Market Overview

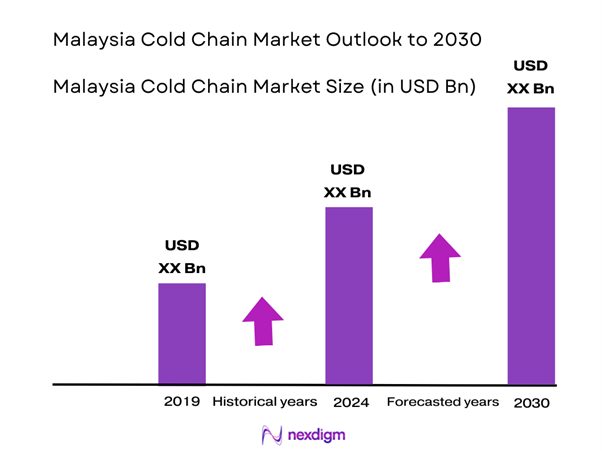

The Malaysia cold chain market is valued at approximately USD 222.28 billion in 2024 with an approximated compound annual growth rate (CAGR) of 11% from 2024-2030, showcasing a robust growth trajectory driven by factors such as a burgeoning e-commerce sector and the increasing demand for perishable goods. This market is underpinned by the growing health consciousness among consumers who demand fresh and high-quality food products.

Key cities, including Kuala Lumpur, Penang, and Johor Bahru, dominate the Malaysia cold chain market due to their strategic geographic locations, robust infrastructure, and proximity to significant agricultural and manufacturing hubs. These urban centers enjoy substantial investments in logistics facilities, making them essential for both domestic and international trade. Additionally, the urban population’s increasing purchasing power and the expansion of supermarkets and hypermarkets further solidify the cold chain market’s prominence in these regions.

Technological advancements in refrigeration have transformed Malaysia’s cold chain landscape, with innovations such as energy-efficient cooling systems becoming essential for operations. As of 2023, over 60% of cold storage facilities in Malaysia are now outfitted with smart refrigeration technologies that utilize IoT devices for monitoring. The government’s aim to reduce carbon emissions has resulted in substantial investments in energy-efficient systems, with approximately USD 100 million allocated for initiatives that enhance energy efficiency in the sector.

Market Segmentation

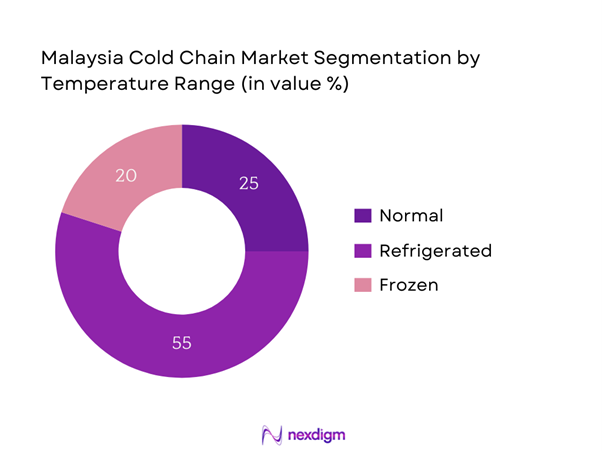

By Temperature Range

The Malaysia cold chain market is segmented by temperature range into three categories: Normal, Refrigerated, and Frozen. The refrigerated segment currently dominates the market share due to its versatility and demand across various applications, including food and pharmaceutical sectors. Refrigerated storage ensures the safety and quality of perishable products, making it essential for suppliers aiming to meet consumer expectations for freshness. Owing to an increase in the consumption of chilled food items and beverages among health-conscious consumers, refrigerated solutions are increasingly recognized as critical for maintaining product integrity in the supply chain.

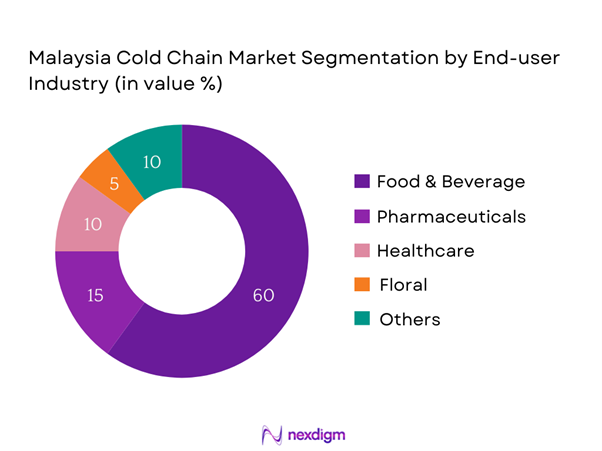

By End User Industry

The market is further segmented by end user industry into Food & Beverage, Pharmaceuticals, Healthcare, Floral, and Others. The food and beverage sector holds the dominant market share, attributed to the rising consumption of fresh produce, meat products, and dairy. Driven by consumer preferences for healthy eating and convenience, this sector is increasingly utilizing advanced cold chain logistics to ensure product quality during transit. Additionally, the growth of online grocery shopping amid changing consumer behavior reinforces the essential role of the cold chain in maintaining the freshness and safety of food products.

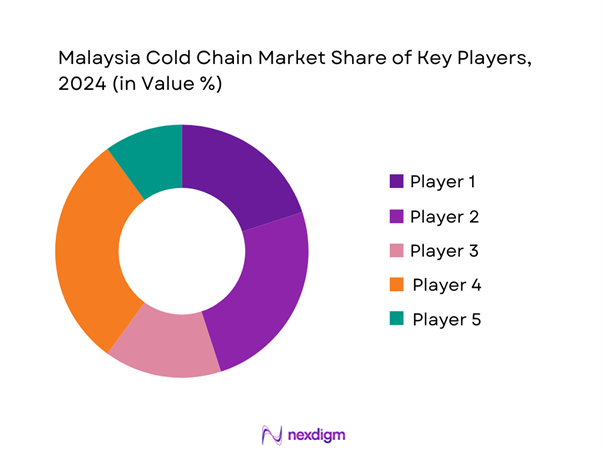

Competitive Landscape

The Malaysia cold chain market is characterized by strong competition among a few significant players, including Cold Chain Logistics Sdn Bhd, GAC Logistics, and LF Logistics. These companies have established extensive networks and capabilities to meet the growing demand for temperature-sensitive products, reflecting the significant influence of these key entities in shaping market dynamics.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | No. of Facilities | Key Clients | Market Segment Focus | Technology Adoption |

| Cold Chain Logistics Sdn Bhd | 2000 | Kuala Lumpur | – | – | – | – | – |

| GAC Logistics | 2006 | Kuala Lumpur | – | – | – | – | – |

| LF Logistics | 2005 | Penang | – | – | – | – | – |

| YCH Group | 1997 | Johor Bahru | – | – | – | – | – |

| APM Group | 1985 | Selangor | – | – | – | – | – |

Malaysia Cold Chain Market Analysis

Growth Drivers

Increased Demand for Fresh Produce

The demand for fresh produce in Malaysia is rising significantly due to increasing health consciousness among consumers, which drives them towards healthier food options. In 2023, the country’s fruit and vegetable sector was valued at approximately USD 5.2 billion, reflecting its importance in the agricultural market. Furthermore, the national aspiration to increase the contribution of the agriculture sector to GDP to 4.6% in 2025 is promoting investments in cold chain logistics to ensure the quality of perishables. The integration of efficient cold chain solutions is essential to minimize wastage, which is estimated to be around 20% for fresh produce.

Expansion of Organized Retail

Organized retail in Malaysia has been experiencing rapid growth, with the sector projected to reach USD 66 billion by the end of 2025. This growth is driven by a proliferation of modern supermarkets and hypermarkets catering to the urban population’s changing shopping habits. The rise of retail chains like Tesco and Giant necessitates enhanced cold chain solutions that maintain the freshness and quality of a wide array of products. Furthermore, the Food Safety and Quality Act, enforced by the Ministry of Health, emphasizes the need for stringent cold chain practices, further driving the market’s growth.

Market Challenges

High Operational Costs

The cold chain market faces significant challenges due to high operational costs driven by factors such as rising energy prices and maintenance expenses of refrigerated systems. In Malaysia, energy costs have increased by 12% over the past two years, impacting profit margins for cold storage facilities. Furthermore, installation and maintenance of advanced cold chain technologies can require capital investments upwards of USD 200,000 per facility, creating financial barriers especially for smaller operators. These rising costs compel businesses to adopt more efficient practices while striving to retain their competitive edge in the market.

Regulatory Hurdles

Navigating regulatory hurdles is a significant challenge for the cold chain market in Malaysia. Compliance with the Food Safety and Quality Act and guidelines set by the Ministry of Health requires strict adherence to safety standards, which can be cumbersome for operators. As of 2023, approximately 30% of cold storage facilities reported difficulties in meeting these regulatory requirements, resulting in increased operational delays and fines. Additionally, the need for constant training and updating of facilities to comply with changing regulations adds to the operational burden in an already complex market environment.

Opportunities

Rising E-commerce in Food Delivery

The e-commerce segment for food delivery in Malaysia is flourishing, with the food delivery market projected to exceed USD 1.5 billion in 2024. This trend presents a significant opportunity for the cold chain market as online platforms increasingly rely on efficient logistics to fulfill consumer expectations for timely delivery of fresh products. The increasing ubiquity of mobile payments and rising internet penetration, which stands at about 95% in urban areas, further stimulates demand for swift and reliable cold chain solutions to support the booming online grocery shopping trends. This growth trajectory underscores the essential role of refrigerated logistics in meeting consumer needs.

Growth of Temperature-Sensitive Pharmaceuticals

The pharmaceutical industry in Malaysia is increasingly focused on temperature-sensitive products, with the sector projected to contribute USD 2.5 billion to the economy by end of 2025. The need for a robust cold chain to transport vaccines and medications highlights the importance of precise temperature controls to ensure product efficacy. The government has recognized this imperative, resulting in enhanced collaborative efforts between cold chain providers and the pharmaceutical sector. As the local pharmaceutical market scales up, there is a growing demand for specialized cold storage solutions, presenting an opportunity for cold chain businesses to diversify and cater to this critical domain.

Future Outlook

Over the next few years, the Malaysia cold chain market is expected to exhibit significant growth driven by advancements in technology, expansion of e-commerce, and increasing consumer demand for high-quality perishable goods. The growing trend of online grocery shopping, coupled with heightened awareness of food safety standards, will further accelerate the demand for cold chain solutions. Continued investments in infrastructure and logistics capabilities positioned to meet these evolving consumer preferences will play a vital role in shaping the future dynamics of the market.

Major Players

- Cold Chain Logistics Sdn Bhd

- GAC Logistics

- LF Logistics

- YCH Group

- APM Group

- Integrated Cold Chain Solutions

- J&T Express

- Malaysian Cold Chain Association

- Singamas Container Holdings Ltd

- DFI Logistics

- Berger Transport

- TRANSCO Group

- Agri-Food Systems Pte Ltd

- DKSH Holdings (Malaysia) Berhad

- MHE-Demag

Key Target Audience

- Retail Chains

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Logistics and Transportation Firms

- E-commerce Platforms

- Government and Regulatory Bodies (Ministry of Health Malaysia, Ministry of Agriculture and Food Security)

- Investments and Venture Capitalist Firms

- Cold Chain Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Malaysia cold chain market. This step leverages extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including regulatory impacts, technological advancements, and consumer behavior trends.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Malaysia cold chain market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resulting revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. Accurate market analysis will lay the groundwork for future forecasts and strategic recommendations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data while accounting for emerging trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction ensures that statistics derived from the bottom-up approach are verified and complemented, thus facilitating a comprehensive, accurate, and validated analysis of the Malaysia cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Context and Market Evolution

- Key Drivers of Market Development

- Supply Chain Dynamics

- Value Chain Analysis

- Growth Drivers

Increased Demand for Fresh Produce

Expansion of Organized Retail

Technological Advancements in Refrigeration - Market Challenges

High Operational Costs

Regulatory Hurdles - Opportunities

Rising E-commerce in Food Delivery

Growth of Temperature-Sensitive Pharmaceuticals - Trends

Technological Integration (IoT, AI in Cold Chain Management)

Sustainable Practices in Cold Chain Logistics - Government Regulation

Standards for Food Safety

Licensing and Compliance Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Cost, 2019-2024

- By Temperature Range (In Value %)

Normal

Refrigerated

Frozen - By End User Industry (In Value %)

Food & Beverage

Pharmaceuticals

Healthcare

Floral

Others - By Storage Type (In Value %)

Third-party Logistics

In-house Storage - By Distribution Channel (In Value %)

Direct Sales

Retail - By Region (In Value %)

Central

Northern

Southern

Eastern

Sabah & Sarawak

- Market Share of Major Players by Value/Volume, 2024

Market Share by End User Industry Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Networks, Capacity, Unique Value Propositions, Margins)

- SWOT Analysis of Major Players

- Pricing Strategy Analysis of Major Players

- Detailed Profiles of Major Companies

Cold Chain Logistics Sdn Bhd

DKSH Holdings (Malaysia) Berhad

GAC Logistics

YCH Group

LF Logistics

J&T Express

Integrated Cold Chain Solutions

APM Group

MHE-Demag

Malaysian Cold Chain Association

Singamas Container Holdings Ltd

DFI Logistics

Berger Transport

TRANSCO Group

Agri-Food Systems Pte Ltd

- Market Demand Patterns

- Consumer Spending and Budget Allocations

- Regulatory Compliance Impact

- Pain Point Analysis

- Purchase Decision Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Cost, 2025-2030