Market Overview

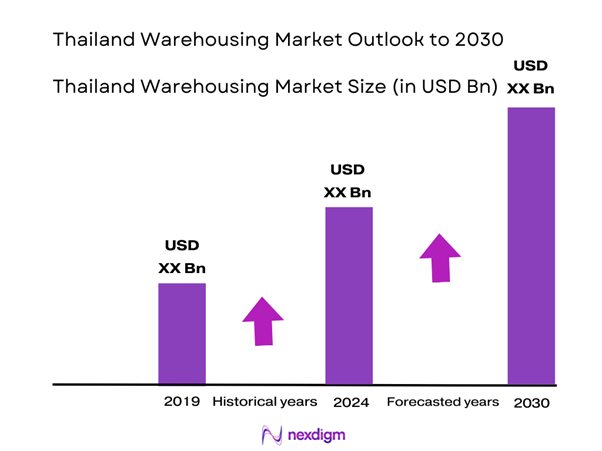

The Thailand Warehousing Market, valued at approximately USD 1 billion in 2025 with an approximated compound annual growth rate (CAGR) of 12% from 2025-2030, is propelled by a surge in e-commerce activities and rapid urbanization that have reshaped distribution demands. The need for efficient logistics and storage solutions is leading to significant investments in warehousing facilities, thereby expanding the market. This growth is further backed by favorable government policies that support infrastructure development and enhance supply chain efficiency, allowing businesses to meet the evolving consumer needs effectively.

Major cities like Bangkok and Chonburi dominate the Thailand warehousing landscape due to their strategic locations and well-developed transportation networks. Bangkok, as the capital and largest city, serves as a logistics hub, housing multiple distribution centers that facilitate trade and commerce. Chonburi, with its proximity to major ports, plays a crucial role in facilitating import and export activities, making it a preferred location for warehousing operations.

Thailand’s urbanization rate reached approximately 51% in 2022, with projections suggesting that urban populations will surge by an additional 15 million by 2030. This rapid urbanization contributes to increased demand for logistics and warehousing facilities in urban centers to meet the growing needs of retailers and consumers. Simultaneously, the government has committed USD 80 billion towards infrastructure development, which includes major transportation projects like the Eastern Economic Corridor (EEC).

Market Segmentation

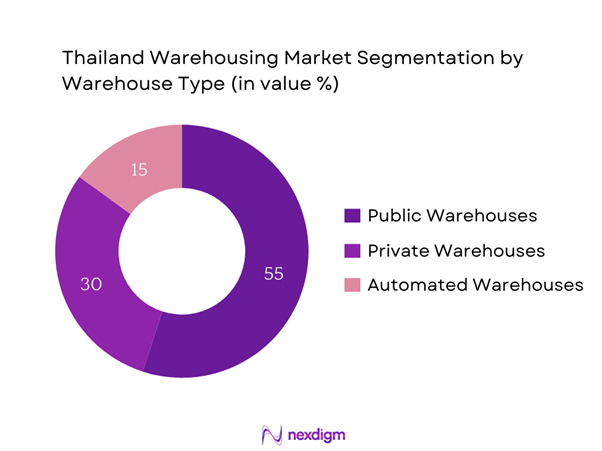

By Warehouse Type

The Thailand Warehousing Market is segmented by warehouse type into public warehouses, private warehouses, and automated warehouses. Among these segments, public warehouses currently hold a dominant position, accounting for a significant share of the market. This is primarily due to their versatility and accessibility to numerous businesses, which prefer renting space as a cost-effective solution rather than making substantial capital investments. Public warehouses provide flexible storage options and cater to various industry needs, from e-commerce to retail, thus driving their widespread adoption.

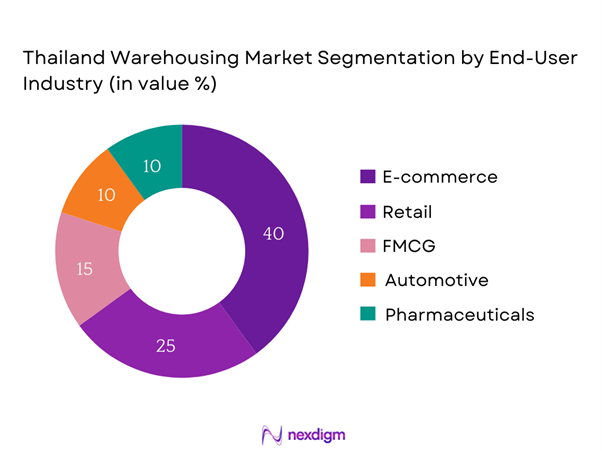

By End User Industry

The market is further segmented by end user industry, including e-commerce, retail, FMCG, automotive, and pharmaceuticals. The e-commerce segment leads the market, holding a substantial share, due to the rapid growth of online shopping behavior in Thailand. With more consumers opting for e-commerce platforms, businesses are compelled to enhance their logistics capabilities and establish efficient warehousing solutions. As a result, more warehouse spaces are being tailored to meet the dynamic demands of online retail, ensuring rapid order fulfillment and efficient inventory management.

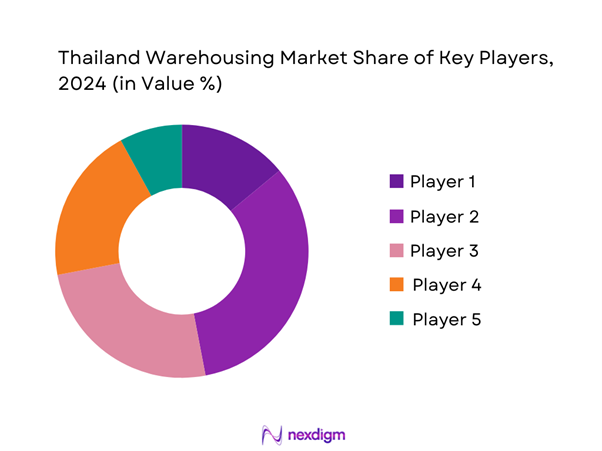

Competitive Landscape

The Thailand Warehousing Market is characterized by a concentrated competitive landscape, with key players—including leading local enterprises and international logistics firms—dominating the market. The presence of both domestic and foreign companies fosters healthy competition, driving innovations and improvements in service offerings. Companies are increasingly focusing on expanding their footprint and investing in advanced technologies to improve operational efficiencies.

| Company Name | Establishment Year | Headquarters | Revenue (USD) | Warehouse Area (sqm) | Key Services | Market Position |

| JK Realty Co. | 1995 | Bangkok | – | – | – | – |

| Thai Warehousing Co. | 2002 | Chonburi | – | – | – | – |

| Advanced Logistics | 2010 | Bangkok | – | – | – | – |

| TPI Polene Public Co. | 1997 | Bangkok | – | – | – | – |

| SCG Logistics | 2016 | Bangkok | – | – | – | – |

Thailand Warehousing Market Analysis

Growth Drivers

Rise of E-commerce Solutions

The growth of e-commerce solutions in Thailand is reshaping the warehousing landscape, with the e-commerce sector valued at USD 12 billion in 2022. The number of online shoppers in Thailand reached 62.6 million, highlighting an increase in digital buying behaviors. In addition, logistics investments in e-commerce platforms are projected to rise significantly, fueled by the Thailand Digital Economy and Society Development Plan, which aims to boost the digital economy to USD 21 billion by end of 2025. This surge in e-commerce directly drives demand for warehousing, enhancing fulfillment capabilities for retailers and logistics providers.

Increased Foreign Direct Investment

Foreign direct investment (FDI) in Thailand saw a significant uptick, attracting USD 17 billion in 2022, making it the second-largest recipient of FDI in Southeast Asia. With policies aimed at encouraging investment, including the Thailand 4.0 initiative, the government focuses on promoting advanced manufacturing and logistics, which directly supports warehouse expansion. The influx of foreign capital leads to enhanced logistics capabilities and infrastructure, facilitating the establishment of sophisticated warehousing solutions to accommodate growing operational requirements.

Market Challenges

Economic Fluctuations

The Thailand economy faced fluctuations in 2022, with GDP growth rates experiencing volatility due to external pressures and market dynamics, resulting in a 2.3% growth in 2022. Such fluctuations impact consumer confidence and spending, affecting the volume of goods moved through warehousing facilities. The uncertainty in global markets due to geopolitical tensions can also disrupt supply chains, leading to unpredictable demand for storage solutions. Economic instabilities can hinder investment in warehousing infrastructure, as businesses become more cautious in their planning.

Regulatory Compliance Obstacles

Thailand’s regulatory environment imposes various compliance obstacles for warehousing operations, including import/export certifications and taxation requirements that can complicate logistics processes. In 2022, over 30% of businesses reported encountering regulatory challenges when navigating import regulations, as outlined by the Trade Policy and Strategy Office (TPSO). These compliance issues can delay warehousing operations, increase operational costs, and reduce overall market efficiency, hence affecting profitability for companies reliant on integrated logistics solutions.

Opportunities

Technological Advancements

The ongoing adoption of technological advancements presents significant opportunities for the Thailand warehousing market. As of 2022, approximately 66% of logistics companies reported investing in advanced warehousing technologies, including automation and data analytics, which improve operational efficiency. Warehouse management systems and AI are transforming inventory management, enabling real-time monitoring and decision-making, thus streamlining workflows. The continued integration of technology in warehousing operations is expected to enhance scalability and adaptability, positioning companies favorably for future growth.

Sustainable Warehousing Trends

Sustainable warehousing trends are emerging as companies increasingly emphasize eco-friendly practices. In 2023, over 45% of logistics firms implemented sustainability programs aimed at reducing carbon footprints and optimizing resource utilization. The government’s 2023 Green Logistics Policy aims to promote environmentally friendly logistics by encouraging energy-efficient solutions, such as solar power and waste reduction measures, in warehousing operations. This current focus on sustainability fosters growth opportunities, as businesses align their operations with evolving consumer preferences for environmentally responsible practices.

Future Outlook

Over the next five years, the Thailand Warehousing Market is expected to experience significant growth driven by continued e-commerce expansion, increased foreign investments, and robust developments in logistics infrastructure. As consumer behavior shifts towards online shopping, businesses will increasingly seek innovative warehousing solutions to optimize operations and meet delivery expectations. Additionally, advancements in technology within the warehousing sector, such as automation and AI integration, will further enhance efficiency and streamline supply chains, positioning the market for dynamic evolution.

Major Players

- JK Realty Co.

- Thai Warehousing Company

- Advanced Logistics

- TPI Polene Public Co.

- SCG Logistics

- Sena Development Public Company

- Siam Global House

- Logistic Property

- TST Warehousing

- SET Logistics

- Yusen Logistics

- Kuehne + Nagel

- DHL Supply Chain

- Agility Logistics

- XPO Logistics

Key Target Audience

- Logistics and Supply Chain Managers

- Warehouse Operations Executives

- E-commerce Companies

- Retail Chains

- FMCG Manufacturers

- Automotive Manufacturers

- Pharmaceutical Companies

- Government and Regulatory Bodies (e.g., Ministry of Commerce, Thai Customs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that includes all key stakeholders within the Thailand Warehousing Market. This process is based on diligent desk research and leverages a combination of secondary data sources and proprietary databases to gather exhaustive insights. The primary objective is to identify crucial variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Thailand Warehousing Market. This includes evaluating market penetration rates, analyzing the distribution of warehouses among various service providers, and examining the resultant revenue generation. Furthermore, service quality statistics are evaluated to ensure reliability and accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through thorough consultations with industry experts via interviews. This diverse range of interviews with representatives of various companies provides operational and financial insights crucial for refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing companies to gain detailed insights into operational aspects, market trends, service performance, and consumer preferences. This engagement serves to verify and enhance the statistics derived from previous analyses, ensuring a comprehensive and validated assessment of the Thailand Warehousing Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise of E-commerce Solutions

Increased Foreign Direct Investment

Urbanization and Infrastructure Development - Market Challenges

Economic Fluctuations

Regulatory Compliance Obstacles - Opportunities

Technological Advancements

Sustainable Warehousing Trends - Trends

Digital Transformation in Warehousing

Integration of AI and Robotics - Government Regulations

Import/Export Regulations

Industry-Specific Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Area (Square Meters), 2019-2024

- By Average Rental Rates, 2019-2024

- By Warehouse Type (In Value %)

Public Warehouses

Private Warehouses

Automated Warehouses - By End User Industry (In Value %)

E-commerce

Retail

FMCG

Automotive

Pharmaceuticals - By Region (In Value %)

Bangkok

Central Thailand

Northern Region

Southern Region

Eastern Seaboard - By Storage Type (In Value %)

Cold Storage

Dry Storage

Hazardous Material Storage - By Service Type (In Value %)

Inventory Management

Order Fulfillment

Transportation and Distribution

- Market Share of Major Players by Value/Area, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Clients, Service Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Storage Solutions of Major Players

- Detailed Profiles of Major Companies

JK Realty Co.

Siam Global House

Thai Warehousing Company

Advanced Logistics

Sena Development Public Company

TPI Polene Public Company

Logistic Property

TST Warehousing

SET Logistics

SCG Logistics

Yusen Logistics

DHL Supply Chain

Kuehne + Nagel

Agility Logistics

XPO Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Area (Square Meters), 2025-2030

- By Average Rental Rates, 2025-2030