and bottom-up approaches, ensuring a comprehensive, accurate, and validated analysis of the Malaysia Logistics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Activities

Infrastructure Development Initiatives - Market Challenges

Regulatory and Compliance Issues

Fluctuations in Fuel Prices - Opportunities

Implementation of Technology and Automation

Growing Sustainability Practices - Trends

Adoption of Digital Logistics Solutions

Increase in Last-Mile Delivery Services - Government Regulation

Trade Policies and Tariffs

Safety and Quality Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Transportation Services

Warehousing Services

Freight Forwarding

Customs Brokerage

Value-Added Services - By End-User Industry (In Value %)

E-commerce

Manufacturing

Retail

Healthcare

Automotive - By Region (In Value %)

Central Region

Northern Region

Southern Region

Eastern Region - By Transportation Mode (In Value %)

Road

Rail

Air

Sea - By Customer Segment (In Value %)

B2B

B2C

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Service Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Service Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Fleet Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

POS Logistics

GD Express Carrier Bhd

DHL Supply Chain Malaysia

YTL Corporation

SJS Logistics

Transcom Services

Schenker Logistics Malaysia

Kuehne + Nagel

Nippon Express

J&T Express

Seino Transportation

Kintetsu World Express

Maersk Logistics

Hanjin Transportation

Kerry Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030