Market Overview

The Thailand Auto Finance Market is valued at USD 10.3 billion in 2024, based on a five-year historical analysis. This growth is driven by rising disposable income, an expanding middle-class demographic, and a shift towards vehicle ownership fueled by favorable financing options. The growing availability of flexible loan structures and competitive interest rates are also enhancing consumer access to auto financing solutions, contributing significantly to market expansion. The market is expected to see further growth as companies continue to innovate their financing strategies.

Major cities like Bangkok, Chiang Mai, and Pattaya dominate this market. Bangkok, as the capital, is the economic center with a dense population that drives high demand for automobiles and related financing. Chiang Mai’s rapid urbanization also contributes to a growing market for auto finance, while Pattaya’s tourism industry bolsters purchases of both new and used vehicles. This urban concentration of economic activity solidifies their dominance in the Thailand Auto Finance Market.

Innovations in financing options are transforming the Thailand auto finance market. The proliferation of digital banking and online loan applications has significantly simplified the financing process for consumers. In 2023, around 65% of car loans were processed through digital platforms, allowing for faster approvals and a more streamlined experience. Furthermore, the introduction of flexible repayment plans and zero-interest financing offers are becoming common, making it easier for consumers to purchase vehicles.

Market Segmentation

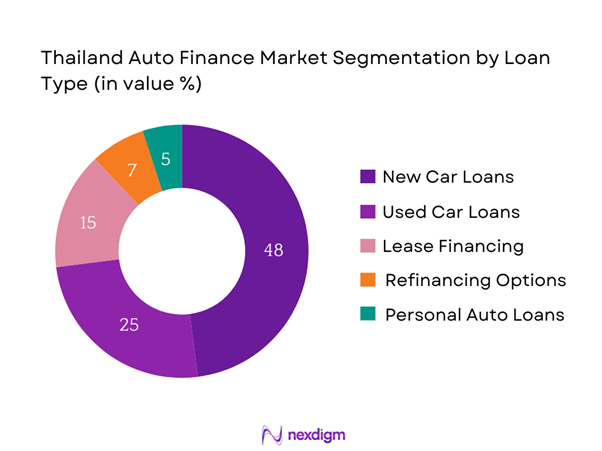

By Loan Type

The Thailand Auto Finance Market is segmented by loan type into new car loans, used car loans, lease financing, refinancing options, and personal auto loans. New car loans dominate this segmentation, as they cater to the increasing consumer preference for brand-new vehicles that feature the latest technology and safety features. The financing options offered by dealerships often make purchasing new cars more accessible, especially with promotions and incentives that further entice buyers. With a growing number of automobile manufacturers setting up showrooms in Thailand, the new car loan segment is expected to maintain its leading position.

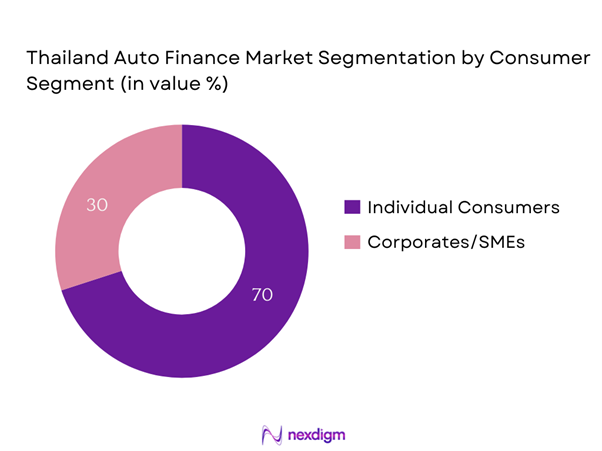

By Consumer Segment

The market is additionally segmented by consumer segment into individual consumers and corporate/SME financing. Individual consumers account for the majority of this segment, primarily due to the growing trend of personal vehicle ownership resulting from the increasing affordability of cars through various financing methods. The shift towards personal mobility, especially in urban areas where public transport may be limited, has led to individual consumers seeking car loans that meet their financial capabilities and lifestyle requirements. This trend reflects a broader cultural acceptance of car ownership as a status symbol and a necessity.

Competitive Landscape

The Thailand Auto Finance Market is dominated by several major players, including Thanachart Bank, Krungsri Auto, and Siam Commercial Bank. The consolidation of these prominent financial institutions illustrates their strong influence in shaping auto financing across the country. These major players have established extensive distribution networks, robust customer service, and diversified product offerings, which further solidifies their competitiveness in the market.

| Company | Establishment Year | Headquarters | Total Assets (in billion USD) | Financing Products | Technology Adoption | Market Position |

| Thanachart Bank | 2002 | Bangkok | – | – | – | – |

| Krungsri Auto | 1995 | Bangkok | – | – | – | – |

| Siam Commercial Bank | 1904 | Bangkok | – | – | – | – |

| Kasikornbank | 1945 | Bangkok | – | – | – | – |

| Bangkok Bank | 1944 | Bangkok | – | – | – | – |

Thailand Auto Finance Market Analysis

Growth Drivers

Increasing Vehicle Ownership

The increase in vehicle ownership in Thailand is a significant driver of the auto finance market. As of 2022, the number of registered vehicles in Thailand reached approximately 41 million, showing a growth of around 5% from the previous year. This growing figure reflects an increasing acceptance of personal vehicles as essential for mobility in urban areas. Furthermore, the government’s focus on improving infrastructure and public transportation systems is encouraging vehicle purchases among consumers who seek convenience. The rising middle-class population is a crucial factor fueling this surge in ownership.

Expanding Middle-Class Population

Thailand’s expanding middle-class population is contributing significantly to the growth of the auto finance market. By 2023, approximately 30% of Thailand’s population is classified as middle-class, with a per capita income of over USD 6,000. This economic uplift enables more individuals to access auto loans and financing options. The World Bank reports that rising incomes in Thailand are expected to support increased consumer spending, influencing demand for automobiles further as more citizens aspire to own vehicles. The influx of disposable income among the middle class makes auto financing more appealing and accessible.

Market Challenges

Regulatory Compliance and Changes

Regulatory compliance poses a challenge for the Thailand auto finance market as the landscape continuously evolves. The Thai government has implemented several regulations aimed at protecting consumers, including strict lending guidelines and interest rate caps. In 2022, the Bank of Thailand announced that lenders must adhere to new regulations that require transparent communication of loan terms, impacting how financial institutions structure their offerings. Compliance with these regulations can lead to increased operational costs for banks and financing companies, potentially stunting growth and innovation in the financial products offered.

Economic Fluctuations

Fluctuations in the economy also create challenges for the auto finance market. For instance, the economic growth rate in Thailand is projected to be around 3.5% for 2024, down from 4% in the previous year, according to the National Economic and Social Development Council (NESDC). This slower growth may affect consumer confidence and spending power, leading to a downturn in vehicle purchases and, consequently, auto financing. Economic uncertainty can result in banks tightening their lending criteria, making it harder for consumers to secure loans, thereby impacting overall market dynamics.

Opportunities

Growth in Electric Vehicle Financing

The burgeoning market for electric vehicles (EVs) represents a substantial opportunity within the auto finance sector. In 2022, EV sales in Thailand increased by 83% compared to the previous year, driven by government initiatives and incentives aimed at promoting sustainable transport. The Thai government has set a target to achieve 1.2 million EVs on the road by 2030, which will necessitate robust financing products tailored to support consumers interested in purchasing EVs. This growing interest in eco-friendly vehicles presents an opportunity for financing institutions to develop innovative loan products that cater specifically to this expanding market segment.

Digital Transformation in Financial Services

The digital transformation of financial services is opening up new channels for auto financing in Thailand. Reports indicate that the country had a 90% internet penetration rate as of 2022, with growing smartphone usage further facilitating online financial transactions. Financial institutions are increasingly investing in technology to develop sophisticated mobile apps and platforms that cater to consumer needs, such as loan comparisons and instant approvals. This digital shift not only enhances customer engagement but also presents unexplored avenues for growth in the auto finance market as more consumers opt for convenient online solutions.

Future Outlook

Over the next five years, the Thailand Auto Finance Market is expected to show significant growth driven by continuous government support for the automotive sector, advancements in financial technology, and an increasing consumer inclination towards personal vehicles. The advent of digital financing platforms is also anticipated to enhance accessibility and convenience for borrowers, further boosting market growth. As the trend towards sustainable and electric vehicles rises, financing firms may expand their offerings to accommodate eco-friendly transportation options as well.

Major Players

- Thanachart Bank

- Krungsri Auto

- Siam Commercial Bank

- Kasikornbank

- Bangkok Bank

- Toyota Leasing Thailand

- Mitsubishi Motors Thailand

- Isuzu Finance

- Honda Leasing Thailand

- UOB Thailand

- Bank of Ayudhya

- Mercedes-Benz Financial Services

- BMW Financial Services

- KCE Auto Finance

- Thai Credit Retail Bank

Key Target Audience

- Automobile manufacturers

- Auto dealerships

- Financial institutions (Banks)

- Investments and venture capitalist firms

- Government and regulatory bodies (Bank of Thailand, Ministry of Finance)

- Insurance companies

- Fleet management companies

- Mobility services providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all major stakeholders within the Thailand Auto Finance Market. This step relies on extensive desk research, using both secondary and proprietary databases to gather pertinent industry-level information. The aim is to identify and define the critical variables that influence market dynamics, which will serve as the foundation for subsequent analysis.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Thailand Auto Finance Market will be compiled and analyzed. This includes an assessment of market penetration, the ratio of financial products to consumers, and resultant revenue generation figures. An evaluation of service quality and consumer satisfaction statistics will also be undertaken to ensure the reliability and accuracy of revenue estimates and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through interviews with industry experts, which may involve computer-assisted telephone interviews (CATIs) and surveys with practitioners representing a diverse array of automotive finance companies. These discussions will provide critical operational insights and financial trends that will help refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with various manufacturers and financing firms to gather detailed insights into product segments, sales performance, consumer behavior, and other relevant factors. This engagement will help verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the Thailand Auto Finance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Expanding Middle-Class Population

Innovations in Financing Options - Market Challenges

Regulatory Compliance and Changes

Economic Fluctuations - Opportunities

Growth in Electric Vehicle Financing

Digital Transformation in Financial Services - Trends

Shift Towards Sustainable Mobility Financing

Enhanced Customer Experience through Technology - Government Regulation

Licensing and Compliance Requirements

Interest Rate Caps - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Loan Type (In Value %)

New Car Loans

Used Car Loans

Lease Financing

Refinancing Options

Personal Auto Loans - By Consumer Segment (In Value %)

Individual Consumers

Corporates/SMEs - By Distribution Channel (In Value %)

Direct Bank Financing

Auto Dealership Financing

Online Financing Platforms - By Region (In Value %)

Central Region

Northern Region

Northeastern Region

Southern Region - By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Motorcycles

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Loan Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Market Positioning, Customer Reach, After-Sales Service, Technology Adoption, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Loan Types for Major Players

- Detailed Profiles of Major Companies

Thanachart Bank

Krungsri Auto

Siam Commercial Bank

Kasikornbank

Bangkok Bank

KCE Auto Finance

Toyota Leasing Thailand

Mitsubishi Motors Thailand

Isuzu Finance

Bangkok Insurance

Mercedes-Benz Financial Services

BMW Financial Services

Honda Leasing Thailand

Bank of Ayudhya

UOB Thailand

- Market Demand and Utilization

- Consumer Preferences and Spending Behavior

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030