Market Overview

The Thailand Car Rental and Leasing Market is valued at USD 1.18 billion in 2025 with an approximated compound annual growth rate (CAGR) of 9.95% from 2025-2030, driven largely by the country’s booming tourism sector and increasing disposable income among residents. In recent years, the market has seen robust demand for both short-term rentals and leasing options, as consumers prioritize convenience and comfort in their travel choices.

Bangkok is a dominant city in the Thailand Car Rental and Leasing Market, primarily due to its status as a major tourist hub and business center. The city’s extensive infrastructure, including well-connected airports and highways, facilitates both local and international travel, driving demand for rental services. Additionally, popular tourist destinations in Thailand such as Chiang Mai and Phuket also contribute to the market’s growth, as they attract a substantial number of domestic and foreign tourists seeking rental options for convenient transportation.

According to the World Bank, Thailand’s urban population has increased significantly, with about 50% of the population residing in urban areas as of 2022. Urbanization leads to increased demand for transportation services, as it brings about higher population density and mobility needs. Major cities like Bangkok and Chiang Mai are becoming economic hubs, further increasing the need for flexible transport options like car rentals. This shift towards urban living influences consumer preferences, making rentals an attractive choice for both residents and visitors as public transport becomes crowded.

Market Segmentation

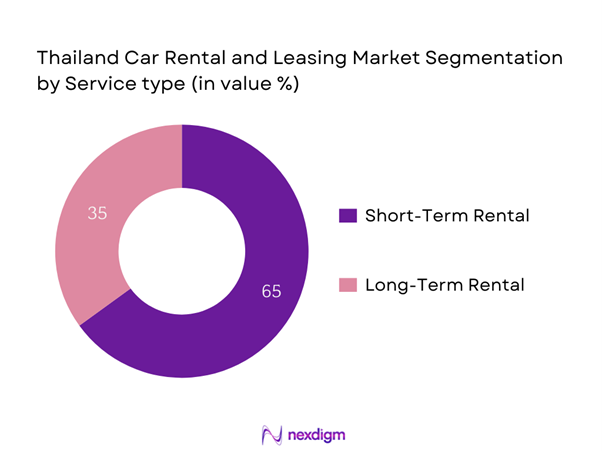

By Service Type

The Thailand Car Rental and Leasing Market is segmented by service type into short-term rental and long-term rental. Recently, short-term rentals have emerged as the dominant segment in the market, mainly due to the rising influx of tourists and business travelers looking for flexible and convenient travel options. This segment benefits from the convenience and ease of online booking platforms, allowing users to reserve vehicles for as little as a few hours to a few days. Companies such as Hertz and Avis have capitalized on this trend by offering comprehensive packages catering to tourists’ needs, thus reinforcing the dominance of this sub-segment.

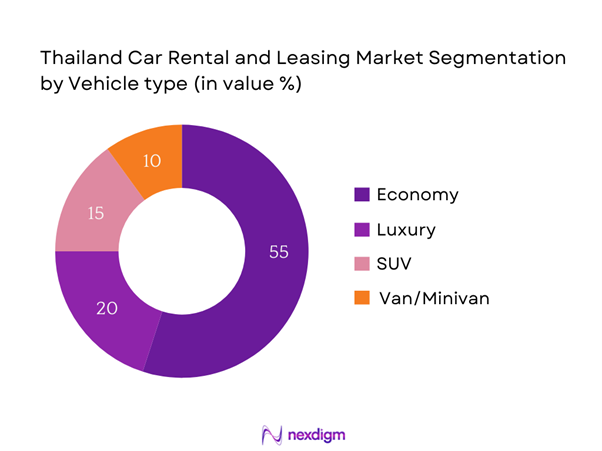

By Vehicle Type

The market is also segmented by vehicle type into economy, luxury, SUV, and van/minivan rentals. The economy segment currently dominates the market due to its affordability and appeal to budget-conscious consumers. Economy cars are the most commonly rented vehicles in Thailand, especially among tourists and young travelers. The appeal of this segment is amplified by the cost-effective options available, which enable a wide range of customers to access rental services. Additionally, leading companies focus on maintaining a diverse economy fleet that satisfies consumer demand, strengthening its market position.

Competitive Landscape

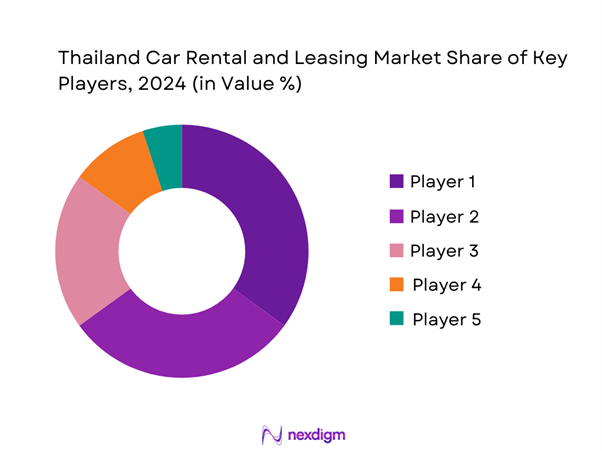

The Thailand Car Rental and Leasing Market is characterized by a few key players, which consolidate the competitive landscape and influence market dynamics. Major companies include Hertz, Avis, and Budget, among other local and international brands. This concentration underscores the significant impact these leading players have on pricing, service quality, and market growth strategies.

| Company | Establishment Year | Headquarters | Market Share (%) | Fleet Size | Customer Rating | Service Network |

| Hertz | 1918 | USA | – | – | – | – |

| Avis | 1946 | USA | – | – | – | – |

| Budget | 1958 | USA | – | – | – | – |

| Thai Rent A Car | 2000 | Thailand | – | – | – | – |

| Ekachai Car Rentals | 2010 | Thailand | – | – | – | – |

Thailand Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Tourism

Thailand’s tourism industry witnessed a robust recovery, with international tourist arrivals reaching approximately 30 million in 2022. According to the Ministry of Tourism and Sports, the tourism revenue was recorded at around THB 1.5 trillion (USD 43 billion), contributing significantly to the economy. This resurgence in travel has directly stimulated demand for car rental services, as tourists seek flexible transportation options to explore the country’s diverse attractions. With tourism projected to continue growth, the car rental market is positioned to benefit from this influx of visitors, making it a key driver of industry growth.

Rise in Disposable Income

Thailand’s GDP per capita has shown steady growth, increasing from USD 6,780 in 2022 to an estimated USD 7,200 in 2023. This rise in disposable income has empowered consumers to seek convenience and luxury services, including car rentals. The Bank of Thailand reports a consistent increase in domestic spending as urban residents favor mobility solutions that enhance their lifestyle. As income levels rise, consumers are more likely to opt for rental in situations such as business trips and family vacations, reinforcing the car rental market’s expansion.

Market Challenges

Regulatory Compliance

The Thailand car rental industry faces stringent regulatory frameworks, including compliance with vehicle safety standards and leasing regulations. The Department of Land Transport mandates regular inspections and certifications for rental vehicles, impacting operational costs and administrative burdens. As of 2023, there were over 200 regulatory statutes governing transportation, posing challenges for smaller rental firms that may lack the resources to navigate these requirements. Non-compliance can lead to fines and operational disruptions, thereby affecting market competitiveness.

Competition and Price Wars

The Thai car rental market is characterized by fierce competition, with numerous local and international players vying for market share. This competitive landscape often leads to price wars, which can erode profit margins. In 2023, major rental companies reported a drop in average daily rental rates due to aggressive pricing strategies aimed at attracting customers. The over-saturation of the market, combined with low entry barriers, makes it challenging for companies to maintain profitability while differentiating their services effectively.

Opportunities

Technological Innovations

The integration of technology in the car rental market presents substantial growth opportunities. As of 2023, nearly 60% of consumers prefer mobile apps for vehicle bookings, according to government surveys. This preference is prompting car rental companies to invest in digital platforms that streamline the customer experience. Innovations such as contactless rentals and real-time vehicle tracking can enhance service delivery and customer satisfaction. Currently, the penetration of these technologies among rental providers is still in its formative stages, offering significant potential for expansion as competition intensifies.

Growth of Ride-Sharing Services

The rise of ride-sharing services in Thailand offers opportunities for collaboration and service diversification within the rental market. With an estimated 8 million rides reported in 2022, services like Grab have altered consumer transportation preferences, blending with rental services for more holistic mobility solutions. Car rental companies can capitalize on partnerships or even create their own ride-sharing initiatives to meet consumer demands for flexible transport. The current dynamics indicate a growing inclination towards integrated transport solutions, positioning the market for innovative adaptations moving forward.

Future Outlook

Over the next few years, the Thailand Car Rental and Leasing Market is anticipated to experience significant growth driven by continued expansion of the tourism sector, increasing urbanization, and the evolving preferences of consumers. Factors such as government infrastructure investments, a rise in domestic travel, and the introduction of technology-enhanced rental platforms are expected to fuel this growth trajectory. The market is ripe for innovation, especially as companies explore electric vehicle options and enhance customer experience through app-based solutions.

Major Players

- Hertz

- Avis

- Budget

- Thai Rent A Car

- Ekachai Car Rentals

- National Car Rental

- Sixt Thailand

- Thrifty Car Rental

- Dollar Rent A Car

- Bangkok Car Rental Services

- Travel Hub Car Rental

- GoCar Thailand

- Rent a Car Thailand

- Siam Car Rental

- Srinakarin Rent a Car

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Land Transport)

- Hospitality Industry Stakeholders

- Tour and Travel Agencies

- Corporate Clients and Businesses

- Online Travel Platforms

- Fleet Management Companies

- Event and Conference Organizers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all significant stakeholders in the Thailand Car Rental and Leasing Market. This step is accomplished through extensive desk research, utilizing both secondary data sources and proprietary databases to compile thorough industry-level information. The primary goal is to establish a framework that defines the critical variables influencing market dynamics, including consumer preferences, competition intensity, and regulatory contexts.

Step 2: Market Analysis and Construction

In this phase, historical data specific to the Thailand Car Rental and Leasing Market will be analyzed. Factors such as market penetration rates, revenue generation patterns, and competitive landscape will be examined. This will not only include qualitative metrics but also a close look at service quality measures to ensure the accuracy of revenue estimates derived from the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on the initial findings and subsequently validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). Participants will include representatives from leading rental companies and market analysts, who will provide crucial operational insights. This feedback will be invaluable in refining and corroborating the data gathered, ensuring a robust analytical model.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple rental service providers to gather detailed insights into various aspects of the market. This includes understanding customer behavior, vehicle preferences, pricing strategies, and promotional approaches. This qualitative input will serve to verify and enrich the quantitative data derived from earlier phases, culminating in a comprehensive and accurate analysis of the Thailand Car Rental and Leasing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Context and Development

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Tourism

Rise in Disposable Income

Urbanization Trends - Market Challenges

Regulatory Compliance

Competition and Price Wars - Opportunities

Technological Innovations

Growth of Ride-Sharing Services - Trends

Sustainability Practices

Fleet Electrification - Government Regulation

Licensing and Permitting

Environmental Guidelines - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Rental Price, 2019-2024

- By Service Type (In Value %)

Short-Term Rental

Long-Term Rental - By Vehicle Type (In Value %)

Economy

Luxury

SUV

Van/Minivan - By Customer Type (In Value %)

Corporate Clients

Individual Customers - By Distribution Channel (In Value %)

Online Platforms

Travel Agencies

Walk-In Rentals - By Region (In Value %)

Central Region

Northern Region

Southern Region

Northeastern Region

- Market Share of Major Players Based on Value/Volume, 2024

Market Share of Major Players by Vehicle Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Fleet Size, Customer Service Ratings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Hertz Thailand

Avis Thailand

Budget Car Rental Thailand

Sixt Thailand

Thrifty Car Rental Thailand

National Car Rental Thailand

Alamo Rent A Car

East Coast Car Rentals

Rentalcars.com

Thailand Car Rentals

Rent a Car Thailand

Bangkok Car Rental Services

Siam Car Rental

Thai Rent A Car

GoCar Thailand

- Market Demand and Utilization

- Customer Preferences and Behavior

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Rental Price, 2025-2030